Investors are already familiar with stocks. Equity funds and mixed funds in particular offer the opportunity to invest in a large number of companies in an efficient manner. The stock market career of companies usuaally begins with the initial public offering (the IPO, “Initial Public Offering”). At this point in time, the business model of a company has already proven itself and reached a critical size. Being traded on an exchange now is the next step in opening up to all investors.

A new way of approaching investors

A differently structured route to the stock exchange has gained in importance since 2020. The term for this is SPAC (“Special Purpose Acquisition Company”). What is behind it? A SPAC is a stock corporation that approaches investors not to offer them an existing business model as a first step. Rather: The capital that comes in during the IPO is only invested in one or more promising companies afterwards. A SPAC is thus initially a mandate to select companies for the investors’ capital.

Even if that sounds paradoxical for a moment, this situation creates advantages for those involved. Investors already have the opportunity to invest in IPOs, even if there are currently none. At the time of an IPO, a company’s shares are often favorably priced to generate interest. Buying shares in a SPAC gives you the opportunity to be part of an IPO in the future without having to find a suitable candidate yourself. On the part of the companies that work with a SPAC, this is one way of going public more cheaply and quickly.

The greatest added value lies in the team of the SPAC itself. You’ll find specialists for all topics that have to do with the capital market. But also industry experts who can specifically approach companies that have not yet considered a regular IPO, although their business model might justify it. Subsequently, the SPAC team also advises the candidate on which measures are helpful. These can also be tips on business strategy.

Even if this concept seems more suitable for institutional investors, SPACs are also an issue for small investors, especially in the USA.

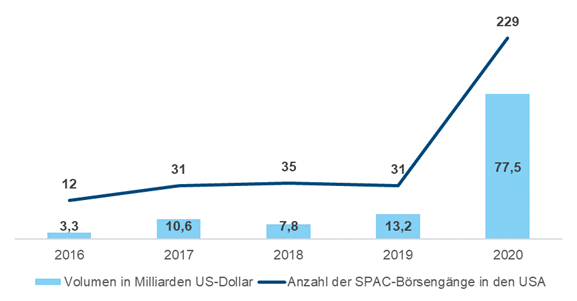

Graphic: Size of the SPAC market in the US

Source: Bloomberg, EAM

The exact process

A SPAC is founded as a stock corporation and goes public. Interested investors buy shares, their capital is transferred to an escrow account. From this point on, the SPAC team has the task of finding one or more companies in which added value can be created through an IPO and who benefit from the cooperation with the experienced experts of the SPAC. Once a goal has been set, all shareholders vote on whether it is a suitable choice or reject it. If the approval has been given, the acquired company merges and the SPAC, which at this point has fulfilled its mandate and ends. The deadline for finding the takeover candidate is typically 2 years and can also expire without success. In this case, the SPAC ends and the money paid is returned.

The share price of SPACs that have not yet found a takeover target still has a fluctuation range that is similar to the general stock market. Or even above, because this topic always inspires the imagination of investors.

SPACs for specialists

SPACs that are already traded on a stock exchange can be distinguished according to whether they are looking for a candidate (“without deals”), or have already found one (“deal announced”), and whether they are multiple targets (“diversified”). There are currently over 500 SPACs worldwide, and about 25% have already named a takeover candidate. The stock prices of SPACs have had an extremely successful 2020. After an equally successful start, the segment has been going through a severe price slump since the beginning of March 2021.

In connection with SPACs, one often thinks of the “private equity” sector. The takeover candidates of SPACs are initially “private”, to be later taken public by merging with the SPAC, and go “public”. Private equity, for its part, invests in non-listed companies, using a fund. One aspect here is also that the private equity team should add value to the company. Occasionally, the cooperation of companies with private equity funds results in an IPO. In a way, SPACs are a transitional stage from the “private” and the “public” world of the capital market.

The discussion about SPACs is sometimes controversial. One possible criticism arises from the fact that, especially for small investors, the costs incurred at the various stages of a SPAC are not made sufficiently transparent.

A recent example

Grab (www.grab.com) is an Asian delivery service for food and consumer durables, as well as a courier service. The company is weighing using an existing SPAC for a quick IPO that could be worth $40 billion. (Source: The Wall Street Journal)

Conclusion

The opportunity to participate in the IPO of interesting companies in, for example, the technology or health care sectors that might not otherwise go public, or for which investors might not be involved from the beginning, has sparked interest in SPACs. SPACs are public companies that offer their shares in exchange for a mandate to acquire a stake in one or more companies that are now still entrepreneur-led, and thus go public.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.