Many savers are fed up investing their saved-up capital at low interest rates. Those who want to finally achieve a good yield have various options: one of them is to invest in fixed-income securities – and the process should be flexible and straightforward, if possible.

This is the question investors are asking themselves today: how to earn a good yield on one’s hard-earned capital in times of low interest rates like nowadays?

The answer: investment funds. For example, funds with fixed-income securities; they come with different maturities and fixed coupon payments accordingly. Even though inflation might fall slightly in the coming year, if you do not invest in funds, you will suffer losses in purchase power. And indeed, you have been doing so for years.

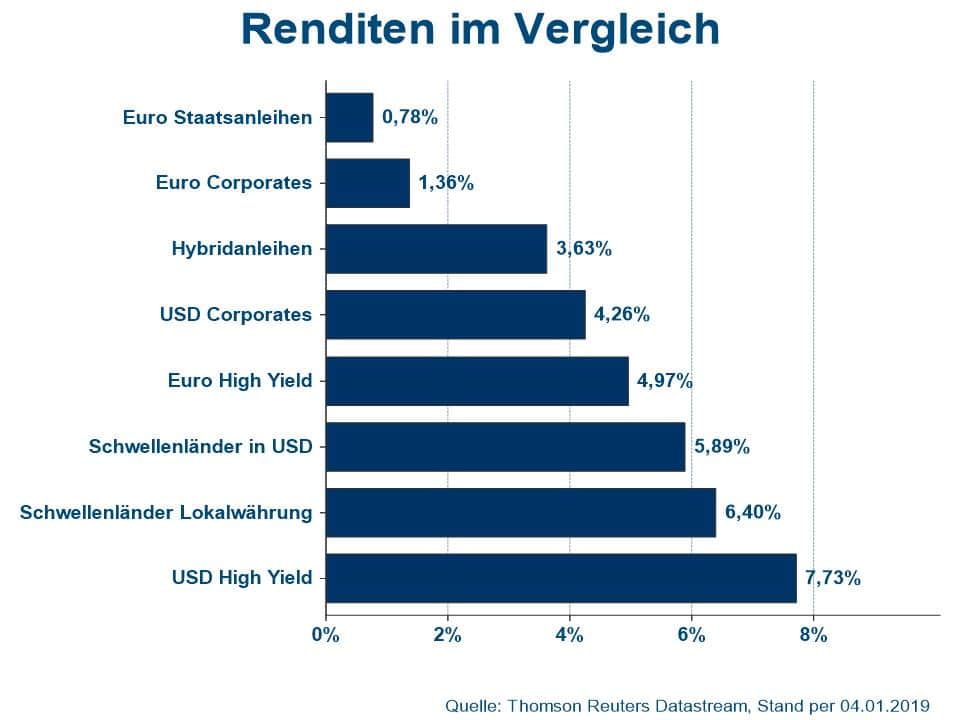

But it does not have to be like that. There are bond segments, both domestically and internationally, that do still pay attractive yields.

• US high-yield bonds

• Emerging markets bonds in hard currency (USD or EUR)

• Emerging markets bonds in local currency

• Hybrid bonds (corporate bonds with very long maturities or with no end of maturity at all)

Where do you invest, and how do you allocate your assets? Experienced fund managers dedicate themselves to this question for a new investment fund: ERSTE FIXED INCOME PLUS.

Flexible investments, ongoing adjustment to changes in the market

Our experts are on a constant lookout for the most attractive bonds for this fund. The investment regime is very flexible, as a result of which we can easily seize opportunities on the global markets. The global interest and currency markets are in constant flux. An individual investor can of course not keep track of all these changes and the resulting need for daily professional reassessment.

This is where ERSTE FIXED INCOME PLUS comes in. The managers of this fund react to changes on the markets on a daily basis, by buying individual bonds as well as modular, themed funds. These may for example invest in floating-rate bank bonds, corporate bonds, high-yield bonds, emerging markets issues, and also euro government bonds.

The right mix and deliberate caps/thresholds

The right mix is crucial. There are also caps: unhedged foreign exchange cannot make up more than 25% of assets under management.

In the following, a summary of the performance of the various bond categories throughout the year:

The fund is available as distributing fund, where the returns are distributed annually to the investor, and as accumulating fund, which ploughs back and reinvests the returns.

No fear of price fluctuations anymore

ERSTE FIXED INCOME PLUS is highly suitable for a savings plan with monthly deposits. The ongoing adjustment often yields short-term effect for investors who regularly pay in fixed amounts, seize yield opportunities on the bond market on an ongoing basis, and thus earn a solid yield in the long run and build capital.

Of course, ERSTE FIXED INCOME PLUS is no fund for “a quick buck”. Fund managers recommend a holding period of at least six years.

For further information, please visit:

https://www.erste-am.at/en/private-investors/funds/erste-fixed-income-plus/AT0000A20DF6

Please also have a look at the fund video:

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.