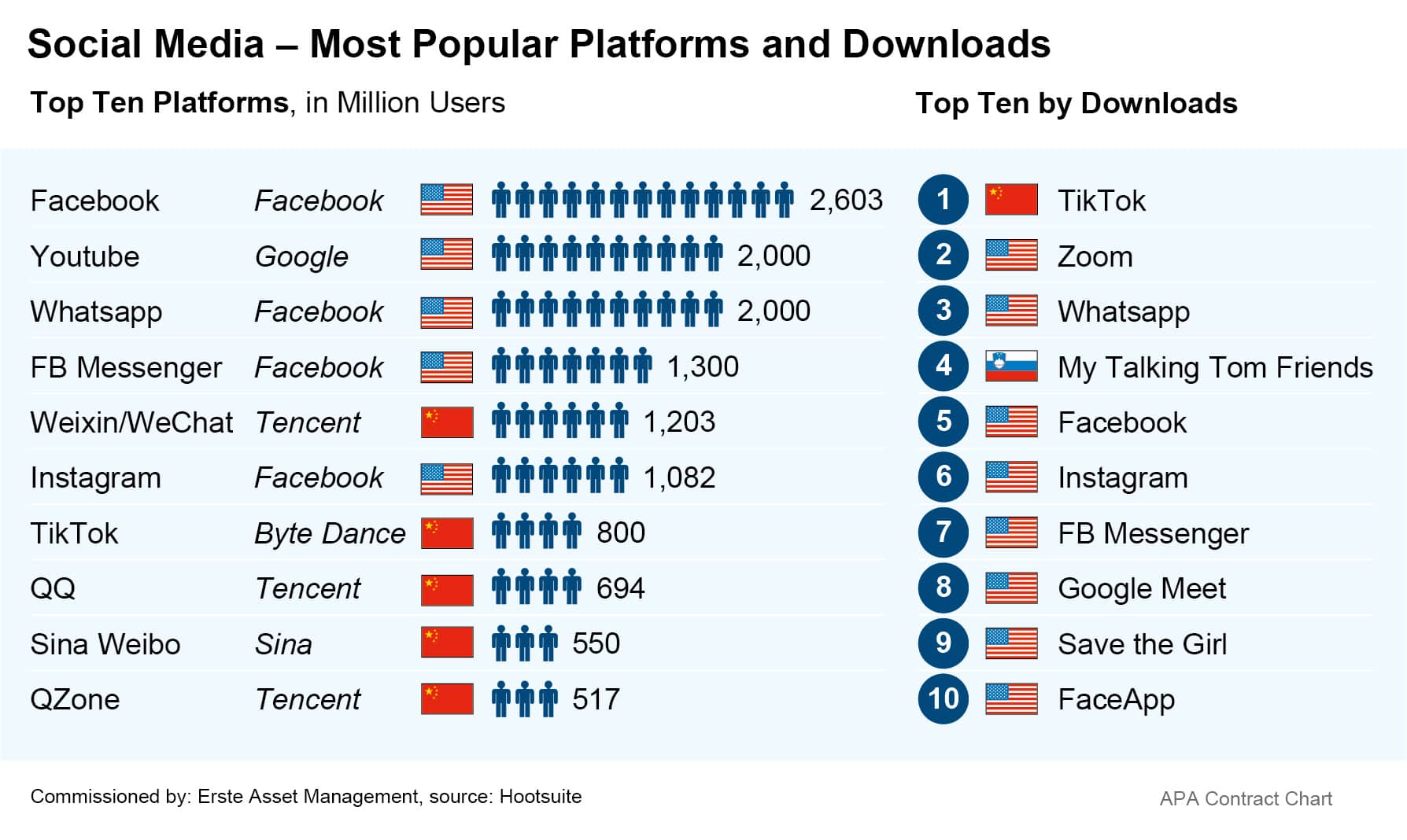

US President Donald Trump has escalated his fight against the Chinese-owned social media services TikTok and WeChat, and in the process also caused new tensions in the trade dispute with China. The Republican recently issued orders prohibiting transactions with TikTok operator ByteDance and WeChat owner Tencent, which are to become effective in 45 days.

With these measures, Trump is targeting two services extremely popular in the US. With around three million users in the USA, most of them Chinese, WeChat is a successful competitor to WhatsApp. WeChat operator Tencent also holds 5 per cent of electric car manufacturer Tesla and 12 per cent of Snapchat’s parent company Snap in addition to holding shares in the music streaming service Spotify and the world’s largest music label Universal Music.

TikTok is an internationally successful video platform with hundreds of millions of users around the world. Users can upload and edit their own clips or watch videos from others. The network has increasingly grown into a platform for political debates and campaigns in the USA, which is likely a further thorn in Trump’s side. The app has around 100 million users in the US and is particularly popular with teenage users there, six out of ten of which now use TikTok. This is the result of a survey conducted every six months among 5,200 teenagers by the US investment bank Piper Sandler.

The US government has been alleging the danger of data from US citizens using TikTok falling into the hands of Chinese authorities for some time. TikTok assures users that the Chinese government has no access to user data and has never requested it. However, President Trump has recently threatened to ban TikTok altogether, citing data security reasons. He continues to see the danger of espionage and political influence from Beijing, but has no objection to the platform continuing to be operated under an American owner in the US. If, however, no sale to a US company is concluded by 15 September, the ban will come into effect.

Microsoft preparing to take over TikTok’s US business

As a result of political pressure from the White House, Microsoft has made preparations to take over TikTok’s US business. The software giant wants to negotiate a deal with TikTok owner ByteDance by mid-September. According to insiders, Bytedance itself agrees to a complete sale of the platform’s US business after Trump’s announcement of the ban.

In response, Trump has demanded that the US government receive a share in the profits from a possible takeover of TikTok’s North American business by Microsoft. After a conversation with Microsoft CEO Satya Nadella, Trump reported that he told him that “a very substantial portion” of the sale price would have to go to the US Treasury, “because we make this business possible”. Several US media spoke of unusual interference without precedence in recent American history.

In China, these plans were met with massive criticism. The Chinese government accuses Trump of “intimidation”. His threat to ban the company in the USA is “plain and simple intimidation”, said a spokesman for the Chinese foreign ministry. Chinese TikTok users have also announced that, should the company be sold to Microsoft, they will uninstall services such as Twitter competitor Weibo, the video app Douyin, and the news platform Jinri Toutiao. American TikTok users have also recently protested massively in social media against Trump’s plans to ban the service.

However, after the recent ban on business with ByteDance and Tencent, talk of selling the US business has subsided, rendering that point moot. After ByteDance had been open to a sale of the US business, Trump now also scared off the TikTok operator with his latest decree. TikTok announced that it would take legal action against a ban by the US government.

More fuel on the trade war’s fire

With the hostilities thus opened, the US President also reignited the trade dispute between the USA and China, causing concern in stock exchanges around the world: “We could see the beginning of an IT war,” said Nana Otuki, Chief Analyst at Monex Securities. IT expert James Lewis of the Center for Strategic and International Studies is certain that “China will retaliate”. He sees a new dimension in the long-running dispute between the major powers: “This is a rupture in the digital world between the US and China.”

For a good two years now, the trade war between the world’s two largest economies has been raging, with a trade agreement signed in January only providing a temporary respite. Since the outbreak of the Corona pandemic, the tone has become sharper again. Critics suspect that the campaign against the Chinese apps is also a political move by Trump to divert attention during the hot phase of the election campaign from the corona crisis at home and the severe slump in the US economy with millions of citizens unemployed.

Erste AM equity funds for technology-companies

ERSTE STOCK TECHNO – this equity tech fund was launched in 2000 and invests in companies from developed technology markets. The majority of companies in this area can be found in the United States. As a result, Pacific and European equities tend to play a subordinated role in the fund.

ERSTE FUTURE INVEST – is an actively managed, global equity fund investing in megatrends (promising future trends). Equities associated with one or more of the following trends are preferred in the selection process: health and health provision, lifestyle, technology and innovation, environment and clean energy, and emerging markets.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.