The environment and technology have been two important themes on the stock exchange for years. Not only because they pay excellent returns, as the above-average gains of equities and funds show. The consequences of climate change that we have experienced very recently in the form of floods and destructive tornadoes even in our region illustrate that it is time to change our mindset. Green technologies that prevent such catastrophes will be leading a paradigm shift in the economy and society in the coming years.

Will Europe become the first climate-neutral continent?

The change in the mindset of organisations and companies has already started, with some pioneers leading the charge. The regulatory pressure from governments is on the rise. The EU Green Deal will direct the global flow of capital towards green and sustainable investments. Europe is to be turned into a climate-neutral continent by 2050, and large countries like the USA and China have also set themselves ambitious goals to reduce greenhouse gases by 2030.

Regardless of whether these ambitious goals can be reached, the train is already in motion. This implies a significant increase in investments in the environmental sector in the coming years. The environmental sector had a headcount of almost 200,000 in 2019 (N.B. these are the latest data) that generated an output of EUR 42.7bn (Statistics Austria, 27 May 2021). The waste management sector will be worth billions in due course. The six most important listed waste management companies generated sales of about USD 90bn in 2019 (see the chart below).

Environmental industry playing an important role

The most important area of the environmental industry is the management of energy resources. This includes mainly renewable energies and heat and energy conservation and management. The area of renewable energies, for example, contains the generation of electricity and heat from renewable energy carriers and the production and generation of energy technologies. Heat and energy conservation and management includes energy-conserving construction services such as thermal energy refurbishment and low-energy or the construction of passive houses as well as energy consulting services and the production of insulating materials. Other important environmental areas are air quality management, water conservation, waste management, and the protection and clean-up of soil, groundwater, and surface water. Many companies from these sectors are listed on the stock exchange and are thus accessible to retail investors.

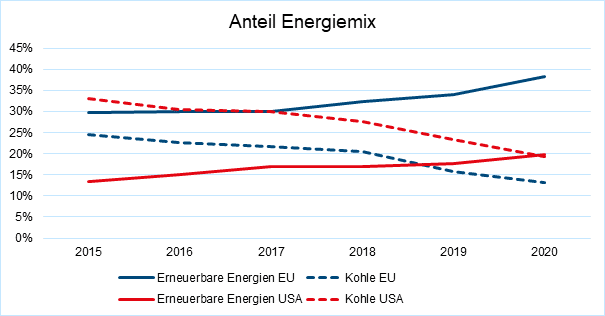

Renewable energies have outstanding growth potential

“The market for renewable energies is the biggest market that the world has ever seen,” as John Kerry, United States Special Presidential Envoy for Climate under President Joe Biden, has been quoted saying in the finance magazine Gewinn (June 2021, focus on sustainable investments). The fight against climate change has enormous economic potential. For example, according to Erste Asset Management, solar power is already the cheapest form of energy production. Some years ago, we would have discussed whether solar power would ever be viable without subsidies. “We can see similar potential in green hydrogen,” explains Erste AM fund manager Alexander Weiss and thus substantiates the upside potential of renewable energy equities in the future.

“Every share has to be scrutinised in detail”

Alexander Weiss, Fund Manager

of ERSTE GREEN INVEST

However, it is important to look carefully at the shares that one picks for the portfolio. Weiss: “We are somewhat sceptical about the manufacturers of solar modules. They engage in fierce price competition and have high capital requirements.” The experts of Erste Asset Management prefer companies that sell and install solar plants such as the US company Sunrun. In the USA, only 5% of the potentially viable roof area is being used for solar plants as we speak. E-mobility also harbours long-term potential, but the focus is more on charging infrastructure than on car manufacturers such as Tesla. In Europe alone, two million charging stations are to be installed by 2025 in order to push the switch to electric cars. In addition, hundreds of millions of euros are going to be invested in hydrogen infrastructure in the USA, Europe, and particularly in China. The company Plug Power is one of many promising companies but has seen quite a setback in its share price in the year to date after an earlier strong rally.

Please also see our BLOG entry: Environmentally friendly technologies will be growing for years

ERSTE GREEN INVEST and its quest to find the gems among green equities

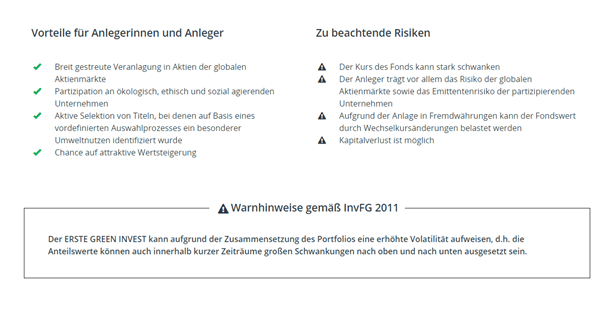

With its investments, the financial sector contributes significantly to the fight against climate change. The ERSTE GREEN INVEST fund was launched last year. The fund focuses on companies that have a positive impact on the environment and support solutions for fighting climate change by means of a sustainable economy. The focus is on themes such as renewable energy, waste management and recycling, transformation, and adaptation. The crucial thing is a measurable impact on the environment.

At +52%, the performance of the fund has been extremely strong. In the year to date, the fund has also seen a double-digit increase despite intermittent selling pressure from solar and hydrogen companies. A performance like this is possible, but it does not happen every day. Investors in environmental shares should be aware of the fundamentally higher volatility risk of this sector. On the other hand, they enjoy above-average rates of return in the long run.

Conclusion: the sector of environmental technologies harbours a lot of potential for the coming years. Many companies in this segment are only at the beginning of their path. The ERSTE GREEN INVEST fund, which celebrates its first anniversary these days, is a chance to invest in interesting and promising shares of companies in the environmental technology area.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.