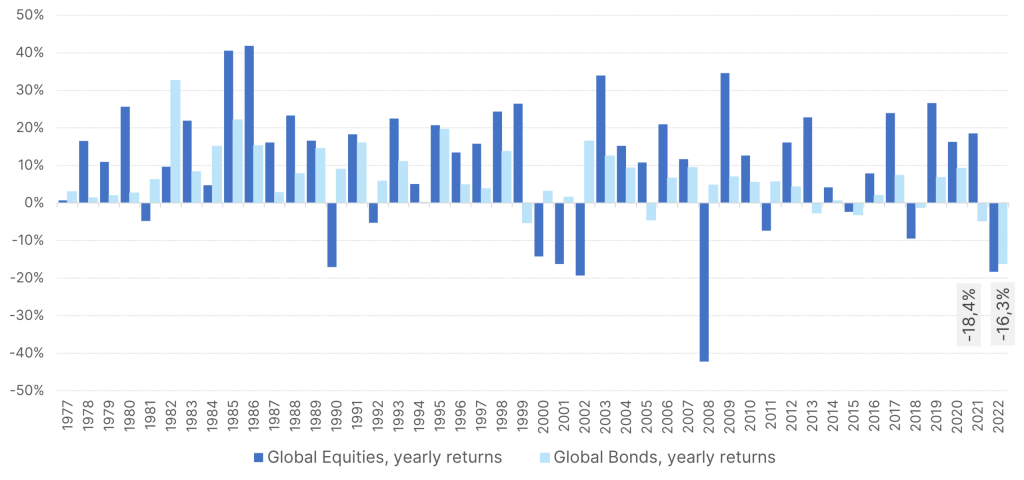

We are looking back on a year full of tensions – for the people, through the burdens caused by rising prices, the energy crisis and the news of the war of aggression in Ukraine – but also on the stock exchanges. The following chart illustrates this clearly:

Equity and bond returns 1977 – 2022

Please note: the past performance of an investment is not indicative of its future development.

A result like the one for 2022, with double-digit losses for shares and bonds at the same time, has actually been unique in a historical time series of almost 50 years. The financial crisis of 2008/09, for example, came with a positive bond result.

The main reason for this was the very determined approach of the international central banks with rapid increases in key-lending rates. These were and are necessary to contain and reduce the exploding inflation.

Positioning of alternative investments

How did alternative investments perform over the year? Let us look at “liquid” alternative investments, i.e. strategies that can be traded daily or weekly. This distinguishes them from “private markets” with longer maturities. First, we look at the main strategies available:

Liquid alternative strategies

| Alternative strategy | How does it work? |

| Managed Futures (CTA): “Multi-asset with short positions” | A so-called multi-asset fund looks at all asset classes. The fund can either be invested (“long”) or switch to cash. Managed futures funds do exactly that – and they can additionally be invested in “short” positions, i.e. they benefit from falling prices in an asset class. This is done systematically: computer models continuously process the prices of all asset classes. The criteria are set once and are then no longer changed. |

| Global Macro: “Multi-asset with short positions” | A so-called multi-asset fund looks at all asset classes. The fund can either be invested (“long”) or switch to cash. Global macro funds can also be invested in “short” positions, i.e. they benefit from falling prices in an asset class. This is done on a fundamental level: fund managers evaluate and take the decisions. |

| Long/short equity: asymmetric equity fund | This strategy includes equity funds that aim to participate more in a rising equity market than in a falling one. Incidentally, this form of hedge is what gave hedge funds their name. |

| Long/short equity Market-neutral: alpha on the basis of share selection | Equity fund managers aim to generate “alpha”, or added value, through the expert selection of shares. This is always related to the general market risk of shares. This strategy is set up in the same way, but neutralises the market risk, i.e. constantly hedges it. Thus, a form of equity selection know-how is offered separately from the market risk. |

How did 2022 turn out for the various strategies?

- Managed futures: Very successful. The trump card: we bet on falling bond prices (government bonds and corporate bonds in almost all financial centres), which for months had been going in only one direction. Also, the funds were positioned for a stronger US dollar (the strength of the US dollar against the euro resulted from the expected energy bottleneck in Europe, which ultimately did not materialise). In equities, there was no clear entry signal for managed futures. This left one out for better or worse.

- Global macro: Fund managers did not jump at the trend of falling bond prices with conviction. They expected inflation to remain temporary. For equities, on the other hand, the situation was very mixed over the year: weak months were followed by strong ones. The development was difficult to assess.

- Long/short equity: The intended asymmetry actually occurred when comparing the years 2020 and 2021 (with strong gains) and 2022 (a moderate loss). In a dramatic equity year, it was impossible to generate a positive result.

- Long/short equity market-neutral: Q1 was unfavourable for equity selection. 2021 had been growth year with a better development for companies and their shares in the growth segment. This sentiment suddenly turned to value at the beginning of January 2022. As a result, substance shares outperformed growth equities. Value and growth are not the only factors, but they have a variety of effects. Many fund managers were unable to make up for the first quarter by the end of the year, resulting in a slightly negative result.

In total, a very good result for managed futures, a balanced or slightly negative result for global macro and long/short equity market neutral, and a moderately negative result for long/short equity. Alternative investments thus substantially outperformed equities and bonds.

Conclusion

Portfolio diversification was hard to achieve in 2022. Alternative investments stood out from the tense environment and are substantially ahead of equities and bonds in the performance ranking.

Alternative strategies expand the investment toolbox by additional degrees of freedom. The multi-strategy fund Alpha Diversified 3 represents our contender in this area.

Advantages for the investor

- UCITS-compliant Absolute Return Fund.

- Broad diversification across a variety of investment styles and managers.

- Foreign currency exposure is hedged.

Risks to be considered

- Asset class cannot be compared with traditional asset classes.

- The net asset value can fluctuate significantly.

- Limited (weekly) redemption of shares.

- Limited transparency of subfonds.

- Possibility of a total loss.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.