The crisis of confidence in the banking system continues to dominate market events and has significantly increased the uncertainty surrounding the further development of key economic indicators. One thing in advance: a recession has become (even) more likely.

Resilience

Published economic indicators point to an acceleration in real global economic growth to above potential growth in the first quarter of 2023 from the fourth quarter of 2022.

The V-shaped recovery in China after the pandemic-related opening measures has played a good part in this. However, higher growth is also emerging in the advanced economies. This is indicated by the flash estimates of purchasing managers’ indices for selected developed economies for the month of March. The aggregate index continued to rise.

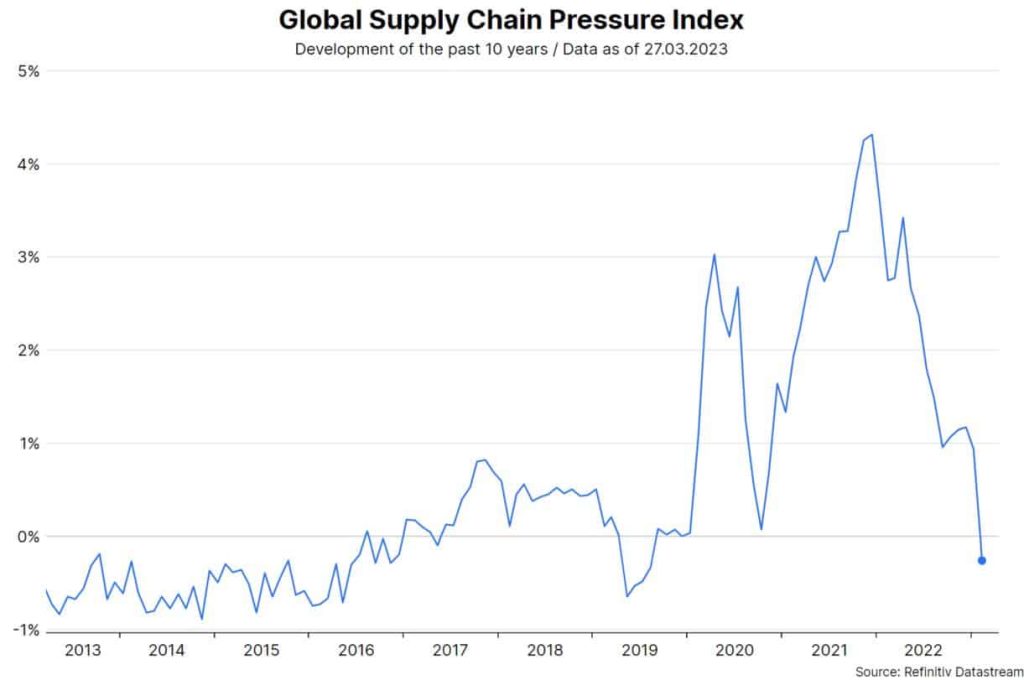

To date, economic activity has proved remarkably resilient. In Europe, the sharp fall in the wholesale price of natural gas has played a significant role in this. At the same time, the labor market remains very tight. In January, the unemployment rate in the OECD area reached a new low of 4.9%. In addition, a normalization is taking place in supply chains. The New York Fed’s Global Supply Chain Pressure Index fell below its pre-pandemic level in February.

Note: Past performance is not a reliable indicator for future performance.

Inflation persistence

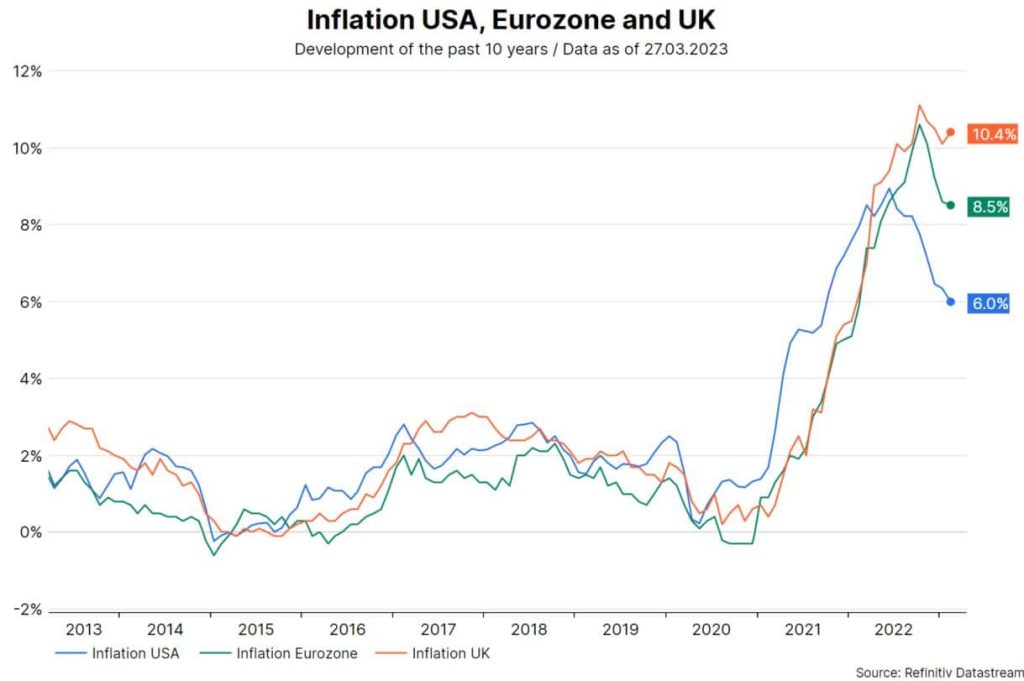

Unfortunately, the headwinds are increasing. Inflation rates remained uncomfortably high at the beginning of the year. In the OECD area, consumer prices rose 9.2% on an annual basis in the month of January. Last week, consumer prices in the UK for the month of February surprised with a sharp increase of 1.1% month-on-month to 10.4% year-on-year.

Note: Past performance is not a reliable indicator for future performance.

Next Friday, the flash estimate for consumer prices excluding food and energy in the eurozone for the month of March is expected to come in at a high 5.7% y/y (previous month: 5.6%). On the same day, the deflator (inflation) for personal consumption excluding food and energy in the U.S. is expected to rise by 4.7% year-on-year. There are indeed indications of a decline in trend inflation (NY Fed Underlying Inflation Gauge, NY Fed Consumer Inflation Expectations), but the published inflation rates are far too high.

Rapid hikes in key interest rates

High inflation is creating pressure on central banks to tighten monetary policy stances. Within a year, key interest rates have been raised very quickly and more and more central banks have started to reduce the very high bond holdings in their portfolios.

Last week, some major central banks continued to raise policy rates (U.S.: +0.25 percentage points to 4.7%-5%, UK: +0.25 percentage points to 4.25%, Switzerland: +0.5 percentage points to 1.5%). The week before, the European Central Bank raised key interest rates by 0.5 percentage points to 3.0% for the deposit facility.

Collateral damage

The goal of restrictive monetary policies is to push inflation down toward the central bank target. In the process, however, collateral damage has occurred: a crisis of confidence in the banking system. This implies two risks. First, financial market stability could be at risk. For this reason, central banks offer commercial banks a lot of liquidity, takeover partners for banks that got into troubles are quickly found (Credit Suisse) and, in the US, the authorities guarantee the full amount of deposits in problem banks.

The authorities assure that a systemic crisis can thus be prevented. Second, a further tightening of bank lending standards is very likely. In principle, central banks consider this desirable. After all, an important effect channel of key interest rate hikes is a slowdown in lending, which puts pressure on economic growth and, with a time lag, on inflation.

Uncertain Substitute

Uncertainty about the dampening effect of tighter monetary policy on economic growth and inflation in terms of magnitude and timing was already considerable before, but recent events in the banking system have raised it again. This is because the extent of the likely tightening of lending standards is still in the dark.

This also makes it difficult to assess the extent to which the (probably) tighter credit environment will serve as a substitute for a restrictive monetary policy. However, the risks of a recession have increased again in the medium term. At least, this is supported by the experience (econometric relationships) of the past decades.

Market implication

There could be a new driving factor for market development. Until now, rising interest rates have been primarily responsible for falling asset prices. If the expectation of a marked tightening of lending standards actually materializes, falling growth rates (a recession) could put pressure on risky assets, even if interest rates fall.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.