The corona crisis has affected emerging and developed economies equally hard, and the consequences were similar across all markets: weak supply chains, a lack of consumers, and a massive increase in gearing. The world looks very different for companies: They were able to hold their own in the crisis. Emerging market corporate bonds are therefore an interesting asset class in the current low-rate environment. Péter Varga, Senior Professional Fund Manager at Erste Asset Management, answers the key questions.

Why is indebtedness a serious risk?

Whereas national governments and institutions in Europe and the USA passed a compact economic set of measures and managed to feed off past reforms in order to absorb the crisis better, this was not nearly the case in most of the emerging markets. A large number of heads of state and government in the emerging markets unfortunately failed to put the times of easy finance on the markets to good use. Corruption and mismanagement also play an important role. Many countries such as Angola, Ecuador, El Salvador, and Costa Rica have backed themselves into a corner – their reforms in recent years never came or, if they did, only half-heartedly so.

What is the impact of the fall in crude oil prices?

Many emerging economies suffer from the price development of commodities, especially the slump in oil prices. The governments in emerging economies also often do not have the adequate tools, and the national central banks are under enormous pressure. In Chile and Peru, unorthodox measures have been taken by granting people access to their future retirement funds – with dire consequences for the future. Previous A students like Mexico and Columbia are in danger of losing control over their budget deficit and thus also their investment grade rating in the coming one or two years.

Who will help the emerging markets and is there a way out?

One thing is for sure: many emerging countries will need to receive help from the IMF or the World Bank in order to recover. However, in contrast to earlier bail-outs and the unrestrained borrowing of some countries, this time the help will probably be tied to specific environmental targets or the Sustainable Development Goals of the United Nations. This will ensure a positive development in the medium term, as it will also allow for the restructuring of their economies so as to make them fit for the future. But the path will be an arduous one for the investors.

What do companies do better than governments?

Emerging markets companies are a completely different kettle of fish than their economies. Even though they have been hit hard by corona, many have come out alright on the other side – whichhas several reasons. We cannot sugar-coat the debt problem of emerging markets companies either, but the controls definitely work better in the bigger companies than in some governments. First, the bond issuers are mostly listed on the stock exchange and are thus subject to stringent scrutiny, competition and risk management. This means that corruption or mismanagement are rather uncommon. Second, many companies are broadly diversified, operate globally, and thus do not depend that strongly on the local economy. Also, these companies generate their sales via exports and thus in foreign currency, or they hedge their liabilities in foreign currency.

Which companies are particularly interesting?

In selecting companies for investment, an active fund management and thorough analysis are indispensable, especially during corona. The same goes for the sectors in which the various companies operate. Structurally important sectors like food production or telecommunication offered opportunities at the outset of the crisis. Companies such as JBS, Marfrig, or Minerva Foods from Brazil with strong global access managed to convince the market. We also like right now the airline GOL from Brazil, which should rebound significantly once infection rates are down and quick tests are easily available at the airports.

How attractive are the risk premiums on emerging market corporate bonds?

Investors continue to have appetite for emerging markets corporate bonds, given that these securities offer the advantage of a profound degree of diversification. Corporate bond spreads are at 350 basis points, still above pre-Covid-19 levels. It is hard to find a bargain on the market at this point, which is why active management and years of experience are particularly important so as to find companies that would possibly benefit from a recovery at a disproportionate degree.

The title selection includes a strong focus on sustainability aspects, in line with the investment philosophy of Erste AM. One example is HIKMA PHARMACEUTICALS. The Jordanian pharmaceutical company and its line of products benefit from the Covid-19 measures, it has almost no debts, and scores high on the ESG scale. Fitch Rating even rated the company BBB- for the first time on October 22nd. (Jordan itself is rated B1 / BB).

How important are sustainability aspects for the allocation?

The European Commission, headed by Ursula von der Leyen, and Xi Jinping in China have presented very ambitious plans with regard to CO2 neutrality and a more sustainable economy. New regulatory frameworks in sustainability such as the planned CO2 import duty or the plans concerning a hydrogen economy will also affect the companies in the emerging markets. It is unclear what sectors and companies will be affected to what degree. Emerging markets companies have issued an increasing number of so-called green bonds, i.e. bonds where an environmentally friendly use of the proceeds has to be guaranteed. Much like in the case of equities, enormous demand meets limited supply. Therefore, it is not always possible to make sense of the valuations from an economic perspective. However, the ‘green economic turn’ is unstoppable at this point. Investments will continue to flow into sectors like clean energy, transport, or recycling and thus create growth and jobs. This is the dawn of a new growth story that offers a lot of opportunities and optimism.

Invest in emerging market corporate bonds with the ERSTE BOND EM CORPORATE

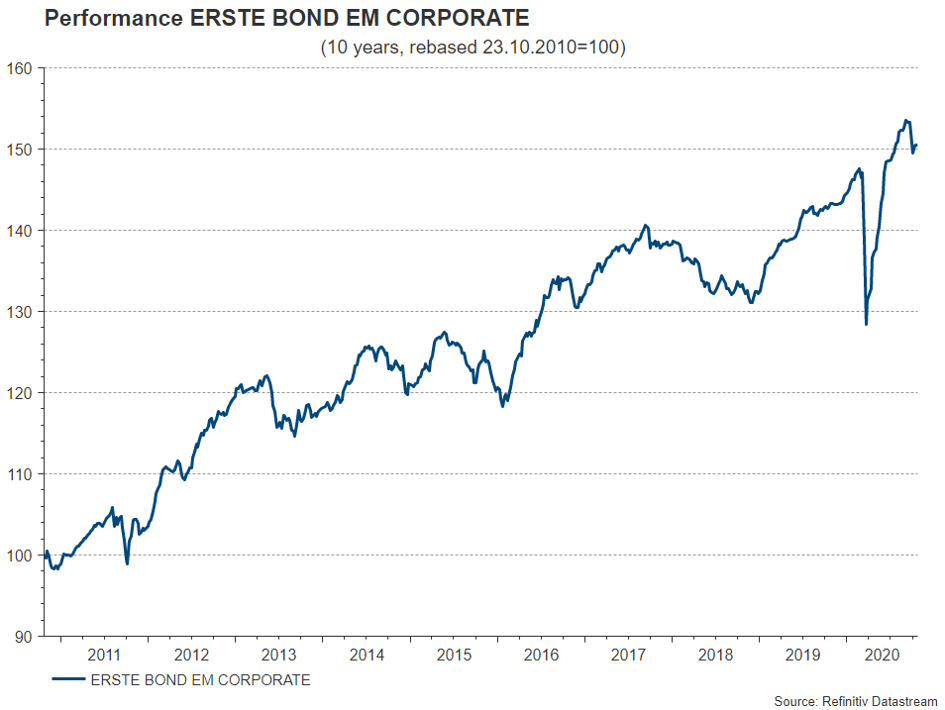

ERSTE BOND EM CORPORATE invests in corporate bonds from emerging economies. The fund invests globally and thus gives its investors access to the growth opportunities in these rising markets. Foreign exchange risks are largely hedged against the euro. The fund currently has EUR 455mn worth of assets under management (as of 20 October 2020).

In the year to date, the fund has gained +5.6% (as of 23 October.2020). Since its launch ten years ago, ERSTE BOND EM CORPORATE has achieved an average gain of +5%[1] per year. Our fund managers have received numerous awards on the basis of this track record, among them the Lipper Award.

The German investor magazine Börse Online awarded the fund a “grade 1” in October and gave it a buy recommendation

[1] The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium of up to 3,50 % which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. Past performance is not a reliable indicator of the future performance of a fund.

Conclusion: In recent years, companies from the fast-growing emerging markets have raised a lot of money on the capital market. While interest rates in industrialised countries remain low, corporate bonds from emerging markets offer attractive risk premiums. Given the ongoing corona crisis, debt and volatility need to be kept under review.

“This is a marketing release and not a financial analysis. It was not drawn up in compliance with the legal provisions promoting independence from financial research and is not subject to the prohibition of trading following the dissemination of financial research. “

“If portfolio positions of funds are announced in this document, these are based on the state of market development at the time of going to press. As part of active management, the portfolio positions mentioned can change at any time. “

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.