Recent academic studies have provided important insights into the interconnected challenges to human prosperity that result from the climate and biodiversity crises. The main conclusions are that the world is currently not on track to reach the Sustainable Development Goals (SDGs)[1][2] in time nor the targets for climate change and biodiversity.

Biodiversity is defined as by the Convention on Biological Diversity as “the variability among living organism from all sources including among others, terrestrial, marine and aquatic ecosystems, as well as the ecological complexes of which they are part; this includes diversity within species, as well as between species and ecosystems”.

Lack of biodiversity as a systemic risk

Furthermore, given that half of the world’s GDP[3] depends on a functioning biodiversity, the lack thereof has been recognised as a systemic risk[4] and viewed as one of the fastest deteriorating global risks over the next decade[5]. While interdependencies are often difficult to identify and understand, nature is an important ally in fighting against ecosystem disruption and human-caused climate change.

Destruction or fragmentation of habitats and the exploitation of species and biological systems, which has effects on genes in some species, including species development and survival rates, are only some of the biggest challenges for biodiversity. For instance, 85% of species on the International Union for Conservation of Nature (IUCN) Red List[6] are primarily threatened by habitat loss. The destruction of habitats and food systems causes approximately 25% of climate emissions, which in turn is the main cause of biodiversity loss. The agri-food sector is threatened both by the loss of biodiversity (reduction in crop diversity, reduction in the number of pests) and by the consequences of climate change, such as the increase in extreme weather events.

On the other hand, climate change challenges include adaptation to changing weather patterns, mitigation of greenhouse gas emissions, protection of vulnerable ecosystems and ensuring water resources. The concentration of GHG has led to global warming, which in turn affects distribution of water resources. Furthermore, these challenges are not confined to a single region or country but are felt globally.

Common strategies for all challenges

Another study[7] has found that the triple challenge of climate change, loss of biodiversity, and human well-being requires synergy and common policies. Every organism in an ecosystem plays a role in the system, which means they are interdependent. When one part of this network of organisms disappears, it has an impact on the rest of the ecosystem, which becomes less resilient and more vulnerable to disturbances. Biodiversity and climate change are interconnected in the same way, and this relationship has important ramifications for how effectively ecosystems function. The number and geographic spread of species across a broad spectrum of habitats are directly impacted by changes in the climate throughout the world.

The aforementioned study identified that the interdependence of the triple challenge could be addressed with the help of rapid reduction of fossil fuel, the promotion of sustainable development, healthy nutrition, the comprehensive implementation of nature-based solutions, and the strengthening of land and water management. Because of the interrelationship of climate and biodiversity risks, the framework also advances efforts to address and mitigate risks associated with climate change. By directing capital to projects that are linked to biodiversity and keep investing in nature-based solutions, companies can significantly offset carbon emissions.

Planetary boundaries

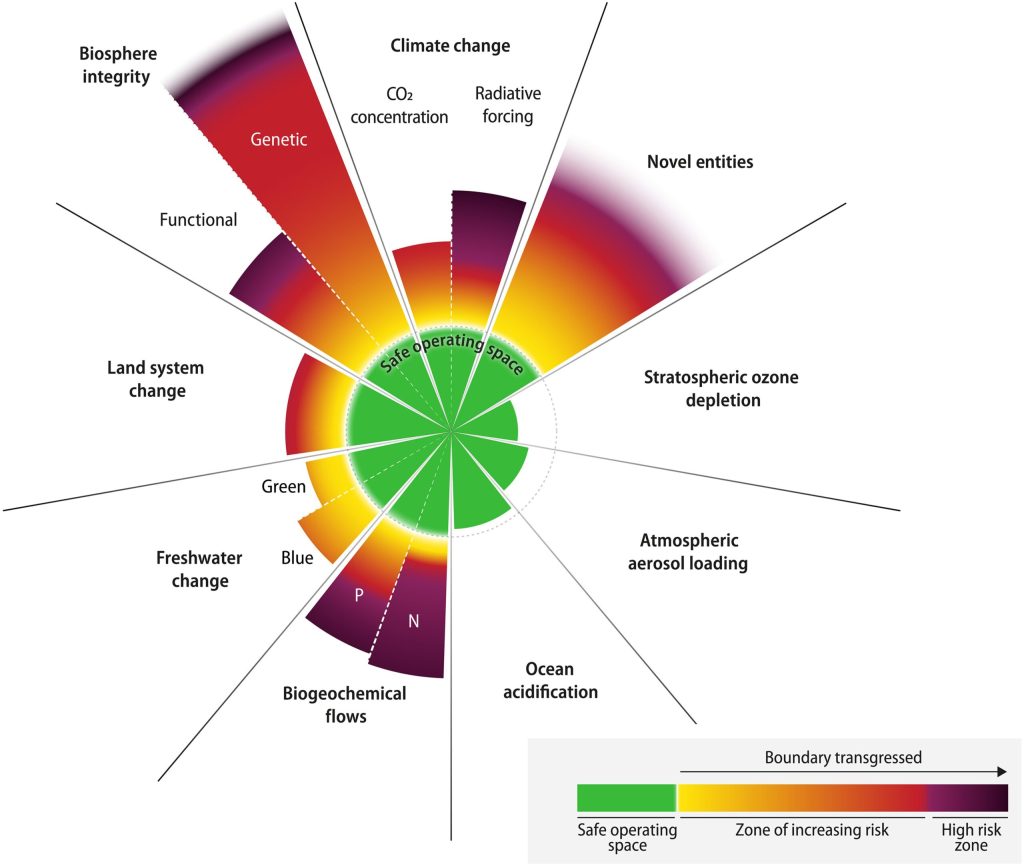

Ongoing research is crucial for understanding the intricate relationships between climate change and biodiversity. Based on new research published in the Journal Science Advances[8], six out of nine planetary boundaries have already been crossed (see Figure 1), while simultaneously pressure in all boundary processes is increasing. Transgression of these boundaries suggests disruptions of Earth system which is now well outside of the safe operating space for humanity.

Fig 1: Current status of control variables for all nine planetary boundaries.

Source: Science Advances, Vol.9, No. 37. Date as of 21.09.2023

Different limits within which humanity can still develop and thrive for generations are mutually dependent and reinforcing. Consequently, the interaction between rising CO2 concentrations and biosphere damage, especially forest loss, and projected temperature increases as either or both increase.

In addition, the biosphere’s ability to continue functioning on the planet depends on the genetic diversity that has been acquired by natural selection over the course of the history of co-evolution with the geosphere. Genetic diversity and planetary function are the two dimensions that constitute the planetary boundary for biosphere integrity. Both are outside safe limits.

The study’s findings show that respecting the limit of the land system change is one of the most effective solutions available to humanity for reducing climate change. Restoring overall worldwide forest cover to late-20th-century levels would offer a significant cumulative decrease in atmospheric CO2 in 2100. Given the current emphasis on biomass as a substitute for fossil fuels and the production of negative CO2 emissions via bioenergy with carbon capture and storage, this replanting does not appear likely, though. The pressure on the planet’s remaining forest land is already being increased by both of these activities.

In order to reliably and regularly analyse the entire integrated Earth system and guide policy processes so that the Earth’s condition is not changed beyond what is acceptable to current society, there is an urgent need for robust scientific and policy tools.

Recognising and addressing this interdependence is essential for the long-term sustainability of both the natural world and human society. Therefore, the Earth system must be considered in a systemic context with the interdependency between climate change and biodiversity.

Net Zero and Nature positive

The importance of net zero commitments of companies and countries cannot be underestimated in the context of tackling climate change, biodiversity, and transitioning to a sustainable future. The financial sector plays a crucial role in allocating capital, which heavily influence the trajectory of greenhouse gas emissions and the overall environmental impact of industries.

Moreover, the financial sector can also direct resources towards businesses who transition to a “nature-positive” future. A nature-positive business model is based on regeneration, resilience, and recirculation,not only on mitigating negative environmental impacts of economic activities but also on actively contributing to restoration, conservation, and enhancement.

Consequent implementation of nature-positive business models and net-zero transition might support the achievement of rebalanced and restored natural resources and overcome the current “polycrisis” which the WEF defines as “a cluster of related global risks with compounding effects.“[9]

Read more articles from the ESGenius Letter on the topic of “Climate Risks” here!

Sources:

- Elevating Biodiversity’s Profile Reveals Interrelationships with Climate Risks | Breckinridge Capital Advisors

- Planetary boundaries – Stockholm Resilience Centre

- All planetary boundaries mapped out for the first time, six of nine crossed – Stockholm Resilience Centre

- https://www.zurich.com/en/knowledge/topics/climate-change/climate-change-biodiversity-twin-challenges-for-business-leaders

- Overview of priorities, threats, and challenges to biodiversity conservation in the southern Philippines (sciencedirectassets.com)

- view (axa-im.co.uk)

- https://business.bofa.com/content/dam/flagship/bank-of-america-institute/esg/biodiversity-means-business.pdf

- “Why climate change is intimately tied to biodiversity”, The Economist in December 2022

[1] United Nations – The 17 Goals

[2] United Nations – Globals Sustainable Development Report (GSDR) 2023

[3] World Economic Forum (WEF) – The Future Of Nature And Business 2020

[4] WEF – The Global Risks Report 2020

[5] WEF – The Global Risks Report 2023

[6] The IUCN Red List of Threatened Species

[7] The Triple Challenge: synergies, trade-offs and integrated responses for climate, biodiversity, and human wellbeing goals

[8] Science Advances | Earth beyond six of nine planetary boundaries

[9] WEF – The Global Risks Report 2023

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.