2023 brought many surprises – including positive ones, such as the unexpectedly good performance across all asset classes. What can investors expect in the new year and which topics could come into focus? Gerald Stadlbauer, Head of Discretionary Portfolio Management, provides an outlook.

2023 – Always expect the unexpected

After the pandemic-dominated years of 2020/21 and the inflation and interest rate shock following the invasion of Ukraine in 2022, it is safe to say that 2023 was a pleasantly positive surprise. Numerous unexpected events also occurred last year, such as the supposed banking crisis in March or the Hamas attack in the fall – although the impact on the economy was limited. In retrospect, the global economy and the financial markets generally digested or coped surprisingly well with the adverse problems of the previous year.

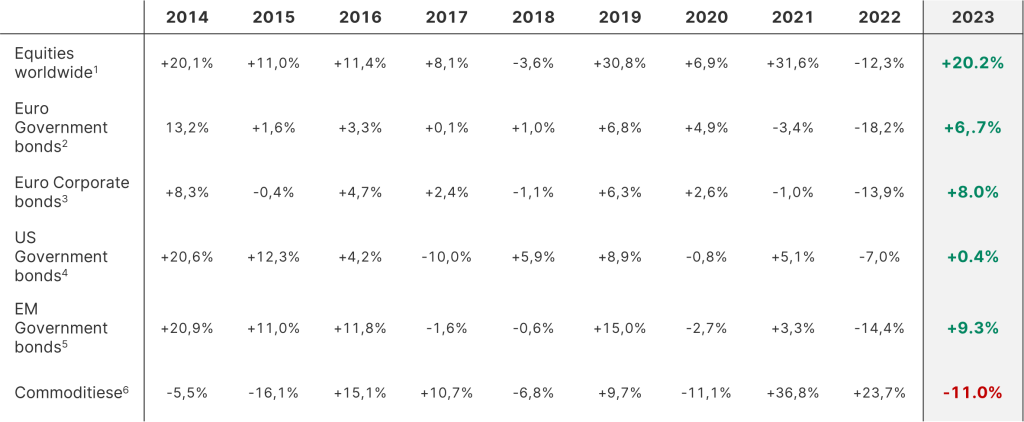

The recession in the US, which was often considered a certainty a year ago, did not materialize and the performance for 2023 shown below is a true mirror image of the performance in 2022. The presentation gives the impression that, with the exception of commodities, there was hardly anything that could have gone wrong last year. However, this impression is deceptive to a certain extent, as 2023 was by no means easy and solid portfolio performance was not a foregone conclusion.

Yearly performance of selected asset classes in EUR

Note: Past performance is not a reliable indicator of future performance. Representation of indices, no direct investment possible.

Source: LSEG Datastream; Indizes: 1MSCI WORLD TR 2ICE BofA Euro Government Index TR 3ICE BofA Euro Corporate Index TR 4ICE BofA US Treasury & Agency Index TR 5ICE BofA BBB & Lower Sovereign External Debt Index TR 6Bloomberg-Commodity TR

On the equity side, the low market breadth for most of the year should be mentioned – without the technology sector and the large US companies in particular, performance would be significantly lower. On the bond side, the picture would also be mixed without the strong performance in the last quarter. Due to the much more restrictive interest rate policy of the Fed and ECB and the resulting frequent changes in market expectations, the interest rate markets were confronted with the highest level of volatility since the 1990s.

However, volatility should decrease noticeably in 2024, making bonds appear more attractive than they have for decades. The losses in the commodities sector are more than manageable given the overall market trend. All in all, we are therefore starting the new capital market year 2024 with a completely different outlook compared to the previous year.

The same procedure every year!

Even if the current starting position is very different to that of a year ago, the market-determining themes are likely to remain the same. In the coming year, we will continue to focus primarily on what the economy, inflation and, depending on this, the central banks will do. The key question therefore remains whether the US economy in particular will be able to prevent a recession despite the strongest cycle of rising interest rates in 40 years and whether inflation will fall to a level suitable for central banks and remain there.

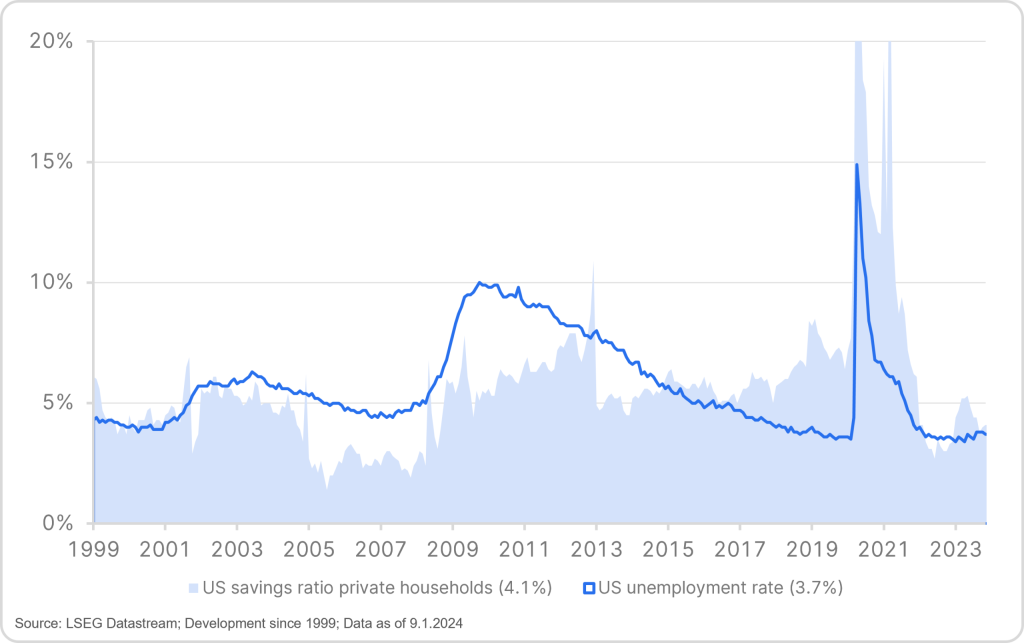

Even if the US economy is set for a noticeable slowdown in the first half of the year, we believe that the “soft landing” should be successful for the first time. The US labor market is still bursting with enormous strength, as illustrated by the latest labor market report with 216,000 new jobs created in December. The shortage of skilled workers is not exclusively a European problem. Demographic change is also making itself felt in the USA. As the chart below illustrates, workers are in a comfortable situation given a certain level of job security, so consumption – which accounts for more than two-thirds of economic output – should remain stable even without depleted coronavirus savings. Moreover, hardly any of these savings have been spent in Europe, which harbors a certain amount of additional potential.

US household savings rate and unemployment rate

Austerity is unlikely to be the order of the day for government budgets in 2024 either, as illustrated by the US budget deficit of 6% and record employment levels. Fiscal policy will remain expansive in the medium term on both sides of the Atlantic due to the multi-year stimulus programs such as the JOBS, Inflation Reduction or CHIPS & Sciene Act in the US or the NextGenerationEU program in Europe.

On the demand side, the situation therefore appears stable and the starting position for companies is also solid. The rise in financing costs has been compensated for surprisingly well in the aggregate and the future potential for productivity increases now appears in a completely new light thanks to AI. In addition, it should not be forgotten that a wide range of economic sectors, such as industry and real estate, have already been in recession for months – at 16 months, the global purchasing managers’ index for the manufacturing sector has been below 50 for longer than ever before in a recession. A recovery in these sectors could therefore also compensate somewhat for the impending weakness in the services segment.

Ahead the curve

Even if the economic environment were to deteriorate further, central banks could (unlike in recent years) now act rather than just react. The painful monetary policy trend reversal has not only given central bankers back their credibility, but also room to maneuver. For the first time in years, they seem to be “ahead of the curve” again.

Accordingly, the central banks can prepare well for the upcoming interest rate cuts. Surprisingly, the first step has already been taken by Fed Chairman Jerome Powell, who was surprisingly clear in December about interest rate cuts in the coming year. However, we doubt whether the Fed will actually start cutting interest rates in the first quarter, as the market expects. Too much has been invested in fighting inflation, meaning that any easing will probably come too late rather than too soon. In any case, the prerequisite for a reversal of interest rates is a continued fall in inflation, which should probably remain above, but at least in the region of, the central bank’s target of 2%. Regardless of the exact timing, monetary policy will probably be eased in the coming year, which should relieve some of the pressure on the economy from the interest rate side rather than easing it further.

Turning point

Inflation and key interest rates fall and the economy completes the “soft landing” that was thought impossible. The script for the coming year could look that simple if it weren’t for the countless “sideshows”. Geopolitical disputes such as the conflict in the Middle East and Ukraine are likely to remain constant sources of uncertainty. It also remains to be hoped that China will not follow up its threats against Taiwan with action.

The coming year is also a “super election year”. Not only we in Austria, but also more than 3 billion people around the world are required to elect a new representative body over the next 12 months. The US presidential elections at the beginning of November will be of particular global relevance here – Donald Trump is and will remain unpredictable and any re-election would be accompanied by significantly increased uncertainty. The turning point propagated by Olaf Scholz almost two years ago is in full swing, which means that the general situation is likely to remain fragile in the longer term.

Conclusion: Cautiously optimistic outlook

Looking ahead to the coming year, the investment environment remains challenging. Inflation has not yet been finally conquered, monetary policy remains restrictive overall, the economy is on shaky ground and the list of geopolitical risks seems to be getting longer by the month.

2024 will once again feature many “unexpected” events, both negative and positive. Nevertheless, we are looking forward to the upcoming capital market year with great confidence. The recent past has proven that companies, consumers and, as a result, the economy have become much more resilient than the daily news situation would often suggest.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.