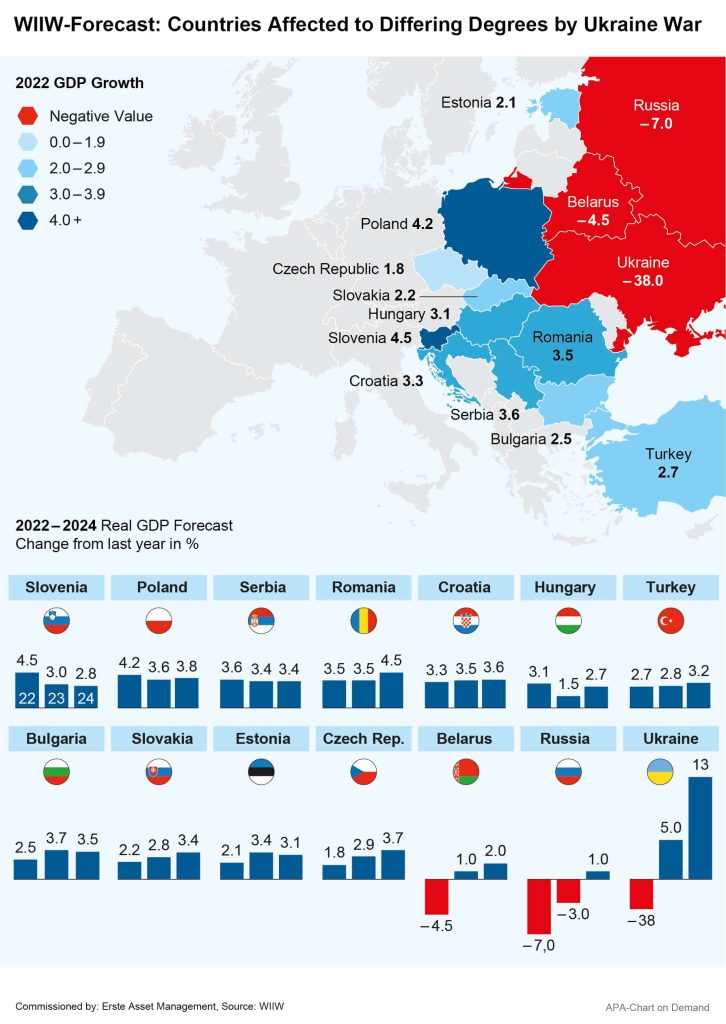

According to a recent study by the Vienna Institute for International Economic Studies (WIIW), the economic impact of the war in Ukraine will affect the economies of the countries of Central, Eastern and Southeastern Europe (CESEE) to varying degrees. While the EU members of the region should be able to absorb the effects relatively well and avoid a recession, the experts expect strong downturns for the Ukraine, Russia, Belarus and Moldova.

For the EU members in the CESEE region, the experts expect growth of 3.3 per cent on average this year, despite high inflation, the energy crisis and supply chain problems, thanks to solid private consumption in these countries. WIIW forecasts the strongest growth of 4.5 per cent for Slovenia this year, followed by Poland (4.2 per cent) and Serbia (3.6 per cent). The WIIW experts see significant growth of 3.3 per cent for Croatia, which plans to introduce the euro come New Year 2023. According to WIIW forecasts, inflation in the Eastern European EU countries is likely to remain high at around 11 per cent on average, but is expected to improve starting next year.

Russia Handling the Sanctions Better Than Expected

Although Russia is suffering noticeably from the sanctions imposed by the West, it is likely coping with them better than originally expected. The WIIW economists expect a recession of only 7.0 per cent for the country this year, after forecasts in spring had assumed an economic decline of 9.0 per cent. For 2023, they forecast a drop in GDP of 3.0 per cent and for 2024 even a small growth of 1.0 per cent. Russia itself no longer sees the expected economic slump as dramatically as it did recently.

Russia’s central bank recently reported the first signs of stabilisation after the initial drop following the sanctions. The crisis is developing less badly than originally feared, said Kirill Tremasov, the central bank’s director for monetary policy. In May, an advisor to Russian President Vladimir Putin also predicted that the gross domestic product (GDP) would drop by no more than 5 per cent, after the Russian Ministry of Economy had forecast a decline of more than 12 per cent a few weeks previously.

Recently published figures support this prognosis. The Purchasing Managers’ Index for Russia, calculated by S&P Global, rose again for the first time in June, increasing by 3.2 points to 51.7. This is the first time since February that the economic barometer has been above 50 points again, signalling growth. The Russian Ministry of Finance recently reported a budget surplus for the country to the tune of RUB 1.374trn or the equivalent of about EUR 23bn in the first half of the year.

High Energy Prices Are Helping Russian Figures

The background of this development lies in the high gas and oil prices. The oil embargo agreed by the EU has intensified the rise in oil prices, from which Russia has additionally profited, write the WIIW experts. Due to the price increases, Russia’s exports to the EU rose massively by 96 per cent to 101.9 billion euros in the period from January to May, according to Eurostat. According to a study by the Centre for Research on Energy and Clean Air in Helsinki, the EU is still the largest buyer of Russian oil exports with a share of 51 per cent.

The bottom line is that Russia’s income from oil and gas sales is well above target: according to its finance ministry, Russia sold more than 100 billion euros worth of oil and gas in the first half of the year and has thus already achieved 66 per cent of the income planned for the year as a whole. It is not for nothing that the USA has recently been pushing internationally for a price cap on Russian oil. US Treasury Secretary Janet Yellen recently called for a price cap that would just about give Russia an incentive to export oil, but not allow any profits for the war budget.

WIIW Expects “Shock in Instalments” for Russia

In the longer term, however, the sanctions against Russia are likely to leave a noticeable mark, despite the energy price boom. The WIIW expects an “economic shock in instalments”. The slump has been slowed down for the time being, but the full effect of the sanctions is likely to make itself felt gradually, expects WIIW economist Vasily Astrov.

Russia is likely to suffer significantly from the restricted import of many Western goods and industrial products. Production outages in industry due to a lack of Western components are already dramatic, according to WIIW. “Where this is not yet the case, it is only a matter of time as stocks deplete at a rapid pace,” Astrov said.

Western technology in particular, such as aircraft parts, cannot be substituted so easily, explained WIIW economist Mario Holzner at a press briefing. The EU oil embargo against Russia could also show the intended negative effects in 2023. Holzner therefore expects a “very painful development for the Russian economy”.

Meanwhile, Russia’s central bank has recently lowered interest rates further to support the economy. Russia’s key interest rate fell by 1.5 percentage points to 8.0 per cent, the country’s central bank announced on Friday, marking the fifth interest rate cut in a row. However, the central bank does not have to worry too much about inflation at the moment: while inflation is still high at 15 per cent, it is tending downwards. According to WIIW experts, inflation is also being dampened by the strong rouble and the population’s reluctance to consume.

Ukraine Should Recover From 2023 After Severe Downturn

Naturally, the war has had a devastating impact on Ukraine. The WIIW forecasts an economic downturn of 38.0 per cent for the country this year. Although a recovery in economic capacity can be observed as the country adjusts to the new reality of war, capacity utilisation is still 40 per cent below pre-war levels. Another major problem is the blockade of the Black Sea ports. “This prevents the export of much of Ukrainian grain, which will further drive up global food prices,” said WIIW economist Olag Pindyuk.

However, the economic decline should be followed by a rapid recovery in Ukraine starting next year. WIIW expects the Ukraine’s GDP to grow by 5.0 per cent in 2023 and as much as 13.0 per cent in 2024, and Western investment could help in the form of productivity gains. Pindyuk also expects positive effects and a boost for reform efforts from the EU candidate status granted to Ukraine.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.