Hard to believe, but we are now in the final quarter of the year. The finish to Q3 on equity markets proved to be quite volatile, as various factors came into play. The debt problems of the Chinese property firm Evergrande shook market confidence not just in Asia, but also in the developed world. The Fed concluded the meeting with a hawkish tilt, signaling a turn in its ultra-loose monetary policy stance. And finally, German voters headed to the polls. The composition of the new government is not yet clear, but the worst-case scenario from a market point of view was successfully avoided. Where does all this leave us for the remainder of the year?

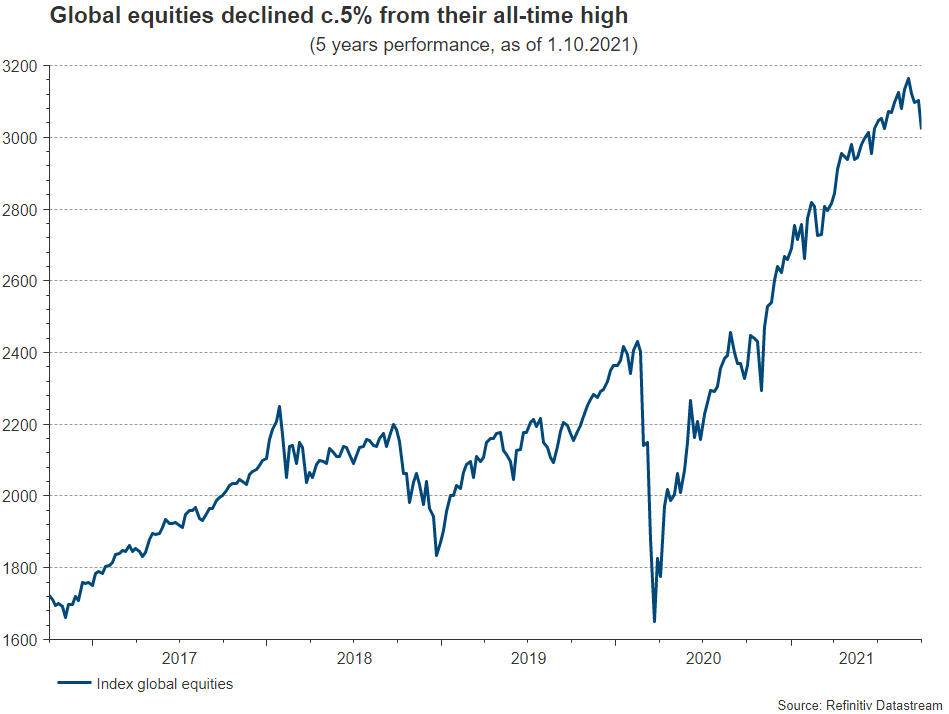

Equities decline from all-time highs

While the majority of developed market equity indices is up by double digit percentage points this year, a pronounced sell-off took place in September, resulting in a flattish third quarter performance. For months, indices have been hovering around all-time highs, helped by low volatility, low (real) yields and company earnings which handily beat expectations. One of the biggest risks to this steady performance was a negative spillover effect from China, a stock market which has underperformed significantly this year. For one, the Chinese economy faces a tougher comparison base, as the country was one of the fastest to recover from the corona-shock last year. Also, lending activity is in a decline. But as of late, the main reason for the underperformance has been a regulatory crackdown by the Chinese government on multiple business sectors. Equities in the developed world managed to avoid a contagion effect, up until the threat of a default of Evergrande loomed (for more details, s. https://blog.en.erste-am.com/house-of-cards-the-case-of-evergrande/ and https://blog.en.erste-am.com/has-the-real-estate-boom-in-china-come-to-an-end/) . As a result, MSCI World lost more than 1.6% on September 20th, the steepest one-day decline in months.

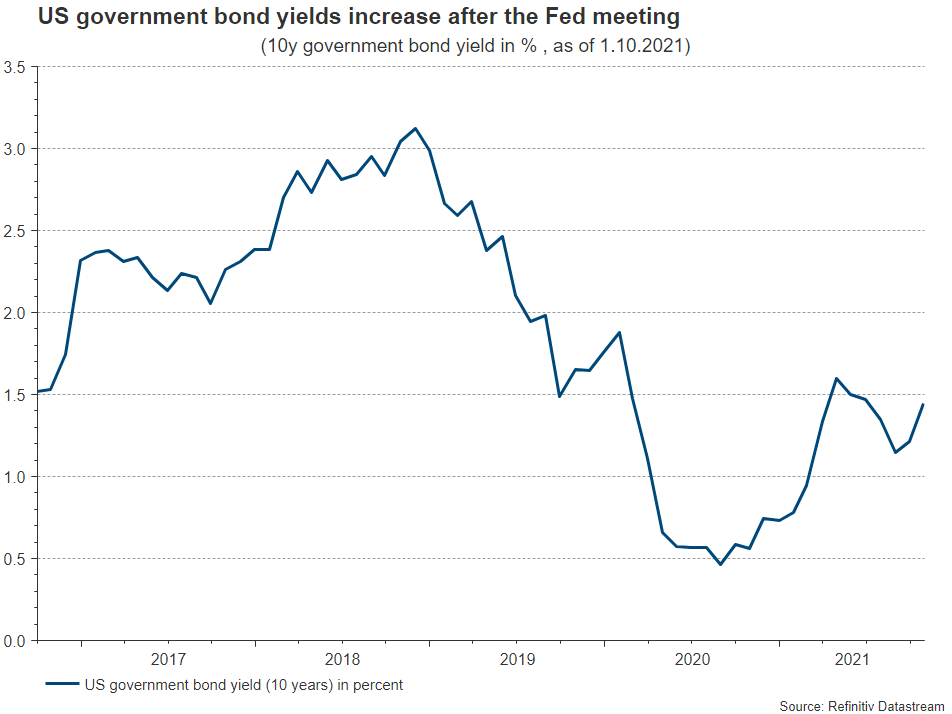

Yields are on the rise

Two days after the market sell-off came the Fed meeting, which indicated that it is time to withdraw parts of the monetary support set in place as a reaction to the pandemic. Fed-chief Powell prepared markets for tapering (=reducing the amount of monthly asset purchases by the Fed) to start this year and to finish by the middle of next year. Also, the dot plot (=rate levels expected by the respective Fed members) brought forward expectations for a first rate hike to 2022. This hawkish tilt came at a time when various central banks around the world have begun a tightening cycle or are planning to do so soon (s. also https://blog.en.erste-am.com/falling-momentum-and-hawkish-cbs/). With a short delay, the bond market reacted quite remarkably. 10-year yields in the US increased by more than 30bp from their August lows, and the same was true for their German counterparts. In anticipation of future rate increases, the US 2-year yield reached its highest level since the outbreak of the pandemic. Most importantly however, the US yield curve started steepening again after being in a declining trend for months, and real yields took off from record lows.

German election outcome positive for equities

Last but not least, the result of the German election on September 26th was supportive for equity markets in two ways. Firstly, the uncertainty is reduced, and secondly, a market unfriendly outcome of a triple-left coalition was avoided. Currently there are three coalition variations in place: SPD – Greens – Liberals, Christian Democrats – Greens – Liberals or once again a grand coalition of SPD and CDU/CSU. All of these scenarios have in common that there will be a balance between left and right-leaning economic ideas, which is a positive from an investor point of view (for more information on the respective party programs, s. also https://blog.en.erste-am.com/german-bundestag-election-decisions-for-the-future/). The market seemed to agree with this statement as the German DAX outperformed other European indices on the day after the elections. A tail risk remains that all coalition talks fail and new elections will have to take place, but currently we view the chances of this is rather low.

Will value outperform?

The above described reaction of the bond market to the Fed meeting had a great effect on the sector performance of equities. A steepening yield curve and higher rates correlate positively with cyclical and value stocks, however they also put pressure on defensive growth stocks (s. also https://blog.en.erste-am.com/how-are-global-equity-markets-doing/). After almost half a year of growth outperformance, the Fed meeting seems to have revived the value trade. Typical value sectors like banks and energy rallied, and banks are now back to being the best performing sector this year in the European Stoxx 600 index. We are of the view that value will be able to outperform again in this year`s remaining three months. The heavy underperformance since May, as well as the low starting base of yields and the yield curve make for an attractive starting point. Also, cyclically exposed stocks will have further room to run if delta-related growth concerns in the end turn out to have been overdone. The Chinese situation will need to be closely monitored, but currently we are optimistic that the negative spillover effects to other markets will be contained.

Source: Bloomberg

Note: Past performance is no reliable indicator for future performance.

In the short-term, one of the main risks comes from higher rates. When yields increase, growth stocks with lofty valuations get penalized due to an increasing discount factor. This however puts pressure on broad equity indices as it is this type of stocks which have the highest weights and the highest market capitalization. If this scenario plays out, it is likely that going forward we will see gains in value stocks but a flattish to slightly negative performance in indices like the S&P 500.

Equities remain an attractive asset class

In the mid-term however, we maintain our positive stance on equities also on a broader level. Even if the Fed starts its tightening cycle and yields increase, we should not forget that in a historical context, yields are still at the very low end of the range and safe government bonds barely offer real returns, which make equities look attractive. Also, the global economy is in good shape, with global growth expected to come in at 6% and 4.9% in 2021 and 2022, as measured by the IMF. The recent performance of company earnings is a cause for optimism, supported further by upside revisions during the quarter. While there are risks on the horizon, we remain constructive on equity markets over the next 12 months.

CONCLUSION

Global equity markets have fallen back from their all-time highs in recent weeks. The US Federal Reserve’s announcement that it would be scaling back bond purchases in the near future caused bond yields to rise and growth stocks to “suffer”. In China, the turmoil surrounding the Evergrande real estate group and the government’s regulatory measures weighed on sentiment. In contrast, the result of the German Bundestag election brought relief among stock market players. In the short term, the risks on the horizon have increased, but equities remain in a favorite position.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.