Many market participants take a break in summer, so the general level of activity subsides a bit and the months of July and August are somewhat quiet. While this effect can easily turn into the opposite, with selective negative news potentially causing excessive market fluctuations as only a few informed players assess the movements, there are signs suggesting that one can go to the beach with peace of mind in the summer of 2023.

One aspect that we have repeatedly highlighted here on the blog is a potential recession in the USA, triggered not by economic difficulties nor by a crisis of confidence as in 2008/2009, but by the rapid interest rate hikes implemented by the Federal Reserve. These are – and are meant to be – a drag on the economy as subdued activity takes pressure off the inflation side. The extraordinary levels of inflation in the USA and Europe that we have seen since around 2021 have left central banks with no alternative but to take decisive action.

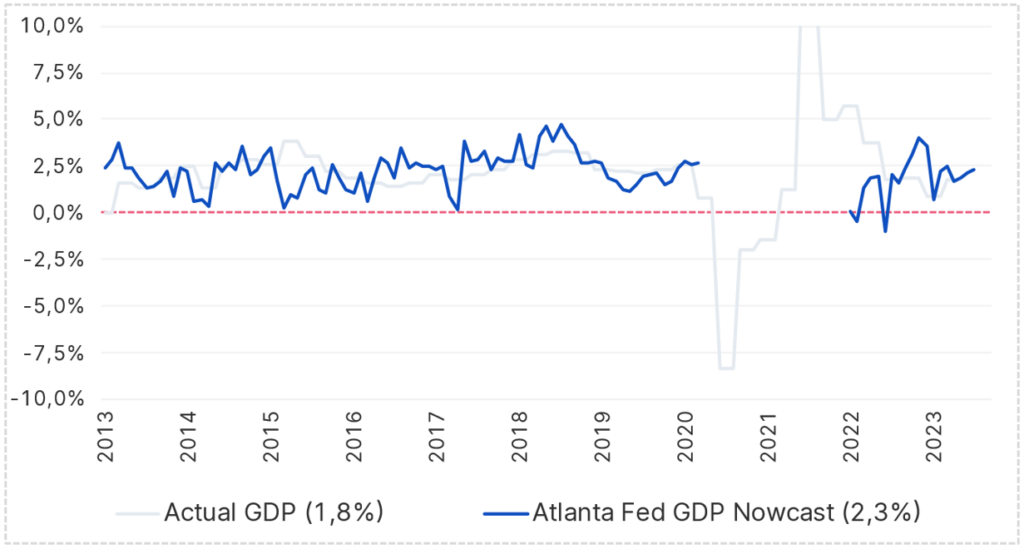

A recession basically means an economy contracting for half a year. However, several months pass before reliable values for economic growth come in, and even then, there may still be revisions afterwards. The practice of “nowcasting” attempts to mitigate this aspect by basing economic growth on freshly received data in real time. The following chart offers two explanations: 1. the significance of the nowcast values (blue line) for actual economic growth (grey line) is satisfactory, and 2. the current value is +2.3% and therefore far from recession terrain.

Economic growth USA: „Nowcast“

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

Since the COVID pandemic subsided, economic growth, as measured by the nowcast, has actually only been negative from January to July 2022. A recession is a significant economic event because it usually comes with high unemployment, causing social tensions, and because corporate profits can collapse, with corresponding consequences for the stock exchanges. In the pandemic years, the concept of nowcasting has reached its limits, with values that are difficult to classify, which is why we left this area in the chart blank.

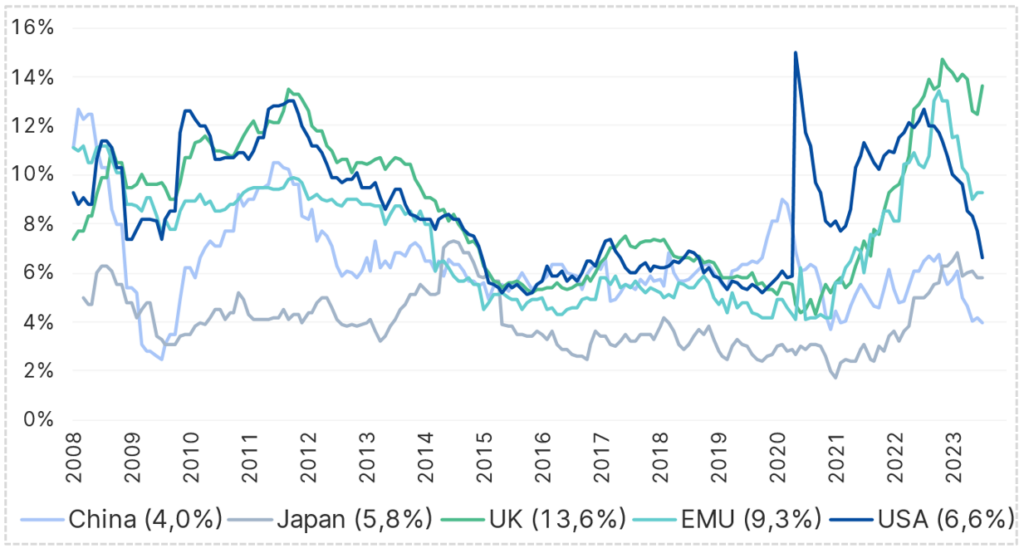

The so-called “misery index”, which adds up inflation (in %) and unemployment (in %), is a measure of the stress faced by the population. The chart below shows that our world was exposed to more than enough misery even after the pandemic. The welcome news under these circumstances is that the strains are now easing off, and inflation is falling. The unemployment rate, interestingly, has added little to the burden during this period, as labour shortages prevail internationally. The UK continues to show the highest misery level at this point.

„Misery“ Index: inflation plus unemployment

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

In the chart, the massive spike in the USA in August 2020 is striking. This was due to the fact that in the course of the lockdown, workers were actually laid off (and soon rehired), in contrast to Europe, where working time models were resorted to as a bridge.

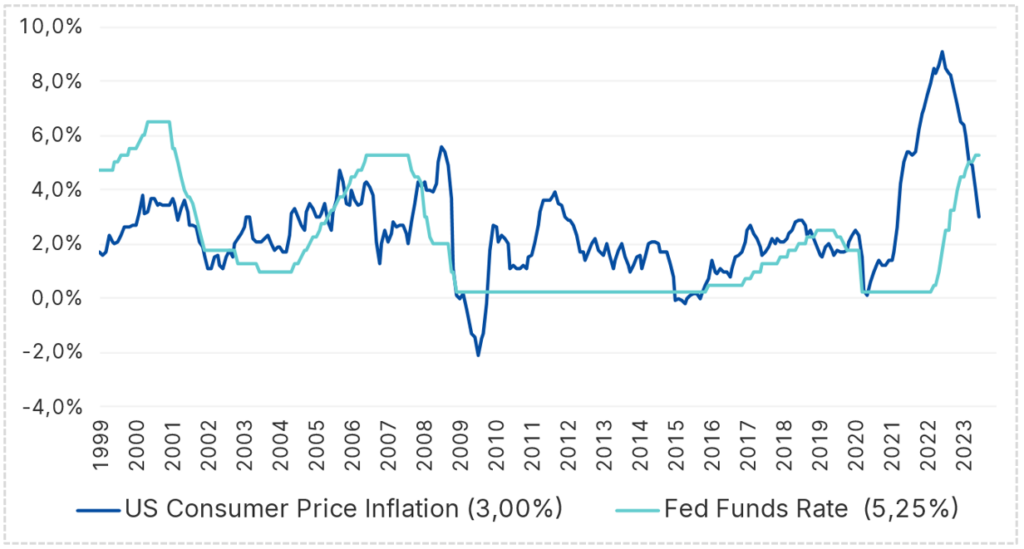

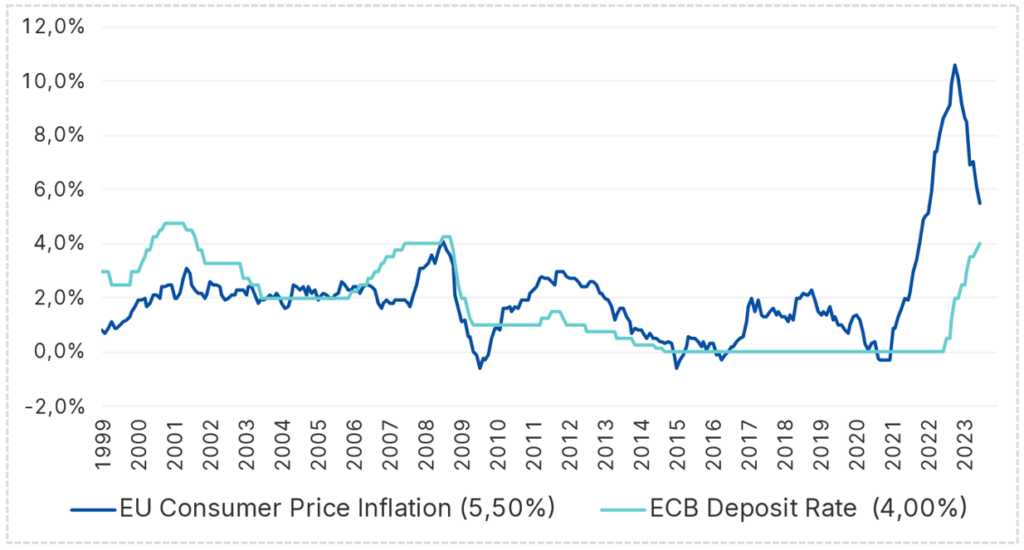

Economically, inflation and key-lending rates should be comparable. These two charts show that the US Federal Reserve has mastered this Herculean task at this point: the lines for inflation (blue) and interest rates (turquoise) already intersect. The European central bank, on the other hand, presumably still has some way to go.

Consumer prices USA and Fed funds rate

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

In the Eurozone, consumer prices and key-lending rates have not (yet) converged:

Consumer prices Eurozone und key-lending rate

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

An interesting aspect is the fact that inflation in the euro area has been largely below the target level of 2% over the past ten years. The ECB’s decision to enter the interest rate hike cycle comparatively late is controversial; it should also be seen in this context.

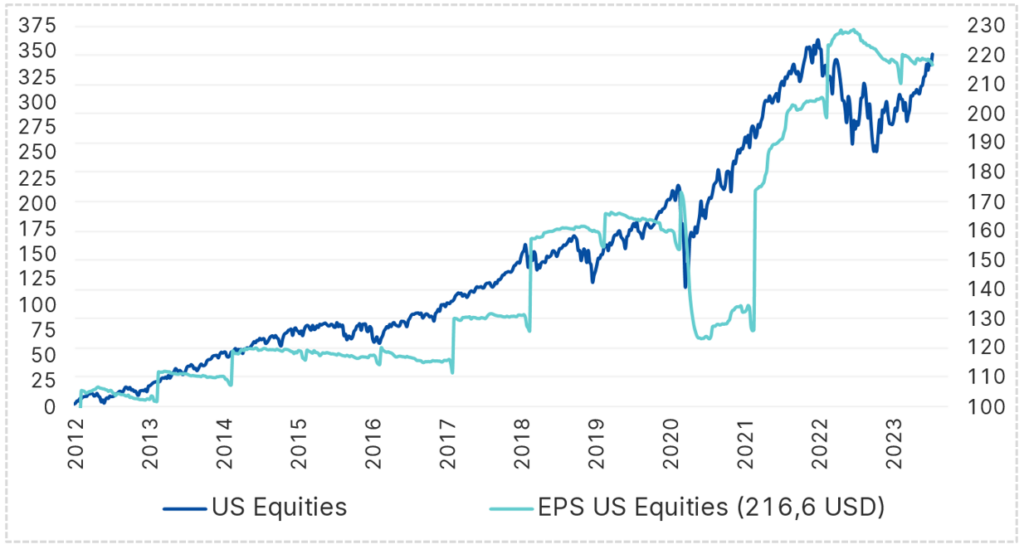

In the long run, the profits of listed companies and equity market prices are in sync. One component would usually lead, but under normal circumstances an equilibrium is reached sooner or later. The following chart shows that this is currently the case: profits have not collapsed (which would be the effect of a severe recession), therefore stock market prices have recently risen again. Both lines intersect today.

Earnings per share and stock market performance

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

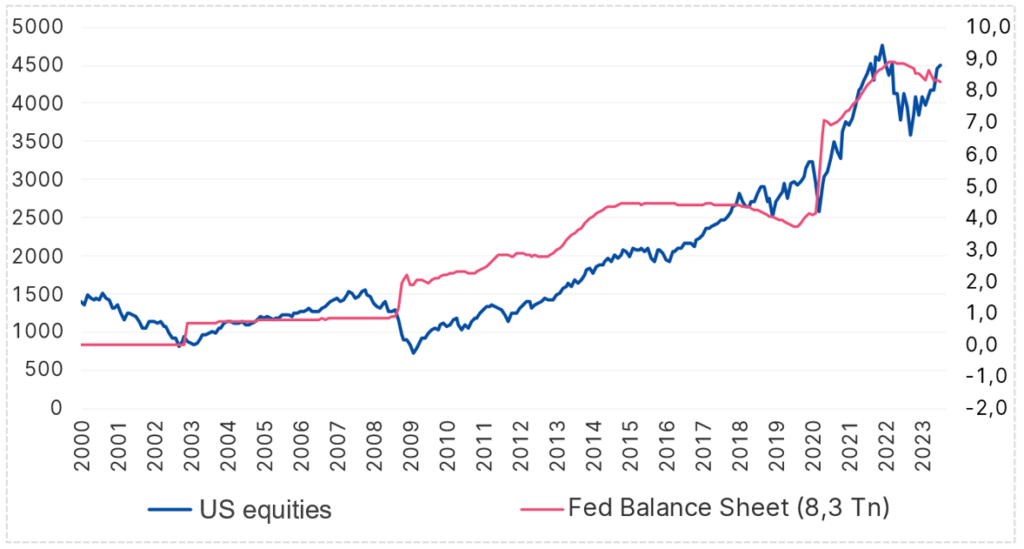

We are past the period of “cheap” money, i.e. the phase of its easy availability. The following chart shows the correlation for the USA: the extent to which the Federal Reserve has provided and continues to provide liquidity to the economy displays a correlation with the prices of US equities.

Fed measures (Quantitative Easing) and stock market performance

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

Since mid-2022, the Fed’s balance sheet, i.e. the amount of money channelled into the economy to support it, has been shrinking. At the same time, the red line on the chart has only just dipped after its high. The good news here is that equity prices may have “emancipated” themselves from the Fed’s support and will therefore not necessarily have to react to the ongoing reduction in liquidity with losses.

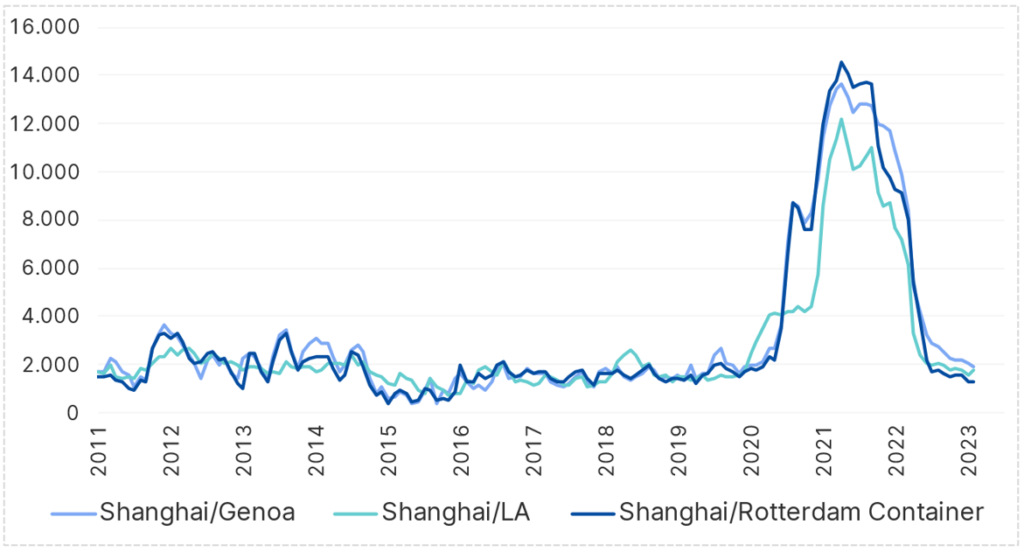

In the pandemic, supply chains were clogged up. One of the reasons was the sharp increase in online orders for goods that required a long delivery route. The prices of containers on cargo ships were exploding:

Container shipping

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

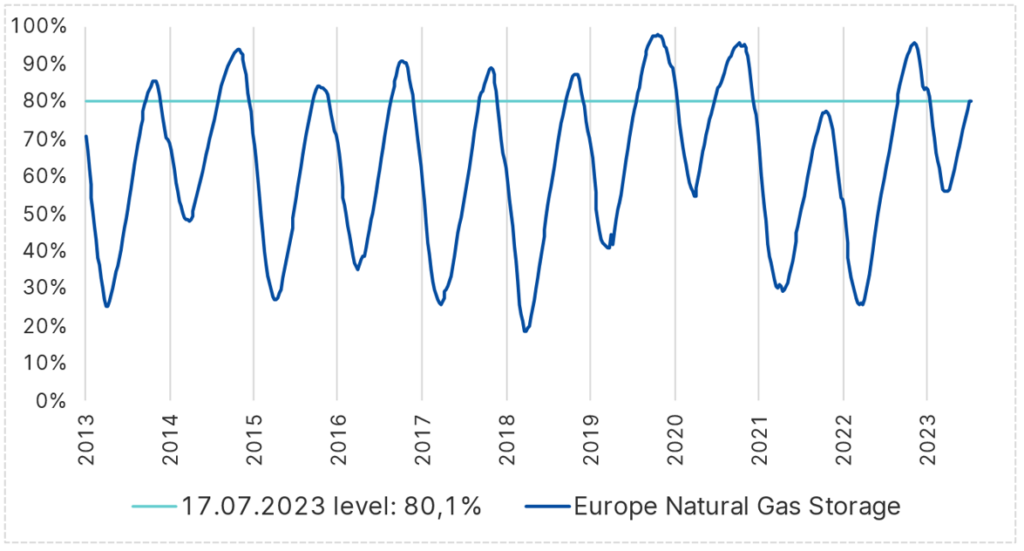

The situation has now normalised. This has a dampening effect not least on inflation; and commodity prices show a similar picture. Speaking of raw materials: the natural gas storage facilities in Europe, where substitute suppliers had to be found when the gas deliveries from Russia failed to materialise or were to be reduced deliberately, were a delicate topic only a short while ago. In particular Germany, an economic heavyweight in Europe and formerly the world champion in exports, and Austria were and still are highly dependent on natural gas. If it had not been possible to refill the storage facilities in time, a significant recession could have set in in Germany. This challenge was overcome – at high cost – mainly by so-called LNG, i.e. liquefied natural gas that could be transported without a pipeline. The infrastructure for this commodity was expanded at record speed.

The mild winter has also made the situation much easier. As of today, the natural gas storage filling level across the EU is already back at 80.1%, i.e. higher than in many previous summers. This should give Europe a head start for the winter of 2023/24.

Natural gas storage filling level

Source: Bloomberg; As of 14.07.2023; Note: Past performance is not a reliable indicator for future performance of an investment.

Conclusion

The equity markets are often sailing calmer waters during the summer months. For the summer of 2023, several signs suggest that no nasty surprises should spoil our holidays.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.