In times of crisis, investors are particularly worried not only about capital losses, but also about dividend moratoria. These worries are not completely unfounded: according to calculations by DZ Bank, DAX companies would have typically cut their dividends by more than 25% in previous recessions. Due to the extent of the corona crisis, these cuts could be even more substantial this time. There has been a particular sort of political pressure in Europe to suspend dividends, especially if public relief funds have been accessed.

This sort of discussion is counter-productive for companies that normally pay out hefty dividends. In this blog entry, we are going to talk about the status quo of the “dividend emperors”, especially about the question of how high-dividend shares have so far fared during the crisis.

Value and high dividend-shares have been underperforming the market in 2020 to date

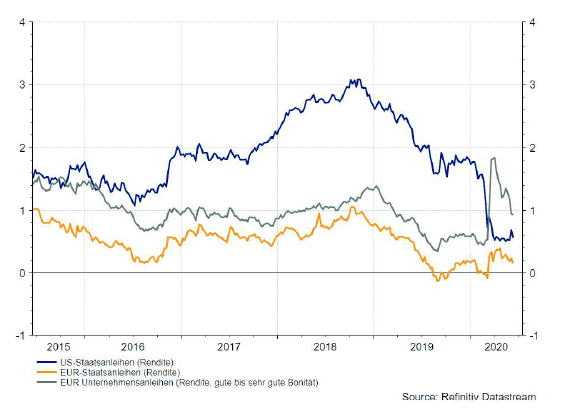

Even though value shares entered a strong phase at the beginning of June, 2020 has so far been dominated by quality and growth shares. That figures, because growth shares benefit more substantially from a decline in interest rates and the demand for quality tends to be strong during crises. In this context, the question whether equities (i.e. securities that pay dividends) provide any form of protection against negative performance is justified. Chart no.1 does not suggest so. Generally speaking, equities paying higher dividends have underperformed the market in crises.

Chart 1: relative global performance (source: Thomson Reuters)

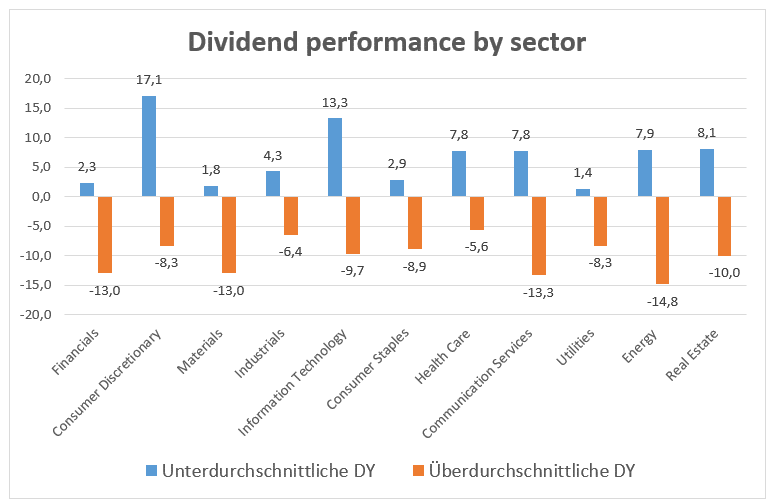

A global analysis glosses over regional differences such as dividend volume or company quality, which is why we will split the overall market into different regions. We will be looking at two portfolios in each case, one for companies with above-average dividend yield, and one for companies with below-average dividend yield.

Chart 2: regional performance by dividend yield (source: Bloomberg)

The regional analysis paints a conclusive picture. As chart 2 illustrates, companies with above-average dividend yield have clearly underperformed those with below-average dividend yield or no dividend at all in 2020 to date. The picture is extreme in the USA, where low-dividend companies have outperformed high-dividend companies +11.8% vs. -7.6%.

Since there is hardly any difference regionally, a look at the different sectors seems reasonable. Again, we recognise a pattern of companies with above-average dividend yield performing significantly worse than their peers with low dividend yield.

Not the volume of the dividend is important, but its stability

It is important for investors to take into account the stability of the dividend payments. In the high-dividend segment, investors have to differentiate between cyclical and non-cyclical sectors. The financial and the energy sectors are cyclical, and the likelihood of a dividend moratorium during a crisis (recession) is much higher.

This has been known for a while, which is why the so-called dividend aristocrats hold a special position in the USA:

Dividend aristocrats are shares that have paid a dividend for at least 25 years and have continuously increased it every year.

In Europe, the strategy has been gaining supporters as well. However, in contrast to the USA, there are hardly any companies with a 25-year dividend history, which is why the rule has been softened up a bit:

Euro dividend aristocrats are companies that have paid a dividend for at least 10 years and have kept it constant or increased it year-on-year.

According to this definition, there are currently 123 US dividend aristocrats and 42 Euro dividend aristocrats. The numbers illustrate one thing for sure: investors keen on dividend continuity will find it hard to avoid the USA. No other country has companies with such a long history of stable dividend policy.

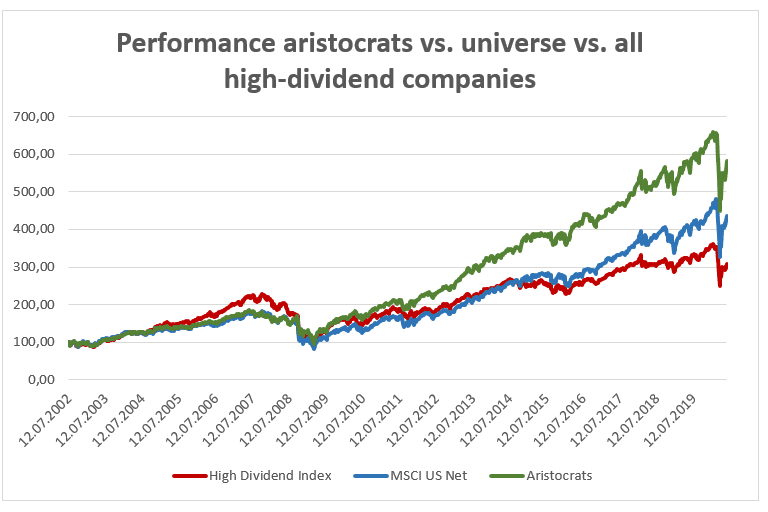

Stability pays off. These companies enjoy above-average levels of trust from investors. In order to ensure such degree of stability, the business model has to be of excellent quality. Only a few companies have managed to join this echelon of companies. As chart 4 illustrates, the dividend aristocrats have outperformed the overall market since 2002, whereas the segment of high-dividend shares overall has clearly underperformed the market. This shows yet again that it is not enough to focus on the extent of the dividend, but that its stability is of crucial relevance.

Energy utility companies, healthcare, and industrials with robust performance

That being said, chart 3 reveals an important finding: the extent of the negative performance is not the same across the board. Financials, energy, and telecoms have clearly underperformed industrials, utilities, and the healthcare sector.

This does not come as a surprise, since investors are (rightly) worried that companies from certain sectors may cut their dividends or suspend them altogether. In the financial sector, fears are that many companies and individuals will be unable to honour their debt, which comes with negative knock-on effects on the dividend policy. In Europe, some banks have pushed back their planned dividend payments from early summer to autumn, when the extent of the crisis can be better ascertained.

In the energy sector, many companies have been badly hit by the massive slump of the oil price. Under these circumstances, we expect dividend cuts even for large groups that so far have pursued a very consistent dividend policy. The telecoms sector is well-known for its continuous dividend policy. However, the breakdown of tourism has left its traces in this sector as well, given that the lucrative roaming business has largely evaporated.

Other sectors have fewer problems. The healthcare sector almost benefits from the crisis and is not facing any significant decline in profits. The same is true for the utilities sector.

Chart 3: sector performance dividend yield (source: Bloomberg)

Chart 3 suggests that the continuity of dividend payments is of considerable importance.

Not the volume of the dividend is important, but its stability

It is important for investors to take into account the stability of the dividend payments. In the high-dividend segment, investors have to differentiate between cyclical and non-cyclical sectors. The financial and the energy sectors are cyclical, and the likelihood of a dividend moratorium during a crisis (recession) is much higher.

This has been known for a while, which is why the so-called dividend aristocrats hold a special position in the USA:

Dividend aristocrats are shares that have paid a dividend for at least 25 years and have continuously increased it every year.

In Europe, the strategy has been gaining supporters as well. However, in contrast to the USA, there are hardly any companies with a 25-year dividend history, which is why the rule has been softened up a bit:

Euro dividend aristocrats are companies that have paid a dividend for at least 10 years and have kept it constant or increased it year-on-year.

According to this definition, there are currently 123 US dividend aristocrats and 42 Euro dividend aristocrats. The numbers illustrate one thing for sure: investors keen on dividend continuity will find it hard to avoid the USA. No other country has companies with such a long history of stable dividend policy.

Stability pays off. These companies enjoy above-average levels of trust from investors. In order to ensure such degree of stability, the business model has to be of excellent quality. Only a few companies have managed to join this echelon of companies. As chart 4 illustrates, the dividend aristocrats have outperformed the overall market since 2002, whereas the segment of high-dividend shares overall has clearly underperformed the market. This shows yet again that it is not enough to focus on the extent of the dividend, but that its stability is of crucial relevance.

Chart 4. Dividend aristocrats (source: Bloomberg)

Key ratios of the US dividend aristocrats

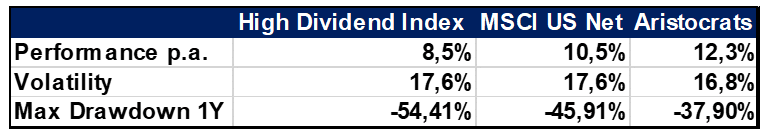

Table 1: key performance ratios US aristocrats (source: Bloomberg)

The US aristocrats not only outperformed the overall markets and the other high-dividend shares, but they did so at lower volatility. In addition, at -37.9% the maximum drawdown was significantly less than what we experienced in the overall market and in the high-dividend segment. This clearly shows that it is important to be careful when selecting dividend shares, given that many of them are cyclical and thus significantly riskier than the overall market.

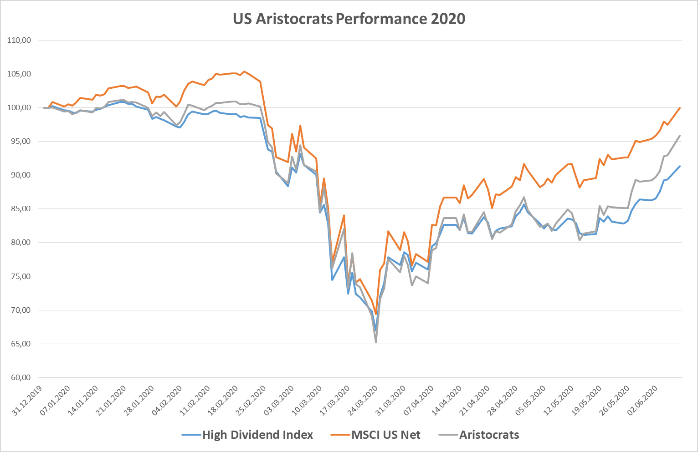

Chart 5: US aristocrats 2020 (source: Bloomberg)

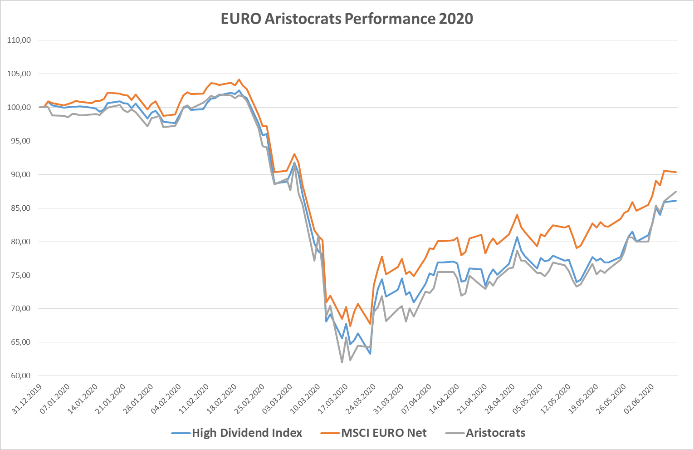

Chart 6: Euro aristocrats 2020 (source: Bloomberg)

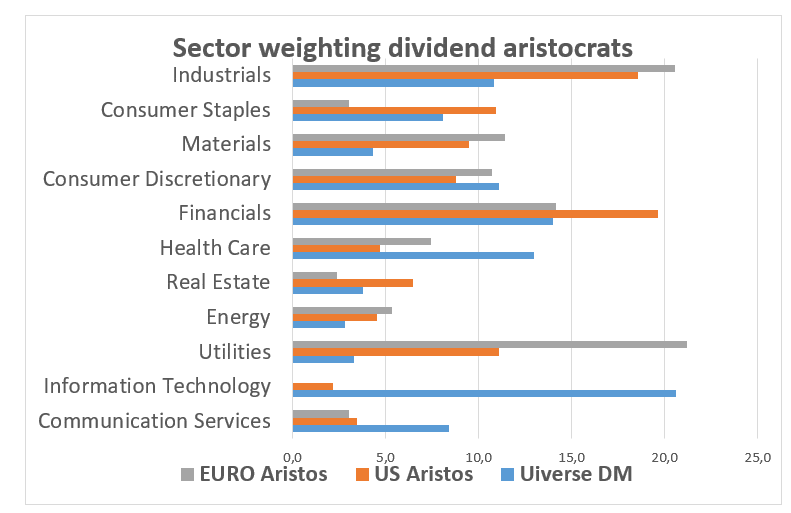

As charts 5 and 6 highlight, the dividend aristocrats have so far in 2020 not outperformed the main index either in the USA or in Europe. In fact, the decline was on the substantial side, but so was the recovery. A look at the sector weighting of the aristocrats in Europe and the USA will put this statement somewhat into perspective. 2020 (as of 8 June 2020) has to date seen a positive performance of IT and the healthcare sector. As chart 7 shows, these sectors are strongly underrepresented in a high-dividend portfolio.

Chart 7: sector weightings Euro, US aristocrats in comparison with the overall universe (source: Bloomberg)

Chart 7 clearly highlights that in a high-dividend (aristocrats) portfolio industrials, materials, and utilities are strongly overweighted, whereas IT and communication services (telecoms and media) are significantly underrepresented.

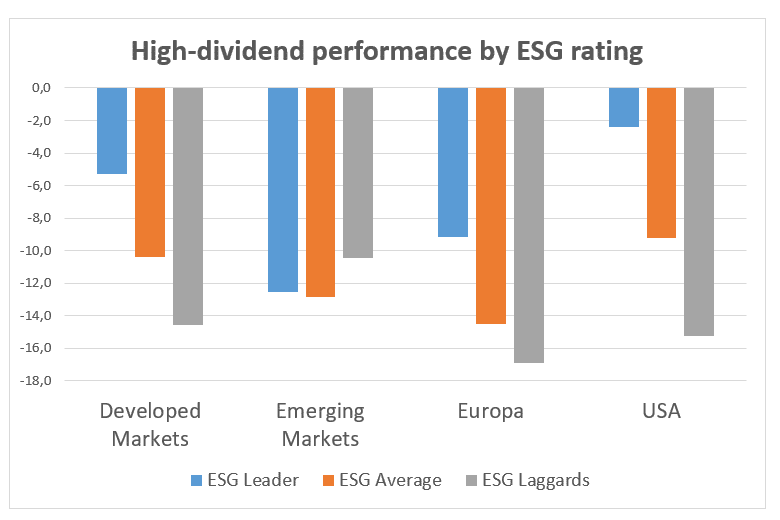

Also interestingly, many dividend aristocrats are at the same time ESG leaders, i.e. 58% of the European dividend aristocrats. Not a single one of the companies belongs to the category of ESG laggards (MSCI methodology).

Investors investing in dividend aristocrats are simultaneously ESG investors

This finding is quite relevant. Companies that pursue a stable dividend policy seem to follow a sustainable strategy in general.

Chart 8: dividend performance by ESG rating (source: Bloomberg)

A combination of ESG and high, stable dividend makes sense

This is exactly the strategy we pursue in our ERSTE RESPONSIBLE STOCK DIVIDEND fund: we invest exclusively in equities that fulfil the strict sustainability criteria of EAM. At the same time, we attach great importance to a clearly above-average dividend yield and to high dividend quality when selecting the shares for the portfolio. The fund also only invests in highly capitalised companies whose share price has only been subject to below-average fluctuations (i.e. low volatility) in recent years.

Conclusion:

Even though stable high-dividend companies have not outperformed the market during the crisis, we expect an above-average performance in the long run. Long-term models indicate that dividend aristocrats in particular are able not only to outperform companies with an unstable dividend policy, but also the overall market. It is therefore crucial to take into account dividend continuity on top of dividend volume. Otherwise, underperformance will occur. Whoever follows this advice is in all likelihood also a sustainable investor.

Dividend aristocrats are strongly underrepresented in the IT and healthcare sectors. Therefore, this strategy is also suitable for investors who are already invested in these sectors and are looking for a promising form of diversification.

For more details on the fund, please visit:

https://www.erste-am.at/de/private-anleger/fonds/erste-responsible-stock-dividend/AT0000A1QA79

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.