The indicators on inflation and those on economic activity are currently competing with each other to see which of the two categories has the greater significance for the financial market. On the inflation side, inflationary pressures are diminishing. On the growth side, the goods sector is weak at the global level, while estimates for GDP growth in Europe and China have been adjusted upward.

Beveridge

The labor market is very tight. The ratio of job vacancies (very high) to the unemployment rate (very low) is currently very high. In economics, the relationship is known as the Beveridge curve. This means increased inflation risks, which is why central banks continue to signal a restrictive monetary policy. A key question for this year is whether there can be a sustained decline in inflation without a sharp rise in the unemployment rate or recession.

Disinflation

Since the beginning of the year, optimism for a sustained decline in inflation (disinflation) has led to price increases in equities and bonds as well as a weaker US dollar. This is a mirror image of last year. This is mainly due to the fading effects of the two negative shocks:

- pandemic (falling goods prices)

- Ukraine war (falling energy prices)

Lower inflation means less restrictive monetary policies and a lower loss of purchasing power. Both points are positive for real economic growth.

Three scenarios

The three broad scenarios for 2023 are

A) “continued disinflation” (including policy rate cuts),

B) “stagnation” (no policy rate cuts this year) and

C) “global recession” (resumption of policy rate hikes in H2 after a pause in H1).

In the current environment, the question is thus whether future economic reports will contradict scenario A (disinflation).

Falling producer prices

December producer prices fell month-to-month in the US and Germany. This week, the U.S. personal consumption deflator will be looked at to see if it fits the disinflation narrative.

Weak goods sector

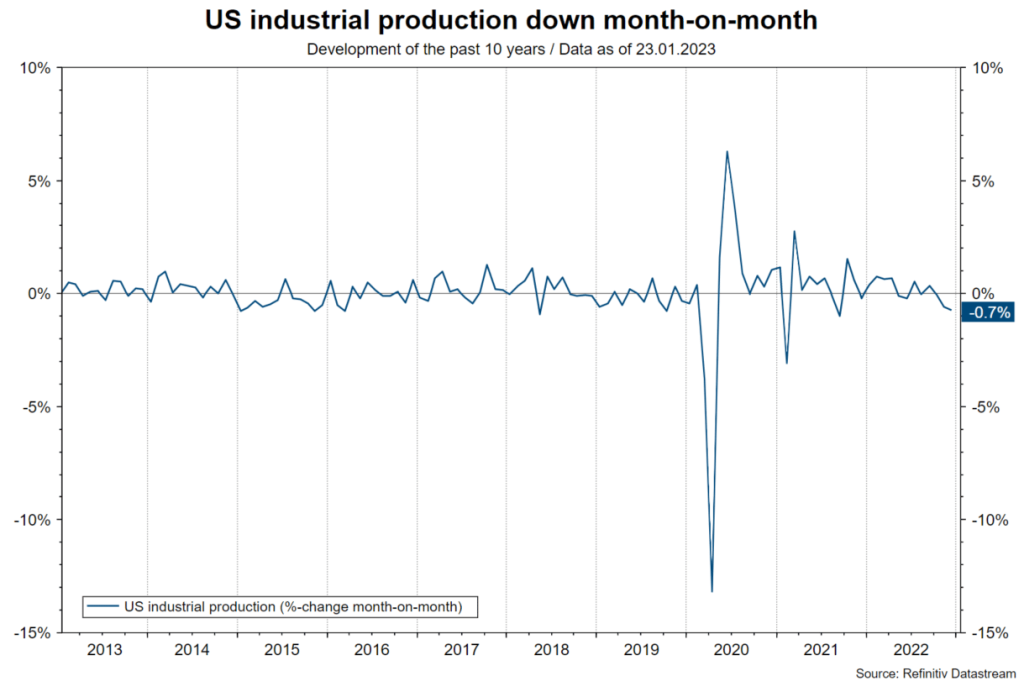

Weak indicators of economic activity have been published in recent days. In the US, both retail sales and industrial production fell month-on-month in December. Two regional Fed reports (New York and Philadelphia) for the month of January point to continued weakness in manufacturing.

Note: Past performance is not a reliable indicator of future performance.

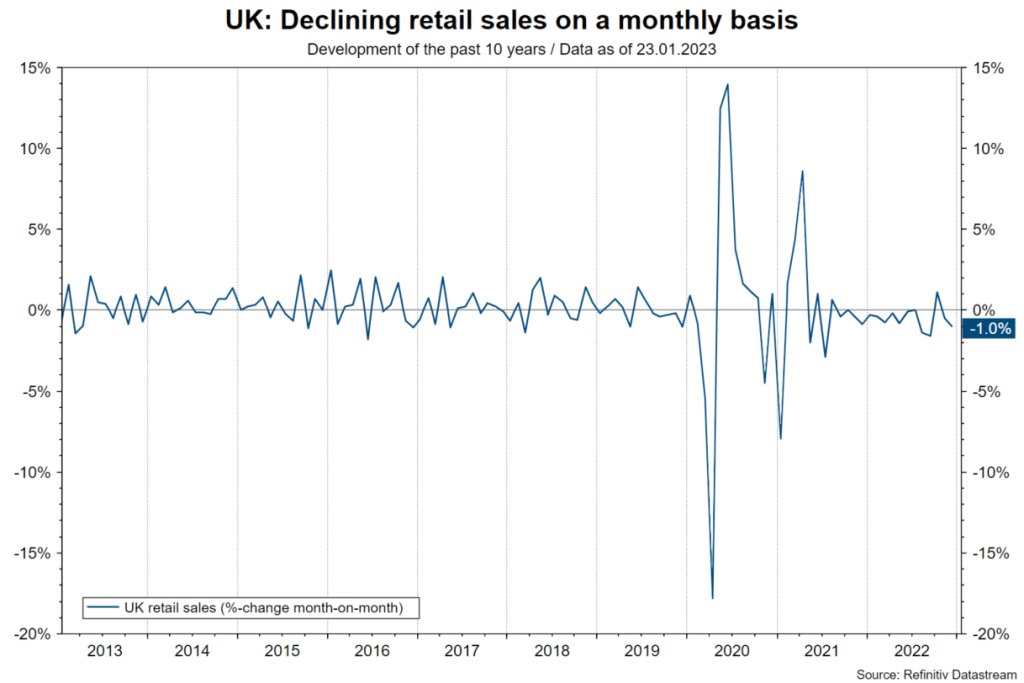

Retail sales in the UK also fell in the month of December. In addition, goods exports in the East Asian region – a barometer for global manufacturing – show a strong downward trend. Similarly, real estate indicators remained negative in the USA (building permits, housing starts, sentiment), China (falling prices) and the UK (falling prices).

Note: Past performance is not a reliable indicator of future performance.

Falling gas price in Europe

On the positive side, in Europe the rapid decline in energy prices and fiscal support measures have led to an improvement in economic indicators and estimates. Meanwhile, the key gas price futures TTF has fallen slightly below the level just before the invasion of Ukraine at EUR 67 / MWh. Evidence for slight real GDP growth in the first quarter after stagnation in the fourth quarter of 2022 is growing. At the end of 2022, a technical recession had still been assumed (GDP contraction for two quarters in a row). This positive development was supported by the ZEW economic barometer for the month of January. The expectations component for Germany has now risen for the fourth time in a row.

Note: Past performance is not a reliable indicator of future performance.

V in China

China’s economic indicators pose a puzzle. Survey-based indicators such as the purchasing managers’ indices have pointed to a contraction in gross domestic product (GDP) in the fourth quarter. It was a big surprise when the GDP report showed only quarterly stagnation. However, the expectation for the 1st half of the year is important. The rapid departure from the zero-tolerance policy toward new infections and the selective support measures for the real estate sector argue for a V-shaped (fast) economic recovery in H1.

Weak growth

This week, the preliminary purchasing managers’ indices for key countries in the developed economies and the IFO economic barometer for Germany will provide new information on economic growth. Currently, the indicators in aggregate point to a weak growth environment but no recession.

Conclusion: Conditionally positive environment

As long as optimism for persistently falling inflation rates dominates growth fears, the environment for risky asset classes such as equities remains constructive – all other things being equal. But that could change quickly. Inflation rates could stabilize at uncomfortably high levels, putting pressure on central banks to continue the cycle of interest rate hikes after a pause in the first half of the year. Even an unchanged restrictive monetary policy (no interest rate cuts) would have a negative impact on economic growth.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.