Guest author: Jenny Teng, Senior Fund Manager

Jenny Teng is senior fund manager in the equity team of Erste AM. Born in China she is employed since 2008 at ERSTE-SPARINVEST and responsible for the Asian equity markets.

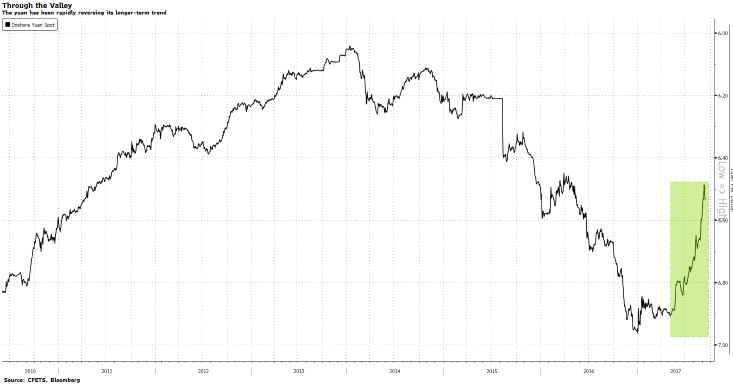

Long enough we have heard about the depreciation of Chinese currency Renmimbi (RMB), but this year RMB has showed rather unusual movements.

With an appreciation of 7%, the Chinese currency reached its strongest level versus US dollar since sixteen months in the first week of September. This is indeed a remarkable movement after the currency’s continuously depreciation from 2014 to 2016.

Development of Renmimbi vs. US-Dollar (01/2010-09/2017)

Source: Bloomberg; Data as of 2.10.2017

What are the drivers of the rally?

Besides a general US-Dollar (USD) weakening and a better outlook of the Chinese economy it is highly speculated that the sharp appreciation is the consequence of the Chinese government’s intervention. Starting in late 2016 the Chinese authorities took steps to support RMB versus USD. Due to this FX policy shift, companies and residents in China are facing increasing restrictions on converting RMB into foreign currencies.

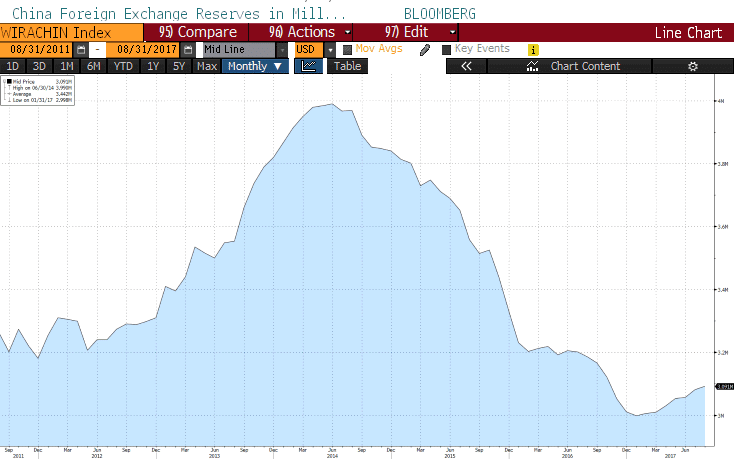

It is also reported that the Chinese government asked state-owned enterprises (SOEs) to convert their foreign currencies into RMB. In May 2017 the People’s Bank of China (PBOC) adjusted the formula for calculating its daily RMB reference rate. A “counter-cyclical adjustment factor” has been added, giving the central bank more direct control over the value of the currency. These actions to a large extent caused the rally of RMB this year and helped China’s FX reserve rising for seven consecutive months from February to August.

China Foreign Exchange Reserves (in Million USD)

Source: Bloomberg

Why does China want to strengthen RMB at this point?

One of the most important reasons is to ease capital outflows, which was a major cause of downward pressure on RMB. According to estimates from Bloomberg Intelligence, more than $1.2 trillion fled out of China from August 2015 to December 2016. Foreign companies transferred cash out of the country. Chinese companies repaid dollar debt, increased overseas mergers and acquisitions. Also Chinese households changed RMB to foreign currencies for overseas investment, adding to more capital outflows. China spent its foreign-exchange reserve to defend RMB, causing a decrease of its FX reserves from USD 4 trillion in June 2014 to around $3 trillion in January 2017. A slump in currency and FX reserves caused concerns. China’s policy makers therefore took steps to reverse the trend.

Another important reason is to maintain the relationship with the United States. The sharp appreciation of RMB began in May, shortly after the Summit between US President Trump and Chinese President Xi in April. Bear in mind that President Trump stopped accusing China of currency manipulation after his meeting with Xi, the timing of these events might not be a coincidence.

The efforts to strengthen RMB are also seen as part of a response to Moody’s downgrade of China’s sovereign credit rating in May, the first downgrade since 1989. China needs stronger RMB to boost investors’ confidence and attract more foreign investment.

Is RMB appreciation sustainable?

What happens to RMB next will depend on USD direction and China’s FX policy. There are several important political events happening in the coming months: the 19th Communist Party Congress in October, President Trump’s visit to China in November. RMB may stay relatively strong versus USD till then. However, China does not want RMB to strengthen so much, that it weighs on the country’s exports. As evidence China’s central bank took actions on 8 September to slow down the appreciation. The PBOC removed the reserve requirements for financial institutions to buy FX. This will reduce the cost of buying FX and pare the RMB’s strength indirectly in the short-term.

With the opening up of China’s financial markets, RMB will become in long term a more market-driven currency. In short term, neither sharp depreciation nor sharp appreciation will be tolerated by the Chinese government. At present RMB remains to be a managed currency, a strictly managed one.

Please note:

Prognoses are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.