As expected, the US Federal Reserve reacted to the current robust US economy by raising the key interest rate for the third time this year on Wednesday. The target for the Fed Funds Rate was raised by 0.25 percentage points to a range of 2.0 to 2.25 per cent. A further increase towards the end of the year is likely, going by the central bankers’ outlook for the interest rate. Three further hikes are currently planned for 2019.

While the financial markets pretty much regarded the interest rate hike as a done deal, the accompanying comments on the Fed’s further steps were awaited with anticipation. Fed’s monetary policy strives to achieve maximum employment as well as price stability. Therefore, the central bankers’ assessments regarding inflation and the labour market are considered important indicators for future interest rate policy.

Robust economy, but trade conflict is a potential risk

The Fed now confirmed its assessment of the economic situation. It noted that the labour market continues its consolidation, while economic activity grows at a rapid pace. Consumer spending and corporate investment have increased, while inflation remains close to the Fed’s two-per-cent target. However, a possible risk the currency guardians see is the global trade conflict. US President Donald Trump’s protectionist economic policy is also fueling this risk.

An increasing number of companies is worried about the dangers of rising costs and growing uncertainties, said Fed Chairman Jerome Powell. Fears include supply chain disruptions, loss of market access and a general decline in investment willingness.

Meanwhile, U.S. President Donald Trump fears that the Fed’s interest rate hikes will have a negative impact. rising interest rates make loans more expensive for businesses and consumers. After repeatedly criticising the Fed’s monetary policy in the past, he also took issue with the Fed’s latest interest rate decision.

Eighth increase since 2015 interest rate turnaround

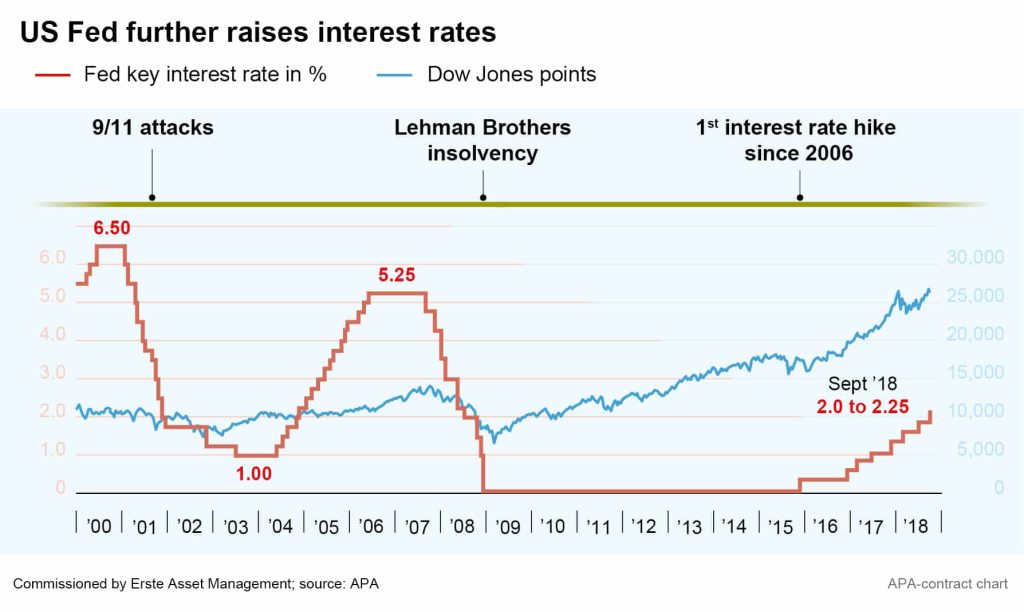

The Fed has now raised its key interest rates for the eighth time since the start of the interest rate turnaround in late 2015. The interest rate hikes were accompanied by increasing stock market prices, with the Dow Jones stock index, among others, climbing to new all-time highs in September.

Interest rates and stock prices are thus continuing to recover from the aftermath of the 2008 financial crisis. At the time, the US Federal Reserve had tried to slow the economic downturn by slashing interest rates, keeping the key interest rate at the then-all-time low of 0 to 0.25 per cent between the end of 2008 and 2015.

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.