After a three-year hiatus due to the Corona pandemic, the technology industry returned to the renowned CES electronics trade show in Las Vegas this year. Over the past 45 years, the trade show has repeatedly been a stage for important technology premieres, with breakthrough products such as the first VCR (1970), the first DVD (1996), and the first televisions with OLED screen technology (2008) being unveiled there. This year, 3,100 exhibitors from 173 countries vied for the visitors’ attention.

One dominant theme across industries was artificial intelligence (AI). The range of use cases on display ranged from chatbots to cloud services, but one particularly prominent application was autonomous driving. Numerous automotive companies are currently working on autonomously driving vehicles, although experts remain uncertain as to when these will actually be commercially viable. Another dominant theme at the trade show was climate change, with an increasing number of companies focusing on sustainability and presenting themselves accordingly.

Virtual Realities Are Trending

Virtual realities also played an important role. While Facebook parent company Meta’s Metaverse is fairly well known to the public, many other manufacturers aim to offer their customers artificial environments for entertainment and work with virtual reality goggles. Taiwanese tech company HTC is expected to offer a competing product to Meta’s Quest VR goggles. Sony announced before CES that its new Playstation VR2 virtual reality goggles will be launched this February. In addition, automaker Stellantis and Microsoft unveiled a Metaverse showroom at CES.

After the Pandemic Boom, the Industry Suffers From Economic Uncertainty

The industry trade show’s quasi-relaunch comes after a difficult year for the industry. The boom during the pandemic years is over for now, replaced by a weak economy, uncertain economic outlook, supply chain issues and chip shortages, and rising inflation, all taking their toll on the industry. Consumers are holding back on purchases in this environment, and companies are cutting back on investments.

In addition, central bank interest rate hikes to fight inflation are hitting the tech industry particularly hard. Tech companies often have large financing needs to develop new products that take time to pay off.

Amazon and Meta Plan to Lay off Thousands of Employees

Against this backdrop, several large technology groups recently announced extensive downsizing programs. Online retailer and cloud services provider Amazon plans to cut more than 18,000 jobs, primarily employees in the e-commerce division and the human resources department. This corresponds to about 6 per cent of the approximately 300,000 administration employees. According to agency reports, this is the first major workforce reduction in the US tech company’s history, which was founded in 1994.

Facebook parent company Meta is also cutting jobs for the first time since the company’s founding in 2004. In total, 11,000 jobs, or about 13 per cent of the workforce, are being laid off. Meta is suffering from collapsing advertising revenues and billion-dollar losses from its Reality Labs division, where, among other things, the Metaverse’s development is concentrated. Investors have also recently been sharply criticising the fact that, by investing heavily in the Metaverse, CEO Mark Zuckerberg is pretty much putting all his eggs in one basket and betting all on his vision of a virtual world. According to analysis companies, the Metaverse is not yet widely accepted by users.

A number of other tech companies have also reported layoffs this year. Corporate software provider Salesforce is making cuts to about one-tenth of its workforce, cutting roughly 8,000 jobs. “The environment remains challenging and our customers are being more deliberate in their purchasing decisions,” co-chief executive Marc Benioff wrote in an employee letter explaining the move. Computer manufacturer HP plans to cut 6,000 jobs by 2025. Elon Musk also made headlines when he fired 3,700 Twitter employees – half the workforce of the short message service – immediately after buying it.

Microsoft Also Recently Announced an Extensive Cost-Cuttting Program

Most recently, Microsoft, another industry heavyweight, announced a major workforce reduction program. Microsoft plans to lay off about 10,000 employees by the end of March, nearly 5 per cent of its workforce. Microsoft CEO Satya Nadella justified the layoffs on the company blog as a cost-cutting measure, saying “(…) we will align our cost structure with our revenue.” However, Nadella stressed that the job cuts would also be offset by new hires and investments in areas of critical strategic importance.

Tech Stocks Recovered Somewhat This Year After the Challenges of 2022

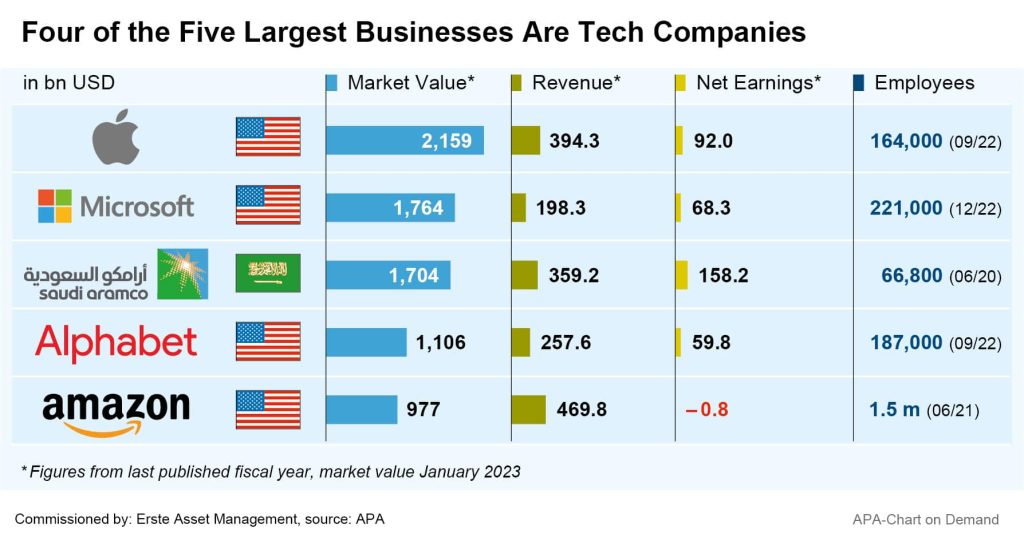

The difficult situation tech companies face is directly reflected in the stock market. The Nasdaq-100 sector index fell by 33 per cent last year, although it managed to recover somewhat since the start of the year, gaining close to 6 percent so far. Despite all the difficulties, tech companies are posting profits in the billions and in many cases managed to increase them last year. The industry giants are also still high up on the list of the most highly valued companies. Some investors are now likely expecting the now-leaner tech companies to flourish with new developments in areas such as AI and cloud services, as well as a new focus on sustainability.

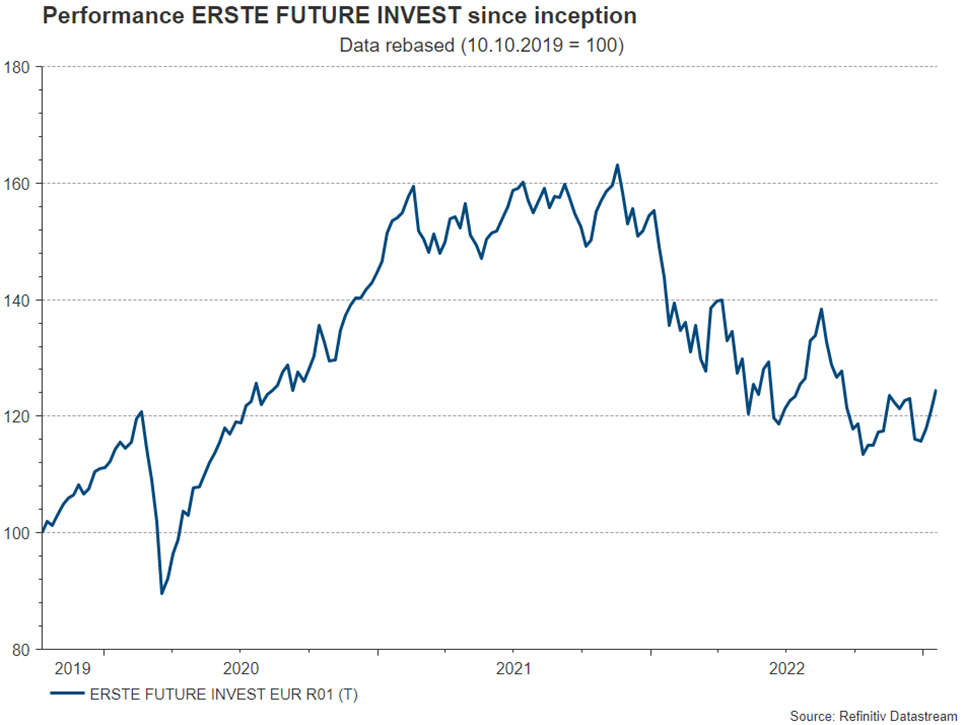

Investing in the tech megatrends with ERSTE FUTURE INVEST

Artificial intelligence, cloud services or virtual realities are topics that are seen as having great potential in the future, regardless of the economic question marks. The megatrends not only influence our daily lives, but also open up new opportunities to create financial independence and prosperity. With the ERSTE FUTURE INVEST fund, one invests in shares of companies that are in the process of realizing their potential in the 5 potential megatrends of health & healthcare, lifestyle, technology & innovation, environment & clean energy, and economic forces in transition. As an investor:in in megatrend stocks, one should aim for a long-term investment horizon. In addition to the long-term opportunities, there are certain risks to consider (see advantages and disadvantages) and one must expect temporary price fluctuations at any time, which can be larger.

Note: Past performance is not a reliable indicator of future performance.

ERSTE FUTURE INVEST – Advantages for the investor

- Participation in global, promising future topics (“megatrends”).

- Investment in an actively managed portfolio consisting of quality and growth stocks.

- Risk diversification across multiple countries and industries.

Risks to be considered

- The securities in the portfolio may be subject to increased price fluctuations.

- Due to investments denominated in foreign currencies, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.