Markus Jandrisevits has been the manager of our global flagship equity fund ESPA BEST OF WORLD since 28 February 2002. The performance to date is impressive on an international scale. I asked Markus what was special about his investment approach and how he has positioned himself in the current stock market phase of high political risks.

What is specula bout this equity fund?

Jandrisevits: ESPA BEST OF WORLD is an umbrella fund with a global focus and invests in about ten different investment strategies of internationally renowned fund management companies. As a result, the fund diversifies the risk very broadly. Another advantage is the fact that we as institutional investors can buy and sell the funds at attractive prices. We pass on this advantage to our investors.

Markus Jandrisevits (c) Stephan Huger

What kinds of sub-funds are in your investment universe?

Jandrisevits: Depending on the stock exchange cycle or our market assessment we may employ several strategies. For example, growth shares tend to outperform during upswings. Among them are for example Facebook, Alphabet (Google), and Amazon, all of which record above-average sales growth. So-called growth strategies are particularly successful in such periods. At the late stage of the cycle, smaller companies catch up, which is why it is important to invest in small/caps at that point. They trail blue chips in upswings and catch up later. I also keep a constant eye on the so-called value segment. Among them are shares that command a lower valuation than the overall market and that, say, pay higher dividends.

For example, we invest in strategies that recreate a specific index. In doing so, we employ so-called ETFs (exchange-traded funds). In addition, we hold shares in Lots Global System, a very actively managed equity fund. Here, the fund manager knows every title inside out and is in direct communication with the management of the respective company.

What are the crucial issues you pay attention to when selecting a fund?

Jandrisevits: For us it is important to see that the fund management team follows a consistent approach that is transparent and is adhered to consequently. Ideally, we meet the fund management team personally. In the selection process we use our own key ratios to measure the success of the respective strategy.

The historical performance of the fund during upswings and downswings is of particular importance to us. It shows the success of the investment strategy. When we come across a strategy that beats a benchmark index in an upswing and does not lose as much in a downswing, we have found a product that we would want to take a closer look at. We are also interested in funds that have underperformed the market recently and harbour potential for a rebound. If our market assessment changes, we discard funds that do not fit our concept any longer.

How is the fund positioned at the moment?

Jandrisevits: In the current market phase, I focus particularly on actively managed funds. The stock exchanges have come a long way and it will be harder to find the right individual titles in the future. Overall, the fund managers have increased the weighting of European equities and expect a weaker US dollar. I invest in a balanced portfolio of value and growth shares, with only 10% allocated to small caps at the moment.

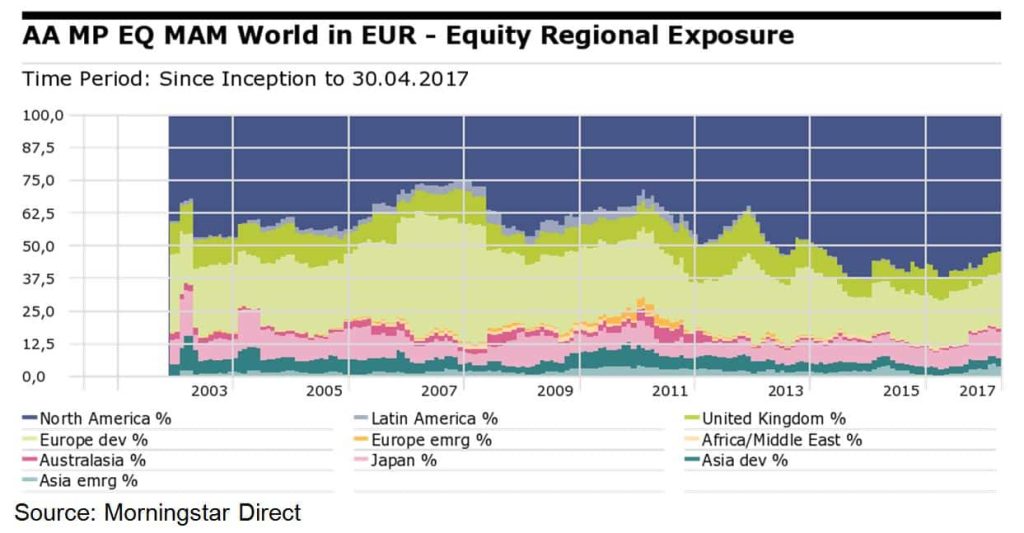

Regional weighting of the fund over time (2003-2017)

Watch our product video of ESPA BEST OF WORLD:

Read more information:

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.