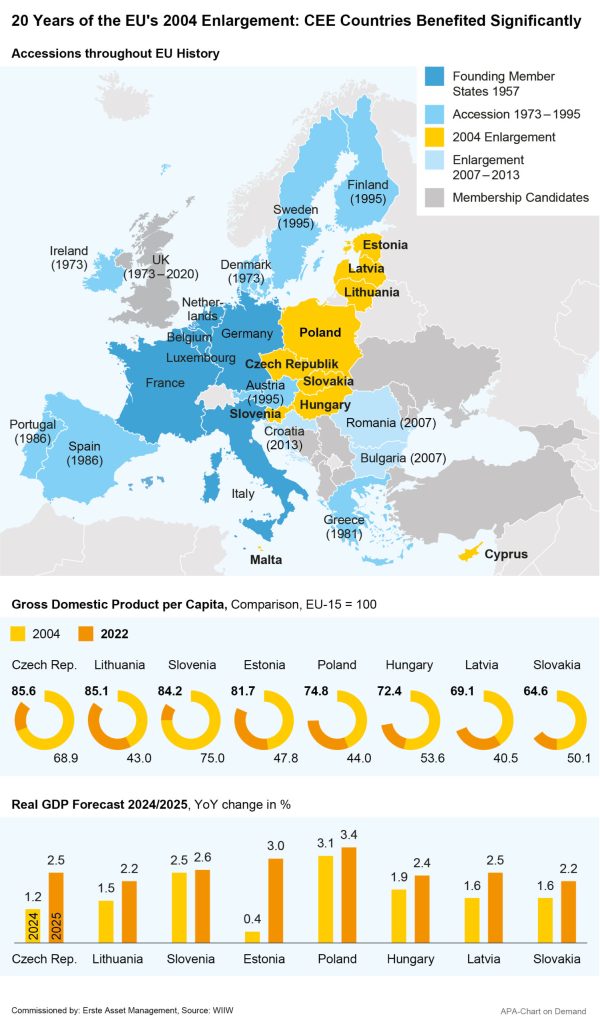

With the 20th anniversary of the EU’s Enlargement on 1 May, the EU celebrates a political and economic success story. The accession of Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia and Slovenia was the European Union’s biggest enlargement to date, with Romania, Bulgaria and Croatia joining at later points.

Politically, a new era dawned for the former Warsaw Pact countries. The political and institutional reforms necessary for admission were also a milestone on the path to Europe. However, the enlargement was also a definite success story from an economic perspective, as recent analyses by Erste Group and the Vienna Institute for International Economic Studies (wiiw) show.

New Member Countries Caught up Economically

Measured in terms of GDP per capita, the new member countries have caught up massively over the past 20 years and in some cases reached the levels of many Western countries. Romania, Bulgaria, Poland and the Baltic states have made particularly strong gains, the wiiw notes. While the economic performance of these countries was around 30 to 40 per cent of the EU-15 average in 2004, Lithuania and Estonia now have a GDP per capita of more than 80 per cent of the older EU member countries.

GDP per capita in Poland and Romania has more than doubled since 2004, according to Erste Group experts. In 1990, Poland’s GDP per capita roughly equalled that of South Africa, Brazil, North Macedonia and Turkey – but in subsequent years Poland overtook all of these economies, according to the wiiw. The Czech Republic and Slovenia also currently show similarly high levels, although both countries started from a higher level of prosperity.

In order to better assess the effect of EU accession, the Erste Group experts also modelled the estimated economic development of several member states in a fictitious scenario where they did not join the EU and compared this with the actual development. According to the results of the analysis, per capita GDP in Poland in particular would be significantly lower today without the country’s EU accession. The Czech Republic, Hungary and Slovakia benefited less strongly, but still significantly. Slovenia’s advantage from joining the EU was noticeably smaller.

Foreign Investment Drove Growth

According to the wiiw economists, the enlargement countries chiefly benefited from the boom in foreign direct investment (FDI) triggered by the accession. With the institutional reforms in the new member countries and the dismantling of trade barriers between the “new” and “old” EU countries, foreign investments poured into the region in order to leverage the low-cost, qualified labour. As a result, the EU-CEE countries became important hubs in international production networks.

However, according to economists, the “old” EU countries have also benefited significantly from the enlargement. For Austria and its companies in particular, the EU enlargement has been a success story. “Our country has benefited from EU enlargement more than almost any other in the European Union,” says WKÖ Secretary General Mariana Kühnel. Austria’s exports to Hungary, Slovenia, the Czech Republic, Slovakia and Poland have tripled since 2003. Austria has also become a “top investor in the region”.

Economists Expect the Region to Grow Further

Following the region’s booming economy over the past 20 years, experts believe that the catch-up process in the new member countries remains intact. “For most countries in the region, this year is looking much better than last year,” says wiiw Deputy Director Richard Grieveson, summarising the institute’s spring forecast.

For 2024, wiiw forecasts average growth of 2.5 per cent for the EU member countries in the CEE region, increasing to 3 per cent in 2025. Romania (3.0 per cent) and Croatia (2.9 per cent) are expected to show particularly strong growth in 2024, according to the wiiw economists, as the economy there is supported by funds from the NextGeneration EU coronavirus recovery fund, among other things.

According to the wiiw forecasts, Poland, the Czech Republic, Slovakia and Hungary will grow by an average of 2.4 per cent this year and 3 per cent in 2025, while the euro area will all but stagnate this year. “In view of rising real wages, primarily due to a sharp decline in inflation, private consumption is the main pillar of growth,” explains wiiw economist Olga Pindyuk, lead author of the spring forecast.

Countries Need New Growth Strategies

However, after the boom of the past 20 years, many new member countries are also facing new challenges. Although the economies of the region have caught up with the EU’s level, there are still strong regional differences within the countries themselves, the wiiw notes. Prosperity in the capitals of Romania, Poland and the Czech Republic reaches up to one and a half to two times the levels of the EU average, while the poorest regions of these countries are only at around half the EU average.

A change in the FDI-based growth model of the regions is also increasingly urgent, the wiiw emphasises, recommending that for a modern industrial policy, the countries should play a more proactive role in networking important players in the economy, including the private sector, academic institutions, key ministries and economic development agencies. Secondly, it is important to harmonise industrial policy with EU rules and regulations and make the most of this integration.

In addition, the young EU member countries need to rethink their approach to FDI promotion if they want to move beyond their current role as an extended workbench in the value chain. Institutional improvements and reforms must go hand in hand with political efforts to avoid corrupt practices and interventions distorting the markets. Finally, structural changes are also necessary, including a comprehensive social safety net to ensure that neither people nor regions are left behind.

Another challenge is the migration to the West, which has led to a shortage of qualified labour in some new member countries. According to surveys, more than 30 per cent of companies in Poland’s manufacturing industry suffer from a labour shortage – in Slovenia more than 25 per cent and in Slovakia and Hungary 20 per cent respectively. It will therefore be necessary for these countries to increase employment rates, foster immigration and family formation and minimise emigration, the wiiw concludes.

In addition, further institutional reforms and a transition away from fossil fuels are necessary. The transition towards a net-zero emission economy and digital transformation will open up further growth opportunities for the new EU countries, according to the experts at Erste Group. The countries also benefit from the help of the EU’s Just Transition strategy, which is intended to alleviate the negative economic consequences of the change. But there is also strong support from the EU institutions for the digitalization process.

The Enlargement Continues

But the enlargement project has not come to an end: potential candidates include the Western Balkan states of Albania, Bosnia-Herzegovina, North Macedonia, Kosovo, Montenegro and Serbia. “These six countries are the missing pieces in the European mosaic, without them the EU is not complete,” said Austrian Foreign Minister Alexander Schallenberg on the occasion of the enlargement’s anniversary. Georgia, Moldova and Ukraine are also considered candidates.

The wiiw experts see this as both an opportunity and a risk. On the one hand, the newly integrated countries would have a significant labour cost advantage, which could affect the current strong positions of the EU-CEE countries as assemblers in the EU value chains. On the other hand, precisely this shock could prompt the EU-CEE countries to improve their positions in these value chains, according to the analysis.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.