Péter Varga has been responsible for and manages the ERSTE BOND EM CORPORATE fund since it was launched in 2007. He can look back on a highly successful performance, which has already earned the fund several awards.

On 15 June, another milestone was added to the history of the fund. It is now part of our sustainable Integration Universe.

This means that ESG criteria (environmental, social, governance) will be taken into account in the investment process, as a result of which the fund is now in line with article 8 of the EU Sustainable Finance Disclosure Regulation (SFDR). These are the main changes:

- We calculate our proprietary ESGenius Score for all issuers of the screening universe. It is composed of ESG data provided by external rating agencies and our own ESG research.

- In order to be included in the investable integration investment universe, the issuers have to hold an ESGenius Score of at least 30.

- In addition, our integration funds come with a number of exclusion criteria. For example, child and forced labour and the producers of weapons and weapons systems are taboo.

In this interview, Péter Varga discusses what this sustainable change means for him as a fund manager and what it changes in his investment process.

The conversion to a sustainable article 8 fund adds yet another facet to this fund. How has the portfolio changed as a result of this?

The weightings and basic key ratios have barely changed. That being said, there were a few significant changes on an individual company basis. Well-known companies such as the iron ore group Vale from Brazil, Southern Copper from Mexico, or Anglo American are no longer investable.

In order to take this deliberate step towards sustainability, we screened the investable universe and were pleased to find that only 25% of issuers no longer met the investment threshold. Either for reasons of sustainability or due to missing data that are essential for a high-quality analysis. This also shows that there is significant overlap between emerging markets and sustainability, without mentioning facts about the sometimes almost exponentially growing capacities for solar power or wind power in emerging markets.

Does the change also create challenges, for example with regard to the restriction of investable companies and countries?

Yes, it is a new situation. Prior to an investment, all securities are checked with regard to sustainability criteria. The challenge is particularly evident in the case of new issues, because here, the data availability still leaves a lot to be desired in some cases. Therefore, it can take time to come to a conclusion, which is why we sometimes refrain from subscribing, i.e. investing. But it also shows how much potential for improvement there still is, especially in the area of sustainability.

How well prepared are companies in emerging markets when it comes to sustainability and ESG?

About five years ago, when the first questions about sustainability were being asked at conferences and meetings, many emerging markets companies still reacted with amazement. Now, some companies even proactively present their ESG principles and processes. Here, it is our task to critically examine and find companies with credible potential.

Our colleagues in the Responsible Investments team are of enormous help in this respect, enabling us to subject companies that are important to us but that are not checked by the big agencies to our own screening process. It is precisely these companies that often promise the greatest potential, because they simply do not have the resources to produce a comprehensive sustainability report. However, this does not have to mean that these companies per se are not also sustainable or do not have a sustainable, promising business model. Therefore, when appropriate, we organise conference calls with these companies to better understand and examine their processes. In this context, we can see a particular added value through this additional level of analysis of sustainability

Overall, issuers are now better prepared than they were a few years ago. Some are also using the global push for more sustainability to generate a competitive advantage. For example, by using green energy sources to reduce environmental impact.

“My goal will remain to ensure that the performance of our EM corporate bond funds is among the best internationally.”

Péter Varga, Fund manager ERSTE BOND EM CORPORATE

What has changed in your daily work as fund manager and in the investment process?

I often say: we fund managers work in a multi-dimensional matrix. Many factors, often interrelated, should ultimately generate the fund’s performance. Sustainability now adds another dimension – which makes my job as a fund manager even more exciting!

However, many factors are not entirely new, such as governance. Environmental issues have also been relevant in the past, especially in some industries with an increased footprint. Inadequate internal processes have repeatedly caused major environmental damage in the past, which can sometimes even threaten the existence of a company. One example was the dam burst in a mine of the Brazilian company Vale in 2019.

I will be looking at these and similar topics even more closely. The idea is to also try to discover certain trends in the area of sustainability for specific companies and to examine whether, how, and when these could become relevant to the performance.

What is your general stance towards sustainability? Is there a high demand for sustainable investments in emerging market bonds?

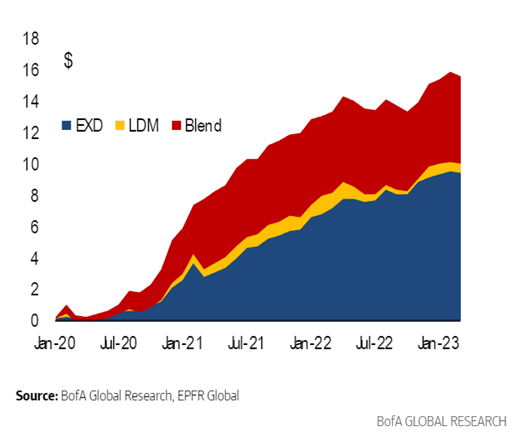

Anyone who walks through the world with their eyes open can see noticeable and serious changes happening in our environment and climate. The following chart illustrates that the demand for sustainable emerging markets products has been on a clear increase since 2020 – even in phases when the sentiment on the overall market was subdued. We have also noticed this trend among our clients.

Inflows into ESG Emerging Markets funds since January 2020 (overall $ 16bn)

Note: Past performance is no reliable indicator of future developments. Sources: BofA Global Research, EPFR Global

To me, sustainability also means to consciously avoid companies that would be investable, but where I can see very relevant sustainability risks. One example is the US-Brazilian meat producer JBS. This company accounts for just under 0.5% of the total investable universe. However, I am trying to cover this exposure with other companies until JBS changes its processes more comprehensively and addresses its sustainability risks better (Child labor, no cattle from ex-Amazonian areas).

In the area of sustainable emerging markets bond funds, we have long been among the pioneers with the launch of ERSTE RESPONSIBLE BOND EM CORPORATE in 2013. In any case, my goal will remain to ensure that the performance of our EM corporate bond funds is among the best internationally, as has been the case with ERSTE BOND EM CORPORATE for 16 years.

Thank you very much for the interview!

ERSTE BOND EM COPORATE at a glance

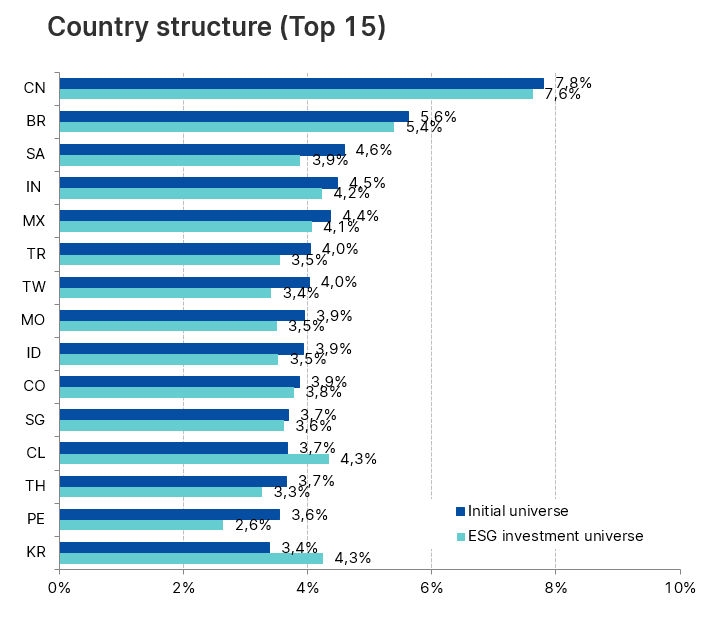

ERSTE BOND EM CORPORATE allows investors to participate in the growth opportunities of the emerging markets. The fund invests globally in corporate bonds from the emerging markets. Since mid-June, environmental, social, and corporate governance factors have been incorporated into the investment process. At country level, India, Mexico and Brazil currently command the highest weightings in the portfolio.

As of 14 June 2023 / Development since launch of fund / indexed (06.07.2007 = 100)

Note: The development in the past is not a reliable indicator for future performance of an investment. Source: Refinitiv Datastream

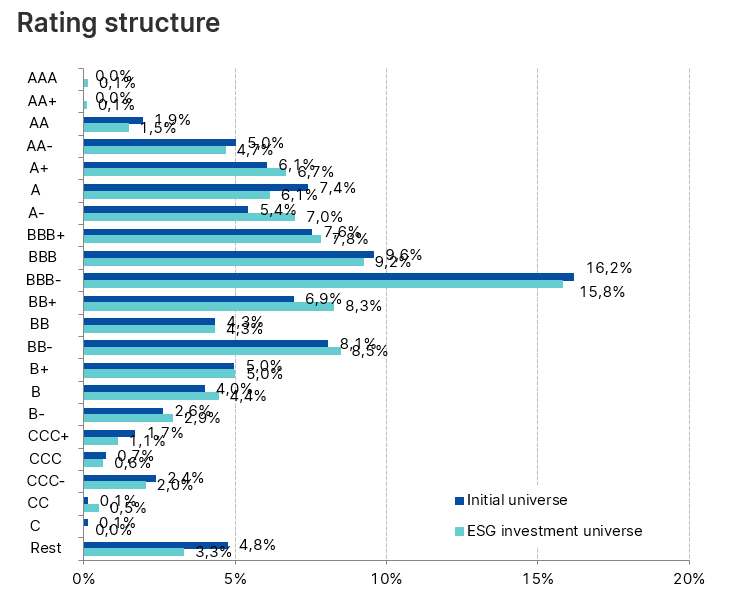

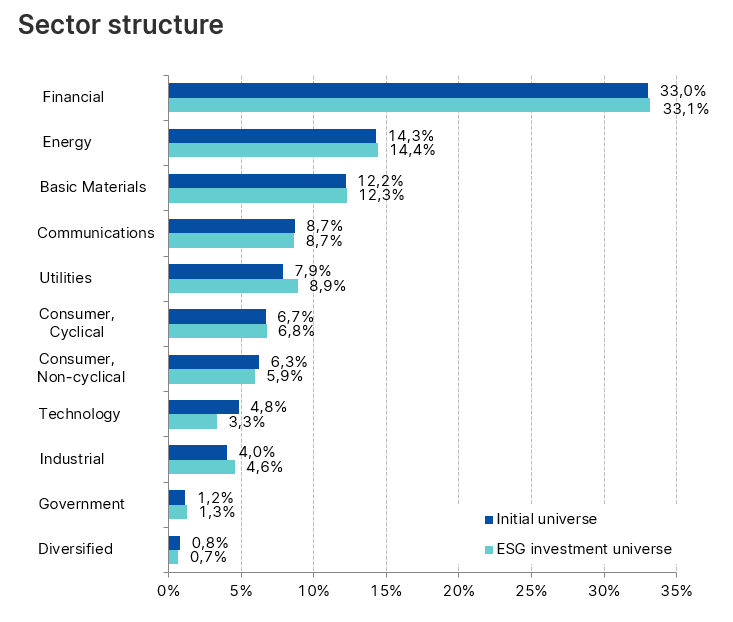

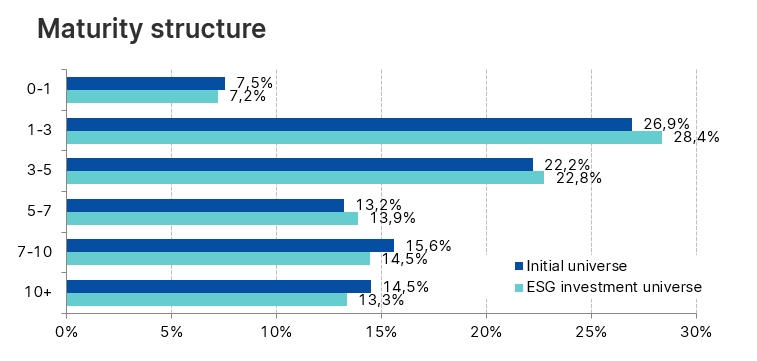

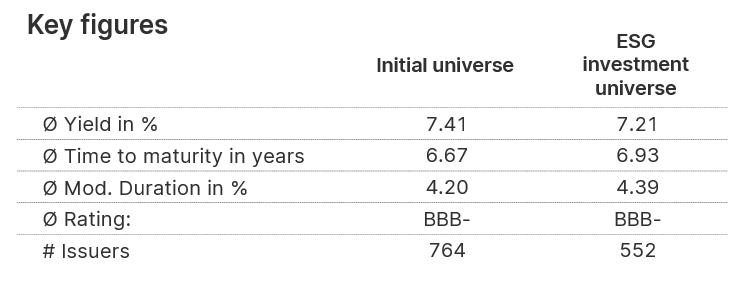

Since mid-June, environmental, social and corporate governance factors have been incorporated into the investment process. The fund’s transition has resulted in certain changes to the fund’s investment universe. Here is a comparison of the initial universe with the new universe according to the ESG Integration standard:

Source: Bloomberg, own calculations. Rating breakdown using composite ratings based on ratings from three leading rating agencies. Data as of end of 05.2023. Key figures as of 09.06.2023 – all values calculated “to worst”.

Risk notes

Advantages for the investor

- Chance of attractive returns from the most interesting emerging market corporate bonds

- Global diversification in emerging markets

- Foreign currencies are mostly hedged against the euro

- Risk diversification via a variety of bonds from a wide range of issuers

Risks to be considered

- Increased risk due to average and below average credit rating of participating companies.

- Emerging markets are traditionally subject to high volatility.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For further information on the sustainable focus of ERSTE BOND EM CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE BOND EM CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE BOND EM CORPORATE as described in the Fund Documents.

Forecasts are no reliable indicator of future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.