It is easy to explain why the banks chose 19 April for this “fund holiday”: on this day, almost 300 years ago, the father of the fund idea, the Dutchman Abraham van Ketwich, was born – on 19 April 1744. Ketwich recognised that with the help of a fund, risk could be diversified more widely, and at the same time the costs for the fund shareholders could be reduced. This laid the foundation for investment funds in their present form, which now exist in thousands of different varieties. In Austria alone, more than 2,000 investment funds are licensed for sale.

The USPs of funds

Whether high-yield bond markets or higher-risk investments in equity markets – funds are a cost-effective and efficient way to invest and provide for the future. Depending on the asset class, funds are subject to lower or higher fluctuations in value (i.e. volatility) as well as different risks resulting from the underlying investment markets. Due to the investment on the capital markets, capital loss may occur with every investment.

The troubled savings book

Those who have relied on the savings book as an investment instrument in the past have been put to a hard test in recent years: the zero or low interest rate strategy of the European Central Bank coupled with the extreme increase in inflation ensured that the assets parked in the savings book were being gradually eaten up by the devaluation of money. More and more investors are therefore turning to alternatives such as investment funds or other investment assets to counteract this and increase the chance of maintaining purchasing power. Please note that investment funds should be seen as a long-term investment, while savings books are used for short-term liquidity.

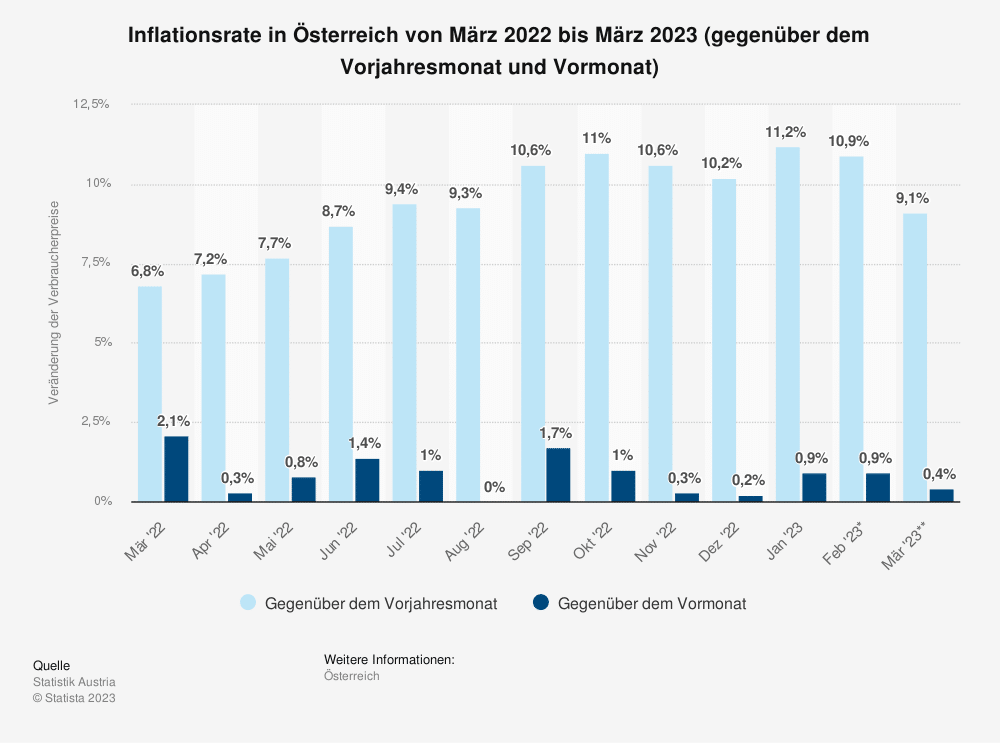

Inflation rate in Austria, February 2022 to February 2023 (month-on-month and relative to the referential month of the previous year)

Booming investment funds

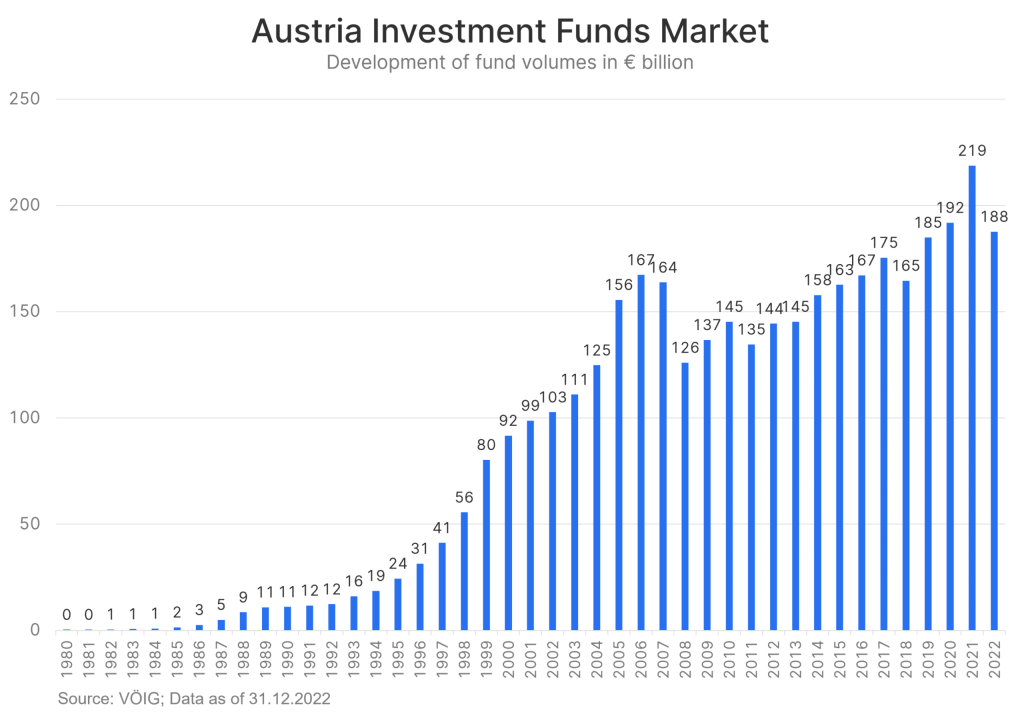

Despite the slight reduction in assets under management recently, investment funds are still booming. According to Verband der österreichischen Investmentgesellschaften (Association of Austrian Investment Companies; VÖIG), assets under management amounted to about EUR 187.7bn in Austria in 2022. Of this, more than EUR 40bn are managed by Erste Asset Management GmbH.

VÖIG has been keeping records of fund assets under management since 2004

The data for 1998 to 2003 were adjusted to assets under management and are therefore comparable with the current data.

It pays off in the long run

Especially with long-term fund savings plans, the investment horizon should also be adjusted. In the long term, it pays to invest funds in the capital market and thus participate in higher return opportunities. This applies not only to fixed-income securities such as bonds, but also to equity markets. An interesting strategy, for example, is to invest a fixed amount in a certain fund every month. The advantage: if you regularly pay in equal amounts, you can achieve a more favourable average price than if you invest the entire amount as a lump sum payment.

The basic principles of funds

- Broad risk diversification, e.g. in assets from different issuers, countries and asset classes

- The management and selection of securities is carried out by experts (i.e. fund managers).

- Ongoing (usually daily) establishment of the mathematical value (calculated value)

- Management of the funds by a specialised institute (investment company)

- The fund assets are divided into equal shares

- Strict supervision of fund management by independent auditors

- Funds are special assets and are protected even in the event of bankruptcy of the commercial bank the investor banks with or the custodian bank

- Highest possible transparency for investors (financial reports, prospectuses, information on websites, etc.)

This is what you have to bear in mind

- Depending on the asset class, funds are subject to minor or major fluctuations in value

- Investments in funds involve different risks resulting from the underlying investment markets

- Due to the investment on the capital markets, capital losses may occur with every investment. Holding the investment until the end of the recommended investment period or beyond is no guarantee that any price losses will be recovered

- For the protection of investors, the redemption of fund shares may be temporarily suspended in accordance with the fund regulations

- Order settlement and price fixing are subject to different modalities, depending on the fund, which are laid down in the fund regulations

- The composition of the fund portfolio is the responsibility of the fund manager (in accordance with the fund regulations). The investor has no influence on the decision-making process

Time to get information and speak to an advisor

Information is everything, especially on World Fund Day. At Erste Bank and Sparkasse, you can get competent advice on your various options. In addition, you can find extensive information on the websites of domestic fund providers and on financial portals. Since investment funds are very transparent, it is easy to compare the different funds. This makes the motto of World Fund Day clear: Investing in funds. For many, this is a suitable way to invest money.

What is a fund: https://www.erste-am.at/en/private-investors/our-solutions/what-is-a-fund

Fund savings plans: https://www.erste-am.at/en/private-investors/our-solutions/what-is-a-fund

Sustainable investing: https://www.erste-am.at/en/private-investors/sustainability

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note that an investment in securities also involves risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.