On the occasion of the World Water Day on 22 March, Erste Asset Management (Erste AM) published its second water footprint for its sustainable equity funds. “We set an important milestone by publishing water risks last year in order to induce companies to release their own water data. Data coverage has improved significantly since then for this year’s model,” says Walter Hatak, Senior ESG Analyst with Erste Asset Management.

Whereas in 2017 46.8% of companies published their calculations, in 2018 the number had increased to 56%.

Water data coverage of sustainable equity funds

Sources: Bloomberg, MSCI-ESG, ISS-oekom, calculations by Erste Asset Management, water and sales data, FYs 2015-2018

Water risks are linked to economic risks

The shift to a sustainable use of water is important: drinking water – i.e. a basis of existence – is becoming increasingly scarce. Nowadays one in seven people lives in a region with scarce water resources. By 2025, this number may increase to 3.5mn people and thus affect almost half the world’s population.[1] The World Economic Forum therefore regards a potential global water crisis as fourth-biggest economic risk in the coming years (N.B. which means it considers inflation and deflation risks far less relevant). “A water shortage can come with various implications such as stricter regulation of water consumption, massive price increases, production delays, or even the closing-down of production facilities. Therefore, it seems necessary to assess water risk from an economic perspective,” as Walter Hatak points out.

[1] World Resources Institute

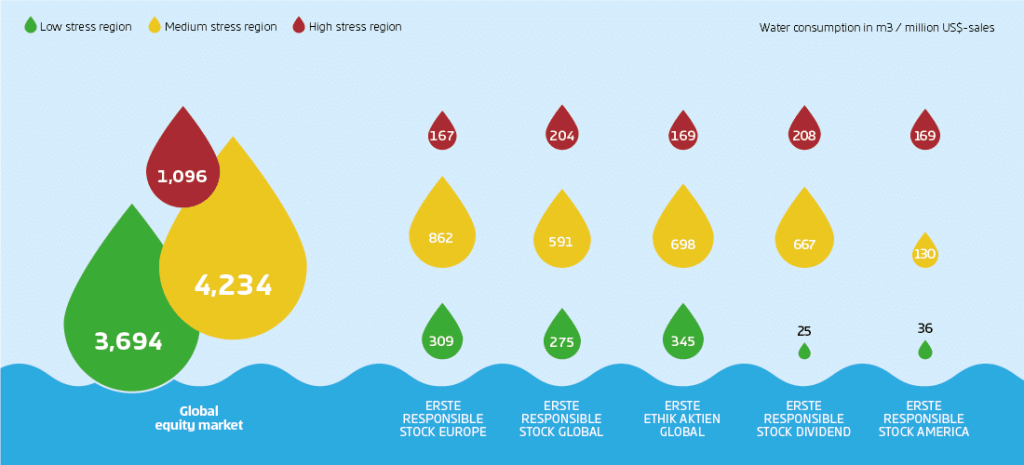

Regional component counts

In contrast to the CO2 footprint, the regional component provides very important additional information about the water footprint. Companies whose production facilities are located in regions with high water stress levels are subject to high water risk, even if water consumption is average by industry standards. “It does of course make a difference whether the production facility is based in Cape Town, where the complete shutdown of water supply was avoided in the eleventh hour last year, or close to the Alps, which are not by accident referred to as Europe’s water castle,” explains Walter Hatak.

The breakdown in low, medium, and high stress regions is based on the risk assessment of the world Resource Institute, which takes into account physical, regulatory, and reputation risks. The world map based on these criteria that illustrates the different risk regions can be accessed online.

Water risks taken into consideration for investment decision

The selection of companies in the sustainable funds of Erste Asset Management aims, among other goals, at inducing a more responsible use of water. This strategy has proven successful: sustainable funds significantly outperform the global equity market (both overall and when allowing for regional risk data), and they have clearly improved on last year’s performance.

“This is due to our comprehensive ESG analysis. In order to reduce water risks, the sustainability analysts of Erste AM take into account the management and the regional distribution of water consumption in the assessment and valuation of companies,” explains Walter Hatak. To what extent a company operates in risky regions with scarce water resources and depends on high local water consumption enters into the ESG rating model, as does the information on what measures have been taken to improve water consumption and make it more sustainable overall.

Sources: Bloomberg, MSCI-ESG, ISS-oekom, calculations Erste Asset Management water and sales data FYs 2015-2018; index data as of 28 December 2018

The key ratio illustrating the average water intensity of the companies held by the funds is the water consumption of the respective companies. Water intensity measures water consumption in cubic metres per USD 1mn worth of sales.

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.