After the partial lifting of the lockdown, all eyes are on the economic data in the various countries. The crucial question for the capital markets remains whether the government and central bank measures have been effective. The investment strategy of the YOU INVEST funds is still driven by the pandemic and by the measures taken to fight and contain the resulting damage.

US government demands negative interest rates

US President Trump has called on the central bank to follow the example of other countries and introduce negative key-lending rates. In their statements, central bank officials have pushed that option back. It is currently not regarded as necessary. Other supporting measures such as the purchase of corporate bonds via exchange-traded funds (ETF) have been launched this week. The actual economic data have started to gradually show the full extent of the economic impact of the lockdown. The markets’ reaction has been very restrained.

We continue to favour equities

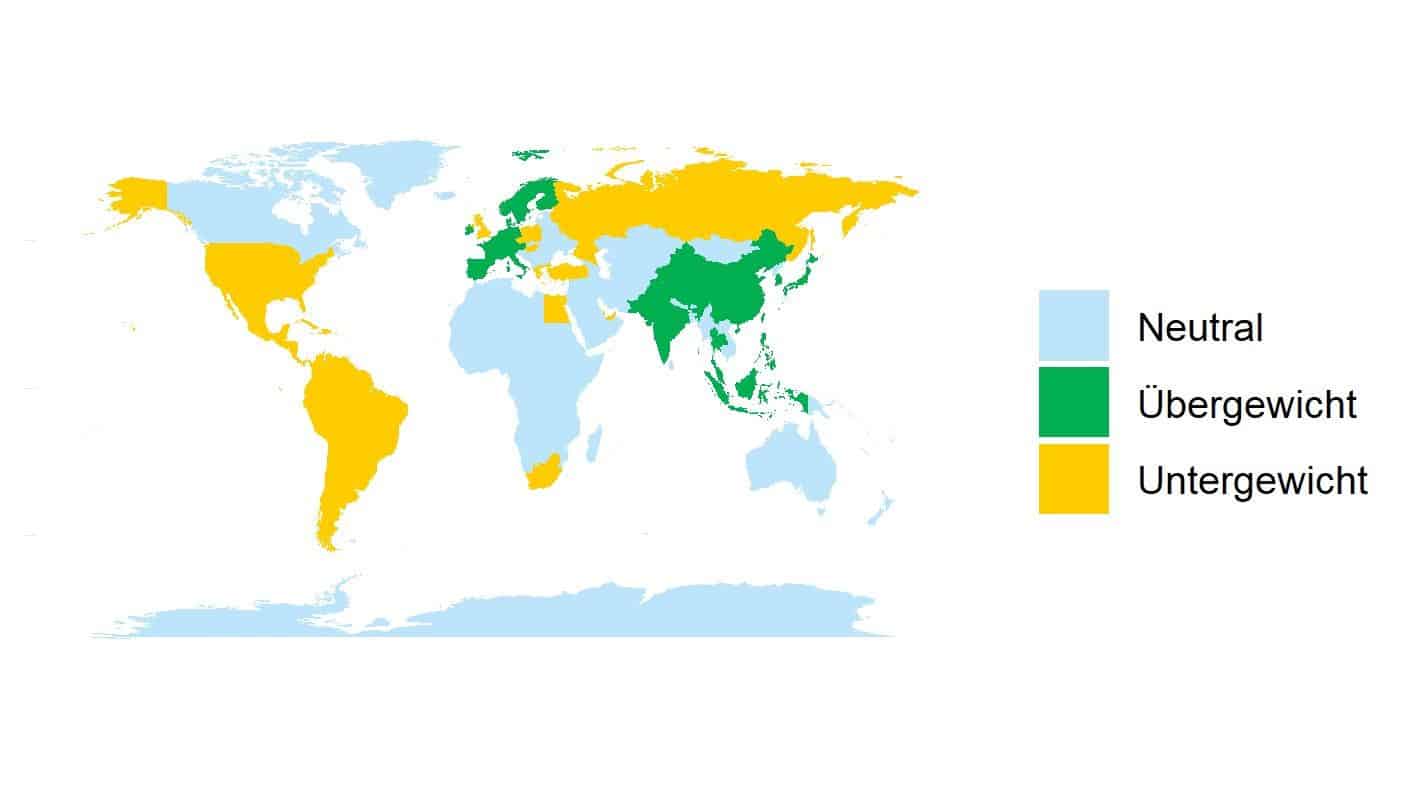

In the YOU INVEST portfolios, equities remain invested at 75% of their maximum quotas, with the USA accounting for the lion’s share of the equity contingent. In terms of sectors, we have reduced healthcare by a slight margin, given that it had already come a long way. We remain optimistic for most defensive consumer goods and technology shares. Energy companies account for a small, complementary portion.

Neutral / underweighted / overweighted

Bonds: high-yields remain attractive

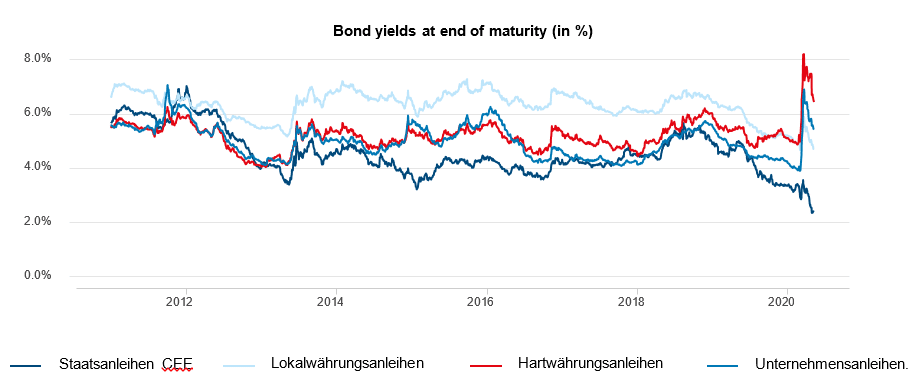

In the bond sector, we have increased our corporate bond position in the USA. We will continue to mirror the central bank in its purchases with some of our allocation. We have stepped up higher investment grade and high-yield segments, depending on the fund.

Government bonds (CEE) , local currency bonds, hard currency bonds, corporate bonds Note: Past performance is not indicative of future development.

We have increased our high-yield position at the expense of international government bonds in foreign currency. Here, we do not expect any impulses from the currency front, and yields are accordingly low. We are keeping our emerging markets positions as well as our US Treasuries, where we hedge the foreign exchange risk.

Zero interest rate drives gold price

The zero interest rate policy should remain in place for a significant amount of time, lending support to the gold price. Gold should at the very least constitute a stabilising factor in the event of a second wave of corona infections. Here, our allocation remains at 2.5%.

This is YOU INVEST

Flexible solutions, professional management, and high transparency: this is YOU INVEST. Erste Bank and Sparkassen, in cooperation with Erste Asset Management, provide an actively managed investment concept for all clients who do not want to manage their own investment but who attach great importance to flexibility and transparency.

The flexible use of a diverse range of asset classes is a crucial factor for the success of any long-term investment. Every asset class comes with a different risk/return profile. In order to optimise said profile, the invested capital is broadly diversified across numerous asset classes, such as money market instruments, bonds, equities, and alternative investments. We also invest in different regions and currencies.

The weighting of the various asset classes is based on the risk specifications of the respective YOU INVEST funds, in connection with their mutual performance correlations. In the overall portfolio, the risk/return profile is the better, the less the individual asset classes are correlated. The negative performance of one asset class can be compensated by the positive performance of another one in the context of the portfolio.

Warning notice:

The YOU INVEST active, advanced, balanced, progressive, solid and RESPONSIBLE balanced may make significant investments in investment funds (UCITS, UCI) pursuant to section 71 of the 2011 Austrian Investment Fund Act.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.