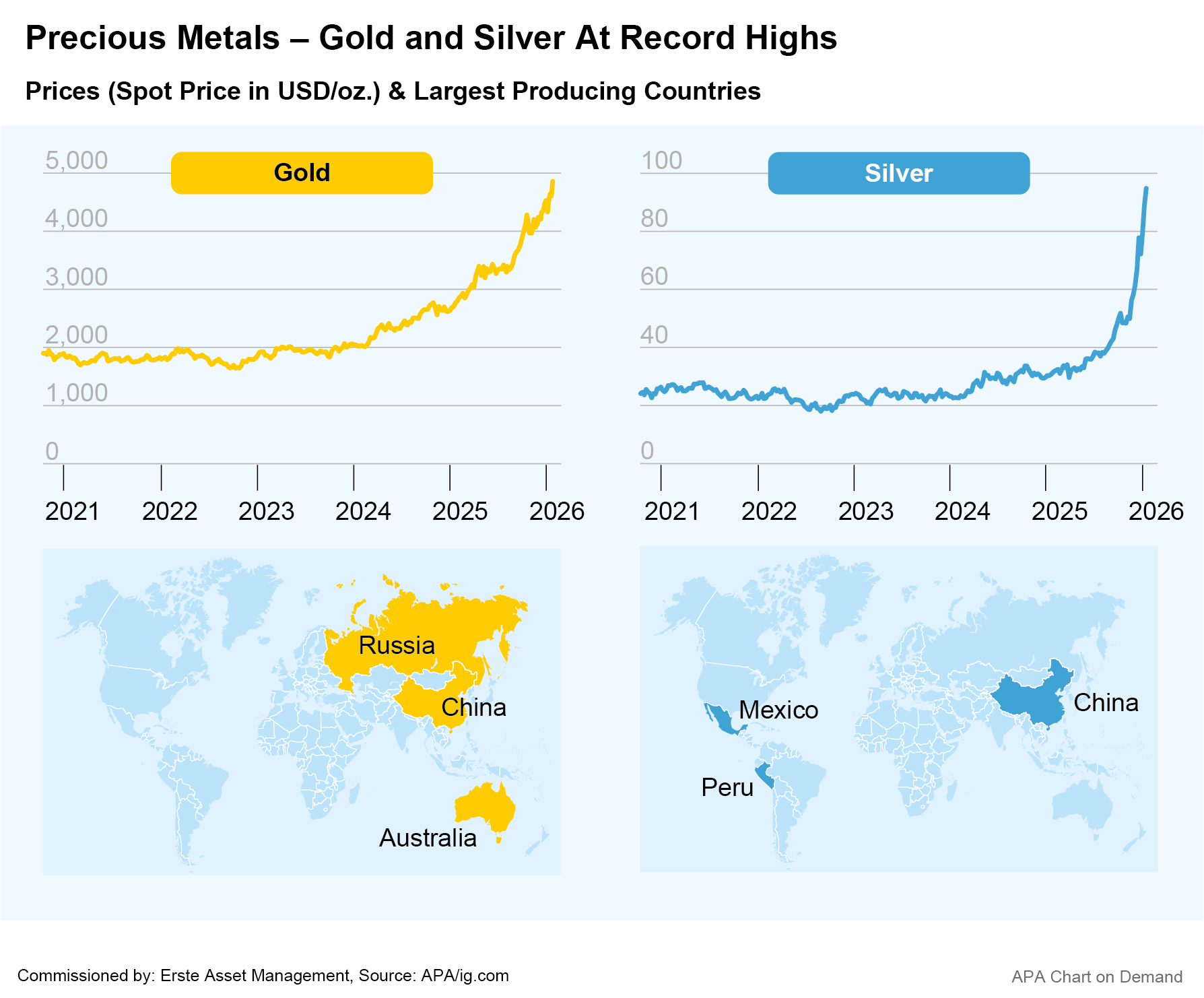

In the midst of an eventful week on the stock markets, gold and silver prices have continued their record rally and reached new record highs . The price of a troy ounce of gold rose above the 4,800 dollar mark for the first time on Wednesday, meaning that the price of gold has risen by over 12 percent since the beginning of the year alone. The price of silver rose above 90 dollars for the first time and at times exceeded 95 dollars. The record rise in precious metals was further driven by fears of a collision course between the EU and the USA. This was triggered by US President Donald Trump’s tariff threats in connection with the dispute over Greenland.

Trump had recently emphasized several times that he wanted to take over the island of Greenland, which belongs to Denmark. Numerous protests against the Greenland plans came from Europe. Germany and other countries have even sent soldiers on a fact-finding mission to Greenland as a sign of solidarity with Denmark. Trump subsequently announced new punitive tariffs against Germany and seven other NATO countries in order to break the resistance to his Greenland plans.

After the EU announced countermeasures against the tariff threats, an agreement was apparently reached at the World Economic Forum in Davos this week. Following a meeting with NATO Secretary General Mark Rutte, Trump announced that he would forgo the planned additional tariffs. Instead, a framework agreement was announced for further talks on the Arctic region and security policy issues. The stock markets reacted promptly and switched into recovery mode after a volatile trading day.

Note: Data as of 21.01.2026

Fears about the independence of the US Federal Reserve are driving investors even more strongly into gold

Precious metals, which are considered relatively safe havens in times of crisis, had already risen sharply beforehand in light of the many geopolitical trouble spots and in particular the escalation of the situation in Iran. In addition, US bonds, which are otherwise also considered relatively safe investment havens, were less in demand this time despite the crises. This is because the political and economic uncertainties were recently compounded by concerns about the independence of the US Federal Reserve and therefore the stability of the US dollar.

Trump has been exerting public pressure on US Federal Reserve Chairman Jerome Powell for a long time. He accuses him of not lowering key interest rates as quickly and as much as he would like. Meanwhile, the US Department of Justice is investigating Powell for cost overruns on a 2.5 billion dollar renovation project at the Fed’s headquarters. Powell rejects the allegations and describes the action as a pretext to put him under pressure over the interest rate cuts demanded by Trump.

Finally, the gold price continued to be supported by rising demand from central banks. According to an analysis by the European Central Bank (ECB), central banks accounted for more than 20% of global demand for gold in 2024. On average in the 2010s, this share was still around ten percent.

Industrial demand and AI boom fuel prices for industrial metals

The silver price is benefiting from strong demand from industry. The price of silver has risen even more strongly than the price of gold. At the beginning of 2025, the price of silver was still below 30 dollars, meaning that the value of the metal has almost quadrupled in just over a year. Other industrial metals such as copper, tin, aluminum and nickel have also risen sharply in price recently, reaching record highs in some cases. This is due to the significant increase in demand for industrial metals for applications in areas such as artificial intelligence (AI) and energy.

The high power requirements of AI data centers in particular are currently driving up demand for industrial metals. The growing importance of electric cars and the associated metal requirements for batteries are also playing a role here. Added to this are fears of a shortage in supply. Nickel prices, for example, have recently risen sharply following production cuts in Indonesia, the most important producer country.

Operators of data centers, which are important for AI applications and cloud services, are increasingly investing in their own supply chains in order to secure the supply of metals that are important to them. For example, cloud giant Amazon recently concluded an exclusive purchase agreement for a mine owned by mining group Rio Tinto in the US state of Arizona to cover its huge copper requirements for its data centers. Note: The companies listed here have been selected as examples and do not constitute an investment recommendation.

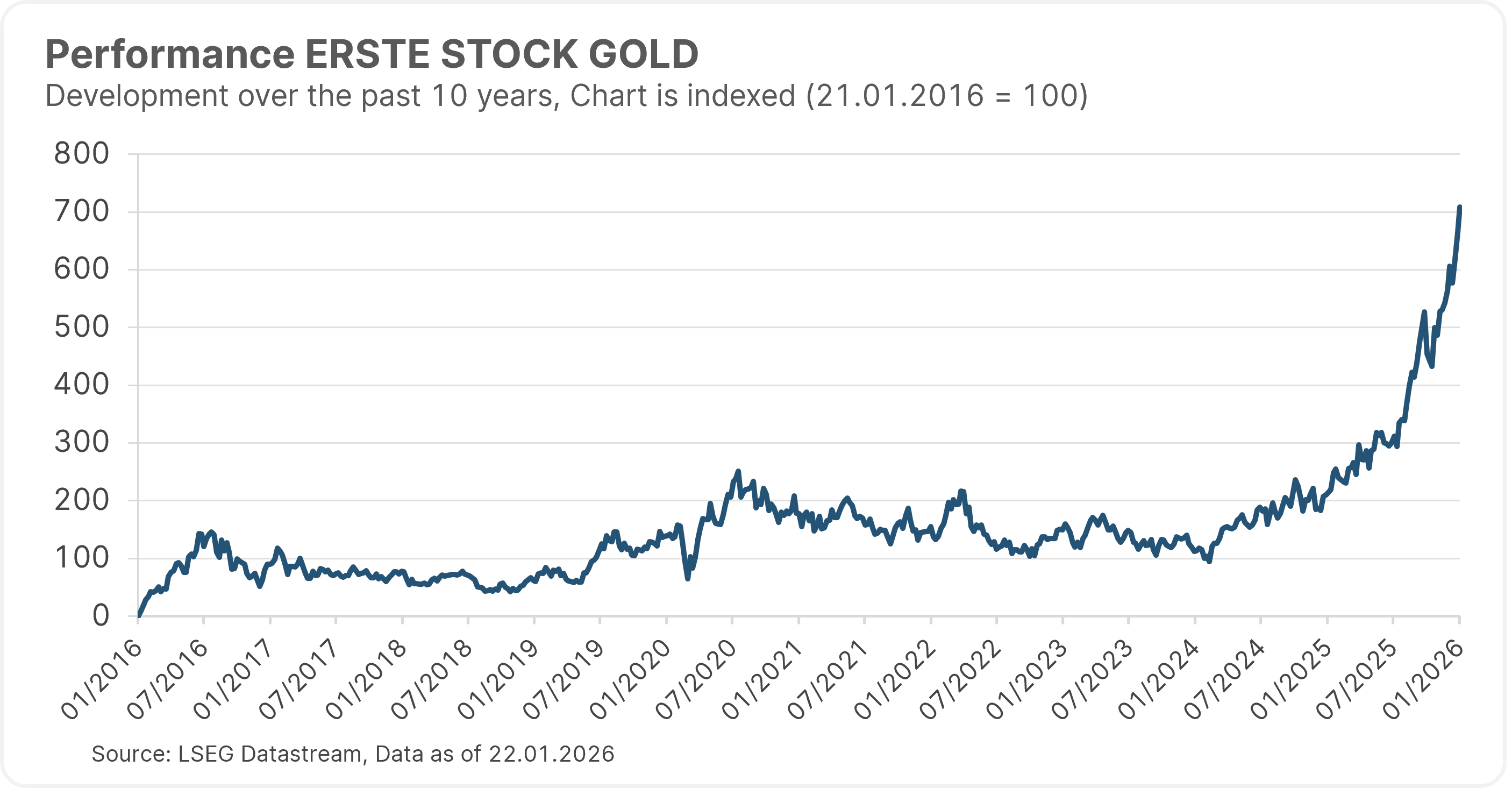

Investing in the gold sector

The ERSTE STOCK GOLD equity fund offers the opportunity to invest in the entire gold mining supply chain with flexible capital allocation. Global gold production in 2024 was approximately 3,300 tons, dominated by countries such as China, Russia, Australia, and Canada. The equity fund focuses on the different areas of companies involved in gold production:

• Producers: Companies that mine gold and participate directly in the gold price.

• Developers: Companies that develop mines and are about to start production.

• Explorers: Companies that search for new gold deposits.

• Royalty/Streamers: Mine financiers who participate in the revenues and profits of mines without mining themselves.

A look at the fund’s performance over the past ten years shows that this strategy has yielded positive results in the long term, especially given the positive development of the gold price in the recent past. Note: Please note that investing in securities involves risks as well as opportunities. Past performance is not a reliable indicator of future performance.

Note: Performance is calculated using the OeKB method. Performance assumes full reinvestment of distributions and takes into account the management fee and any performance-related remuneration. The one-time front-end load that may be incurred upon purchase and any individual transaction-related or ongoing income-reducing costs (e.g., account and custody fees) are not included in the presentation.

Risk information ERSTE STOCK GOLD

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.