Global stock markets also ended last week in positive territory. The US S&P 500 index rose 1.6% for the week, extending its year-to-date gains on hopes that the Federal Reserve is nearing the end of its interest rate hike cycle. Gains continued into the current trading week.

Softer tones from central banks

As widely expected, the US Federal Reserve slowed the pace of rate hikes to 25 basis points, down from 50 basis points in December (100 basis points = 1%). At the press conference following the rate decision, Fed Chairman Jerome Powell did not explicitly oppose easing financial conditions. He spoke of “a few more” rate hikes, suggesting the cycle is nearing an end.

That less aggressive tone was echoed by the European Central Bank and the Bank of England, although both central banks raised rates by 50 basis points last week. ECB President Christine Lagarde said risks to the economic outlook were double-edged. The Bank of England signaled that rate hikes were unlikely to last much longer.

Lackluster reporting season so far

Corporate earnings in the current reporting season continue to be lackluster, especially those of some high-profile technology companies:

- Apple reported a stronger-than-expected decline in revenue,

- Amazon forecast weak revenue in the current quarter, and

- Alphabet’s results narrowly missed analysts’ expectations.

So far, about 70% of the S&P 500 by market capitalization have reported their fourth quarter results. In the process, overall results are almost 1 percentage point below forecasts and earnings per share are expected to fall by 3.4%.

Estimation Erste Asset Management

From a macroeconomic perspective, we are cautiously optimistic about high-potential investments:

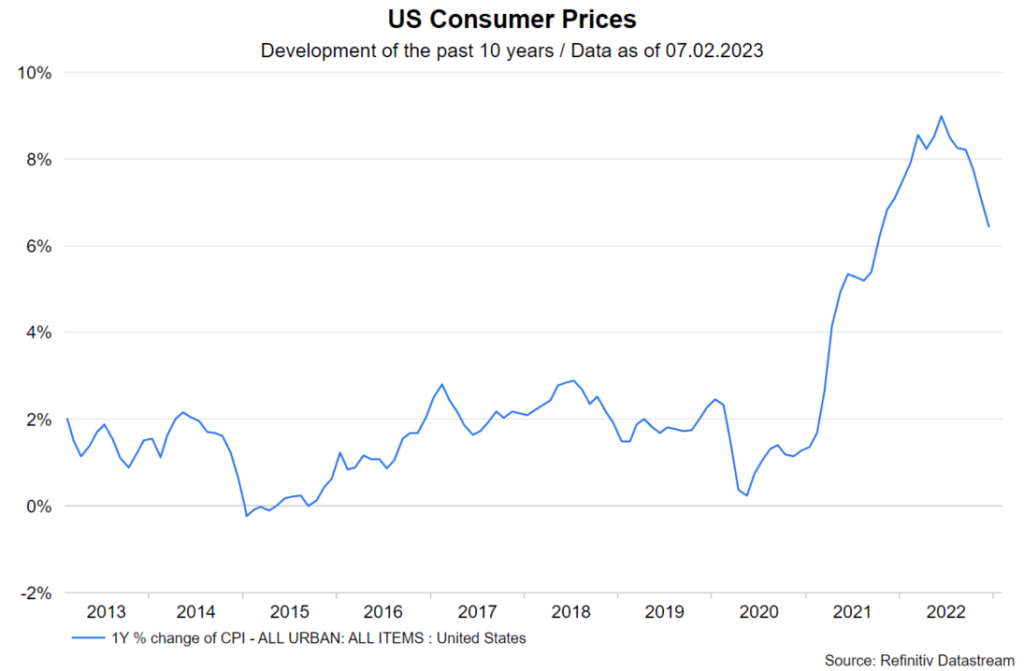

We assume that inflation rates will continue to fall and that we will therefore find ourselves in a disinflationary environment:

- In many regions, inflation rates are falling, driven by falling energy prices and declining goods price inflation.

- The key question for the further development of inflation is whether inflation rates in the service sector will also fall. In many countries, the unemployment rate is low, which puts pressure on the labor-intensive service sector.

Note: Past performance is not a reliable indicator for future performance.

With regard to global economic growth, we expect mixed developments in the coming months and a slowdown over the year as a whole:

- Positive factors are the improved economic activity in Europe due to the fall in gas prices and the V-shaped recovery in China as a result of the departure from the zero-covid policy and the associated opening-up steps. In the USA, on the other hand, recession risks remain high, as the latest leading indicators also show.

Positive for the economy should be our expectation of an end to the cycle of interest rate hikes:

- The Fed and the European Central Bank are signaling an end to interest rate hikes in the near future. Interest rates may then have reached a restrictive level.

- In the event of a faster decline in inflation than we currently expect or a recession, we expect interest rates to be cut.

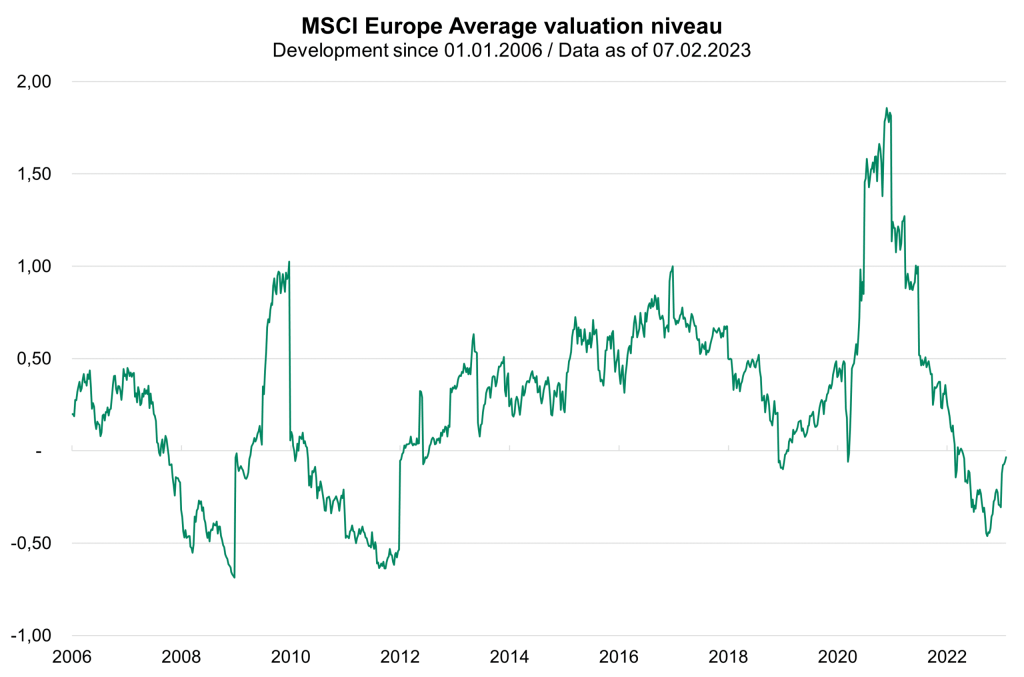

In our view, the slowdown in economic growth is priced into most high-opportunity asset classes:

- Following the recent price rises, equity valuation levels at a global level have moved away from favorable to fair.

- This applies both in Europe and in the USA.

Note: Past performance is not a reliable indicator for future performance.

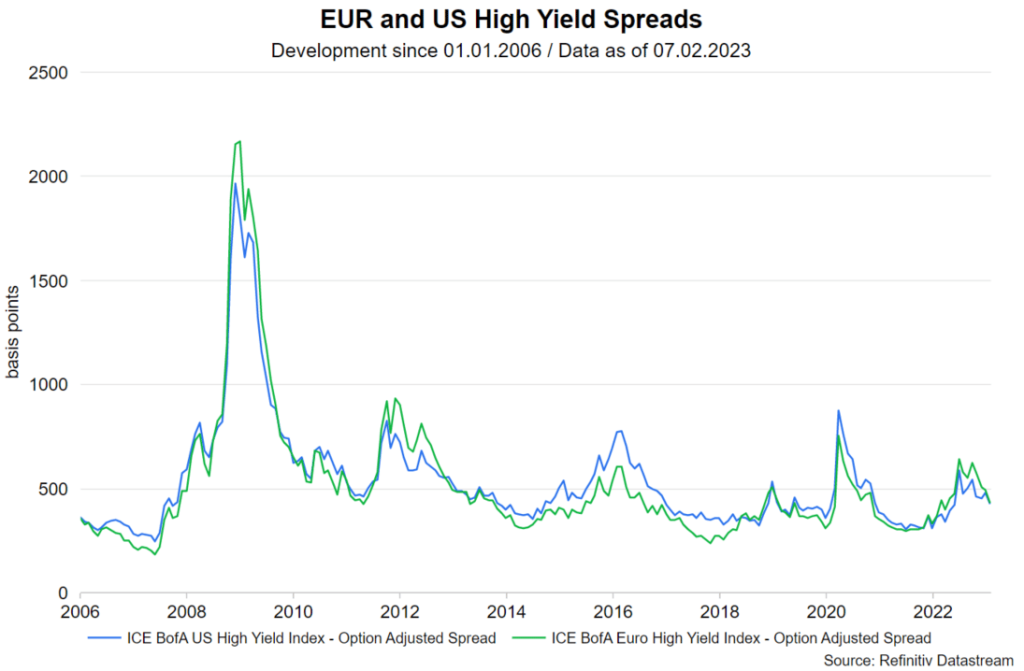

- Credit spreads in the high-opportunity fixed-income segments (high yield, emerging markets) have also narrowed. Nevertheless, they are still at a slightly favorable level.

Note: Past performance is not a reliable indicator for future performance.

- A recession in Europe or the USA is not currently priced in for high-opportunity asset classes.

- The main risk in the equities segment is that corporate earnings could disappoint in the coming quarters.

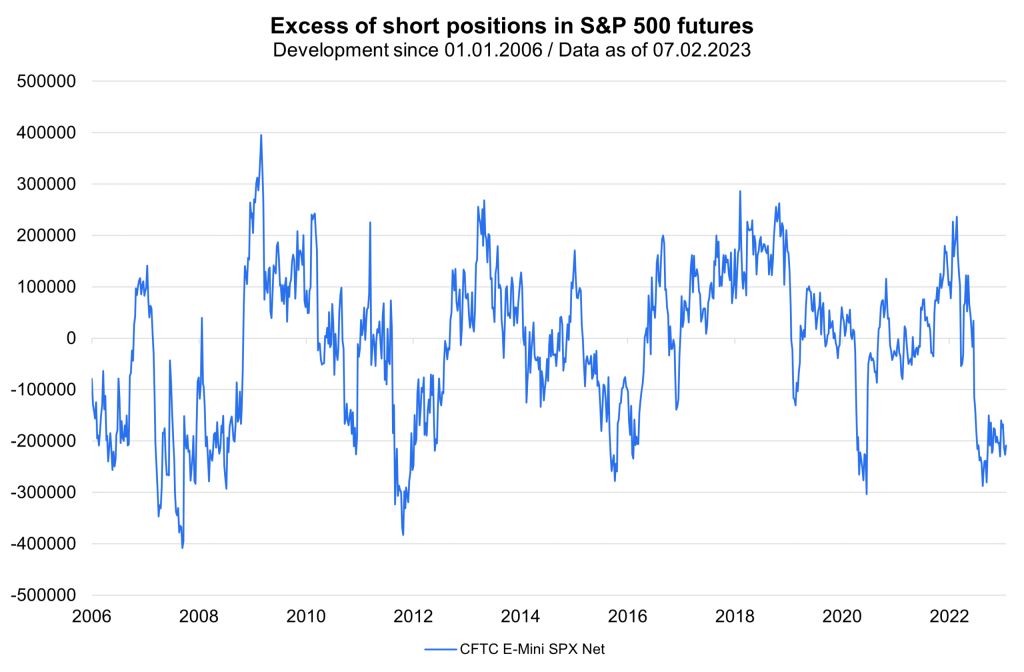

In market terms, we see high-opportunity asset classes supported:

- Many trend-following indicators are currently giving buy signals, based on the recent price development.

- In addition, the positioning of many market participants is not exhausted and tends to be on a defensive level. This could leave room for further purchases by investors. This is also shown in the following chart, which shows an overhang of short positions in S&P 500 futures:

Note: Past performance is not a reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.