After unexpected replacements of the head of the central bank and the finance minister, Turkish President Recep Tayyip Erdogan recently declared war on the inflation and currency depreciation in his country with a new economic programme. “We are in a historic struggle against those who want to force a modern-age surrender on Turkey through the shackles of interest rates, exchange rates and inflation,” Erdogan said in his speech. In doing so, Erdogan is radically turning away from his previous economic policy line by relying on foreign investment and monetary stability.

Currency crisis since years

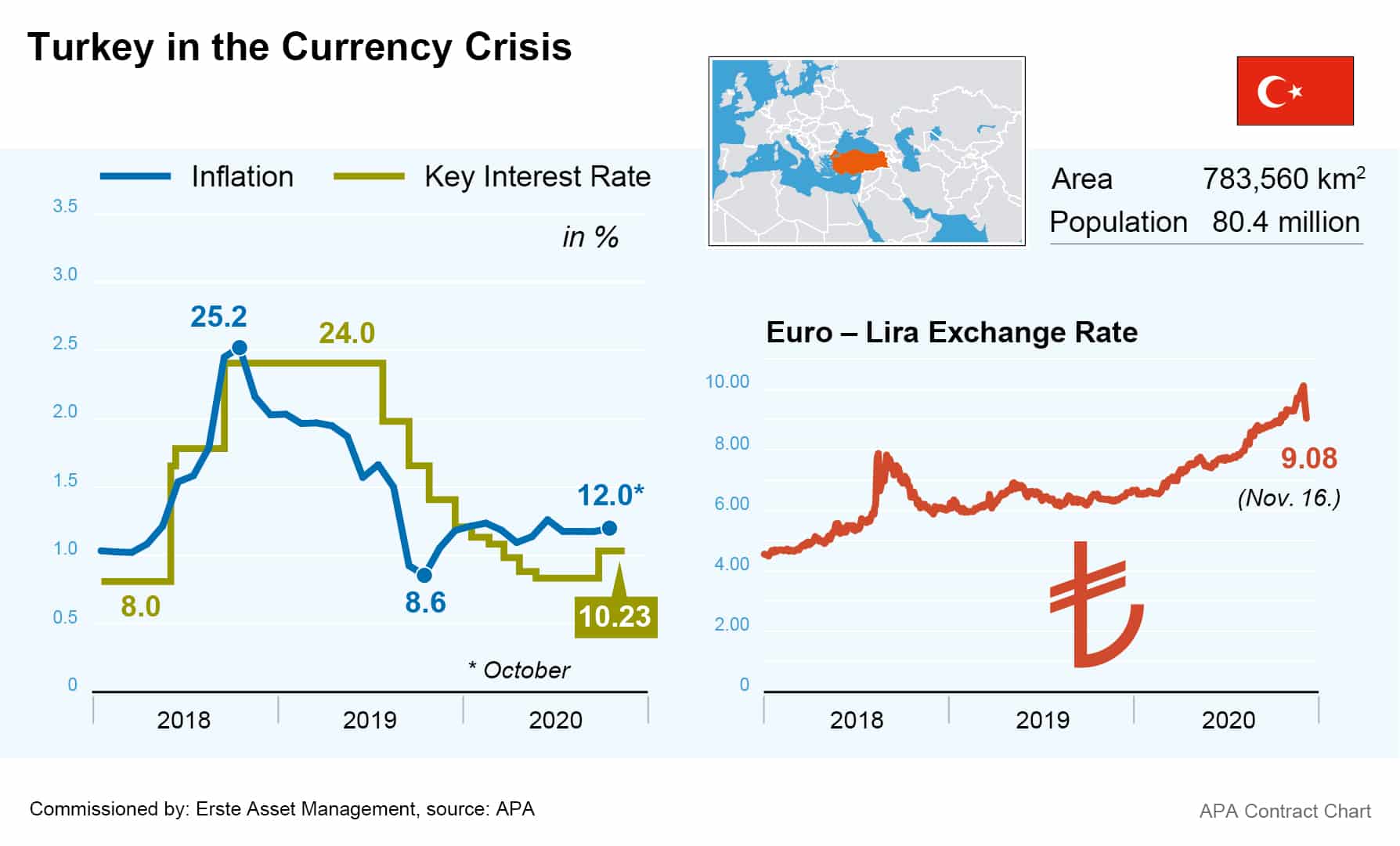

Turkey is currently in the middle of a massive currency crisis. The Turkish lira has already depreciated by about 30 per cent against the US dollar at times this year. No currency of an emerging market country has suffered more in the corona year 2020. The dramatic inflation with price increases of more than 10 per cent is an additional burden on the currency. The country’s severely decreased currency reserves have also accelerated the decline of the lira. In addition, tensions in relations with the EU and the USA as well as concerns about possible sanctions on the emerging market’s currency are putting a strain on the currency.

Higher interest rates could have curbed inflation and made the currency more attractive, but Erdogan and his former head of the central bank had previously vehemently opposed interest rate hikes, contrary to the demands of economists. In the past, the Turkish prime minister repeatedly referred to himself as an “interest enemy”.

With his policy of low interest rates Erdogan did not only want to stimulate the economy in the country. Until now, he also saw low interest rates as a means to fight inflation, acting in blatant contradiction to generally accepted basic principles of economics and the monetary policy practice of other countries. According to observers, Erdogan is also said to have put pressure on commercial banks to continue granting cheap loans – for instance, to boost the construction industry.

Head of central bank and finance minister surprisingly replaced

However, this could now change. After the lira dropped to another record low compared to the dollar at the beginning of the month, Erdogan surprisingly fired the head of the central bank, Murat Uysal, a week ago. Uysal had been installed in the position in 2019, after his predecessor had fallen out of favour with interest rate hikes up to 24 per cent. Uysal had subsequently lowered interest rates again and unsuccessfully tried to support the Turkish currency with massive dollar sales from currency reserves instead of interest rate hikes. Some experts estimate that this year alone, Turkey has spent over a hundred billion dollars to slow down the decline of the lira.

Erdogan appointed former finance minister Naci Agbal as Uysal’s successor by decree. In a first statement immediately after taking office, Agbal announced that the central bank would now fight inflation and ensure price stability by all available means. He also promised transparent communication.

Shortly afterwards, Erdogan’s son-in-law Berat Albayrak also resigned as finance minister in a surprising statement on the social media platform Instagram, citing health reasons. The post was filled by former deputy prime minister Lütfi Elvan. Elvan had studied mining and economics in Istanbul, Leeds and Delaware before his political career and had worked in several international organisations such as the OECD.

Financial markets hope for a turnaround in monetary policy

In an initial reaction, the new appointments were received favourably on the financial markets and seen as a possible sign of a turnaround in monetary policy, with the Turkish lira at times showing significant gains. Erdogan himself also announced a new growth strategy shortly after the replacements. His country should remove all obstacles to increase economic growth, exports and employment. The president now wants to focus on monetary stability and also to strengthen the currency reserves again. He also announced that he would meet with international investors in order to make them more aware of the opportunities for involvement in the Turkish economy. With this, Erdogan also departed from his earlier rhetoric, in which he had partly presented foreign investors as an external threat.

The markets are now eagerly awaiting the next developments, i.e. whether the first interest rate decision to be taken on Thursday under the leadership of the new head of the central bank will fulfil the hopes for a turnaround in monetary policy. Some analysts expect key rates to be raised by several percentage points. One promising sign is the easing of restrictions on lira trade for foreign investors by the central bank shortly after the appointment of its new head. In addition, observers interpret Erdogan’s announcement that the country’s economy will have to swallow some “bitter pills” on its new growth course as an indication of a change in monetary policy.

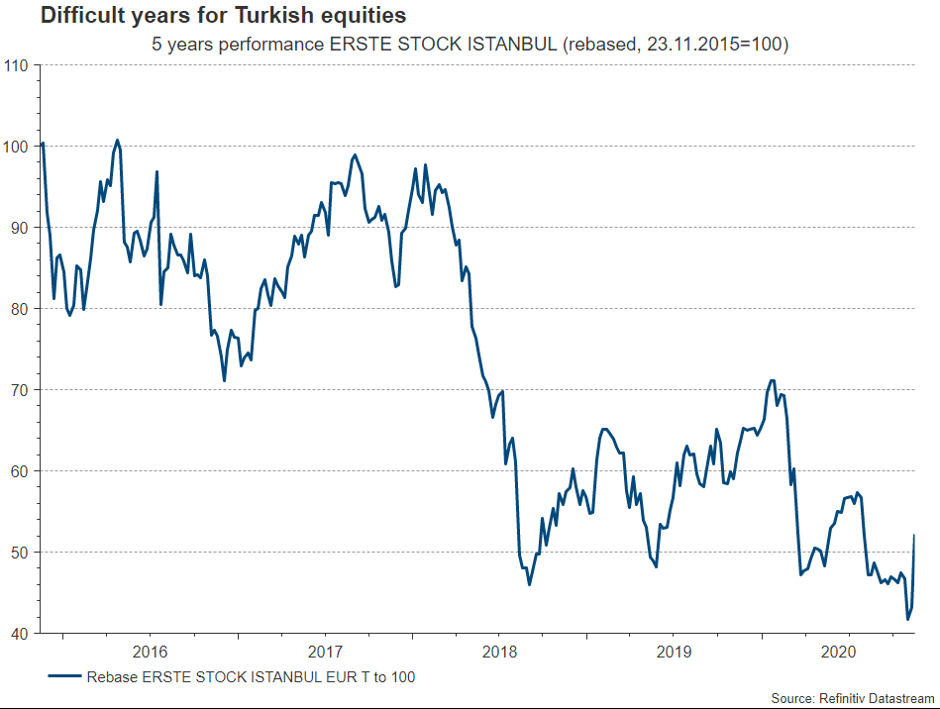

ERSTE STOCK ISTANBUL – chance for a rebound

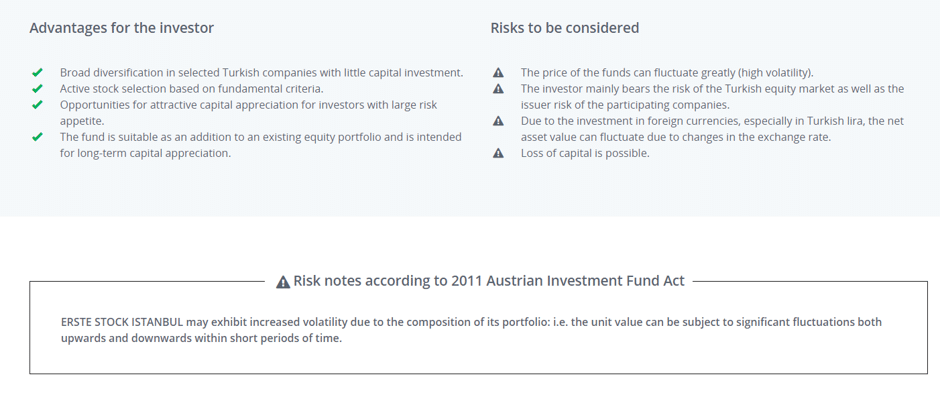

Turkish equities have lost about half their value in the last 5 years. With the appointment of new personalities for the posts of Minister of Finance and President of the Central Bank, there is hope that the economic and monetary downturn can be halted. Turkish equities could benefit from this. The ERSTE STOCK ISTANBUL has a history of almost 20 years, during which its value has increased, despite all the political and economic turbulence. Anyone who believes in a rebound of the shares listed on the Istanbul Stock Exchange will use this fund to invest in high-quality, high-growth companies. There is also the chance to profit from a further appreciation of the Turkish Lira. The generally high price fluctuations of Turkish equities must of course be kept in mind.

Data per 30.10.2020. The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium of up to 4,00 % which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. Past performance is not a reliable indicator of the future performance of a fund.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.