The time of expansionary fiscal policy in response to the effects of the COVID-19 pandemic seems limited. As a result, the focus is shifting to budget consolidation and the government debt of some countries.

Attention is also increasingly focussing on the sustainability of debt and its development; even the USA cannot escape critical scrutiny in these matters. What is the debt situation in the United States at the start of the landmark election year 2024?

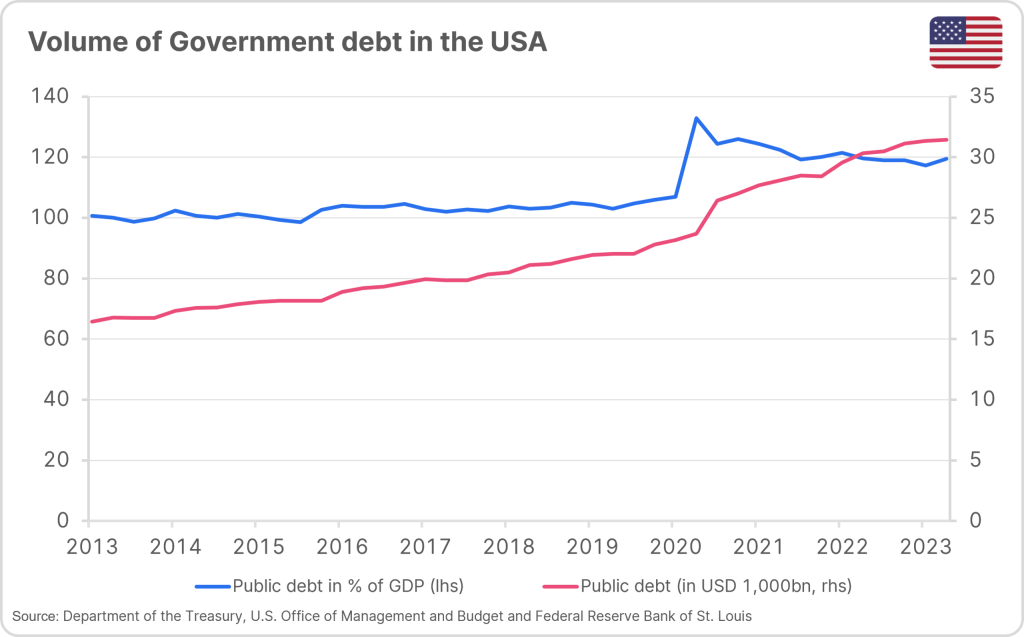

US government debt has increased drastically in the past ten years

In the past ten years the US public debt has almost doubled in absolute terms to around USD 33,700bn (USD 33.7 trillion), with spending aimed at dealing with the pandemic causing a significant increase. As a result, government debt in relation to economic output rose to just under 120%.

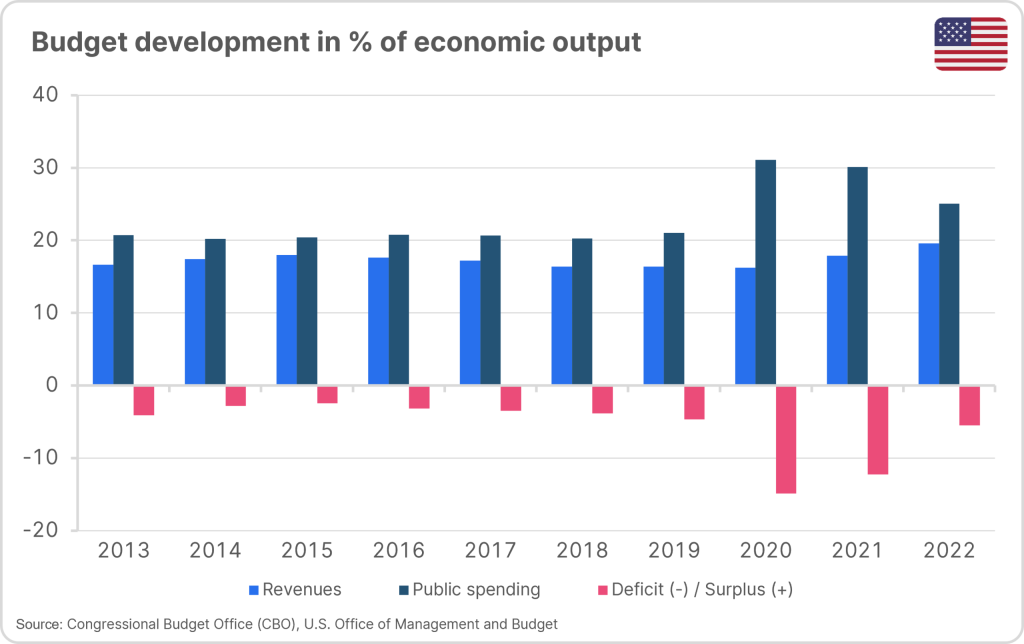

The years 2020 and 2021 illustrated the significant financial impact of the measures taken to combat the pandemic on the budget. The annual deficit was more than 10% of GDP in each case.

However, this was not the only reason for the imbalance. Even before that, after Donald Trump’s election as president, generous tax breaks for companies were passed in 2017 that were not counter-financed. In recent years, social spending and environmental policy under the current President Joe Biden have added to this situation.

In addition to other factors such as a positive labour market environment and a sustained consumer spending mood, the US economy was also well supported by the country’s expansionary fiscal policy until recently and grew by around 5.2% on an annualised basis in the third quarter of 2023. In the period from October 2022 to September 2023, the deficit was nevertheless -6.3%, primarily due to tax revenues, which had fallen significantly short of expectations despite the good economic situation.

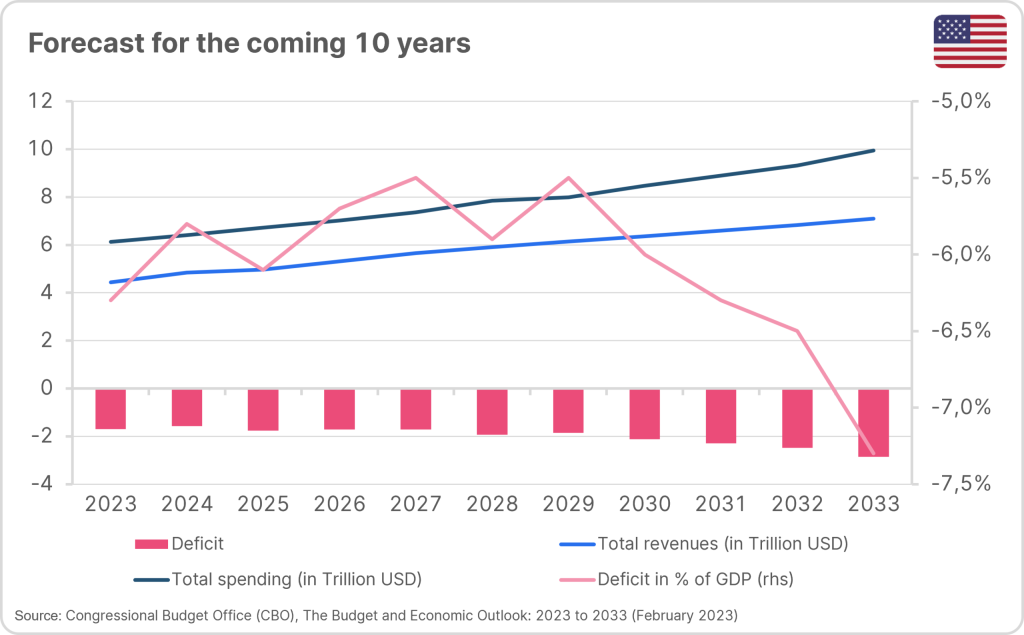

Forecasts suggest that budget deficit could decrease for a short while

Spending has declined significantly in recent periods following the end of many pandemic-related measures and support packages. However, 2023 revenues fell significantly short of forecasts, as a result of which the current deficit was still well above the long-term average for the years prior to the pandemic.

The Congressional Budget Office’s (CBO) 10Y forecast from February 2023 expects that, under the given circumstances, the budget deficit could fall slightly to -5.5% of economic output in the coming years but would widen again significantly in the second half of the period.

Over the past 50 years, the average deficit has been around -3.6%, i.e. well below current levels. It therefore comes as no surprise that the sustainability of the budget path has been subject to discussion in recent months.

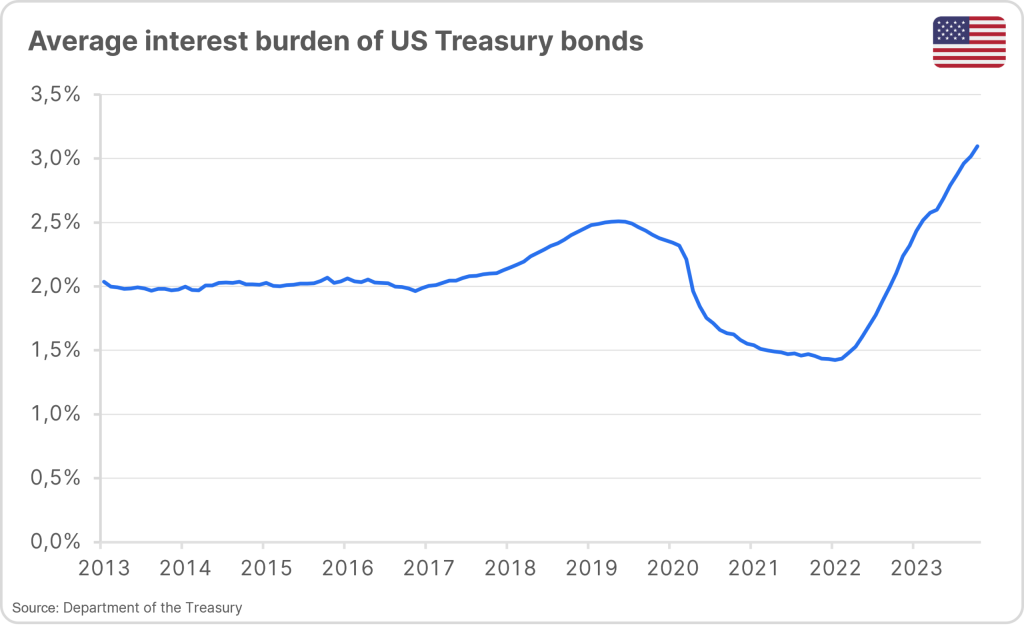

The interest burden has increased considerably

In this context, the increased yields on the financial markets are also having a noticeable impact. The average interest burden has already risen to just over 3% as a result of the rate hikes and the resulting higher refinancing costs. Based on forecasts, interest payments to finance government debt will increase from around 2.4% of economic output in 2023 to 3.6% in 2033; however, not only the existing debt, but also the projected budget deficits for the coming years may have to be financed in a higher interest rate environment as compared to previous years.

The rating agency Fitch explained the USA’s surprising downgrading from the top rating on 1 August with doubts about the sustainability of the current budgetary situation, among other things. As a result, the market participants on the financial markets have increased their focus on the issuing activity of the USA.

Political division as stumbling block of a sustainable solution

The eagerly awaited presidential elections in the USA are due in 2024. Depending on the majority in Congress, the fulfilment of election promises will then have top priority. However, the effects of this have often been less restrictive in terms of fiscal policy in the recent past.

The political division and unwillingness to compromise make it increasingly difficult to find lasting and sustainable solutions to the problems ahead. At the beginning of 2023, when the USA hit the debt ceiling set by Congress, no agreement could be reached. However, due to the budget deficit, an increase was unavoidable and extraordinary measures had to be taken to prevent the USA from defaulting.

When these options had been exhausted by the beginning of June, public pressure increased. However, as no political compromise could be found with regard to the increase, the law was suspended for the time being until January 2025 (after the upcoming presidential elections) and subject to conditions. The last time the USA lost its top rating from Standard & Poor’s was in 2011, when Congress raised the limit just a few days prior to a default.

Bridge financing averted shutdown

At the end of September 2023, no agreement was reached during the annual budget negotiations yet again. Only a few hours before certain parts of the public sector would have remained closed, bridging finance was agreed until 17 November. What followed was the voting-out of the Republican Speaker of the House of Representatives by a motion from his own party and ultimately a lengthy and difficult search for a successor.

When no consensus could be found once again in mid-November, another interim funding agreement was obtained, which will now run until 19 January or 2 February 2024, depending on the public sector in question. In the course of this, the agency Moody’s has also downgraded its outlook to negative, citing the difficult political situation among other things, but has retained its top rating for the time being.

At the beginning of this week, Republicans and Democrats reached an agreement in principle in the budget dispute. They agreed on a budget ceiling of USD 1.59 trillion for the current budget year. The exact breakdown still has to be determined by the relevant committees in the House of Representatives and the Senate. However, additional political demands, with which the opposition Republicans want to force a change in government policy, were excluded from the agreement. The agreement in principle is therefore an important step in the budget dispute, but not yet a final agreement.

Conclusion

Due to the very slight majorities in both chambers of Congress and the division between and within the party camps, important political decisions in the USA are currently increasingly resulting in bridge financing without any sustainable steering effects. However, it is doubtful whether the tense political environment will change in the short term in the wake of the upcoming presidential elections. Preparations in the House of Representatives for a possible impeachment of incumbent Joe Biden are being evaluated as we speak, and various legal proceedings are pending against the former president and potential Republican candidate Donald Trump.

For the USA and its bonds, however, the political tensions and the current budget situation do not have any serious, immediate impact on the financial markets. The US dollar is still the global reserve currency, US bonds are still in demand as highly liquid, safe investment instruments and are also in demand in other areas such as collateralisation. That being said, the measures taken by the rating agencies serve as a clear warning for US politics, suggesting that the lack of political consensus and the current budget situation would not be consistent with a top rating in their assessments without appropriate countermeasures.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.