In the past year, the price of gold has climbed from one all-time high to the next. The yellow metal reached its provisional high of USD 2,450 on May 20, 2024. Reason enough to take a look at what has driven the gold price so far this year and pose the question: What are the chances for gold in the medium term or will the gold rally continue?

Gold soaring despite headwinds

The rally in the gold price may seem puzzling at first if you consider the numerous factors from which gold faced headwinds in the first half of the year:

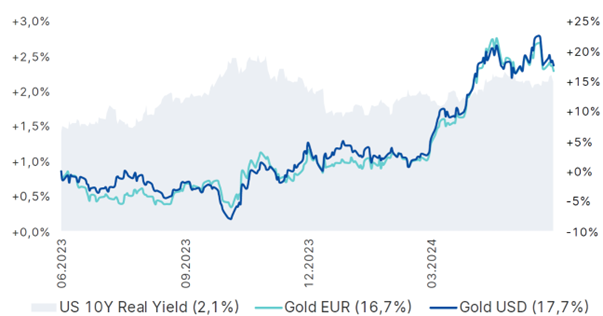

- The most important factor in gold’s price movement, there was no support for gold from real interest rates. Falling inflation did not help because it widened the spread between market interest rates and inflation. The opportunity cost of holding gold, an asset without a calculable return, rose accordingly. From this perspective, it is currently not attractive to hold gold instead of cash-like investments.

Performance of gold in the past year compared to the real interest rate of 10-year US government bonds

Source: Multi Asset Chartbook, Erste Asset Management; Bloomberg; as at 31.05.2024

- The dollar performed well in relative terms in the first half of the year. The dollar index rose from 101.33 to 104.10 (as at 24.07). All other factors held constant, the dollar had a clearly negative impact on gold.

- Due to the generally improving economic data in the developed countries, analysts lower ed the number of interest rate cuts anticipated by the US Federal Reserve and the European Central Bank. The less than expected loose monetary policy is having a negative impact on all commodity prices, including gold.

- Surprisingly, physical ETFs were on the sell side. In the US, there were only 2 months of inflows in 2024, European ETFs sold gold consistently over the past year. Asian ETFs, on the other hand, have reported inflows since March 2023.

Two supporting factors

Taking into account the factors mentioned above, it is hard to understand why the gold price reached new highs. However, two factors were able to withstand the headwinds and provide significant support for the gold price – the central banks and the (geo)political situation:

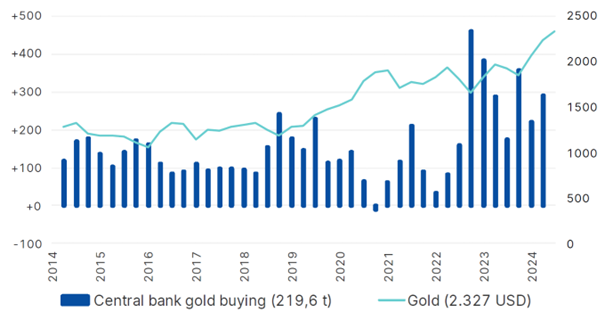

- Central banks continued their purchases. The Chinese central bank in particular is keen to diversify its reserves due to the geopolitical disputes with the US. Other emerging markets and China’s allies are also “encouraged” to avoid the dollar as a reserve and trading currency and have increased their gold holdings.

Gold price and central bank gold purchases (in tons)

Source: Multi Asset Chartbook, Erste Asset Management; Bloomberg; as at 31.05.2024

- The political risks and geopolitical disputes are providing considerable support for the gold price. There are still attacks by Houthi rebels on ships in the Red Sea. The situation in the Gaza Strip also remains tense. China is using various means to ensure that the issue of the breakaway island of Taiwan, which China sees as part of the country, is not forgotten. In addition, the elections in the world’s largest economy (USA) are coming up, and these are likely to be a real balancing act.

Outlook

The future for gold seems promising in terms of the factors explained, for the following reasons:

- According to the “soft landing” scenario priced in by the market, the declining inflation figures will allow central banks to lower interest rates. As a result, real yields are expected to shrink.

- The interest rate cuts by the US Federal Reserve would have a negative impact on the “king” dollar if there are no surprises from inflation in the developed countries, to which the central banks would have to react. The dollar is still excessively strong due to purchasing power parity, and both the current account deficit and the ever-increasing US budget deficit imply a strong headwind.

- Although the Chinese central bank stopped buying gold in May, this is in all likelihood only a short-term pause in its efforts to avoid the dollar. Moreover, according to the World Gold Council’s study, even the central banks of developed countries have indicated that they want to weight gold higher in their reserves. According to the Bank Credit Analyst (BCA), this diversification of central bank reserves will give the gold price a tailwind for several years.

- Geopolitical tensions and uncertainty regarding the next US administration emphasize gold’s role as a “safe haven”. The low correlation of gold with the equity and bond markets should also not be underestimated. In the event of a strong correction or possible recession, gold generally protects the portfolio from a severe crash.

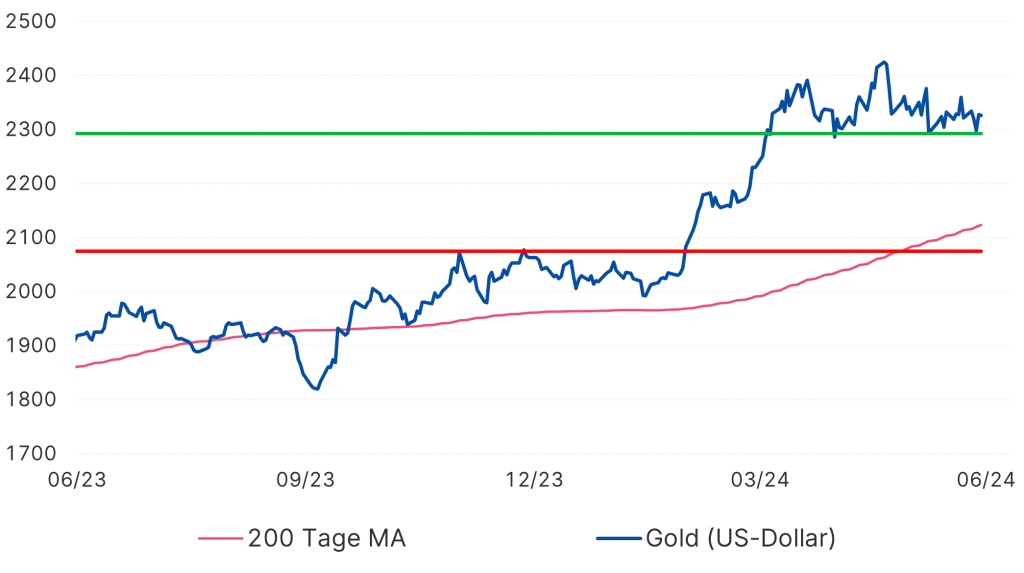

- The technical chart picture is very positive. Gold convincingly overcame the strong resistance at the former all-time high of $2,070, from which level the price has already bounced three times, at the beginning of March and rose above $2,400 within a month. This jump was followed by a sideways movement, which is normal after this rapid advance. The price found strong support several times below $2,300. Even at the current price of around $2,400 (as at 24.7.2024), gold is still in an upward trending channel and should continue its rally after a pause.

Technical picture for gold (over the past year, in US dollars)

Source: Bloomberg; as at 30.06.2024

In light of the above arguments, it would be a logical conclusion to bet on a further rise in gold. However, the positioning is extremely bullish and the FED’s repeatedly emphasized data-dependent approach also has a negative effect, as real yields could possibly remain high for longer than the market has priced in.

Conclusion

Gold has shown particular strength so far this year, gaining more than 15% despite rising real yields. In the short term, positioning is a headwind for the gold price, but central banks’ efforts to diversify their reserves and geopolitical uncertainties should continue to support the price. Gold is therefore a valuable addition to portfolios, not only because of its characteristics as a hedge against inflation and as a safe haven, but also as an alternative to all other assets, as the activities of the central banks show.

Note: Forecasts are not a reliable indicator of future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.