On 17 October 2018, ERSTE BOND LOCAL EMERGING celebrated its 10th anniversary – a perfect time to have a closer look at the asset class “Emerging markets bonds in local currency”.

What is the distinctive feature of bond funds that invest in the local currencies of emerging markets?

The interesting bit about the fund is the fact that it exclusively invests in issuers from the emerging markets. Among them are, for example, government bonds from Central and East European countries such as Hungary and Poland, Asian issuers such as Thailand and Malaysia, Latin America, the Middle East, and Africa.

The bonds are quoted in the respective local currency, such as in Mexican peso, Brazilian real, Polish zloty, or South African rand. The foreign exchange risk associated with the investment is deliberately not hedged. The benefit for the euro investor is the fact that the coupon and interest rates tend to be much higher in those countries. The additional risk the investor assumes stems from the elevated price fluctuations that result from it.

Turbulent start ten years ago

Despite the fact that the fund was launched in the wake of the Lehman Brothers collapse (15 September 2008) and amid a great deal of uncertainty on the markets, from our point of view it was the next logical step to expand the line of products for emerging markets government bonds.

While back then we were among the first providers, the asset class has meanwhile established itself and has become a fixed component of many asset allocations.

The asset class continues to grow as new countries such as China, Serbia, and African countries are becoming investable

While the investment universe ten years ago consisted of 15 countries with an average interest rate sensitivity of 4.2%*), the fund management team nowadays has bonds from 19 countries with an average interest rate sensitivity of 5.1%*) at its disposal. The rising interest rate sensitivity is testament to the maturing of the existing investment spectrum and the ability of some countries to issue bonds at increasingly long maturities in local currency, which allows for the harmonisation of the project life that is being funded and the respective bond maturity. This is positive for the respective domestic banking sector and companies which base their financing in local currency on the yield curve with its wide range of maturities. The larger number of countries and the rising interest rate sensitivity bear witness to the rapid development of this asset class.

And the next countries are already around the corner, the biggest one being China. As third-largest local market worldwide – and by far biggest local emerging market – China would further boost the relevance of this asset class and thus the interest international investors show.

Other countries such as Egypt, Kazakhstan, Nigeria, and Serbia are also candidates.

Changes in financing structure

The fact that increasing volumes of the public budget are financed in local currency is a positive development from the investor’s point of view. In addition to the birth of a new asset class, “emerging markets bonds in local currency”, as top investment opportunity, the various countries benefit from a lower degree of dependence on US dollar finance.

The ratio of local currency debt to foreign currency debt is also an important indicator for evaluating the financial structure of the respective budget from an investor’s perspective.

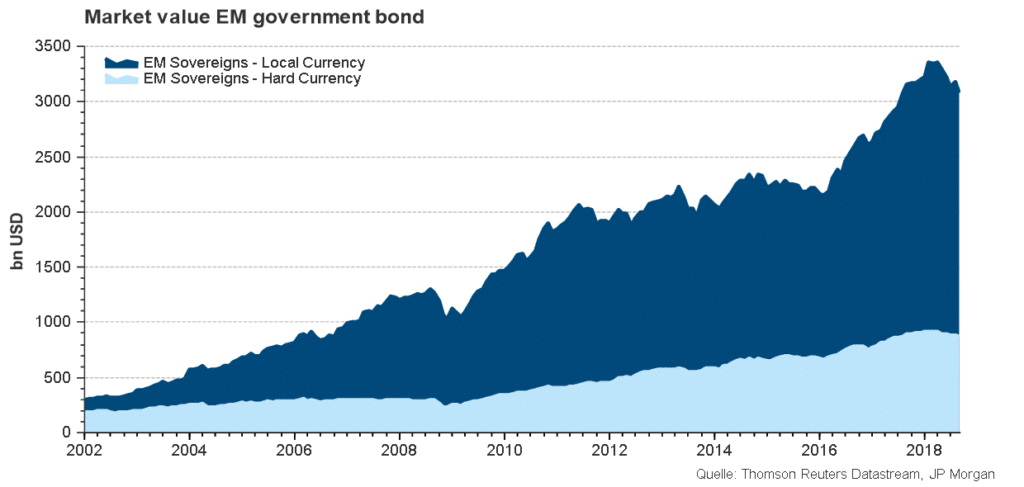

Comparison of the market value of emerging markets bonds in local currency to emerging markets bonds in hard currency 2002-2018

If the aggregate amount of debt is within a reasonable realm, which is the case in most emerging economies, this development has positive repercussions on bond spreads. It means that financing becomes cheaper for these countries.

Yield and currency determine the attractiveness of this asset class

The assessment of how attractive emerging markets bonds in local currency are is based on two factors:

-

Yield **):

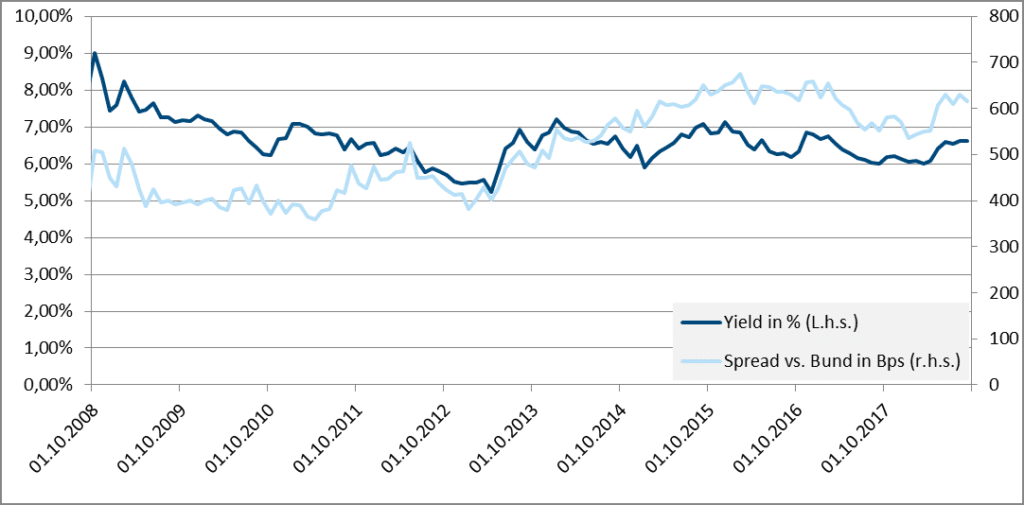

While even the absolute yield of almost 6.75% sounds attractive **), it always has to be put into the context of the risk-free return to see it for what it is.

For euro investors, we use the 10Y German government bond to this end and calculate the spread (i.e. yield differential). At the moment, this differential amounts to almost 625bps (i.e. 6.25 percentage points) – an attractive level even by historical standards.

Emerging markets bond yields and the spread on German government bonds (2008-2018)

Source: Bloomberg; data as of 15 October 2018; the key ratio “yield” is the average yield of the assets reflected by an index or held in a portfolio prior to fees resulting from the hedging of foreign currency risks; please bear in mind that the yield of an assets is not the same as its performance. It also does not take into account any fees diminishing return such as the management fee or individual account or depositary fees.

This is where the traditional euro bond investor (i.e. government bonds or corporate bonds) can wrap up their analysis, seeing as no foreign exchange risk is involved.

In case of emerging markets local currency bonds and ERSTE BOND LOCAL EMERGING, the attractiveness of the second component – i.e. the currency – also has to be taken into consideration. It can be regarded as opportunity as well, i.e. not only as risk.

-

Currency:

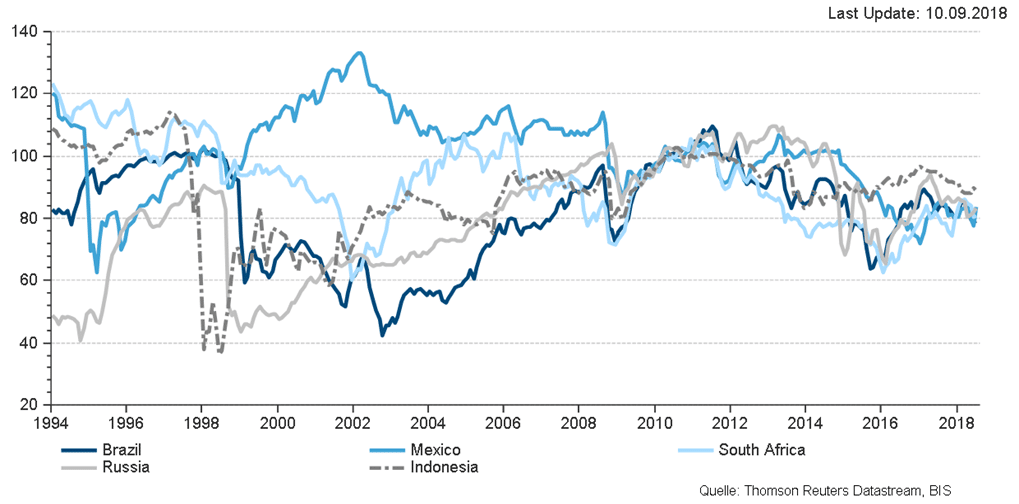

A typical indicator for local currencies are real effective exchange rates. They do not only reflect changes in market prices, but also in the relative price level. Therefore, they are used as long-term indicator for the competitiveness of a country.

On the basis of this indicator, we do not see any form of overvaluation of emerging markets local currencies at the moment.

Real effective exchange rates of selected countries 1994 – 2018

It is important to point out that the currency component introduces a high level of volatility into a portfolio. To the traditional bond investor, this is a new experience and it worries some of them, seeing as it leads to an increase in portfolio volatility.

The currency volatility can also be seen as opportunity, given that short- and medium-term investment opportunities can be seized by active management, even if the overall investment strategy of the fund focuses on long-term gains in net asset value.

Conclusion:

In the long run, an investor benefits from the higher yield level of these bonds. The price the investor pays for the higher yield is the increase in risk, which is particularly influenced by the sometimes strong fluctuations. At the moment, the yields of these bonds are attractive for investors who are prepared to assume risk, especially by comparison with German or Austrian government bonds.

Interesting for investors:

Investment funds with higher levels of volatility such as this one are suitable for savings plans. By investing constant amounts at regular intervals, the investor can achieve a lower average purchase price than for a one-off purchase. For more information, please visit: s Fonds Plan.

*) Modified Duration = interest sensitivity of a bond; it specifies the change as percentage of the price in the event of an absolute change in yields of 1 percentage point; calculated on the basis of a global emerging markets bond index (JP Morgan).

**)The key ratio “yield” is the average yield of the assets reflected by an index or held in a portfolio prior to fees resulting from the hedging of foreign currency risks; please bear in mind that the yield of an assets is not the same as its performance. It also does not take into account any fees diminishing return such as the management fee or individual account or depositary fees; data as of 15 October 2018; source: Bloomberg

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.