The economic and political climate has not improved significantly in recent months. As a result, the capital markets continue to show their volatile side. A rapid countermovement in July was followed by a renewed sentiment detoriation in recent weeks, with the result that both global equities and bonds are currently trading close to their lows for the year.

The reasons for the uncertainty have basically remained unchanged for months – the geopolitical tensions surrounding the Russia-Ukraine conflict, horrendous energy costs, a stubbornly high inflation rate and the resulting struggle of the central banks to curb it. In particular, the policy of the US Federal Reserve has recently become the focus of investors again, as it has become significantly more restrictive within a few months. Thus, the US key interest rate was raised last week for the third time in a row by 0.75% to now 3-3.25%. In addition, Jerome Powell confirmed to accept a significant cooling of the US economy in order to fight the inflation.

“It will be enough”

With these words, which were astonishingly reminiscent of Mario Draghi’s “whatever it takes” speech in 2012, Jerome Powell reaffirmed the FED’s will to bring inflation back to the target level of 2% at last week’s FOMC meeting. While Mario Draghi’s choice of words 10 years ago successfully restored the credibility of the euro, Jerome Powell is trying to restore the credibility of the FED. He is forced to do so now in a particularly drastic manner, because for too long central bankers have talked about a temporary inflation effect.

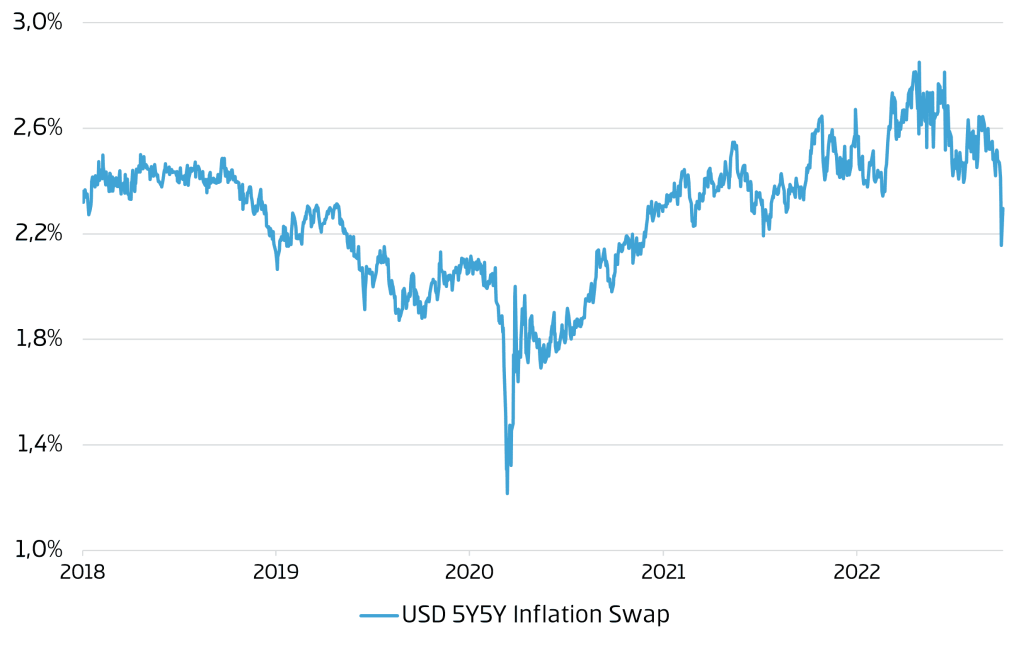

The aforementioned interest rate step of 0.75 percentage point largely met the expectations of market participants, some of whom had even expected a historic step of 1%. Accordingly, Powell remained true to his announcement, which has been particularly clear since Jackson Hole, that the fight against inflation takes precedence over everything else. In addition to the spoken word, the FED dot plots, which illustrate the forecasts of the individual FOMC members, were particularly noteworthy. Even though historically the forecasting quality of the respective estimates is manageable, they still have an important signaling effect to the markets. With an estimated key interest rate of 4.6% on average in December 2023, the FOMC members are thus signaling a much tighter interest rate path for a longer period. The FED is thus creating room for maneuver for the future and is attempting to significantly contain future inflation expectations through this rapid approach. In this context, however, it should be mentioned that even before the FED meeting, 10-year inflation expectations in the US had fallen from their interim high of 2.85% to 2.3% in the meantime (see chart).

Note: Past performance is not a sufficient indicator of the future performance of an investment.

ECB follows FED

While the Fed has made significant gains in terms of credibility in recent weeks, the European Central Bank continues to be in self-discovery mode. Although Christine Lagarde also discovered the 0.75 percent step for herself at the most recent meeting in September, one still has the feeling that the ECB is acting in the Fed’s slipstream with a few months delay. To Christine Lagarde’s credit, however, it has to be said that the situation in Europe is much more difficult. While inflation in the USA is primarily the result of increased demand, in Europe we are confronted with supply-side induced inflation. Skyrocketing energy prices due to the Ukraine conflict and pandemic-related resource shortages led to a “supply shock”, which resulted in record inflation of 9.1% in the currency union at last count.

However, the European Central Bank has no direct influence on these factors. Regardless of this, the ECB cannot continue to wait in the interest of credibility and is therefore now forced to proactively reduce demand. The market is pricing in a 3% key rate in Europe as early as the middle of next year, which would be a considerably restrictive level in the face of a looming recession.

Even though we probably still have the peak of inflation ahead of us in Europe, it should not be ignored that two of the three most significant inflation drivers are gradually easing. Supply chains, which were strained by the Corona pandemic, now seem to be normalizing (albeit belatedly). For example, global freight costs have come down by over 60% since the peak last year, almost unnoticed. Energy costs remain enormous, but here too we have seen positive trends in recent weeks. Fuel in the US, for example, fell 44% since mid-June, and even European gas prices fell by over 40% since the end of August, despite the interim closure of Northstream 1. This leaves second-round effects as the main drivers of inflation, which are now being addressed by the “targeted cooling” of the economy.

Is the recession coming?

In view of the strained energy situation in Europe, the recession in Europe is probably inevitable. In the global context, recession risks have also increased, but in our baseline scenario we expect lower but still positive growth rates.

The US economy, which has been effectively energy self-sufficient since the fracking boom, remains in exceptionally robust shape. It remains to be seen how much higher interest rates will weigh on the economy. At the corporate level, whose profits are ultimately decisive for share prices, the situation continues to appear stable.

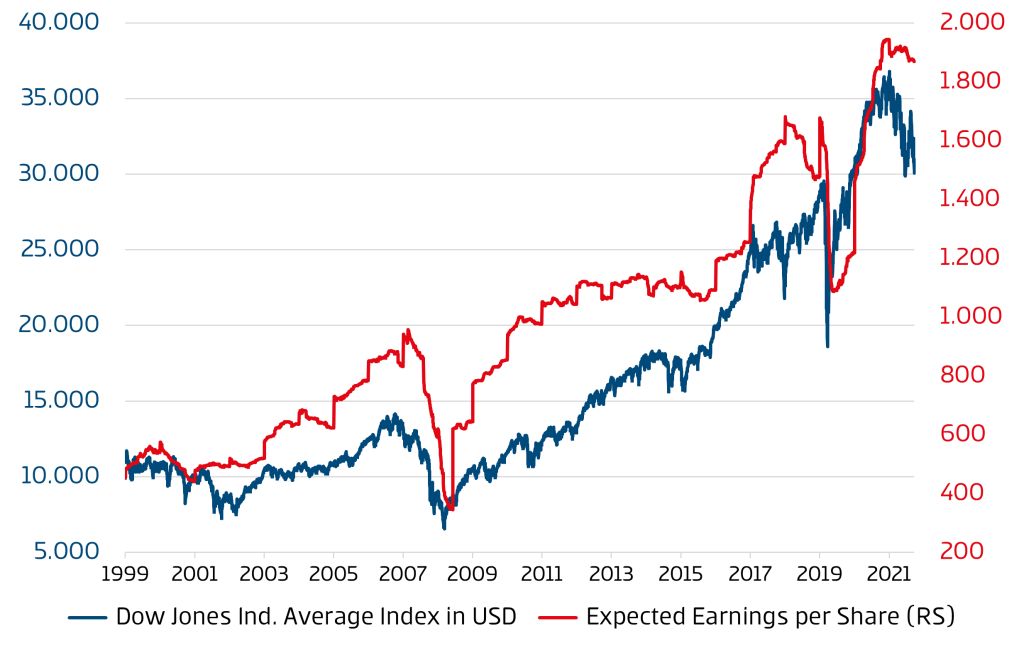

As you can see in the chart below, analysts (who very much take into account the current market conditions) expect only a marginal decline in profits, and thus share prices have recently decoupled surprisingly clearly from actual profits. It remains to be seen whether we will see a significant drop in earnings after all, with a significant delay, or whether the markets are potentially pricing in a development that is too negative.

Note: Past performance is not a sufficient indicator of the future performance of an investment.

Alongside the USA, China is now the most important driver of the global economy – the People’s Republic has weakened recently, as both the ailing real estate sector and the zero-covid strategy have left considerable traces in the economy. The weakness should be short-lived, however, as Xi Jinping is expected to launch his third term with a huge investment package after the twentieth National Congress in mid-October.

In view of the accelerating energy turnaround and the ongoing digitization offensive, government investment activity will again increase strongly not only in China but also worldwide, which should definitely dampen recessionary tendencies.

“The markets are characterized by a high degree of nervousness, and in such phases we believe that a focus on the long term is preferable to short-term speculation.”

Gerald Stadlbauer, Head of Discretionary Portfolio Management

Conclusio: Stamina remains in demand

In line with the preceding explanations, the current environment for the capital markets remains exceptionally challenging. The stock markets are in a bear market and even bonds have suffered losses on a historic scale over the course of the year. Sentiment among market participants is at its lowest point for many years. We are not blind to the fact that multiple risks are weighing on the global economy and thus also on the financial markets. However, it should also be noted that current prices are already pricing in these negative scenarios and that we are looking at attractive valuation levels in the long term.

The development in July showed how quickly the expectation of a less restrictive monetary policy can lead to a trend reversal in the market. The markets are characterized by a high degree of nervousness, and in such phases we believe that a focus on the long term is preferable to short-term speculation. Good nerves and stamina are therefore required, because just like life, successful capital investment is usually a marathon and not a sprint.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.