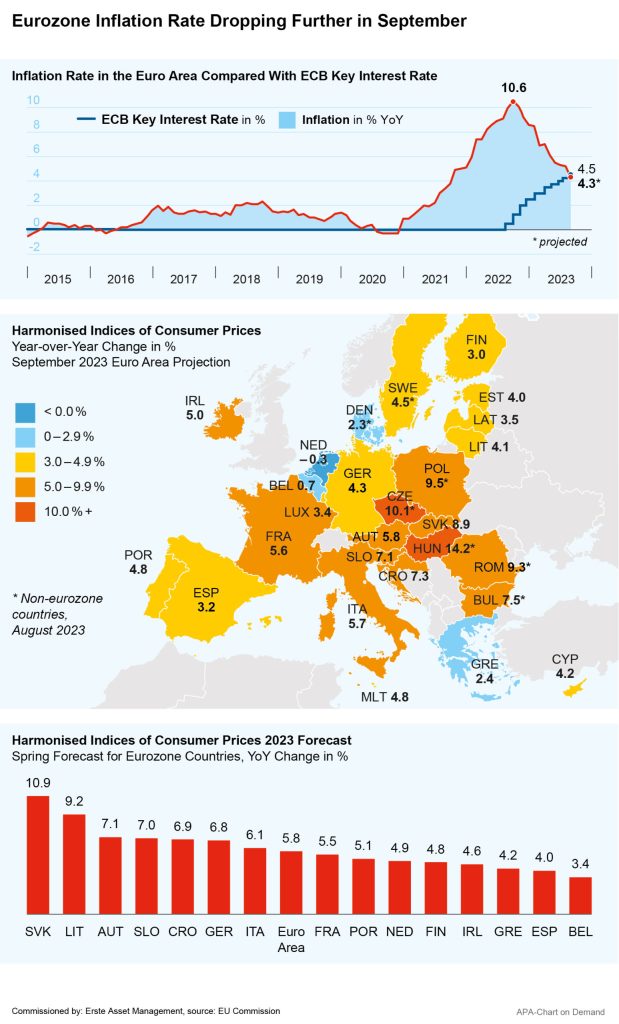

Inflation in the euro area is likely to continue to fall. According to the first Eurostat estimate published on Friday, consumer prices in the currency area rose by only 4.3 per cent compared to the same month last year, down from 5.2 per cent in August.

Note: Please note that an investment in securities involves risks as well as opportunities.

The decline in inflation was surprisingly significant, with economists having expected an average inflation rate of 4.6 per cent. This raised hopes that the European Central Bank’s (ECB) interest rate hikes implemented as a measure against inflation could come to an end. The reported data, the last before the ECB’s next upcoming interest rate decision in late October, had been awaited with some anticipation.

Reported core inflation, which excludes fluctuation-prone energy and food prices as well as alcohol and tobacco, fell to 4.5 per cent in September from 5.3 per cent in August. This figure is considered an important indicator of inflation trends. Energy prices continued to fall, down 4.7 per cent from 3.3 per cent in August. Food, alcohol and tobacco inflation continued to decline slightly to 8.8 per cent from 9.7 per cent in August. Prices for industrial goods excluding energy rose 4.2 per cent. Services increased by 4.7 per cent compared with 5.5 per cent in July.

Data from Germany paints a similar picture. The inflation rate in the euro area’s largest economy fell to 4.5 per cent in September, its lowest level since the start of the Russian war against Ukraine. The Eurostat estimate for September is even slightly lower at 4.3 per cent, down from 6.4 per cent in August. Inflation in France was higher, reaching 5.6 per cent. At 8.9 per cent, Eurostat statistics show the highest inflation rate for Slovakia. At the other end of the spectrum lies the Netherlands, where consumer prices actually fell by 0.3 per cent.

Inflation Still Above ECB Target Despite Sharp Decline

While Inflation in the eurozone has already dropped significantly from its highs of over 10 per cent, it is still well above the European Central Bank’s (ECB) target value of 2.0 per cent. In the view of ECB Vice President Luis de Guindos, the last stretch to reaching the inflation target will be tricky for the ECB, he told the Financial Times. The ECB is on track toward reaching two per cent, he said. “But we must monitor that very closely, as the last mile will not be easy,” he said in an interview published on Monday.

Meanwhile, the ECB has already raised interest rates 10 consecutive times in its fight against inflation. As a result, the deposit rate that governs the financial market now stands at 4.00 per cent, the highest level since the the monetary union’s inception in 1999. According to ECB President Christine Lagarde, the central bank wants to keep interest rates high for as long as necessary to push back inflation. But many economists believe the monetary guardians have now reached the interest rate peak.

Good US Economic Data Fuel Speculation of Further Fed Rate Hike

In the US, a diverging picture is beginning to show, as surprisingly good economic data fueled fears of possible further interest rate steps. The ISM Purchasing Managers’ Index for US industrial sentiment reported on Monday lay at 49.0 points, which is still below the growth threshold value of 50, but well above the forecast mean value of 47.9 points.

This also increased concerns in the markets that the US Federal Reserve could head against inflation with further interest rate hikes, and interest rates in the US bond markets rose in response to the figures. Fed member and president of the Cleveland Regional Federal Reserve Loretta Mester sees the need for another rate hike by the end of the year in the fight against high inflation. “I’m afraid we’re going to have to raise the federal funds rate again this year,” she said Tuesday night. After that, interest rates should be held at the elevated level for some time to push inflation back to the central bank’s two per cent target.

US Fed Held Interest Rates Steady After 16 Rate Hikes

The Fed did not raise the key interest rate further in its most recent rate decision in September, keeping it stable in a range between 5.25 and 5.50 per cent. Previously, the Fed had raised the key interest rate 11 times in 16 months in its fight against high inflation.

The PCE price index, which holds special significance for the Fed, recently rose 3.5 per cent year-over-year, up from 3.4 per cent the previous month, while the core index, excluding energy and food, decreased to 3.9 per cent, down from 4.3 per cent a month earlier.

Markets are now eagerly awaiting the ISM Services index on Wednesday and the US government’s monthly jobs report on Wednesday. The US Federal Reserve is following the situation on the labour market closely in its interest rate decisions, so investors are hoping that the labour market data in particular will provide clues about the Fed’s upcoming measures. A weak labour market stands in the way of interest rate hikes. Robust labour market data, on the other hand, not only clear the way for interest rate hikes, but are also likely to fuel fears of a possible wage-price spiral.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.