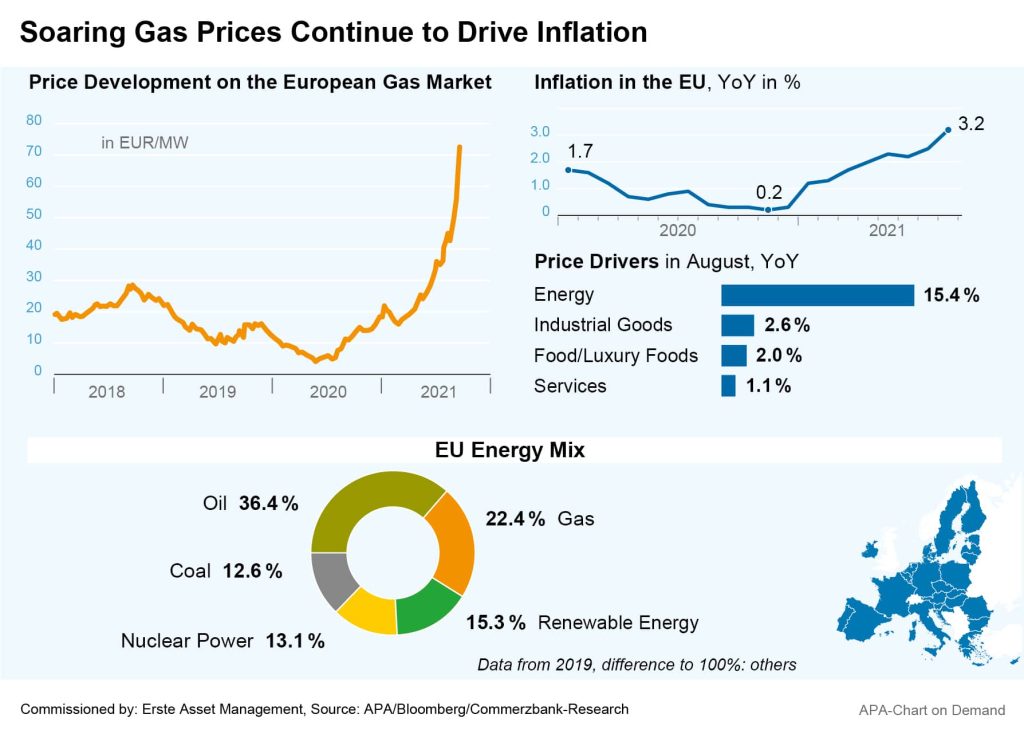

Gas prices continued to soar last week, with the price for natural gas in the EU reaching a record high of over EUR 76 at the beginning of the week. Driven by the gas prices, electricity prices also continued to rise. The price of electricity recently exceeded the 100-euro mark per MWh for the first time – at the turn of the year, it was still at 50 euros. These recent gas price increases are driven by an increase in demand coupled with supply shortages.

With the economic recovery following the easing of lockdown restrictions, demand for energy has risen significantly in many countries this year, particularly in Asia, but also in Europe, thanks partly to the economic recovery, partly because of the unusually long winter. According to an estimate by the International Energy Agency (IEA), EU gas demand increased by a quarter in Q2, the strongest growth since 1985.

The growing demand, however, is offset by shortages on the supply side. The cold winter drained European utilities’ gas reserves, and while providers typically then use the warm season to replenish their reserves, many were slow to restock due to the unusually long cold spell. Currently, gas storage facilities are only 72 per cent full, whereas this figure is usually close to 90 per cent at the end of the replenishment phase. According to market observers, some utilities in Europe may also have hoped for an end to the gas price rally and therefore waited too long before restocking.

Reduced Supply from Norway and Russia

In addition to the sparsely filled storage facilities, there have recently been other problems on the supply side. For example, major gas suppliers Norway and Russia experienced individual production losses. Some experts and politicians also speculate about a possibly politically motivated supply cut on the part of Russia. Claudia Kemfert, an energy expert at the German Institute for Economic Research (DIW), suspects a clear motive on the Russian side to cut gas supplies in order to accelerate the Nord Stream 2 pipeline’s commissioning.

“It has been said that more gas could flow to Europe when Nord Stream 2 becomes operational,” Kemfert said most recently in an interview with the Phoenix television channel. This gives the impression that the aim is to artificially drive up prices on the European natural gas market in order to increase the pressure for quick completion of Nord Stream 2. Russia firmly denied these speculations, claiming that all supply agreements have been adhered to.

Electricity Producers are Strongly Affected by Price Increases

Electricity producers are currently directly affected by the gas price increases. Europe’s electricity production is still heavily dependent on the resources of natural gas and coal. In view of the rising prices for CO2 emissions, there has been a trend towards gas. “Gas-fired power plants emit less greenhouse gases than coal-fired plants and are therefore favoured, while coal-fired plants are being pushed out,” explained Robert Slovacek of Austria’s commercial electricity association Oesterreichs Energie in an interview with APA. In view of the rising gas prices, however, coal is now seeing a slight resurgence in some cases. The UK, for example, has started up formerly shut-down coal-fired power plants in the past weeks again.

Italy is also among the countries most affected by electricity price increases. Without government intervention, electricity prices could rise by 40 per cent and gas prices by 30 per cent in the next quarter, Italy’s Prime Minister Mario Draghi warned on Thursday. The Italian government is already planning measures to curb the negative impact of rising electricity prices on families and businesses.

Energy Prices Continue to Drive Inflation

Meanwhile, rising gas and electricity prices are also fuelling concerns about further increases in inflation. The inflation development is currently being followed closely on the financial markets, because increases in inflation rates could lead to countermeasures by the central banks and thus to an imminent end of the current monetary policy that is supporting the economy.

Energy prices have already been clearly reflected in the latest inflation data for the eurozone. According to Eurostat, consumer prices rose by 3.0 per cent in August, the highest inflationary increase in the eurozone since November 2011. In July, the rate still lay at 2.2 per cent. Energy prices rose particularly strongly again in August, with a 15.4 per cent increase YoY.

The German Ifo Institute expects an inflation rate of 3.0 per cent for Germany over the entire year, which would mark the strongest consumer price increase in 28 years. The last year with a higher inflation rate was 1993, with 4.5 per cent. While a main reason in this are the energy price increases, a special factor specific to the country also contributes: the temporary reduction in VAT in the second half of 2020 that supported the economy is now driving up inflation.

The Food Industry is also Suffering from the Price Rally

However, not only the electricity market, but also the food industry has recently suffered greatly from the gas price increases. This is because the price of carbon dioxide (CO2) has risen along with gas prices. CO2 is a by-product of fertiliser production, which uses natural gas as a raw material. Some fertiliser companies have already cut back or even stopped their CO2 production in view of the gas price increases.

The CO2 is now missing in slaughterhouses, where it is used for sedating. CO2 is also important for the food industry’s cold chain, for vacuum packaging of meat and for the production of beer and soft drinks. As a result, meat producers in the UK are already coming under increasing pressure. While the government briefly supported industry supplier CF Industries in order to get the production of CO2 up and running again, the UK’s food industry is warning of shortages.

The further development of gas and oil prices now depends heavily on the supply situation, but also on the coming weather development. A planned increase in Norwegian gas supply should soon bring some relief. There is no reason to panic at the moment, but according to energy experts it is still too early to sound the all-clear.

Several European countries are currently planning measures to cushion the consequences of the price rally, and EU-wide measures are also being discussed. At the EU level, a “toolbox” is to be created from which member countries can use measures such as VAT cuts without violating the EU guidelines for energy markets. Many experts, such as Claudia Kemfert from the DIW, are also calling for greater promotion of renewable energies to reduce Europe’s dependence on Russian gas imports.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.