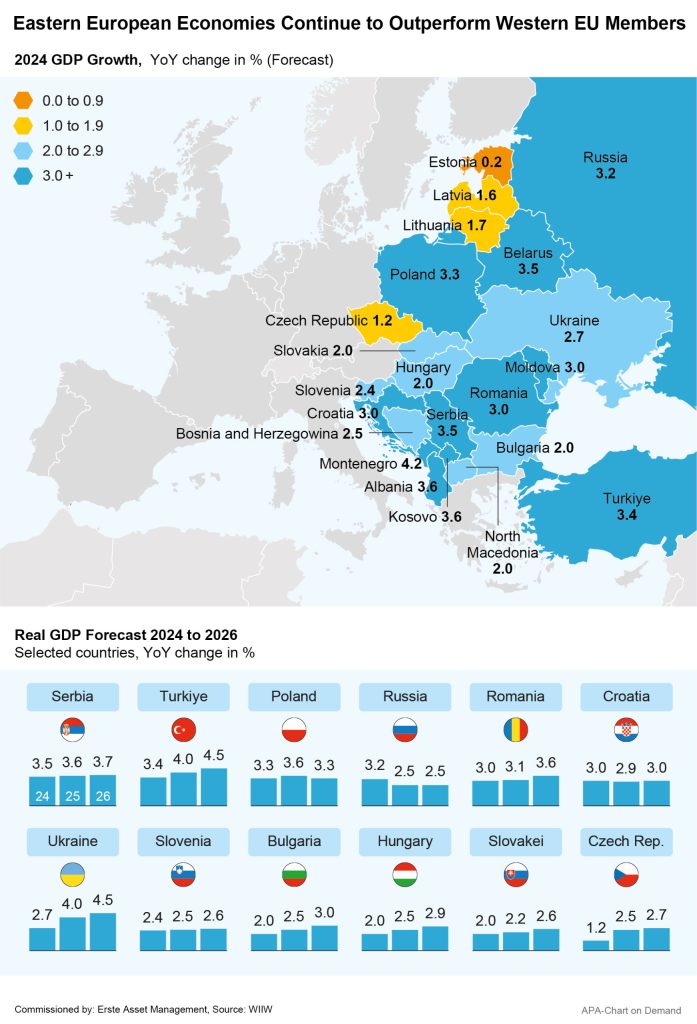

The Central and Eastern European countries’ economies are expected to outperform the eurozone again this year. In its summer forecast, the Vienna Institute for International Economic Studies (wiiw) expects an average GDP growth of 2.6% for the EU members of the Eastern European economic area, with growth likely to increase to 3% in 2025, the wiiw experts write. For the euro area as a whole, the wiiw forecasts a mere 0.6% of growth for the current year, increasing slightly to 1.6% in 2025. The International Monetary Fund (IMF) also sees Eastern Europe continuing to outperform the “old” member states. In their global economic outlook, the IMF experts forecast growth rates of 3.2% (2024) and 2.6% (2025) for Europe’s growth markets, but growth of only 0.9% and 1.5% for the eurozone as a whole.

Note: Prognoses are not a reliable indicator of future performance.

Private consumption picks up while industry weakens

The main driver of growth in many Eastern European countries has recently been private consumption. According to the wiiw, the decline in inflation rates and rising real wages will likely continue to drive consumer spending. According to the wiiw experts, Q1 saw inflation-adjusted wage increases in the region for the first time in three years.

In contrast, industry is likely to continue struggling in many countries, according to the wiiw forecast. Particularly countries with strong ties to Germany could suffer from the economic slump in Europe’s largest economy, as Germany is the primary trading partner for the majority of countries in Central and Eastern Europe. However, the German economy has been in crisis mode for some time: Q2 saw Germany’s GDP shrinking by 0.1% year-over-year, leaving the country behind other large economies such as France or Spain.

Poland in the lead among Eastern EU members

In a comparison of EU members in Eastern Europe, Poland is seen in the lead for 2024. The wiiw expects the country’s GDP to grow by 3.3% in 2024 and 3.6% in 2025, while the IMF forecasts growth rates of 3.1% and 3.5% respectively. According to the national statistics authority, Poland’s GDP grew by 3.2% in Q2 YoY, with strong domestic demand again being the main driver.

Agnieszka Kulesa, an economist from the Warsaw think tank CASE (Centre for Social and Economic Analysis), also sees strong positive effects for Poland’s economy from the growing number of migrant workers in the country. Thanks to them, continuity of production and services can also be maintained during weekends and holiday periods, Kulesa explained in a recent interview with the daily newspaper Rzeczpospolita. According to calculations by CASE experts, migrant workers contributed an average of 0.2 percentage points to GDP growth every year between 2015 and 2023.

Strong growth in Romania and Croatia expected

The other Visegrad states are also expected to grow this year, albeit at a slower rate than Poland. While the wiiw forecasting a growth rate of 2.0% for both Slovakia and Hungary this year, the Vienna-based economic researchers only see moderate growth of 1.2% for the Czech Republic, which had only a slight GDP increase of 0.4% YoY to show. According to the Czech Statistical Office, stable domestic demand proved to be the economy’s chief driver once again.

For Romania and Croatia, the wiiw experts forecast strong GDP growth of 3.0% this year, as both countries will likely reap further benefits from the NextGeneration EU COVID-19 recovery funding. However, the wiiw expects an inflation rate of 5.6% for Romania this year, which should then gradually fall below 3%. Consequently, the OECD sees combating high inflation as one of the biggest challenges for Romania.

Turkish Hyper-Inflation Returns After Change in Economic Policy

Inflation in Turkey continues to be a massive problem, despite having come down somewhat recently. After inflation rates of 72% in June and 62% in July, it fell to around 52% in August. According to economists, inflation was slowed by the high key interest rates, which increasingly dampened demand. President Recep Tayyip Erdogan prevented interest rate hikes for years, thereby fuelling inflation. However, Erdogan has since changed his position, approving the rate hikes now, and since June the Turkish central bank has increased its key interest rate by 41.50 percentage points to 50.00%.

According to the IMF, the economic situation has improved significantly since this course change and is expected push the inflation rate down to 24% in the coming year. According to the IMF experts, the sharp interest rate hikes combined with fiscal restraint also helped to restore confidence on the capital market, ensure lower deficits and create new buffers. The wiiw and the IMF expect growth of 3.4% for Turkey for 2024, while OECD economists are forecasting GDP growth of 3.6%. According to the wiiw, the Turkish economy should also benefit from having significantly weaker ties to German industry compared to other countries.

CEE stock markets clearly up

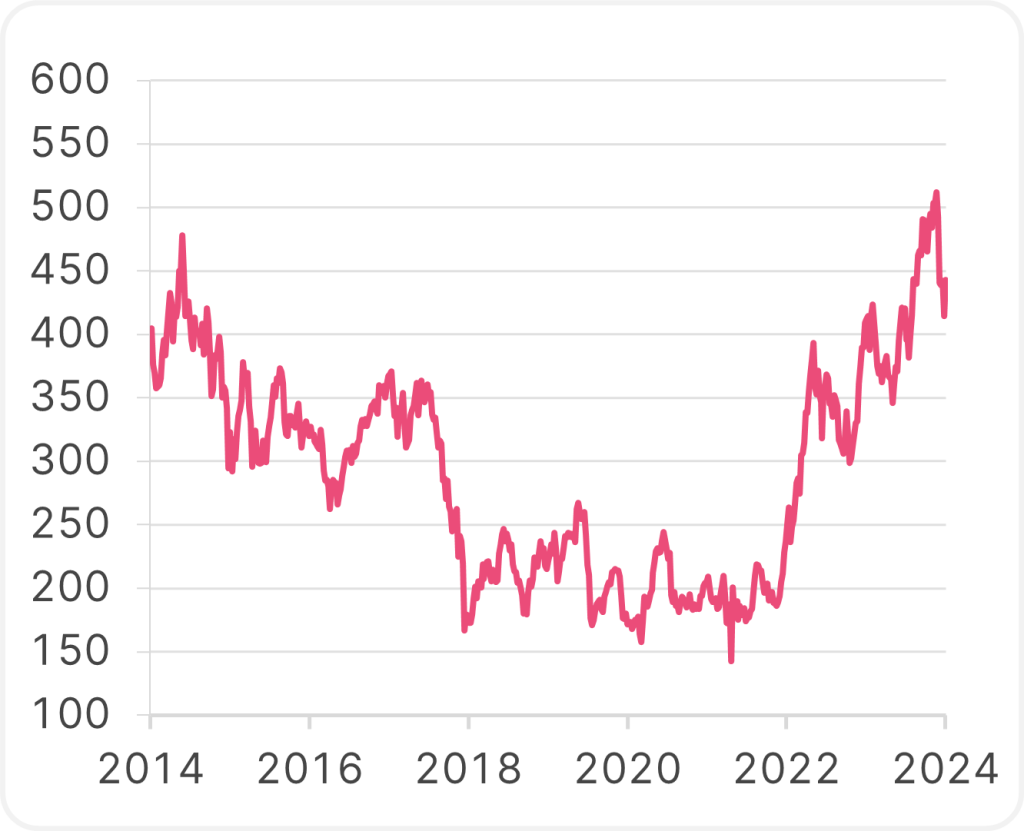

The measures taken to combat inflation in Turkey were also well received by the stock market. ERSTE STOCK ISTANBUL, for example, has made significant gains to date with an increase of around 27%. The equity fund invests in companies domiciled or listed in Turkey.

Note: The performance is calculated according to the OeKB method. The performance assumes full reinvestment of the distribution and takes into account the management fee and any performance-related remuneration. The one-off issue premium that may be incurred upon purchase and any individual transaction-related or ongoing income-reducing costs (e.g. account and custody account fees) are not taken into account in the presentation. Past performance is not a reliable indicator of future performance.

Performance ERSTE STOCK ISTANBUL

in EUR; over the past 10 years; ISIN: AT0000704341; Data as of 4.9.2024

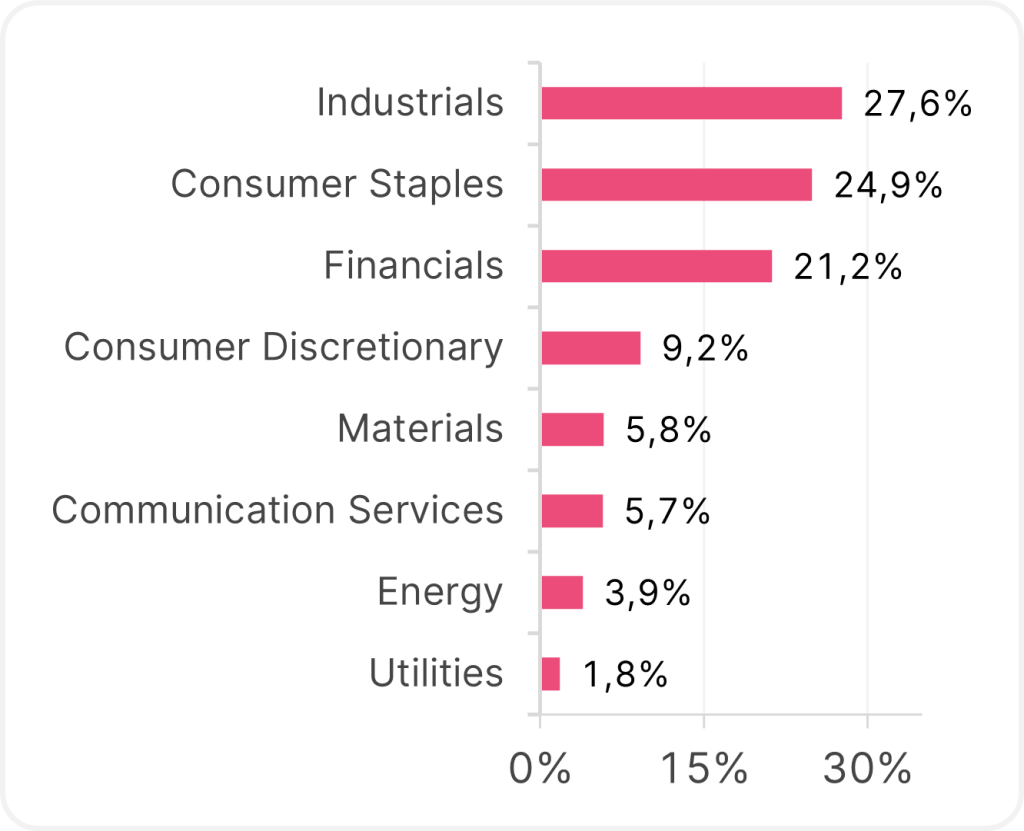

Allocation by industries

in ERSTE STOCK ISTANBUL; Data as of 4.9.2024

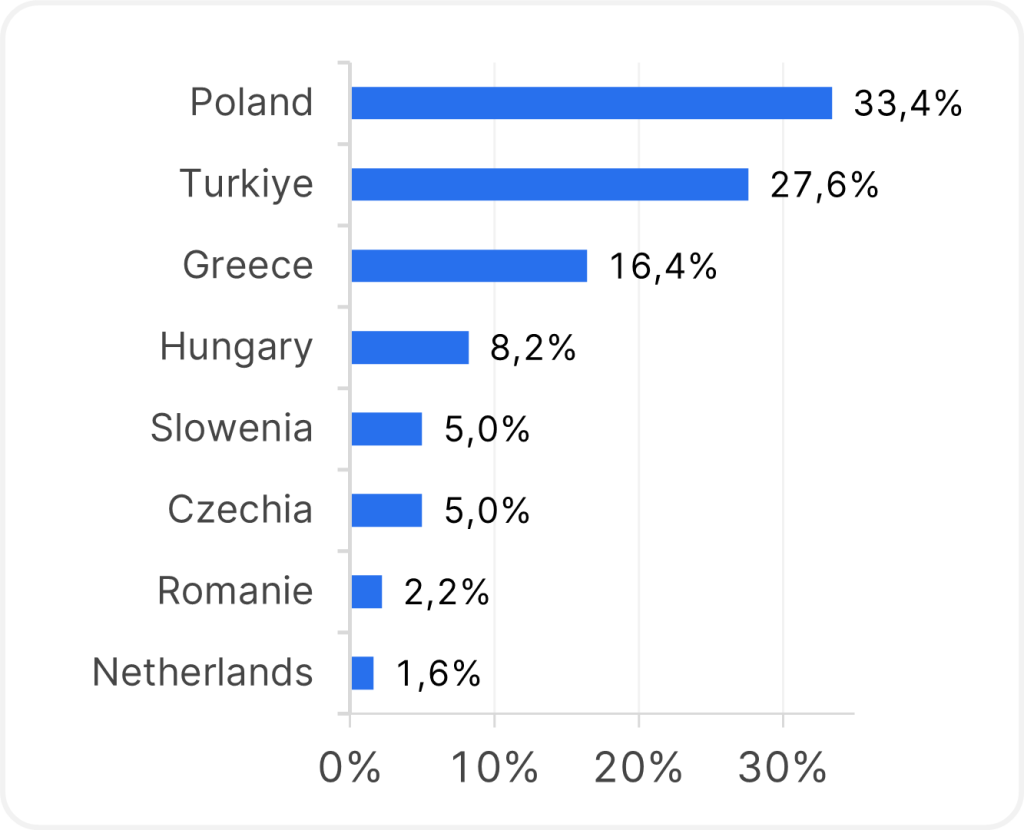

However, there have also been positive figures on the Eastern European stock exchanges so far in 2024. The markets are also benefiting from the gradual decline in inflation and the good growth prospects. With ERSTE STOCK EUROPE EMERGING, investors can participate in the performance of shares in Eastern European companies.

The equity fund invests primarily in companies from Central, Southern and Eastern European countries (including Turkey and excluding Russia),

In addition to the fast-growing Polish market, shares in Turkish companies currently have the strongest weighting in the fund. At over 16%, Greek companies are also currently highly weighted in the fund.

Allocation by countries

in ERSTE STOCK EUROPE EMERGING; Data as of 4.9.2024

Notes ERSTE STOCK ISTANBUL

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Advantages for the investor

- Broad diversification in selected Turkish companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation for investors with large risk appetite.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, especially in Turkish lira, the net asset value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Risk notes according to 2011 Austrian Investment Fund Act

ERSTE STOCK ISTANBUL may exhibit increased volatility due to the composition of its portfolio: i.e. the unit value can be subject to significant fluctuations both upwards and downwards within short periods of time.

Notes ERSTE STOCK EUROPE EMERGING

Information about the segregation of the illiquid, non-fungible portion of the Fund as of 7 October 2022 due to the current political situation and the associated uncertainties regarding the fungibility of the Moscow Exchange can be found here.

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Advantages for the investor

- Broadly diversified investment in companies of Central and Eastern European emerging markets with little capital investment.

- Opportunities for capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.