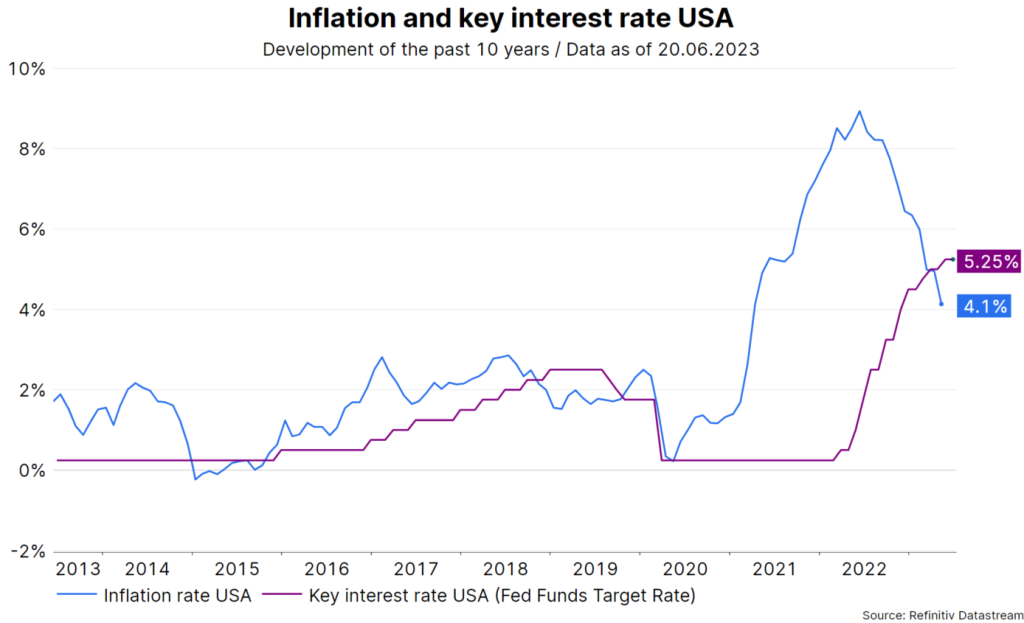

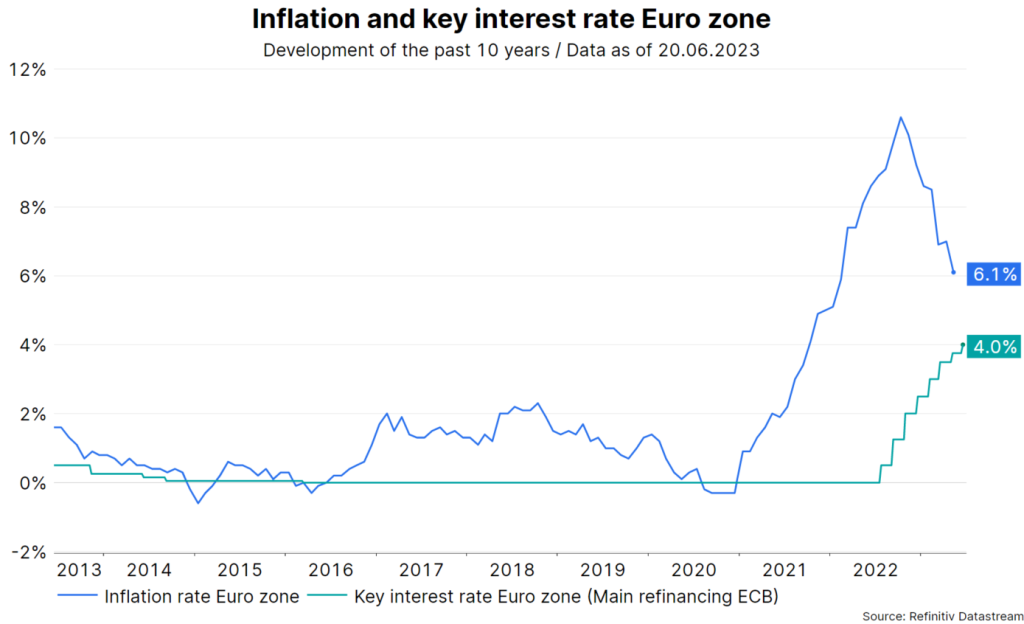

After the big inflation and interest rate shock, both central banks and markets have been trying to get their bearings for several months. Since mid-May, the future key-lending rates priced into the market have risen again. The market thus expects monetary policy to remain restrictive, with the determining factor being the dynamics in inflation. Although inflation rates are falling, they are doing so more slowly than expected.

Last week, the central banks in the USA and the Eurozone raised their inflation expectations. Accordingly, further key-lending rate hikes were also announced. At least there are some signs of a further decline in inflation.

No interest rate move in the US

The world’s most important central bank, the Fed, left the range for the effective key-lending rate (i.e. Fed funds rate) unchanged at 5% – 5.25% last Wednesday, despite raising Q4 inflation expectations for 2023 to 3.9% year-on-year. The March estimate for the so-called core PCE deflator had still been at 3.6% for Q4.

Even though the Fed funds rate remained unchanged this time, the central bank hinted at several rate hikes for the future. On average, the meeting participants expect a rate of 5.6% for the end of 2023, up from previously 5.1%.

Rate hikes temporally stretched out

There is a strategy behind this. The more the Fed funds rate approaches a sufficiently restrictive level, the more cautious the central bank becomes with interest rate hikes. The idea is to keep the risk of excessive rate hikes, which would unnecessarily trigger a recession, as low as possible.

After the Fed has reduced the extent of interest rate hikes per meeting in recent months, the path of interest rate hikes is now being stretched out over time. The Fed will now refrain from raising key-lending rates at each meeting. This gives the central bank more time to better assess the effect of past rate hikes and their monetary policy on growth and inflation.

After all, in the month of May, core inflation in the service sector (total excluding food, energy, and housing costs) fell to a low of 0.16% month-on-month. In addition, consumer inflation expectations have declined significantly in two surveys by the New York Fed and the University of Michigan. This also reduces the probability of inflation persistence, i.e. inflation remaining at a very high level.

Three criteria for the ECB’s approach

In contrast to the Fed, the European Central Bank raised key-lending rates further by 0.25 percentage points. The main refinancing rate is now 4.00%. The ECB bases its strategy for fighting inflation on three criteria:

- How far above the central bank’s inflation target of 2% is the inflation forecast?

The central bank has raised its expectation for consumer price inflation excluding energy and food, i.e. the core rate, for 2025 from 2.2% in March to 2.3%. This is a clearly hawkish signal – more rate hikes are needed. - The underlying inflation process

Core inflation continued to fall in May but was still much too high at 5.3% year-on-year. At least core inflation is falling at monthly intervals. - The effect of the previous key-lending rate hikes on inflation

Little is yet evident here, which is probably only natural. The influence of monetary policy on inflation is subject to considerable uncertainty, both in terms of strength and duration. With regard to the ECB meeting in July, a key-lending rate hike is in any case very likely, according to ECB President Christine Lagarde.

Bank of England also expects further interest rate increase

The Bank of England is also expected to raise key-lending rates in the United Kingdom this week. Market prices reflect a hike from 4.5% to 4.75%. The driving factor behind this is the very tight labour market. Unemployment is low, employment growth is outpacing weak economic growth, and wage growth is inconsistent with the 2% inflation target because productivity is subdued.

Conclusion: soft or hard landing?

With regard to the assessment of the level at which the cycle of interest rate hikes implemented by central banks will terminate, we are still in an upward revision process. Inflation is falling, but only slowly so. Currently, the working assumption is that the Fed, the ECB, and the Bank of England will all raise their respective key-lending rates by at least another 0.5 percentage points (to 5.75%, 4.5% and 5%, respectively).

In the past, restrictive monetary policies would usually trigger a recession (a so-called hard landing). Hopes for a soft landing are fuelled by falling inflation rates and economic indicators that point to low economic growth but no recession. The next important data in this context will be the preliminary purchasing managers’ indices for the month of June for the major developed economies on 23 June.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.