In an attempt to combat the high national debt, France’s new centre-right government under Prime Minister Michel Barnier has annoucned a drastic austerity programme shortly after taking office, planning to raise EUR 60bn through savings and additional revenues in 2025.

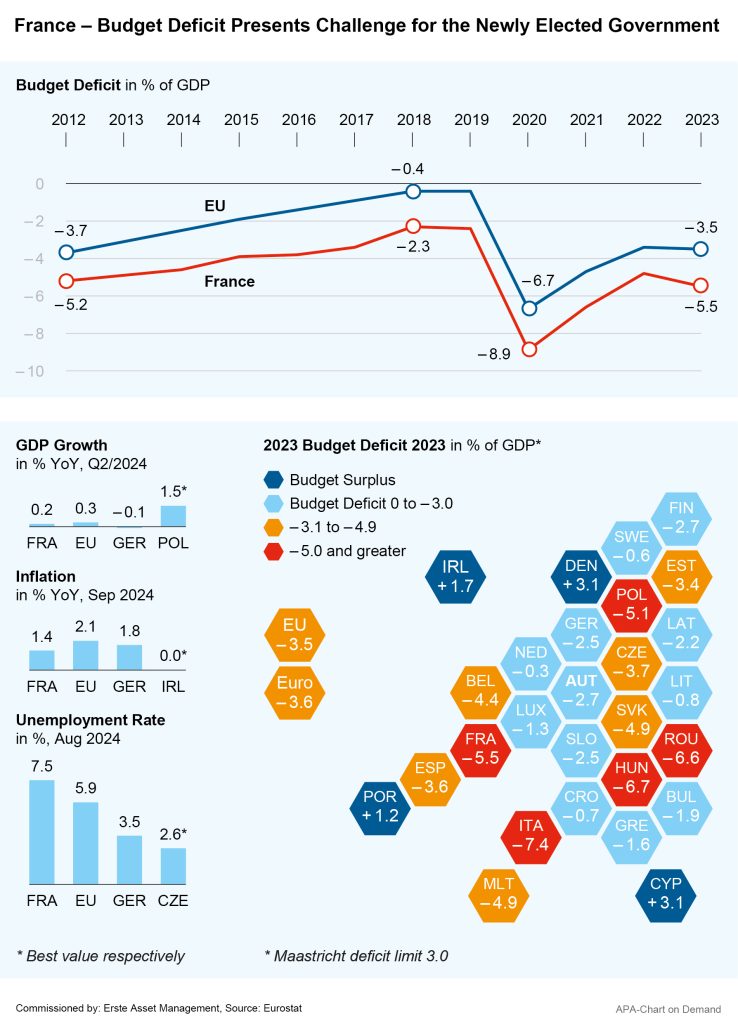

Two-thirds of this is to be achieved through spending cuts, and one third through tax increases aimed primarily at companies with high revenue, but also at high-income households. The goal is to limit the increasingly large budget deficit, which could reach around 6 per cent of the GDP this year, to 5 per cent.

National debt is “the real sword of Damocles” threatening France, said the new French Prime Minister Michel Barnier in his government statement in early October. The previous government had originally assumed a budget deficit of 5.1 per cent for 2024. This figure was amended to a 5.6 per cent deficit in early September, and in late September, the new budget minister Laurent Saint-Martin warned of an impending deficit of 6 per cent in Parliament’s budget committee. The renowned business newspaper Les Échos also reported on a possible deficit of this magnitude.

Lower income and excessive spending

The main reasons for the increase in the deficit are lower than expected tax revenues and excessive public spending. In addition, the protracted and difficult process of forming a government following the early elections four months ago is likely to have led to a wait-and-see attitude on the part of many economic players.

With this deficit, France exceeds the EU convergence criteria, which stipulate a maximum debt of 3 per cent of GDP for participation in the Economic and Monetary Union. The EU has therefore already initiated an excessive deficit procedure against the EU’s second-largest economy. The deadline originally set for the end of September for submission of a debt reduction plan has now been postponed to the end of October.

Turning away from business-friendly policies met with resistance

With their drastic spending cuts and tax increases, the plans now presented are a clear departure from the business-friendly policies of the previous government. In view of the financial situation, it was necessary “to demand a contribution from large companies that make high profits”, said Barnier.

The austerity budget has so far met with resistance in Parliament. Even before it was presented, there was criticism from both the left-wing camp and the right-wing nationalists. As the new government does not possess a majority in the National Assembly, it could therefore only get the budget through in a modified form or push its version past the MPs with a special article of the constitution.

There are also reservations in the ranks of the government, whose members are dissatisfied with the budget cuts and the departure from the previous economic policy. During President Emmanuel Macron’s previous term in office, taxes for large companies were reduced. Finally, criticism also came from the High Council of Finance, which assessed the government’s plans for their sustainability and concluded that the underlying growth forecasts were too optimistic.

Deficit and tax plans are being closely monitored on the financial markets

Developments in France are being closely monitored on the financial markets. The high level of debt and the difficulties in forming a government already caused uncertainty, but now there are also concerns that the austerity budget could slow down economic development.

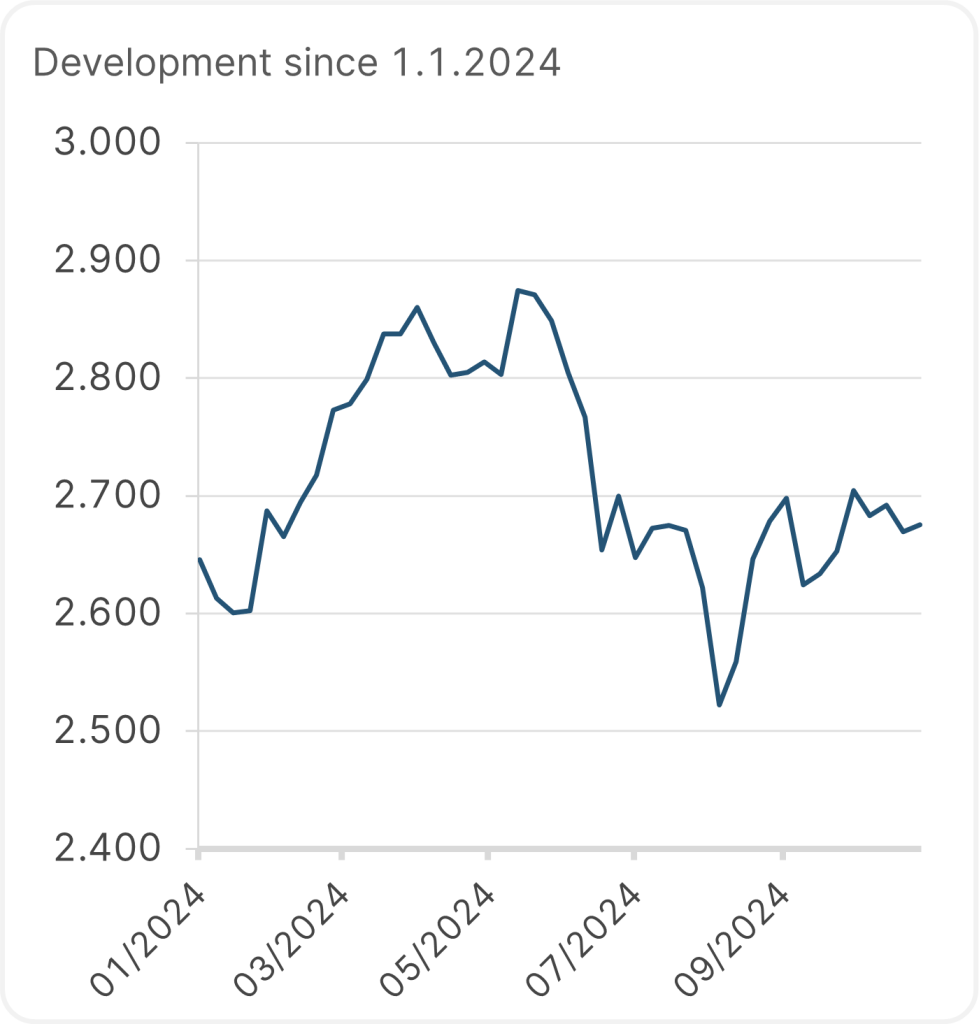

On balance, the French stock market index MSCI France has barely moved since the beginning of the year, lagging behind the significant gains of other stock exchanges’ indices. In addition to the economic policy factors, there concerns about China’s economy also exacerbate matters on the stock market, as some important listed companies in France are particularly dependent on demand from China.

Note: Past performance is not a reliable indicator of future performance. Source: LSEG Datastream

Development MSCI France

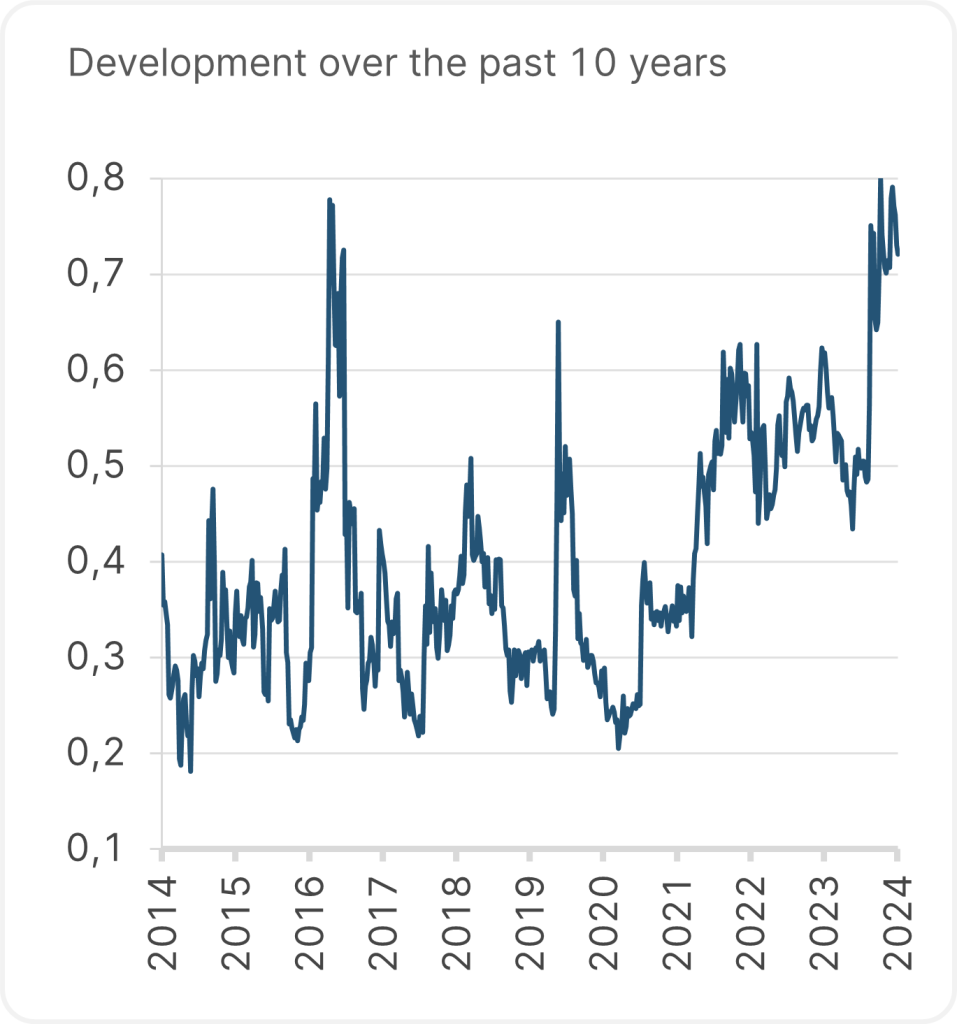

Investors on the bond markets were also cautious about French government bonds this year in view of the new elections and the increasing deficit. The risk premium of French bonds measured by the yield spread to comparable German securities has risen noticeably this year. The rating agency Fitch revised its credit rating outlook for France from “stable” to “negative” in October due to the uncertainties around the economic policy. By way of explanation, Fitch also cited the uncertainty about a minority government’s ability to even get the necessary economic programmes off the ground.

Note: Past performance is not a reliable indicator of future performance. Source: LSEG Datastream. The risk premium is the difference between the yields on 10-year French government bonds and 10-year German government bonds.

Risk premium on French government bonds

According to informed circles, President Macron had already asked for understanding for the budget problems and possible tax increases at a meeting with high-ranking US bankers preceding the presentation of the budget plans. At a meeting with 13 financiers in late September, former investment banker Macron asked them not to overreact to possible tax increases, the news agency Reuters reported, citing insiders. Macron assured the investors present that these would be targeted and temporary measures due to the weak European economy.

However, some recently published economic data from France came as a positive surprise. The country’s industrial production rose unexpectedly by 1.4 per cent in August. Inflation in France also declined more than expected thanks to more favourable energy prices and reached its lowest level in over three years at 1.4 per cent in Septemb

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.