The weekly market commentary by Chief Economist Gerhard Winzer.

In a global context, equity markets have been posting gains since the beginning of the year. However, that is only half the story: beneath the surface, a significant sector rotation is taking place – away from previously well-performing shares such as large US technology companies and towards sectors and investment styles that have received less attention to date.

At the same time, the largest and most important cryptocurrency, Bitcoin, has incurred massive losses. Other alternative forms of investment such as gold and silver are still in positive territory but have also recorded sharp declines in recent days. This raises the question of whether these are just random movements – the famous “noise” – or whether these developments provide a cue for future trends.

Inflationary growth

First things first: the economic data confirm that we are in a favourable phase of the economic cycle for equities. We could describe this as inflationary growth. In such an environment, the economy grows at or even above its long-term potential, while inflation is at or above the central bank’s target of around 2%. This environment is generally positive for equities, especially for so-called value shares – i.e. shares with comparatively low price-earnings (P/E) ratios. Commodities also benefit from this.

Note: An investment in securities involves risks as well as opportunities.

Good economic indicators

The global Purchasing Managers’ Index (PMI) rose from 52 in December to 52.5 in January. As an early indicator, the PMI is based on surveys of purchasing managers and shows whether economic activity is increasing, stagnating, or declining. As the PMI is available sooner than many official statistics, it provides early indications of economic developments on a global scale. The aggregated January figure points to solid growth in the global economy in the first quarter, projected at around 2.5% (annualised).

In terms of “hard” data, US consumption continues to show decent growth. Although retail sales in December were somewhat disappointing at −0.1% month-on-month, the fourth quarter of 2025 saw annualised quarterly growth of 2.6%. The estimate for private consumption growth (goods and services) is 2.5%, again annualised.

Slight increase in inflation

The latest inflation reports point to a slight increase in the inflation rate of about 2.6% year-on-year in developed economies. On Friday, US consumer prices for January will be published. The core rate (excluding the volatile components of food and energy) is expected to have declined slightly from 2.6% to 2.5%. In the monthly figures, upward risks could emerge: forecasts are at +0.3%, which translates to about 3.6% on an annualised basis. It therefore remains to be seen whether inflation in the United States will be moving closer to 2% or 3%.

In the Eurozone, the flash estimate for January showed a decline in core inflation from 2.3% to 2.2%. At 1.7%, overall inflation has even fallen below the 2% mark. In both regions, price dynamics in the service sector remain above those of the goods sector. A further decline in service inflation would require a slowdown in wage growth (or an increase in productivity). In the USA, the labour cost index suggested as much: wages and salaries in the private sector rose by 3.3% year-on-year in the fourth quarter, following 3.5% in the previous quarter.

Stagnating US employment

Traditionally, financial markets pay particular attention to US labour market data, as employment growth usually allows for conclusions about economic growth, and the unemployment rate provides an indication of the position in the economic cycle. The data for January will be published next Wednesday. Employment growth is expected to remain low, with the unemployment rate remaining steady at 4.4%. This is also indicated by private ADP data. What is striking is that employment has been stagnating for months, while economic growth has been strong. This combination is unusual and unlikely to last.

This setting results in three scenarios for 2026:

- Economic growth is adjusting downwards in line with weaker employment growth.

- Employment growth is gaining momentum and catching up with economic momentum.

- Productivity is rising significantly, not the least on the back of AI. This, while less likely, is now a more common explanation.

Sector rotation

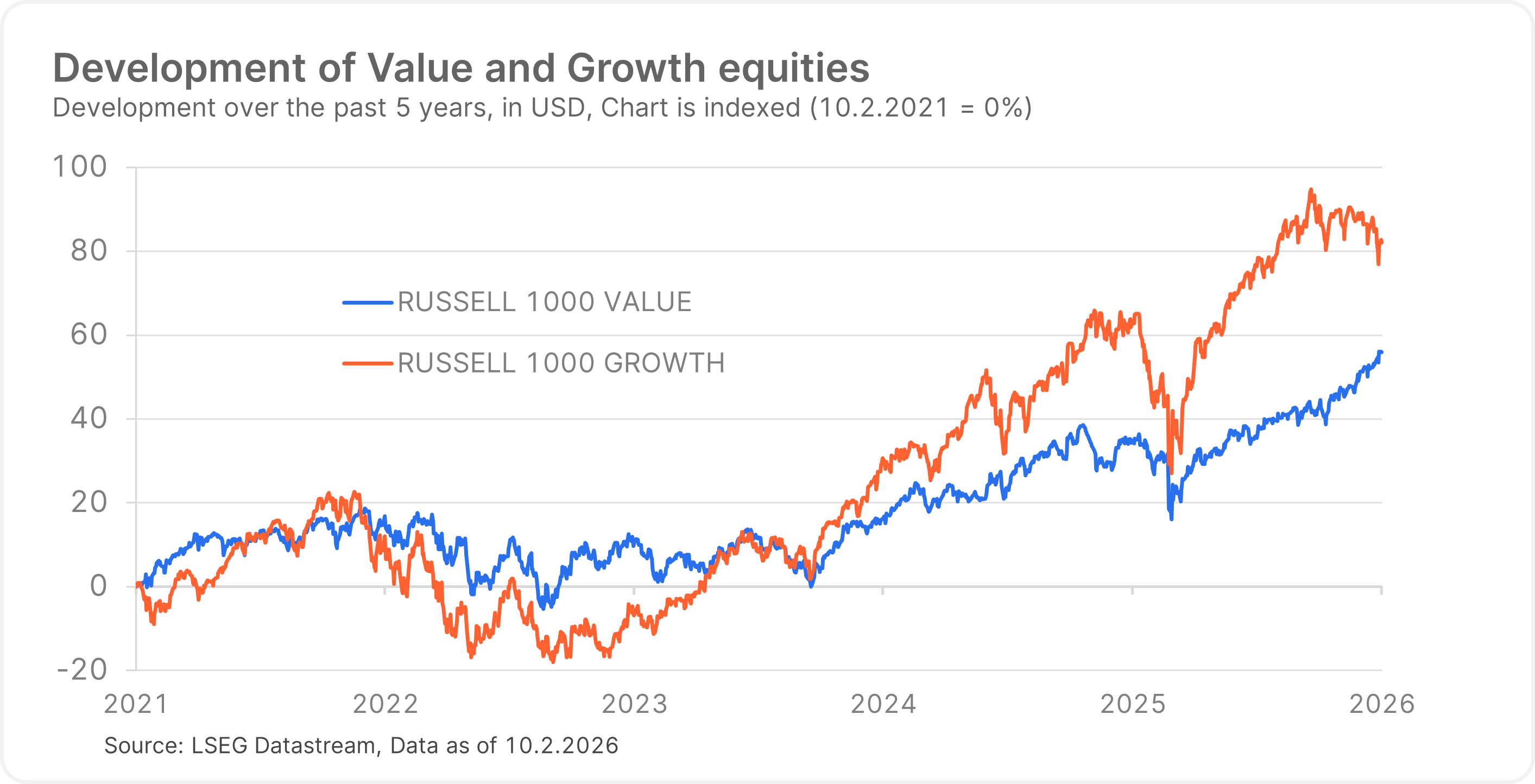

This brings us to the key point. Since October 2025, there has been a pronounced rotation from growth shares to value shares, which has recently intensified by a significant degree. For example, the Russell 1000 Value index has increased by about 10.7%, while the Russell 1000 Growth index has fallen by 2.0%.

👉 Value shares are characterised by low P/E ratios and typically include financials, energy, industrials, and commodities.

👉 Growth shares are more based on future earnings, invest heavily in expansion and innovation, and come with higher valuations. Typical sectors are technology, e-commerce, biotech, AI, cloud, and software.

Please note: Past performance is no reliable indicator of future value development. Representation of an index; no direct investment possible.

Whether this trend is sustainable remains to be seen and is the subject of further research. Historically, value shares have tended to outperform growth shares globally from the 1970s until the financial crisis of 2007/2008 – with one important exception: growth shares dominated in the second half of the 1990s during the dot-com bubble. Since 2007, however, growth shares have clearly outperformed value shares.

The currently most important driver of rotation is a combination of concerns about the high valuations of many technology shares and the expectation that artificial intelligence will indeed have a disruptive effect. Market leadership is shifting away from AI producers to those companies that will ultimately benefit from the productivity gains promised by AI. One possible investor strategy is therefore: “Buy what AI enables – sell what AI makes redundant.” The price corrections for gold, silver, and Bitcoin can be explained in part by profit-taking – not only for technology shares, but also for assets in general that have seen particularly strong, sometimes parabolic price increases.

Conclusion

For the market as a whole, the question arises as to whether the positive growth environment can compensate for the negative effects of sector rotation. In any case, this rotation – which also includes issues such as deglobalisation and political pressure on the US Federal Reserve – has added another item to the list of risks. In our base-case scenario, however, we continue to assume that the markets will remain resilient. In other words, positive fundamentals trump sector rotation.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.