Earnings are among the key factors driving the performance of single stocks and the overall market. They are a proxy for value generation in the listed corporate sector and, consequently, earnings growth typically has an overriding impact on the performance of stocks and equity indices.

For this reason, the quarterly reporting season, when companies not only present their achieved results but also tend to provide hints or even guidance on management expectations for the near future, is such a big event.

The current earnings season is even more important than usually because after the massive correction in the fourth quarter of 2018, market participants need to understand whether the sell-off was caused by a change in investors’ aggregate risk assessment (i.e. higher discount rates) or by a deteriorating earnings outlook (although these factors often cannot not be completely separated).

Here are some of the trends that have emerged in the course of the ongoing reporting season:

1. The current earning season is better than expected (or should we say “feared”?)

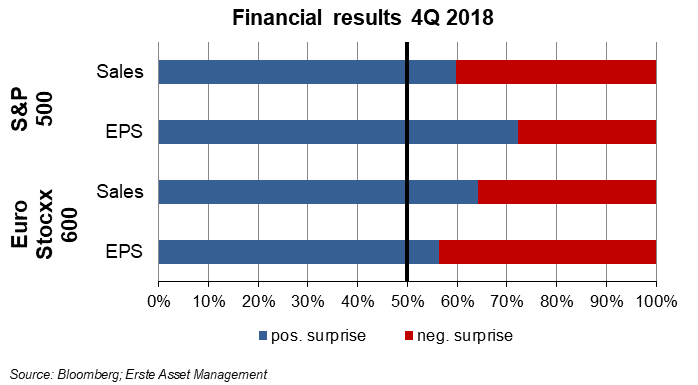

In the US, by mid-February, close to 80% of the companies had reported and more than 70% of the companies reported better earnings than expected (according to Bloomberg consensus) and 60% beat the top line forecasts. Both figures are decent but worse than in the previous quarter.

In Europe as well, positive surprises dominate so far. Of the companies that have released their 4Q results up to mid-February, more than 60% reported better top line figures and 56% beat earnings forecasts. These may not be outstanding figures by historical standards, but they are clearly not particularly worrisome and, unlike in the US, they are even slightly better than in the previous quarter.

2. But note: the bar has been lowered ahead of the reporting season.

While the ratio between positive and negative earnings surprises looks solid at first glance, it should not be overlooked that earnings expectations for the final quarter of 2018 have been cut ahead of the reporting season. In the US, the forecast for 4Q index earnings drifted 2.9% lower during the quarter, and in Europe 4Q earnings forecasts were revised down by almost 12%. Apparently, the sell-off in the fourth quarter and the global growth slowdown triggered substantial downward revisions of earnings expectations. The revisions turned out to be overdone – – considering reported results – but it has to be noted that without these revisions, there would have been – on average – no positive earnings surprise in the US and a negative surprise of almost 10% in Europe.

3. Growth has slowed in Q4

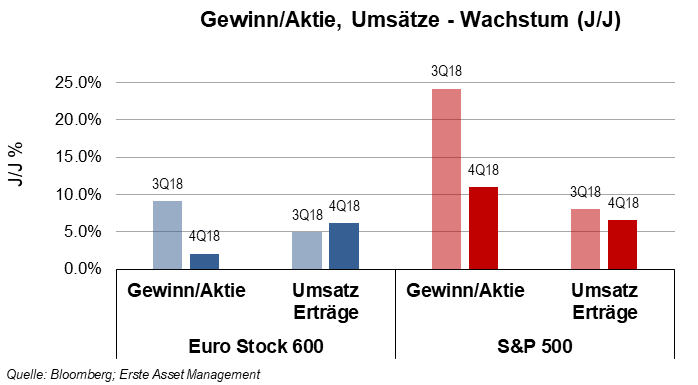

In the US, average annual EPS growth has slowed from 24% in 3Q 2018 to c.11% in the final quarter of last year and in Europe from 9% to 2%. On the revenue side, the picture looks somewhat better: In the US, sales growth decelerated just 1.5 percentage points to c.8% and in Europe top line growth came in even slightly higher than in 3Q.

Three points are noteworthy: while growth has slowed it is important to note that there was still growth in the fourth quarter. Second: the US corporate sector continues outgrowing its European counterpart in terms both of aggregate revenues and of earnings – which is just another confirmation that the macroeconomic background is still stronger in the US than in Europe. Third: margins improved in the US (no surprise, given the impact of the US tax reform) but contracted in Europe.

4.Expectations for 2019 are still positive but risks are skewed to the downside

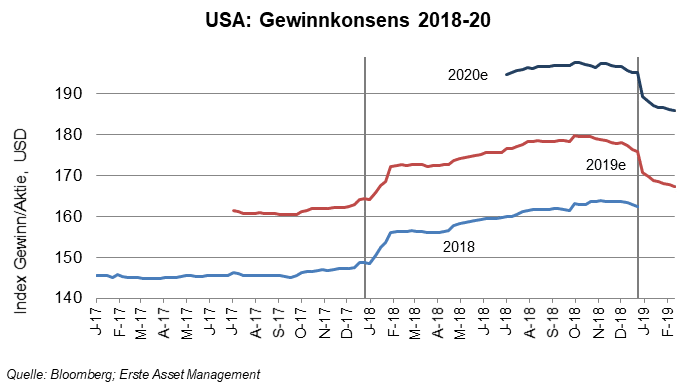

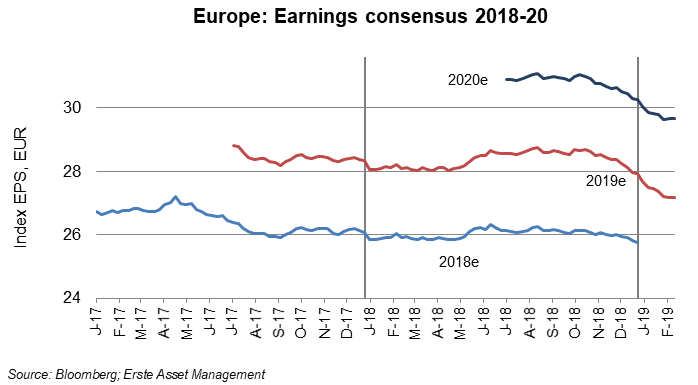

The outcome of the ongoing reporting season has failed so far to end the downward trend in earnings forecasts for the current year. Recent forecasts of 2019 index earnings for the S&P 500 and the Stoxx 600 are 5-7% below their peaks in the second half of 2018.

As a result, both for the S&P 500 and the Stoxx 600 universes, earnings growth estimates for the full year have come down from the high single-digit range to around 6%. However, downward revisions do not seem to be over, and I expect the growth consensus to settle closer to 3-4% after the reporting season is over.

Note: A consensus estimate is a figure based on the aggregated estimates of analysts covering a field or sector.

Overall, the main implication for investors is that – after two years of strong growth – corporate earnings will most likely not act as an upside trigger for US and European equities. While downward revisions seem to have slowed as of late, risks to corporate earnings are clearly skewed to the downside. Global economic growth continues decelerating, while wages and other cost-factors are climbing higher. It is not obvious that these developments are fully reflected in the margin assumptions of sell-side estimates.

Conclusion:

However, there is no reason to be overly gloomy, because a) current estimates do not suggest that investors will face a collapse in earnings, and b) expectations have already been cut significantly. For example, current consensus forecasts are already taking into account that 1Q 2019 earnings will most likely shrink year-on-year on both sides of the Atlantic. Investors do not seem to be infected by an overdose of optimism at present – which in itself is a reason for moderate optimism.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.