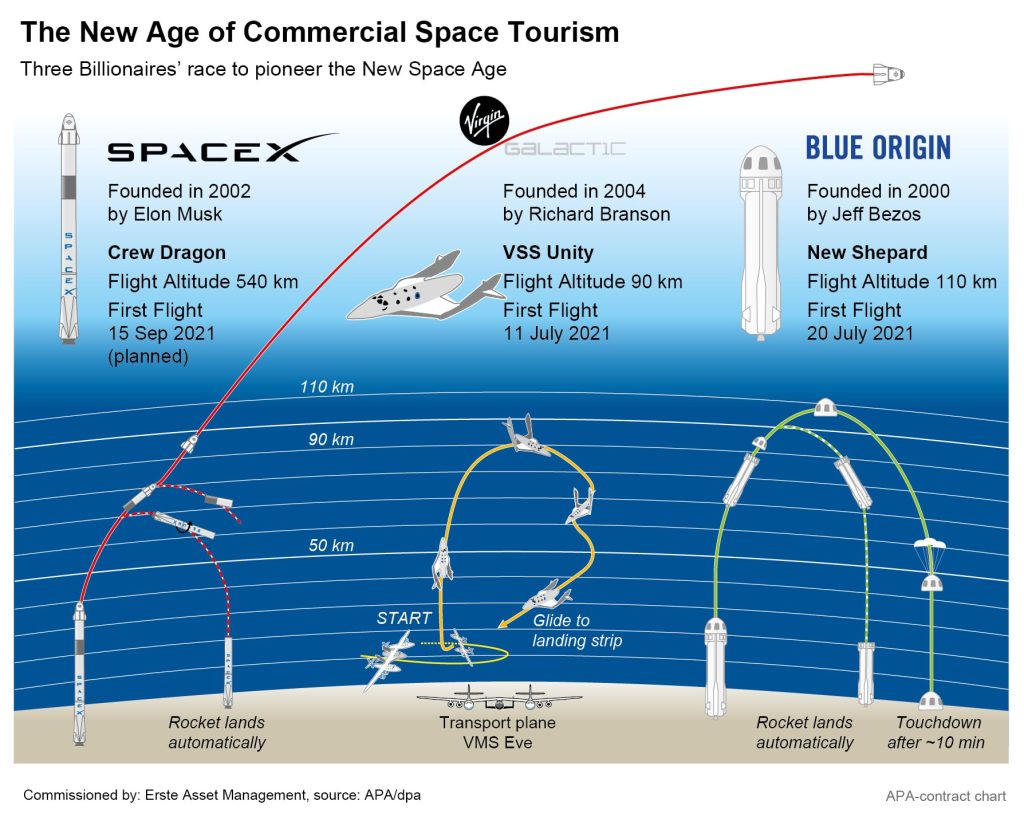

The summer of 2021 marks the official start into the age of commercial space tourism. After the two multi-billionaires Jeff Bezos and Richard Branson launched their respective spaceflight companies’ spacecraft into space in July, Elon Musk, Tesla’s enterprising boss, is already planning an even more spectacular flight for September.

There have been paying space tourists in the past, but they travelled in the Russian state space agency’s Soyuz capsules. And the manned space flight conducted by Elon Musk’s company SpaceX, which took two astronauts to the International Space Station (ISS) last year, was a cooperation with the state-run NASA. For the first time, however, civilians have now flown into space through a wholly private company.

The first to lift off was Richard Branson. On 11 July, the charismatic British entrepreneur and adventurer launched into space on board his company Virgin Galactic’s VSS Unity spaceship together with three passengers and two pilots, narrowly beating Amazon founder Jeff Bezos. However, it is disputed whether the Briton has won the race for the first private space flight, as the VSS Unity only achieved an altitude of 86 kilometres during its flight, whereas the International Aeronautical Association (FAI) defines 100 km as the border to space.

On 20 July, Bezos took off on board the New Shepard, his spaceflight company Blue Origin’s space vehicle, for a short trip into space, on which he slightly exceeded the 100 km limit. Besides Bezos himself, the passengers were his brother Mark, a retired US pilot and an 18-year-old Dutchman whose father had given him the flight as a gift. Unlike Branson’s spacecraft, the New Shepard is pilot-less and automatically controlled.

Elon Musk, however, wants to go even further. The entrepreneur wants to send a civilian crew into orbit in September for a journey lasting several days. For 2023, he is also planning a manned flight around the moon with Japanese billionaire Yusaku Maezawa on board. It is not known whether Musk personally wants to be aboard his space flights. In any case, he has already reserved a ticket for himself on a flight with his friend Branson’s company Virgin Galactic.

Bezos and Branson plan to start regular flight programme shorty

Bezos and Branson now want to establish a regular space tourism service after their successful first flights. Virgin Galactic is planning two more test flights this year, aiming to transport tourists into space on a regular basis from 2022. According to Virgin CEO Michael Colglazier, there are already 600 reservations at prices around 250,000 US dollars per ticket. In the future, Virgin wants to sell around USD 600m worth of tickets for up to 400 flights per year.

Branson wants to lower ticket prices to under USD 40,000 per ticket in further steps as soon as economies of scale allow it. Industry experts, however, doubt the feasibility of the planned ticket prices and consider prices around USD 400,000 to be more realistic. Other observers also consider the plans for building the required capacity to be ambitious. According to an analysis by industry service Paragon Intel, Virgin needs eight operational spacecraft for its plans. At the moment, however, the company is only testing the second one.

In any case, the space plans were well received on the stock market. The listed Virgin Galactic shares have already gained a good 28 percent since the beginning of the year. Shortly after the first flight, the share price dropped significantly, but this was due to the company’s capital increase, which was announced at the same time. Branson himself now holds only 24 per cent of Virgin Galactic.

Bezos is also planning two more manned flights this year and wants to massively expand the programme in the future. There are no official statements on ticket prices, but the Amazon founder spoke of around USD 100m in expected ticket revenues. Overall, the market for space tourism could grow to around USD 3bn annually in the coming decade, according to estimates by analysts at UBS. However, experts see even more potential gain in the use of spacecraft for extreme long-haul flights.

Space industry continues to flourish

It is doubtful whether space tourism can become as lucrative a business as is transporting satellites into space. However, the launch of space tourism has generally boosted innovation in the space industry and also drawn much attention from investors and the media.

Already, private companies are increasingly filling the role formerly in the hands of government space agencies, for example in the transport of satellites. The two best-known spaceflight companies, Elon Musk’s SpaceX and Jeff Bezo’s Blue Origin, are privately owned, but the boom could attract other companies in the sector to the stock market.

Sky News, for example, recently reported a possible IPO of Virgin subsidiary Virgin Orbit. The company launches rockets into space from a converted Boeing 747 to deliver satellites. Experts expect the market for satellites designed to expand the internet infrastructure to continue booming, from which Virgin Orbit could also profit. Virgin Group currently owns 80 per cent of the company, the remainder is held by an investment fund from Abu Dhabi.

Spaceflight start-ups also gaining momentum in Europe

Things are also happening in the sector in Europe. In December 2020, the spaceflight start-up Isar Aerospace raised EUR 75m from investors. The money is to be used to launch the first German rocket into space. This largest financing round ever for a European space company was led by venture capitalist Lakestar.

Swiss nanosatellite operator Astrocast is also looking to raise new capital. In addition to raising capital off the stock exchange, the start-up is currently looking into an IPO on Euronext. According to the company, 30 to 40 per cent of the shares could be listed on the stock exchange as early as Q3. Currently, several mini-satellites from the Swiss company are already in orbit, with the network to be complete with 100 satellites by 2024. This is the company’s response to the growing demand for mobile internet. At the moment, Astrocast is not making any profit off this, but starting in Q3 the company expects operating income.

OHB System from Germany is already listed on the stock exchange. Last year, the company signed contracts worth almost EUR 130m with the European Space Agency ESA for the Hera asteroid mission. Together with the NASA probe Dart, Hera is to examine the effects of an impact with an asteroid in order to derive a technique for deflecting such rock fragments from this experiment.

Also listed on the stock exchange is Mynaric AG, a German company that specialises in equipment for networking satellites in space. The satellites communicate with each other not via radio waves but by means of lasers. The advantage of this is the significantly higher speed. Currently, numerous companies (SpaceX, Amazon) as well as countries (USA, Canada) are trying to bring a constellation of satellites close to the earth into space in order to be able to supply remote areas with broadband internet.

ERSTE FUTURE INVEST: Investing in the technologies of the future

Mynaric has also been included in ERSTE FUTURE INVEST since June 2020. This is an equity fund that – as its name suggests – focuses on topics of the future. We are talking here, for example, about stable and fast internet, which should be available everywhere. About half of the world’s population lacks such access, thus hampering economic development. The internet could be brought to even the most remote regions of the world via a multitude of interconnected satellites.

This fund is about megatrends that will greatly change our lives in the coming years and decades. In addition to blue chips, which significantly shape the developments in their industry and have the market power to initiate new trends, the fund contains a large number of niche players – young companies, often leaders in research and development, with significantly higher risk but of course also correspondingly higher long-term earnings opportunities. This is precisely why diversification across different themes, technologies and companies is important.

CONCLUSION: With their latest flights into space, multi-billionaires Jeff Bezos and Richard Branson have ushered in the era of commercial space tourism in the summer of 2021. Whether space travel can become a lucrative business remains to be seen. Megatrends will change our lives in the coming years and decades and call investors to the scene.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.