War in the Middle East, war in Ukraine – geopolitical uncertainties have increased in recent months. This has also had an impact on Turkey, with its location at the crossroads of the Middle East, the Caucasus and south-eastern Europe – yet the economy is proving surprisingly robust this year. The economy is proving surprisingly robust this year. And this after many years of hardship and after the severe earthquake in February, which claimed the lives of 56,000 people and caused enormous damage in the south-east of the country.

Long road out of the “valley of tears”

Not everything that weighed on the country and its economy can be attributed to external factors. There was a great deal of domestic political uncertainty in the run-up to this year’s elections. The central bank’s policy was highly controversial and lacked confidence. The confidence of financial investors was shaken by abrupt and questionable personnel decisions at the top of the central bank. The consequences were high inflationary pressure, a dramatic devaluation of the country’s currency and political disputes with the European Union, among others. For a long time, it was unclear what would happen next.

Things are looking up

However, since the clear outcome of the presidential elections this spring, there have been glimmers of hope: the victorious long-term president Recep Tyyip Erdogan realized that things cannot go on like this. Accordingly, the government was reshuffled and the governors of the central bank were also reappointed. “A return to a normal stability-oriented economic and monetary policy is the prerequisite for the return of investors,” says ERSTE STOCK ISTANBUL fund manager Alexander Dimitrov.

Despite the currency crisis with the dramatic devaluation of the lira, high inflation and six key interest rate hikes to 40% (!), the Turkish economy will grow by around 4% in 2023. The clear growth, which is also visible in the strong tourism figures, can be attributed to the government’s economic programs. After all, the government has succeeded in increasing employment: as a result of the various economic and social programs, the number of employees has risen by 1.5 million.

Turkey: Key economic indicators

| 2019 | 2020 | 2021 | 2022e | 2023e | 2024e | 2025e | |

| GDP, constant prices y/y | 1.9% | 11.4% | 5.5% | 5.2% | 4.0% | 2.8% | 3.3% |

| Inflation, y/y | 15.6% | 36.1% | 64.3% | 72.2% | 54.2% | 53.1% | 27.5% |

| Unemployment rate | 13.0% | 12.3% | 10.3% | 10.6% | 9.8% | 10.4% | 10.6% |

| Current account, % of GDP | -4.5% | -0.9% | -5.5% | -5.8% | -4.7% | -3.1% | -2.3% |

| Fiscal balance, % of GDP | -3.4% | -2.7% | -0.9% | -3.3% | -5.5% | -4.9% | -4.0% |

e = consensus expectations, Note: Past performance is not a reliable indicator of future performance.

Fuel for the stock market: growth and falling inflation

Alexander Dimitrov, fund manager of the ERSTE STOCK INSTANBUL equity fund, also expects growth of around 3% in 2024 and 2025. The fight against inflation will remain a visible sign. Reducing inflation and stabilizing the currency remain the most important goals of monetary policy. “Inflation will come back. Not least because the SNB has raised interest rates to an extreme level. This will ultimately also stabilize the currency,” says Dimitrov with cautious optimism. Only recently, the rating agency Fitch upgraded the country’s rating from “Negative” to “Stable”. S&P recently upgraded the credit rating outlook to “Positive”.

Attractive valuation of listed companies

Companies appear to be coping well with inflation and are able to pass on price increases to customers. Companies are reporting higher profits and profit margins have increased. “In 2023, we will see the first inflows of foreign investors into the stock market after a few years, which makes us confident about the further development of the market,” emphasizes fund manager Dimitrov.

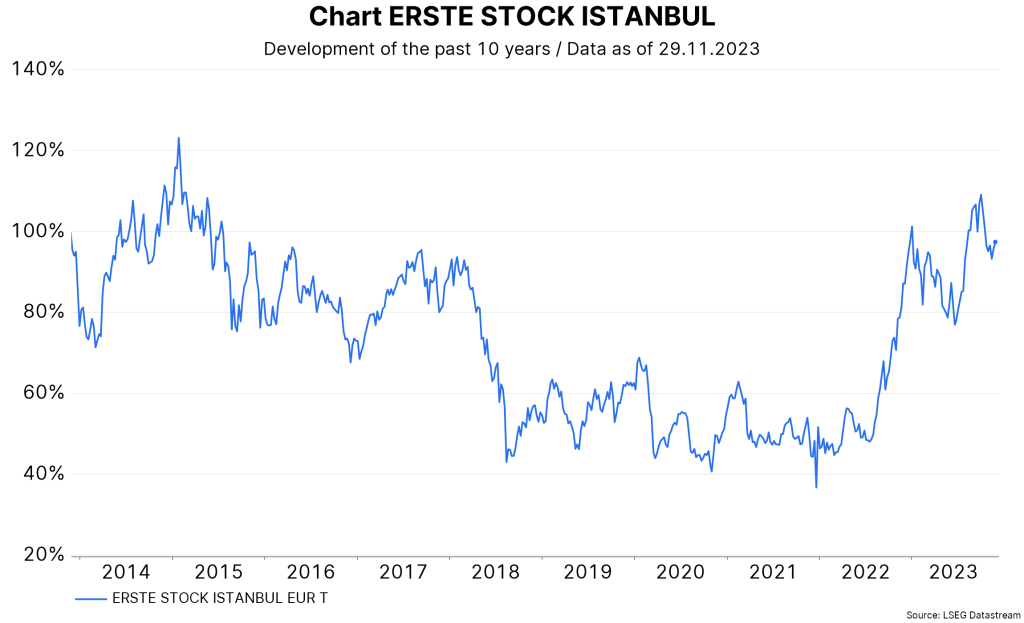

Note: Performance chart since inception. The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. Past performance is not a reliable indicator of future performance.

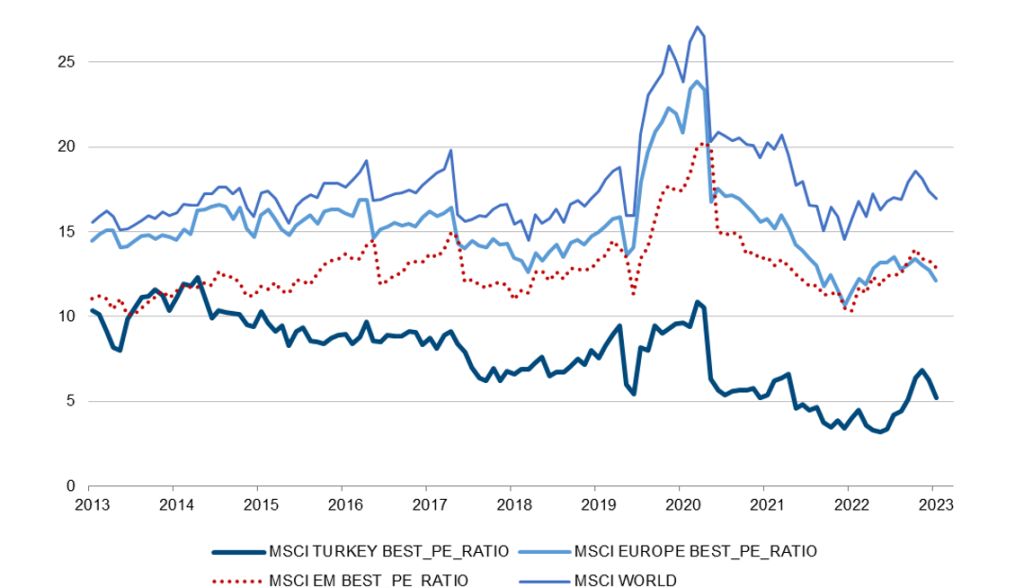

International investors have long since rediscovered the Turkish stock market. Despite the above-average performance of 12.8% p.a. in the last 5 years (- 0.7% p.a. over 10 years) see price chart ERSTE STOCK ISTANBUL, the shares listed on the stock exchange are trading at a price/earnings ratio of just 5.2 and a 60% price discount to other emerging markets, according to Dimitrov. The price-to-book ratio is 1.2 (Source: Bloomberg, 24.11.2023).

Price/earnings ratio of selected indices

Note: Past performance is not a reliable indicator of future performance.

Despite the positive signs, Dimitrov tries to dampen any overly euphoric outlook: “The market performance over the last 5 years is not a re-rating but an improvement of previously weak values. If Turkey continues on its path of normalizing monetary policy and spending discipline, we can hope for more.” The companies are well managed. The industrial base and infrastructure are at a high level. In addition, companies can draw on a pool of young workers. And recently, relations with the European Union have improved somewhat.

Betting on Turkey’s “comeback” with ERSTE STOCK ISTANBUL

ERSTE STOCK ISTANBUL invests primarily in companies domiciled or listed in Turkey. At the moment, it is somewhat more defensive with a focus on the industrial sector and consumer staples. Fund manager Alexandre Dimitrov has

strong balance sheets, profitability and well-managed companies that can develop and grow in both good and bad times. He is currently cautious in the financial sector and real estate stocks, which are burdened by high interest rates.

New: Something is also happening on the ESG side in Turkey: a Kontrolmatik battery factory was recently put into operation. The company, which is part of the ERSTE STOCK ISTANBUL portfolio, is also expanding in the USA.

Conclusion

After years of hardship, the political and economic situation in Turkey is changing. Growth, which has returned this year despite high inflation and interest rates, should continue in the coming years. The country is also benefiting from a young, well-educated population that is entering the labor market. The new central bank policy should stop the currency devaluation. The valuation of listed companies is at a favorable level.

Nevertheless, investors must bear in mind that the Turkish stock market will always be a risky market and will remain so. There are numerous factors that influence the market, including political ones. As this fund does not hedge foreign currency risk, the change in the euro and US dollar will affect the value of the investments made in the fund. Overall, there is a good chance that global investors will rediscover Turkey.

| ERSTE STOCK ISTANBUL may exhibit increased volatility due to the composition of the portfolio, i.e. the unit values are exposed to large upward and downward fluctuations even within short periods of time. |

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.