Everybody is talking about ChatGPT. According to US media, Microsoft is going to invest about USD 10bn in ChatGPT inventor OpenAI over the next few years. Already in 2019 and 2021, the company invested more than USD 3bn in OpenAI and wants to integrate the chatbot software into its services. The megatrend artificial intelligence is also a defining theme on the markets – with which equities can you profit?

We interviewed our fund manager Bernhard Ruttenstorfer on this topic:

Bernhard, apart from the interest rate policy, the topic of Artificial Intelligence (AI) seems omnipresent. What is happening here?

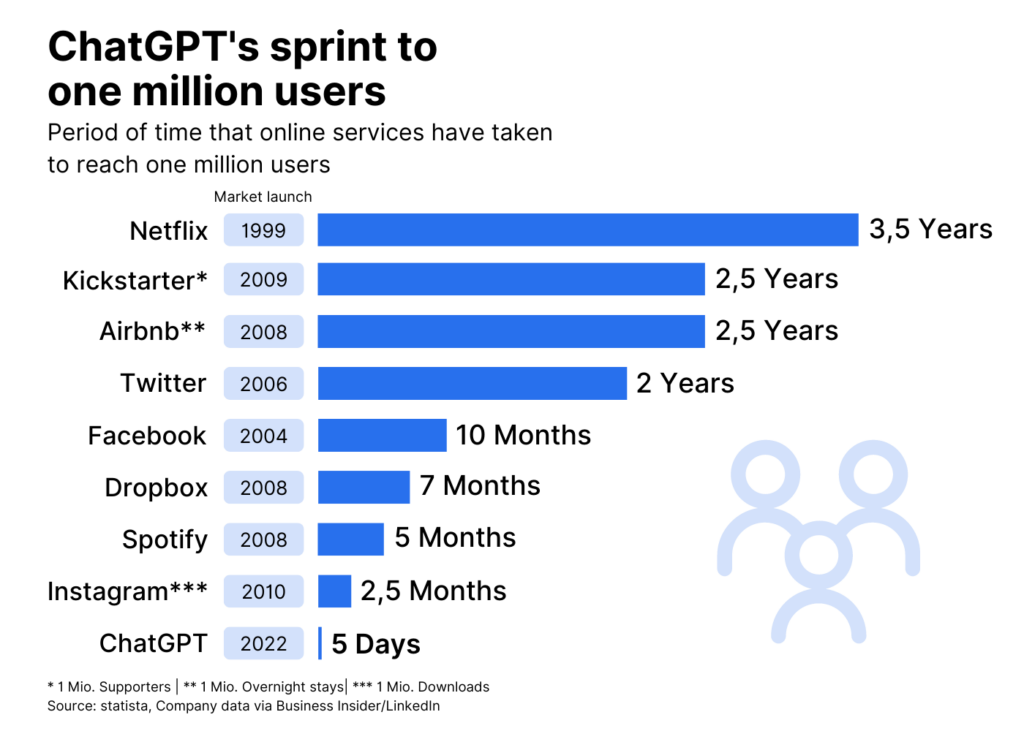

This year has been very much driven by the rise of AI applications. The generic AI service ChatGPT became popular worldwide and achieved unprecedented user growth.

However, it soon became obvious that AI was not only of interest to consumers: a multitude of professional/corporate user products could also be improved by AI. These include pattern recognition (IT security, health, etc.), graphic generation, process optimisation, etc. Numerous companies in the technology sector benefit from these efforts, with examples including Nvidia, Broadcom, AMD, Adobe, ASM, ASML, and TSMC*. The equities of some companies in the artificial intelligence sector have risen significantly so far this year.

What equities benefit from artificial intelligence?

We covered AI with our positions in AMD, Broadcom, and ASML, among others. At the top of the AI list, however, is Nvidia. The company is a leader in that it not only offers cutting-edge technology in the graphics chip area, but also the ecosystem to go with it. Software, server connections, and tools and models based on them create a compelling sales proposition. Broadcom and AMD are number two and three in the graphics chip segment (i.e. chips designed for specific applications, e.g. AI). And it is these graphics chips that shoulder the brunt of processing requests from AI software.

What other segments do you find attractive in the technology sector?

AI actually already plays a big role all across the technology sector. A lot is also happening in the software sector. In addition to hardware for AI, I have also put a focus on software companies in the fund. The valuations we have seen in software companies in recent months have convinced us again to invest more in this industry. While there is still a noticeable reluctance on the part of clients to sign new deals, we can see the market bottoming out. We also expect a significant recovery in business after the current phase.

Does it make sense from your point of view to have a broadly-based portfolio in the technology sector?

To focus on just one theme in the portfolio would be too narrow. The sector is dominated by a variety of trends and themes. Artificial intelligence is currently the most prevalent in the media. Nevertheless, we also regard software security, digital advertising, automation, EVs, payment, video gaming, and other topics as relevant. As these segments experience different cycles, investing across this range of sub-segments generates a high degree of diversification of risk. Potential on the basis of different trends is one of the strengths of our technology equity fund ERSTE STOCK TECHNO.

We can still see upside potential in the following industries:

- Semiconductors: we can see strong demand for AI chips, in particular. Orders from industry and automotive are also stable. One should also bear in mind the solar industry here (semiconductors).

- Software: attractively valued companies with high growth. The cyber security sub-segment should also record stable demand.

- Interactive media and entertainment: the market for digital advertising has also seen signs of recovery. Video gaming is at the end of a longer correction phase. We can see a return to normal growth.

Where are the risks hiding?

On the interest rate front, the headwinds that we felt in 2022 have subsided. Back then, technology shares were particularly affected by the interest rate hikes. In the course of the summer, however, interest rates are expected to peak in both the EU and the US. On a positive note, the enormous cash holdings of tech companies have also started to earn higher interest income.

We will have to see whether we can avoid a recession. We cannot rule it out for either the EU or the US. At the same time, we do not expect a massive contraction, as the current environment does not support this theory. At the end of the day though, the impact of the overall economy on the positioning of the portfolio is limited anyway, given that our investment approach focuses on attractive industries and individual companies. The most attractive companies of these industries form our most significant positions. Overall, we continue to see upside potential for the technology sector, driven by stable demand for technology solutions.

ERSTE STOCK TECHNO invests in high-quality, high-growth companies in the technology sector, including equities that benefit from the megatrend artificial intelligence. Over the past ten years, the value of the fund has more than quadrupled.

Source: Refinitiv Datastream; Data as of 23.06.2023; Chart is indexed (23.06.2013 = 100); Note: Past performance is not a reliable indicator for future performance of an investment.

With ERSTE FUTURE INVEST, investors can also benefit from the growth in the field of artificial intelligence. The equity fund invests in 5 potential megatrends – such as Health & Pensions, Lifestyle, Technology & Innovation, Environment & Clean Energy and Emerging Markets – that are considered attractive for investors.

Risk notes

*) Portfolio positions of funds disclosed in this document are based on market developments at the time of going to press. In the course of active management, the portfolio positions mentioned may change at any time.

The companies listed here have been selected as examples and do not constitute an investment recommendation. They are examples from the portfolio. There is no claim that the securities will be permanently included in the portfolio.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

Advantages for the investor

- Broad diversification in technology companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Legal note:

Prognoses are no reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management