Global growth in the first quarter was roughly at potential (around 2.5% annualized). However, the latest leading indicators, such as the purchasing managers’ indices for June, point to a slowdown in momentum. There are also increasing signs of a slowdown in the USA, which has been the main driver of global growth to date.

On the other hand, it is positive that the latest inflation indicators point to lower inflationary pressure. This increases the scope for central banks to react to economic weakness by lowering key interest rates.

The positive growth impetus from the normalization of supply chains, the high budget deficit in the US, the fall in energy prices in Europe and the recovery in China following the end of the lockdown measures is coming to an end. At the same time, the rise in interest rates, i.e. the more restrictive interest rate policy, is having a dampening effect on growth. Political uncertainty has also increased. Firm labor markets and rising purchasing power are having a supportive effect – because inflation traditionally falls faster than wage growth.

Purchasing Managers’ Index – upward trend still intact

The global purchasing managers’ index did not continue its upward trend in June. After rising from 50 in October 2023 to 53.7 in May, the growth indicator fell to 52.9 in June. However, the level is still high, indicating global growth slightly above potential. A one-off decline is not yet a trend – at least three months of falling data are required for this – which is why the emphasis is (still) on the upward trend.

Somewhat worryingly, the decline in the eurozone purchasing managers’ index (from 52.2 to 50.9) does not confirm the story of increasingly broad-based global growth. The eurozone is struggling to sustainably overcome the stagnation phase.

Rising unemployment rate in the USA

In the USA, employment growth in the non-farm payrolls sector remained strong with an increase of 206,000 in June. However, other labor market indicators were on the weak side. The further rise in the unemployment rate to 4.1% is particularly noteworthy. The level is still low. However, according to economist Claudia Sahm, the recession indicator has risen further (to 0.43 from 0.37). The Sahm recession indicator signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more compared to the minimum of the three-month averages of the previous 12 months. In addition, job postings in the JOLTS report show a downward trend, indicating a decline in demand. However, the level of job advertisements is still high and the indicator even rose in May.

The unemployment rate in the USA has recently continued to rise, although it remains at a low level. © unsplash

After a particularly strong second half of 2023 (third quarter: 4.9%, fourth quarter: 3.4%), real economic growth slowed significantly in the first quarter of 2024 (to 1.4% annualized). The weakening trends on the labor market underscore downside risks for the second half of the year.

Political uncertainty in the USA

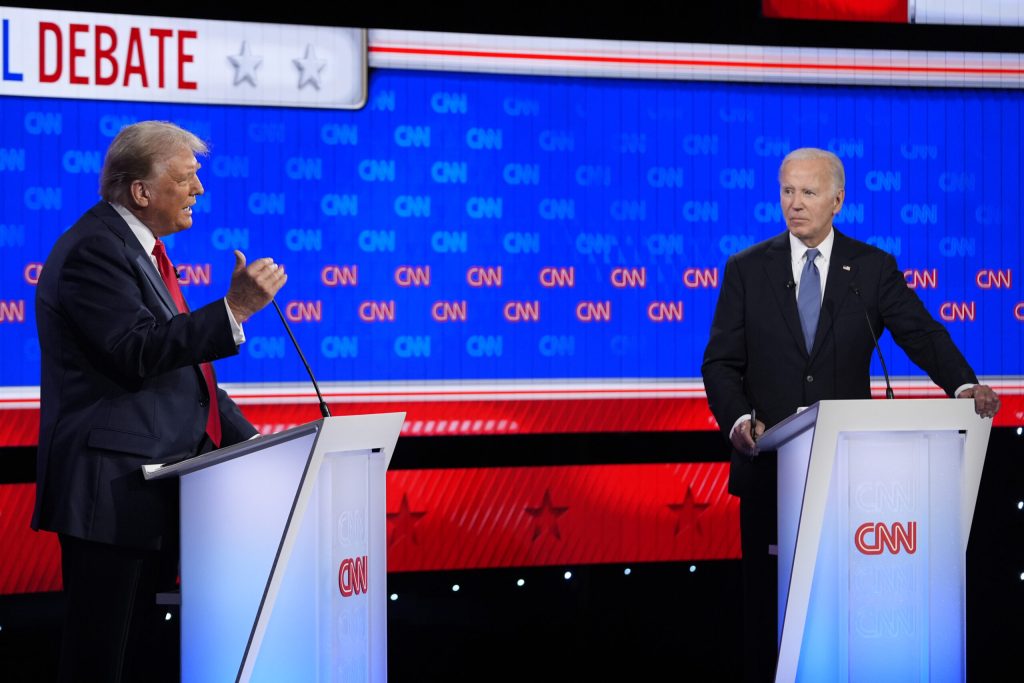

Political uncertainty has also increased: Following the recent TV debate between President Joe Biden and Trump, the odds for the challenger have increased significantly. The nationalist and populist agenda is at least not helpful for positive sentiment. In general, such policies have a dampening effect on growth (less trade and immigration) and promote inflation (higher tariffs). In addition, a debate has begun about a possible resignation of Joe Biden as presidential candidate.

The latest TV debate for the upcoming US presidential election has improved the chances of challenger Donald Trump and triggered a debate about the candidacy of incumbent President Joe Biden. © Gerald Herbert / AP / picturedesk.com

Cohabitation in France

The Left Alliance (Nouveau Front Populaire – NFP) achieved a relative majority in the French parliament. President Emmanuel Macron’s Center Party is in second place. The Rassemblement National (RN) is in third place according to the polls. Typically, the president appoints the prime minister from the strongest party, i.e. the left-wing alliance. A “cohabitation” is imminent.

The election result has at least two implications. Firstly, the chances of reducing the high budget deficit are low. Secondly, the EU could slip down the list of priorities. The integrative forces in the EU could therefore be weakened. Both of these factors have a knock-on effect on the other countries in the EU. In the UK, the shape of economic and fiscal policy is unclear following the Labour Party’s victory. However, an austerity policy seems unlikely.

Falling inflation

In the USA, inflation indicators are showing a downward trend following the sharp rises in the first three months of this year. The central bank is primarily looking at the deflator for personal consumption expenditure to achieve its target. Excluding the volatile components of food and energy, the inflation indicator rose by just 0.1% in May (2.6% year-on-year).

According to the flash estimate, the core rate of consumer price inflation in the eurozone remained at 2.9% year-on-year in June. At the same time, inflation fell significantly month-on-month (0.2%). However, inflation in the services sector remained high at 4.1% year-on-year (and 0.3% month-on-month).

Powell speech

Two events will be the focus of interest in the coming days. On Tuesday and Wednesday, Fed Chairman Jerome Powell will give his semi-annual speeches to two committees in the US Congress. The question is whether he will weaken, confirm or strengthen expectations for interest rate cuts (after a wait-and-see phase). On Thursday, the publication of consumer price inflation in the US for the month of June will provide further information on inflation dynamics.

Conclusion: scope for key interest rate cuts has increased

Economic and political uncertainty is increasing. After all, inflation is falling in the US and the eurozone. This increases the scope for central banks (Fed and European Central Bank) to react to a slowdown in economic growth by lowering key interest rates.

Note: Forecasts are not a reliable indicator of future perform

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.