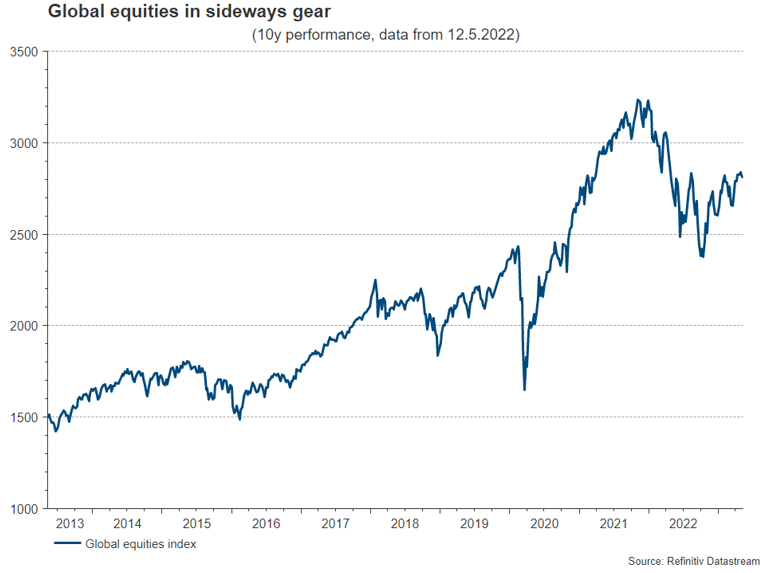

The markets are in a wait-and-see mode. In fact, global stock indices have been moving sideways for around a year. The fluctuations are decreasing from cycle to cycle. The supporting and dampening factors have therefore balanced each other out so far.

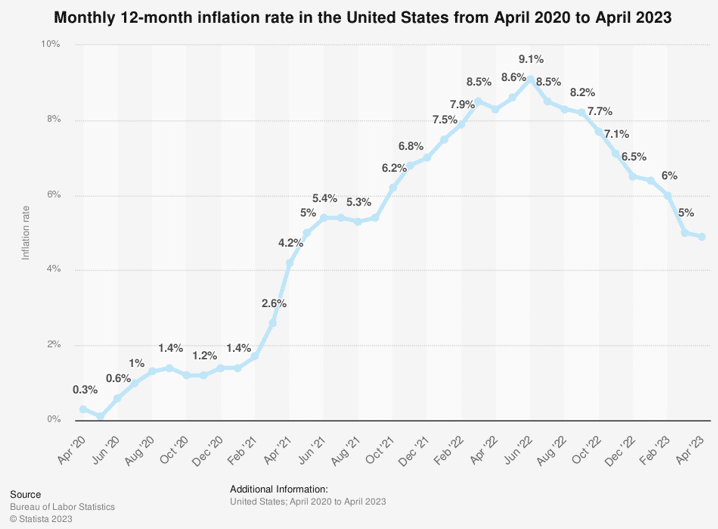

From an economic perspective, the question is still whether either inflation or growth will be the first to take a significant and rapid downward turn. A rapid decline in inflation would allow a soft landing for the economy, because central banks could lower key interest rates. However, a rapid decline in growth indicators accompanied by uncomfortably high inflation would make it difficult to ease monetary policy, which is why recession risks would rise. Overall, the economic indicators cover both scenarios. No scenario can be ruled out with a high degree of probability.

Uncertain monetary policy

In addition, growth indicators lag monetary policy with a time lag of around one year. The impact of growth indicators on inflation again shows a considerable time lag. However, the actual time lags and the actual impact are highly uncertain. This makes it clear why more and more central banks are signaling a pause in the interest rate hike cycle. This is because the aim is to avoid, as far as possible, unnecessary interest rate hikes that could trigger a recession. Early easing, in turn, could have a negative impact on medium-term inflation dynamics (too high inflation). More and more central banks are thus also adopting a wait-and-see stance.

Negative outlook

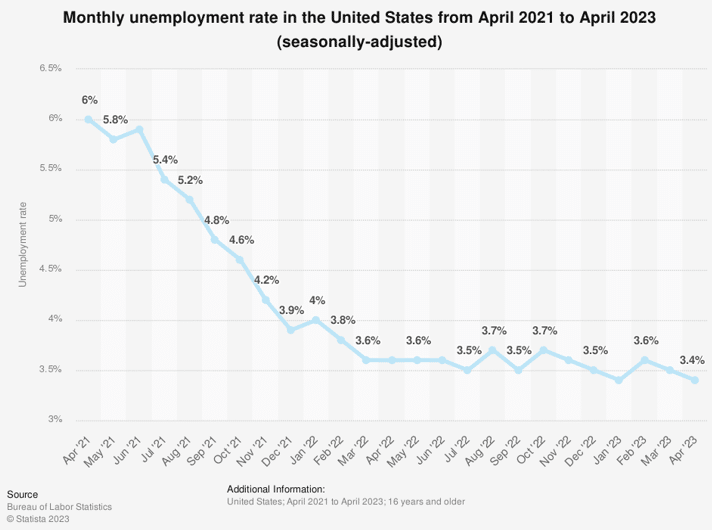

On the negative side are stress in the U.S. banking system, the sovereign debt ceiling soon to be reached in the U.S., tightening of bank lending guidelines in the U.S., the Eurozone and Canada, inflation being too high, restrictive monetary policies, the labor market being too tight and some recession indicators. The last category includes the Conference Board’s Leading Economic Index, which will be released this week for the month of April.

Positive outlook

On the positive side, economic growth has so far proven surprisingly resilient to the numerous negative factors. In addition, there are signs that the labor market is easing from the right side. Job vacancies have followed a downward trend in the U.S., while the unemployment rate has remained at a low level. Inflation rates have also followed a downward trend, although the pace is too slow. In addition, more and more central banks are signaling a pause in the rate hike cycle to better assess the effects of the previous rapid rate hikes.

Inflation: come to stay?

Inflation rates show a falling trend, albeit at different speeds. Overall, the level of inflation is too high. In the U.S., consumer prices increased by 0.4% month-on-month and 4.9% year-on-year in April (high: 9% in June 2022). On the positive side, inflation in the services sector excluding housing has been on a downward trend. The central bank is looking closely at this metric. On the negative side, however, inflation for price components with high persistence is still 6.3% year-over-year (Atlanta Fed Sticky Core Prices). In addition, consumers’ long-term inflation expectations unexpectedly increased in the month of May. The University of Michigan survey shows an increase from 3.0% in April to 3.2% in May (preliminary estimate). This is worrisome because it represents the highest level in the current inflation cycle. Something similar can be seen for the Eurozone. According to a report by the European Central Bank (Consumer Expectations Survey), consumers’ short- and medium-term inflation expectations have increased. The risks of losing the two percent inflation anchor remain elevated.

Weak growth

Signs of the effects of rapid key rate hikes are growing. In both the eurozone (Bank Lending Survey) and the U.S.A. (Senior Loan Officer Opinion Survey), reports on lending show a further tightening of guidelines and a further weakening of credit demand. In addition, in the U.S., the trend increase in initial claims for unemployment insurance has continued and both consumer sentiment (University of Michigan) and small and medium-sized business sentiment (NFIB) have fallen. On the goods front, poor manufacturing data in the Eurozone stood out last week. This week, industrial production in the eurozone is expected to contract significantly for the month of March. Last but not least, in China, both exports and imports contracted month-on-month. The V-shaped recovery in China is mainly in the service sector.

Debt ceiling

In June, the USA will probably reach the limit above which the Treasury is not allowed to increase the debt any further (debt ceiling). This means that the USA would not be able to service its financial obligations. President Biden and congressional representatives are in negotiations. The problem is the pronounced polarization of the two parties (Democrats and Republicans). A technical bankruptcy of the U.S. would trigger a strong uncertainty, because the government bond curve is the most important reference for the entire global financial market. The working assumption is a further postponement of reaching the debt ceiling by a few months.

CONCLUSION

Overall, the positive and negative factors have balanced each other out so far. Market participants continue to wait for the decisive indication as to whether a soft landing (including a mild contraction of GDP) or hard landing (recession) is more likely.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.