In the previous two years, the annual Emerging Markets Credit Conference, organized by the US investment bank J.P. Morgan, had only taken place in virtual form. This year it finally returned to its original format as a live event and I was able to attend.

Both the number of companies represented (108) and that of investors (508) were testament to strong participation. Only the general investor sentiment was on the more cautious side given the weak asset performance this year and the ongoing macroeconomic uncertainties.

Note: Past performance is not a reliable indicator for future performance.

Companies from emerging markets increasingly attractive

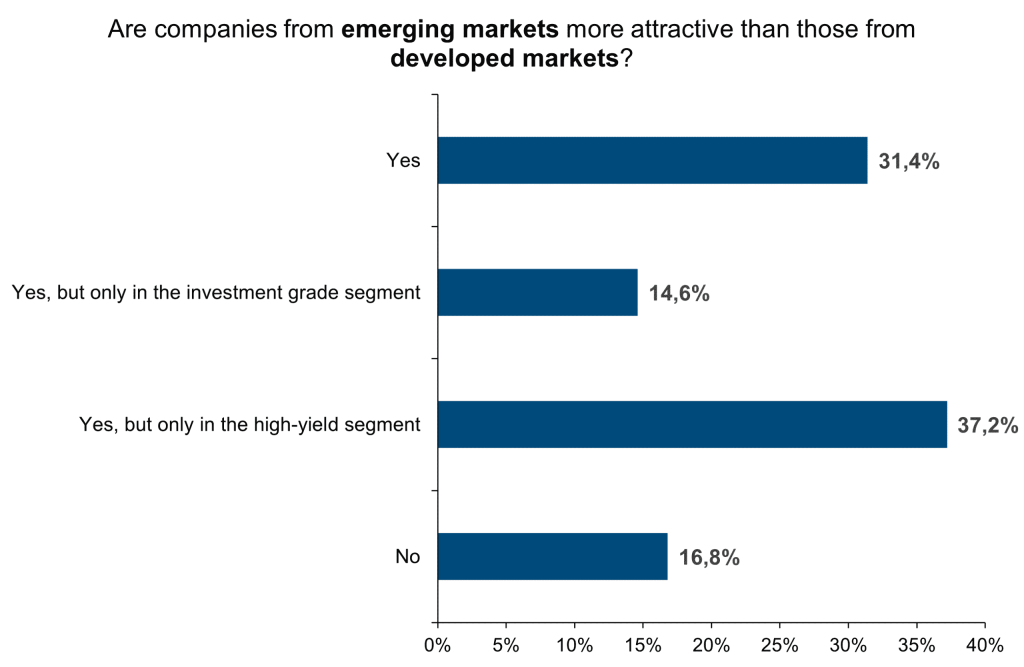

Of course, average spreads have not been regarded as overly attractive either, especially given the rising yields of risk-free and/or high-quality credit asset classes. However, I did notice some departures from this view at the conference, with some yield-based investors finding the higher yields of emerging markets corporate bonds attractive. This was also reflected in the on-site survey, at least with regard to emerging and developed markets.

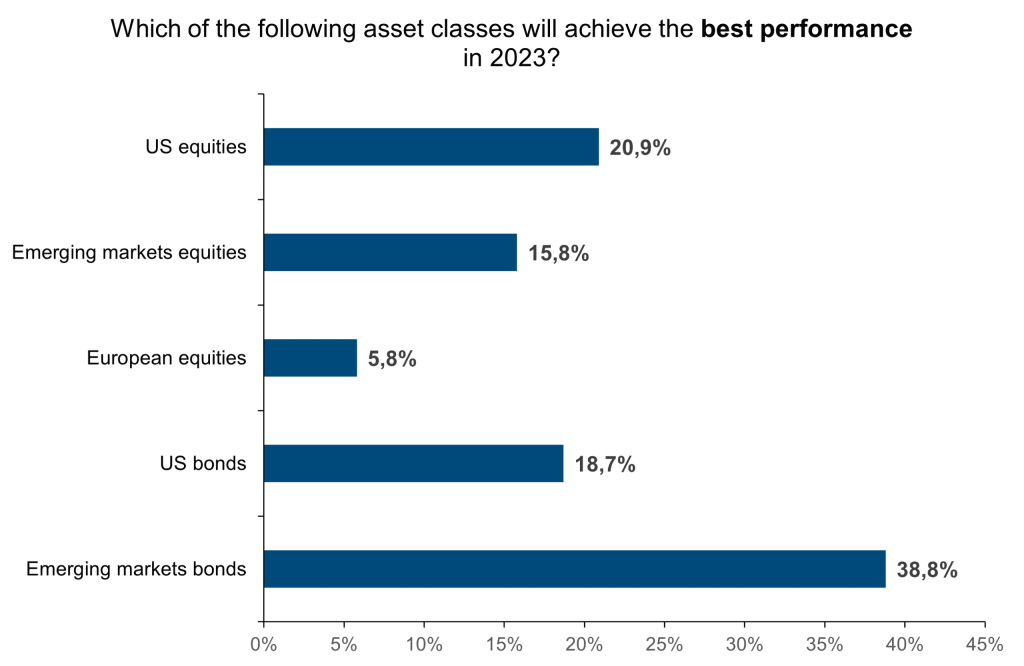

While emerging markets companies face some margin pressure due to higher costs and a challenging environment, there was broad confidence among participants that most standalone fundamentals were in good shape and should be able to withstand some macroeconomic volatility. This could lead to expectations of improved performance for this asset class in 2023, according to the survey conducted at the beginning of the conference. However, we may want to take this with a grain of salt, as the survey participants may have simply been biased towards their own asset class.

Opportunities for corporate bonds in emerging markets

The fundamentals of emerging markets companies have basically started 2022 on a robust note and have remained quite resilient despite some headwinds. Indeed, both sales and earnings expectations for the year have been revised upwards. The reasons include stronger than expected post-pandemic reopening, an increase in commodity prices, and higher volumes and consumption. In addition, companies are increasingly able to pass on higher prices to end consumers. That being said, there are still many opportunities in the emerging corporate bond markets, given the broad global composition and diverse range of this class of bonds.

Therefore, it makes sense to go into more detail, as we do at Erste Asset Management. This makes it possible to find excellent companies at attractive price levels relative to their credit ratios. It happens a lot that emerging market companies are unduly penalised just because they belong to the wrong “postcode”, and the spreads are still attractive given fundamental differences.

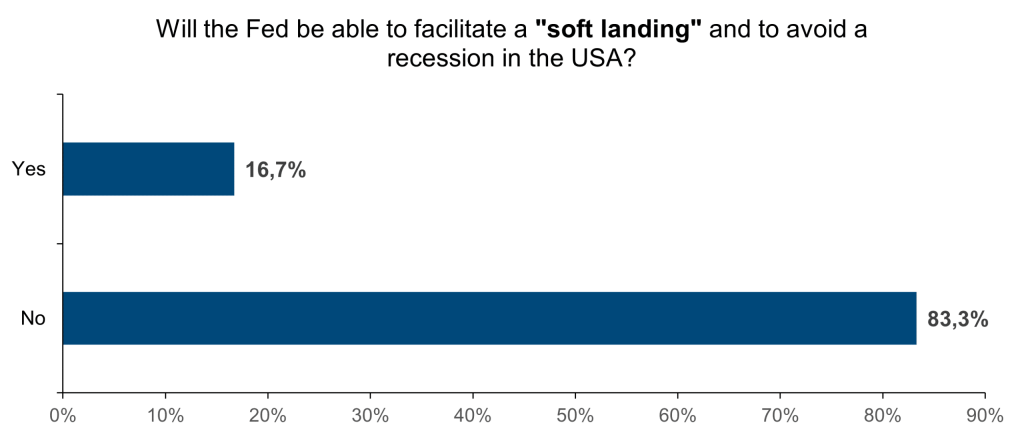

However, there were concerns that weaker issuers could face refinancing problems if the issue market did not pick up by mid-2023. The conference attendants also painted a mixed picture, with macroeconomic concerns about higher interest rates, monetary tightening, and a US recession dominating the strategy, as a result of which their positioning was on the defensive side. This probably reflected the view that global inflation had not yet peaked (60% of respondents) and that the Fed would not be able to engineer a “soft landing” or avoid a recession in the US (83%).

Companies with potential

Of course, I also seized the opportunity to get a closer look at some companies at investor one-on-ones.

IHS Towers left me with a very good impression. The company is one of the largest independent owners, operators, and developers of utilised communications infrastructure in the world, ranking number one in Africa and number three in Brazil. Given its attractive growth and EBITDA over the past five years, IHS Towers is also an interesting company for the ERSTE RESPONSIBLE BOND EM CORPORATE fund due to its high ESGenius score, Erste Asset Management’s in-house sustainability score.

Prosus is also an interesting company for us. It is a global internet group in the investment grade segment and still holds 18% in the Chinese internet group Tencent. However, due to the political risk and the tension between China and the USA, we hold a negative view vis-à-vis the technology sector.

TAQA, also an investment grade company, is the largest water and power utility company in the UAE. With its strong growth in the renewable energy sector, Taqa is in the running for inclusion in our sustainable universe soon, as a result of which it would also be investable for our sustainable funds.

Investing in emerging markets corporate bonds

For investors interested in investing in corporate bonds from emerging markets, Erste Asset Management’s product range offers a number of options. For example, the ERSTE RESPONSIBLE BOND EM CORPORATE fund invests globally in bonds issued by companies from emerging markets. The fund takes environmental, social, and governance aspects into consideration when investing – its investment universe is thus composed according to sustainable criteria.

Risk notes for the ERSTE RESPONSIBLE BOND EM CORPORATE

Advantages for the investor

- Opportunities for additional earnings through interesting corporate bonds from emerging markets.

- Investments are made in companies that meet sustainability criteria.

- Foreign currencies are mostly hedged against the euro.

- Risk diversification through broad diversification in bonds from various issuers.

Risks to be considered

- Rising interest rates can lead to price losses.

- Deterioration in credit ratings can lead to price declines.

- Increased risk due to medium to low debtor credit rating of the participating companies.

- Foreign currency fluctuations can affect the fund price development.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND EM CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND EM CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND EM CORPORATE as described in the Fund Documents.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.