The global microfinance market faced a number of challenges in 2022. On the one hand, there was the Covid 19 pandemic, which was entering its third year and had varying impact and intensity in different countries and world regions. Nevertheless, it was difficult or even impossible for many microcredit borrowers to continue their normal business operations during this phase. Moratoria, deferments of loans were then in many cases the order of the day with the account managers and advisors of the microfinance institutions (MFIs).

As a result, MFIs had to set aside provisions for the sometimes sharp increase in the proportion of loans whose repayments were in arrears. For this purpose, the PAR (“portfolio at risk”) 30 ratio is used internationally, which indicates the proportion of microloans for which repayments are 30 days or more in arrears. This ratio, which also provides information on the financial health of the microfinance market, recently improved to 4.9% for MFIs in the SYM 50 Index. In this case, the longstanding cooperative relationship between microfinance fund managers and global MFIs is working to find constructive solutions. The goal here is to work together to find ways that are mutually agreeable and allow business to continue. When selecting loans to MFIs, great attention is paid to sound risk ratios, stable quality of the underlying loan portfolio and good profitability.

Higher interest rates, inflation and war as challenges

Another challenge is the sharp rise in key interest rates in the USA, in Europe, but also in numerous emerging and developing countries. As a result, MFIs have to refinance at higher interest rates. On the other hand, this also tends to increase the loan rates for microcredit clients. These points could be somewhat cushioned by the fact that MFIs are often sitting on good capital buffers and the refinancing requirement – in some cases with variable interest rates – was not consistently so high. There are different regulations for microcredit borrowers in different countries around the world. For example, there are prescribed interest rate ceilings for MFIs, which may not be exceeded even if interest rates rise.

Furthermore, inflation, which in some cases has skyrocketed worldwide, has led to high price increases in many segments that are relevant for microfinance clients: (Agricultural) commodities such as seeds, energy prices or food prices, to name just a few. With a weakening economy, it is also more challenging for emerging and developing countries to sell their goods and services.

Last but not least, the war between Russia and Ukraine is causing geopolitical strain in addition to the unspeakable suffering of many people. Although both countries play only a minor role in the microfinance market, the war also put a strain on other states in the region.

ERSTE RESPONSIBLE MICROFINANCE with positive performance

Despite this challenging environment, the global microfinance market continued to grow dynamically in 2022. Profitability as measured by return on equity was 13.4% for the largest MFIs. The coupon paid in USD by them on average was most recently 7.5%.

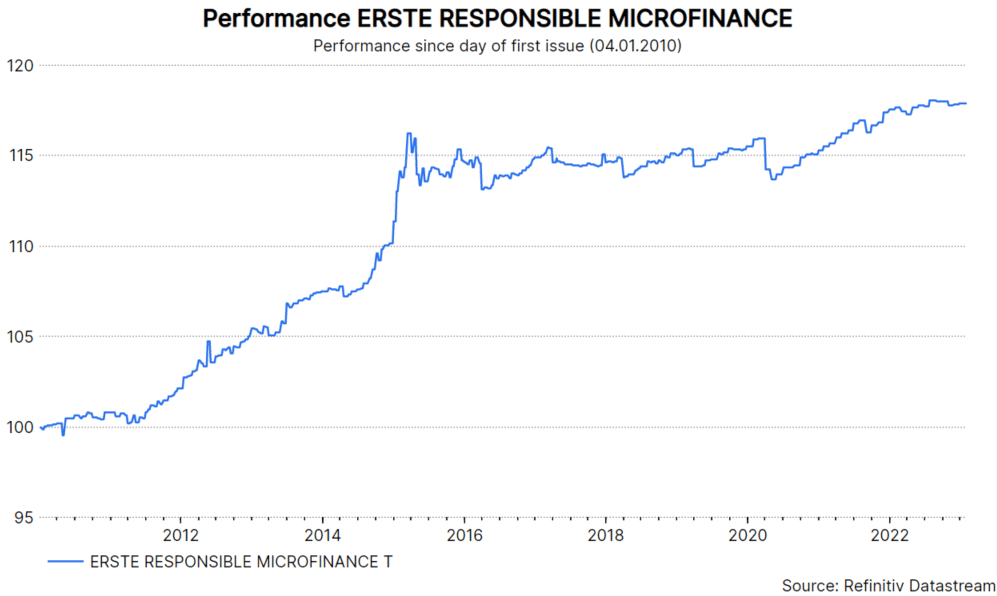

The ERSTE RESPONSIBLE MICROFINANCE fund of funds was launched in January 2010 and has since been the only microfinance fund under the Austrian Investment Fund Act. Since its launch, a cumulative performance of +25.50% has been achieved, which corresponds to a performance of 1.76% per annum. In the past year, the fund was able to achieve a performance of +0.30% despite the challenging environment and thus decoupled itself very well from the global equity and bond markets. The low correlation with these asset classes thus had a clearly positive impact in a diversified portfolio. It also showed once again that investments with a sustainable impact and positive performance are not contradictory.

Over the past 36 months, the volatility of the fund has been just over 1%. This positive ratio of return to fluctuation ensured that the fund was once again successful at the Austrian Fund of Funds Award. Thus, the fund achieved 1st place in its category in the 5-year ranking, 2nd place in the 3-year ranking and 3rd place in the 1-year ranking. As an “impact fund” that aims to directly achieve a positive sustainable impact with its investments, the fund is classified under Article 9 of the European Union’s Disclosure Regulation.

Note: Past performance is not a reliable indicator for future performance of an investment. Please note that investments in securities involve risks as well as opportunities.

About the fund structure

At the end of 2022, the fund had a volume of EUR 102.4 million. Thus, it was able to exceed the 100 million mark for the first time in the past year. ERSTE RESPONSIBLE MICROFINANCE currently invests in 16 target funds and one bond. The target funds had a performance between +4.4% and -4.4% in 2022. This rather wide range proves the usefulness of the fund of funds structure, which leads to a smoothed result due to the regional and thematic diversification. Equity investments in MFIs amount to 5.6% and had a mixed – mostly positive – contribution in the past year. Unhedged local currencies account for a share of 11.4% and were affected by partly higher fluctuations during the year and regionally. Positions in US dollars were hedged throughout. However, due to the interest rate differential between EUR and USD, these hedges were associated with costs.

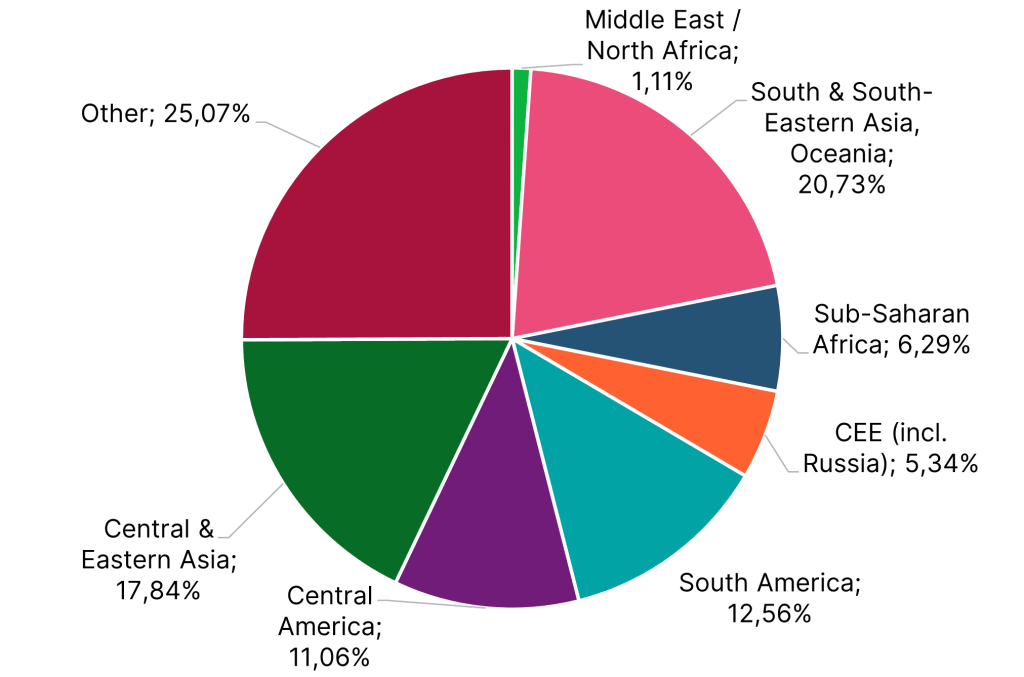

Regionally, South/Southeast Asia with 21.7%, Central Asia with 17.8%, South America with 12.6% and Central America with 11.1% are the main areas of focus. The share in Sub-Saharan Africa is 6.3%. The fund is currently invested in 95 countries via target funds.

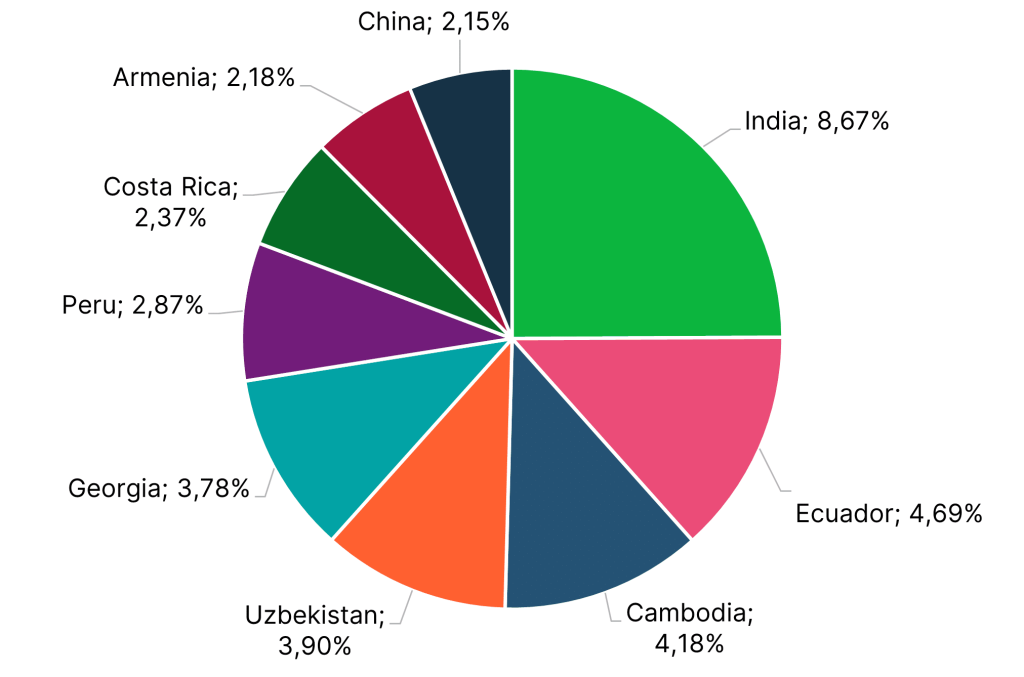

At the country level, India has the highest share at 8.7%, ahead of Ecuador at 4.7%, Cambodia at 4.2% and Uzbekistan at 3.9%.

At the fund of funds level, investments in 412 different MFIs, 72 Agriculture Value Chain Actors (fair trade organizations) and 31 Renewable Energy Organizations are recorded. The share of sub-borrowers among the rural population in the fund is 49%, and that of female borrowers is 67%. At the fund of funds level, the share of fair trade institutions is 2.0%, and the average loan is EUR 3,027.

Key figures

| Number of MFIs | 412 |

| Number of Fair Trade Holdings | 72 |

| Number of Renewable Energy Corporates | 31 |

| Share of female borrowers | 67% |

| Share of rural population | 49% |

| Average loan amount in EUR | 3.027,– |

Advantages for the investor

- Global lending in particular to individuals in emerging markets is supported.

- Correlation is low compared to traditional asset classes.

- Opportunity for long-term attractive earnings.

Risks to be considered

- With regard to the modalities regarding the issue and redemption of unit certificates, please note the key investor information / KID and § 21 AIFMG point 10.

- Investments are made in alternative investments, which in particular involve increased liquidity risks.

- Due to the investment in foreign currencies, the net asset value in Euro can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.