Guest article by Florian Greger, Senior Vice President Investor Relations & Sustainability OMV

With Group sales of EUR 36 bn and 22,400 employees, OMV is Austria’s largest listed industrial company. As a global energy and chemicals company, we intend to become a leading provider of sustainable fuels, chemicals and materials by 2030 with a focus on circular economy solutions – and deliver on the pledge to reach net zero by 2050.

STRATEGIC CONTEXT

Climate change is one of the biggest challenges of our times. The world is already warmer by about 1 degree Celsius since the middle of the 19th century, and we can see the effects. We, as a society, must therefore reduce greenhouse gas emissions to net zero by the middle of this century. The energy sector is at the heart of this challenge.

As the role of oil and gas diminishes, ensuring a secure and affordable supply of energy will remain a priority on the global agenda. In order to achieve a greener and smarter mobility system, we need to shift to alternative and sustainable feedstocks. Biofuel demand in Europe is expected to almost double by the end of this decade due to strict policies and consumer behavior.

Driven by global population growth and increasing prosperity and living standards, the demand for chemicals and materials will continue to rise. High-performance plastics are part of many products we use every day such as computers and mobiles. They make our cars and planes lighter and more fuel-efficient, and they save lives through airbags, helmets, and medical equipment. Lightweight solutions are essential to modern healthy living, but they are also key to delivering a low-carbon economy, given their properties: strong, flexible, and most importantly, inexpensive to produce. However, the ways we dispose of plastic must change. Plastics must become part of the solution, not the problem.

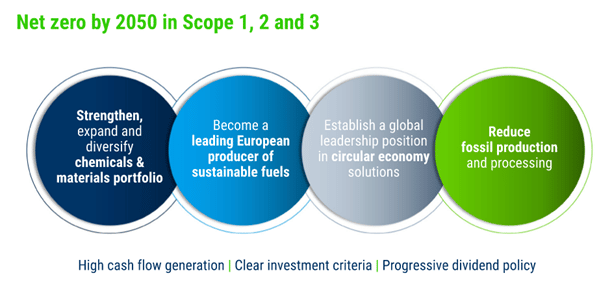

Our vision: OMV will transform from an integrated oil, gas, and chemicals company into a leader in innovative sustainable fuels, chemicals, and materials, leveraging opportunities in the circular economy. An integral part of the Group’s strategy is its ambition to become a net-zero emissions company by 2050 for Scope 1, 2, and 3 emissions. In view of the ongoing transformation in the energy industry and a global goal of net-zero emissions, OMV builds on its strengths and seizes opportunities to position itself competitively.

2030 STRATEGIC PRIORITIES FOR OMV

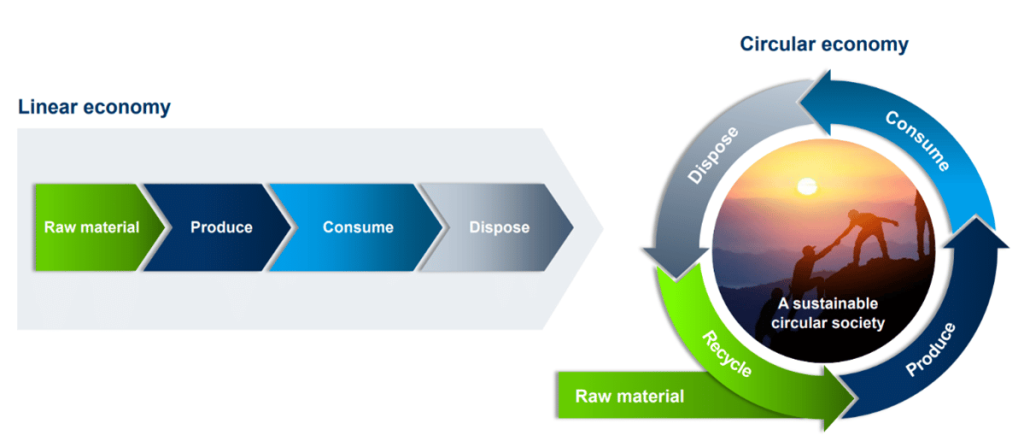

Turning the value chain from a linear to a circular model will be one of the priorities in making OMV a sustainable business. State-of-the-art technology expertise and patented technologies in both chemical recycling and standard and advanced mechanical recycling will help us to minimize pollution and waste, reuse materials, shift to low-carbon energy, keep carbon in the circle, and regenerate the living environment.

DECARBONIZATION

OMV is committed to achieving net-zero emissions (Scopes 1, 2, and 3) by 2050, with interim targets for 2030 and 2040. For Scope 1 and 2, OMV aims for an absolute reduction of 30% by 2030 and of 60% by 2040. For Scope 3, OMV aims at the reduction by 20% by 2030 and by 50% by 2040. In terms of reducing the carbon intensity of energy supply, OMV intends to achieve a decrease of 20% by 2030 and 50% by 2040.

These emission reductions can only be achieved with considerable effort and capital. OMV has earmarked organic investments of more than EUR 13 bn in total for 2022–2030 to achieve this purpose, which represent more than 40% of total organic CAPEX. All business units will build on their existing strengths and know-how on this transformation journey. Portfolio upgrades, enhancing efficiency, increasing renewable energy purchases, reducing throughput and sales of fossil refinery products, and increasing the share of recycled and sustainable feedstocks will be key levers to achieve our overall objective.

BUSINESS TRANSFORMATION

The Chemicals & Materials business will be the core growth engine of the company. OMV aims to become a global leader in specialty polyolefin solutions, with a significantly stronger position in the Middle East, Asia, and North America. We will strengthen our existing polyolefins business, while also building a strong and diversified chemicals and materials portfolio, by expanding into adjacent businesses and new product groups. To achieve this, we target investments and initiatives that improve our returns and carbon footprint. Moreover, OMV will expand its geographical reach, pursuing high-growth markets, such as Asia and North America. This will be achieved through in-market investments and partnerships based on differentiated technologies and application portfolios.

An important pillar of OMV’s strategy is the ambition to become a leader in renewable and circular chemicals and materials. We will capture the potential of emerging renewable and circular markets by leveraging the integrated technology platform and end-to-end position to develop innovative products and new business models. In this context, our target is to deliver around 2 mn t of sustainable C&M products by 2030, which represents up to 40% of produced polyolefin volumes in Europe.

OMV is engaging in all steps of the circular economy value chain. In the area of technology, we have standard and advanced mechanical recycling technologies in cooperation with TOMRA, as well as patented chemical recycling technology, ReOil® developed by OMV, which converts post-consumer and post-industrial plastics into synthetic feedstock. We ran successfully the ReOil® pilot plant in a continuous process and we are now building a ReOil® demo plant with a design capacity of 16,000 t per year at the OMV site in Schwechat – production start-up is planned in 2023.

We aim to develop ReOil® into a commercially viable industrial-scale recycling technology at the Schwechat refinery with a processing capacity of approximately 200,000 t per year of used plastics by 2026. This capacity is equivalent to 50% of the total plastic waste suitable for this process in Austria, or 25% of total plastics in the country.

In Refining, OMV aims to become a leading, innovative producer of sustainable fuels and chemical feedstocks. As a result, we will optimize the interface between oil and chemicals with a focus on the integrated Schwechat and Burghausen sites by redesigning plants to maximize high-value fossil resources and a growing share of sustainable feedstocks for chemicals production. This will significantly reduce diesel product output by 2030, while increasing the chemical feedstock yield to around 24%. The production of sustainable fuels and feedstocks will increase to ~1.5 mn t, while the crude oil distillation throughput will decrease by 2.6 mn t, by 2030.

To ensure our competitive position in the industry and continue to innovate, we must focus our research and development efforts on new technologies for feedstocks. One example is the biofuels Co-Processing initiative which enables us to process bio-feedstocks (e.g., domestic rapeseed oil, used cooking oils, algae-based oil) together with fossil-based materials in an existing refinery hydrotreating plant during the fuel refining process. The final investment decision amounting to around EUR 200 mn for the co-processing of renewable feedstock components in Schwechat was made in 2020 and commercial operation is expected in 2023. Up to 160,000 t of waste and vegetable oil will be hydrogenated. OMV utilizes feedstock that has been certified to EU sustainability standards. As a result, OMV’s carbon footprint will be reduced by up to 360,000 t of CO₂ per year due to the substitution of fossil diesel.

In Marketing, OMV aims to become the first choice of our customers for energy, mobility, and convenience, focusing on the sale of sustainable aviation fuels (SAF), building an EV charging network, and growing its non-fuel retail business.

We recognize the potential of SAF as key element in air traffic decarbonization and we aim to raise own SAF production to >700,000 t by 2030. In addition to already delivering SAF to Austrian Airlines at Vienna airport, we also signed MoUs with Lufthansa, Ryanair and Wizzair to supply more than 1 mn t SAF in the period 2023-2030. OMV produces SAF by co-processing sustainable and regional raw materials, specifically used cooking oil. Compared to conventional jet fuel, SAF contributes to a reduction of greenhouse gas emissions of more than 80% over the entire life cycle.

In the Exploration & Production business, OMV is focusing on maximizing the value and harvesting cash. E&P will reduce gradually its fossil hydrocarbon production to ~350 kboe/d by 2030, with a share of around 60% of natural gas. By 2050, OMV will exit fossil production for energy use. In the same time, OMV will make significant investments in low-carbon solutions, namely in around 10 TWh renewable energy (e.g., geothermal) and around 5 mn t p.a. of CCS capacity by 2030 to reduce its GHG footprint.

Geothermal will play a key role in supplying households with sustainable energy. We want to contribute to this and aim to build geothermal heat capacity generating 8-9 TWh per year by 2030. Amongst other projects, OMV is working on two geothermal development projects: one in Austria and one in Germany. In Austria, OMV conducted a production and injection test in fall 2022 to analyze the geothermal potential in the Vienna Basin, Lower Austria. The initial results are promising, as water could be produced with temperatures of 102 degrees Celsius at a rate of up to 40 m3/h and has been reinjected successfully. In the coming months, the next step is to analyze various parameters of the data obtained to check the technical feasibility and subsequently the economic viability.

CONCLUSION

If we want to maintain and expand living standards for a growing global population in a finite world, while at the same time addressing the challenges of climate change, we must move to a more sustainable way of doing business. For this reason, OMV will re-invent essentials for sustainable living.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.