The recent confrontation between the USA and China in the areas of trade and currency management triggered temporary losses for risky asset classes such as equities. Meanwhile, equities are on the rebound. Are the negative implications of an ongoing USA-China conflict strong enough to set off a decline or even a recession?

Driving factors

Two main factors have been driving market prices for a few months now: first, the fact that the monetary policy has become increasingly supportive. In the year to date, 16 central banks have cut their key-lending rates. More steps will be taken until the end of the year, for example by the European Central Bank. And second, the conflict between the USA and China across several levels is increasing uncertainty and dampening confidence in the business sector as well as investment activity and industrial production. Asset prices rise and fall in dependence of the magnitude, duration, and volume of the respective factors.

Initial situation: zero-percent interest rates

Interest rates tend to fall in the context of a worsening environment (rising uncertainty, declining economic growth). However, they are already very low and continue to fall, but find it harder to do so. This is particularly true for the Eurozone, where interest rates are already in negative terrain.

Generally speaking, the price of money (i.e. interest) balances the level of (desired) saving and (desired) investment. The lower the interest rates, the less attractive is saving and the more attractive are investments.

- Monetary policy less effective: once interest rates have fallen to low levels, the monetary policy becomes increasingly ineffective. That is because the key-lending rates just cannot be cut by several percentage points anymore in order to prevent a recession. This implies that recessions have a bigger impact than in the past (higher unemployment, lower asset prices).

- Secular stagnation: once the interest rates cannot fall at the degree necessary to stimulate the economy sufficiently any longer, and economic growth remains low

- New normal: the low interest rates therefore do not constitute a (cyclically induced) extraordinary level, but they represent the new, normal level.

- Debt: the lower the interest rates, the more sustainable debt becomes. But because the debt ratios continue to rise, interest rate increase become less likely in the future.

- Valuation: the lower the interest rates, the higher the asset values. We have seen this effect in recent months. Numerous asset classes have posted significant gains. That being said, an above-average rate of return within short periods of time also comes with below-average returns in the future, ceteris paribus.

- Alternative assets: the lower the interest rates and the higher the value of traditional asset classes, the more the demand for alternative forms of investments increases (e.g. for crypto currencies).

- Escape plan: the classic escape from this “interest trap” is a very expansive fiscal policy, including massive investments subsidised by the state.

Dismantling globalisation

The announcement by the USA to step up import tariffs on even more products from China and the following depreciation of the Chinese currency (renminbi) have caused the prices of risky asset classes such as equities to fall. Equities have now entered a rebound phase. While the risks are of course on the downside, there are reasons to believe that the confrontation will not escalate.

- Strategic: the confrontation between the USA and China is clearly of a strategic nature. This means it will not be settled for a while.

- Cyclical: the conflict has also picked up from a cyclical point of view. The USA is increasing tariffs and trade barriers, and China responds by taking countermeasures.

- No yielding: the Chinese are hardly willing to yield to the rising pressure from the USA. China’s three conditions remain: 1) the list of the US products to be bought has to be reasonable; 2) existing tariffs and barriers are to be reduced; and 3) the agreement has to respect the dignity of China.

- Currency interventions: in August, China responded by depreciating its currency (renminbi). The USA therefore called China a currency manipulator. Curiously, the action taken by the People’s Bank of China (PBOC) was aimed at allowing the downward pressure on the renminbi exerted by the market. This means the PBOC did not intervene (i.e. did not buy renminbi and sell US dollar) anymore. While the title of “currency manipulator” is of no practical relevance, it may give President Trump the moral justification for currency intervention (i.e. the weakening of the US dollar). This would probably come with significantly negative effects on the financial markets.

- Currency turbulences: the depreciation of the renminbi represents economic stimulus for China, albeit at a crucial cost: the economic problems of China are being exported. As a result, other countries also feel tempted to depreciate their currency. A depreciation spiral is looming on the horizon.

- Limits for the USA: the tactics of the USA to step up the pressure on China with tariffs and other barriers is limited by the negative implications for the own economy and the financial markets.

- Fed: US President Trump seems to try to pre-empt this situation by increasing the pressure on the Fed to cut interest rates. Strategically, it would be a severe problem if the most important central bank of the world were to lose its credibility. In the short run, fingers may be pointed at the Fed in the event of a recession for not cutting interest rates sufficiently.

- Limits for China: China, too, has an incentive to keep the conflict from escalating. This is about market access to the biggest economy in the world and to important technologies. Also, the weakening renminbi is at odds with an important strategic goal: a stable currency is a condition for the establishment of a reserve currency and the expansion of the financial market. In the short run, too, the depreciation harbours the risk of setting off a capital flight from China similar to that of 2015 (even if restrictions are in place to prevent this scenario).

Conclusion

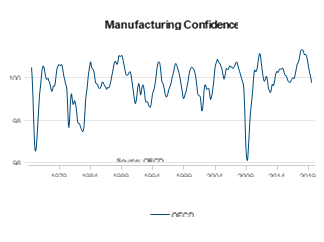

Real global economic growth is slightly below its potential (average growth). Industrial production and capex are stagnating while the strong areas, i.e. the labour market and the service sector have started to show signs of erosion. The surveys about the confidence in the business sector are currently an important indicator for any weakening of the likelihood of a recession. The results of said surveys have been on the decline since the beginning of 2018. The massive turn-around of the monetary policy from interest rate hike to interest rate cut has greatly supported the prices of many asset classes. However, interest rates are already very low, which is why additional impulses from the central banks will be limited. If the assessment that the conflict between the USA and China will not escalate significantly is confirmed, the effects – while still negative – will not be strong enough to trigger a global recession. The validity of the premise will have to be subject to testing on the basis of indicators such as business confidence in the coming months.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.