The US election is over, and the Republicans under Donald Trump have celebrated a historic victory (Red Sweep), including the victory in the Senate and the House of Representatives. As a result, some cleantech shares have corrected sharply. We are here to discuss how our fund managers position themselves and what opportunities arise for renewable equities with Alexander Weiss, fund manager of ERSTE GREEN INVEST.

Alexander, how do you rate this development?

Donald Trump’s election has raised many questions regarding renewable energy that will need to be answered. This uncertainty has weighed on the cleantech equity sector, and shares in this segment have corrected sharply. The correction also affects our two environmental equity funds, ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST. However, it also affects broad indices and ETFs in the renewable energy equity sector.

What is your current positioning in the fund?

Even before the election, we had built up our cash position significantly (above 6%) and will now use it to gradually add shares where we regard the reaction as excessive. Some have lost up to 50% of their value, and we can see buying opportunities there.

Where is this uncertainty coming from?

The big issue is the Inflation Reduction Act (IRA), which many see as being in jeopardy from the current Republican majorities in Congress and from President Trump himself. For many companies in the cleantech sector (solar, wind, e-mobility, hydrogen, etc.), the IRA is indeed a key factor for their growth/earnings prospects.

Take First Solar, for example, currently our top position in ERSTE WWF STOCK ENVIRONMENT and no. 4 in ERSTE GREEN INVEST: according to the consensus, earnings per share are estimated at around USD 10 for 2026 without the IRA, and at about USD 30 with the IRA.

To a certain extent, the reactions are therefore understandable. At the same time, First Solar could actually benefit from the election outcome. Trump has announced tariffs of 60% on all imports from China. First Solar has the entire value chain of its solar modules in the USA and would therefore have even more power to dictate prices.

Note: Please note that investments in securities entail risks in addition to the opportunities.

What areas could benefit from Trump’s victory, and which ones would be affected by the possible repeal of the Inflation Reduction Act?

Different parts of the energy complex are affected to varying degrees by the possible repeal of the IRA. For example, large-scale projects in the onshore wind and solar sectors should be relatively safe. The so-called tax credits here have been extended for years by various administrations. Interestingly, the solar tax credits would have expired even under Trump, but he extended them in line with this “tradition”.

Trump even made positive comments about solar energy during the election campaign (“big fan of solar”). The areas of battery storage and grid expansion should continue to receive support, as these topics are also supported by Republicans. However, we see negative effects for e-mobility and offshore wind in particular – these are the only topics on which Trump has publicly taken a negative stance. That being said, when it comes to e-mobility, Elon Musk may still have something to say in this regard.

Can Donald Trump repeal the Inflation Reduction Act just like that?

In theory, yes. In practice, however, this will prove difficult for three reasons:

Firstly, repealing laws is a very complex and lengthy process. During Trump’s first term in office, repealing Obamacare was one of his stated election goals, but he failed on this issue. By contrast, repealing the Inflation Reduction Act was hardly mentioned in the election campaign.

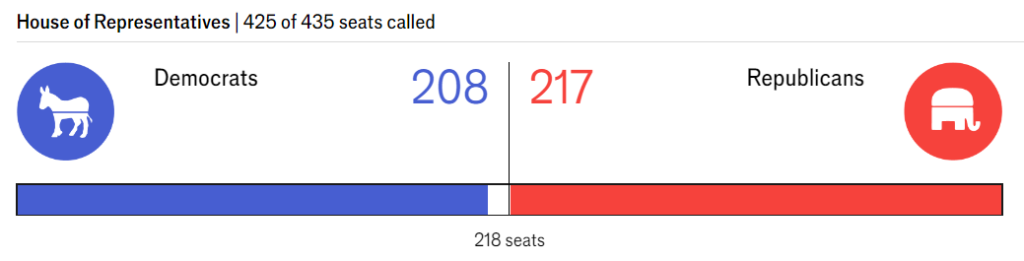

Secondly, it is not clear that the Republicans want to completely repeal the Inflation Reduction Act at all. The investments will largely benefit Republican districts, especially for solar and wind tax credits, where there is a bipartisan consensus. House Speaker Mike Johnson has already mentioned that the IRA would be tackled with a scalpel rather than a sledgehammer. In an open letter, 18 House Republicans have spoken out in favour of the IRA. These 18 Representatives could tip the scales when it comes to the IRA, given the current state of the count in the House:

The exact distribution of seats in the US House of Representatives is still undecided. Source: Associated Press (AP)

Thirdly, Trump’s priority is to provide this affordable form of energy. The lead times for nuclear power are very long (2030+), and the same is true for gas-fired power plants (bottlenecks in turbines). The USA needs energy, especially the tech companies need a lot for their data centres and AI. The Federal Energy Regulatory Commission (FERC) recently acknowledged that the expansion of artificial intelligence was also a matter of national security, and that it would therefore be prioritised in order to keep it in the USA. Also, the fastest electricity to be brought to the grid and at the same time the cheapest is still renewable energy.

Despite all this, it is clear that uncertainty and volatility have increased. The reaction on the day after the election has already shown this and to some extent priced in the worst case. What Trump will actually do is still unclear at this point in time; after all, he was not exactly predictable all the time during his first term in office, either. Even if the Republicans plan to fully repeal the IRA, it would take a long time to implement and, according to experts, would not be implemented until the end of 2025 at the earliest – by which time the midterm elections will be upon us. It remains to be seen whether Republican governors will vote against a law that would bring jobs and investment to their states.

Trump has been president before. How were renewable energy shares faring then?

It’s true, we often forget that Trump has been president before. During that time, share prices in the renewable energy sector were developing very positively. Among other things, Trump extended tax credits for solar energy. He ultimately sees himself as a deal maker who takes very extreme positions into negotiations. Let’s hope that this will prove to be true in this legislative period.

How do you assess the outlook for environmental shares?

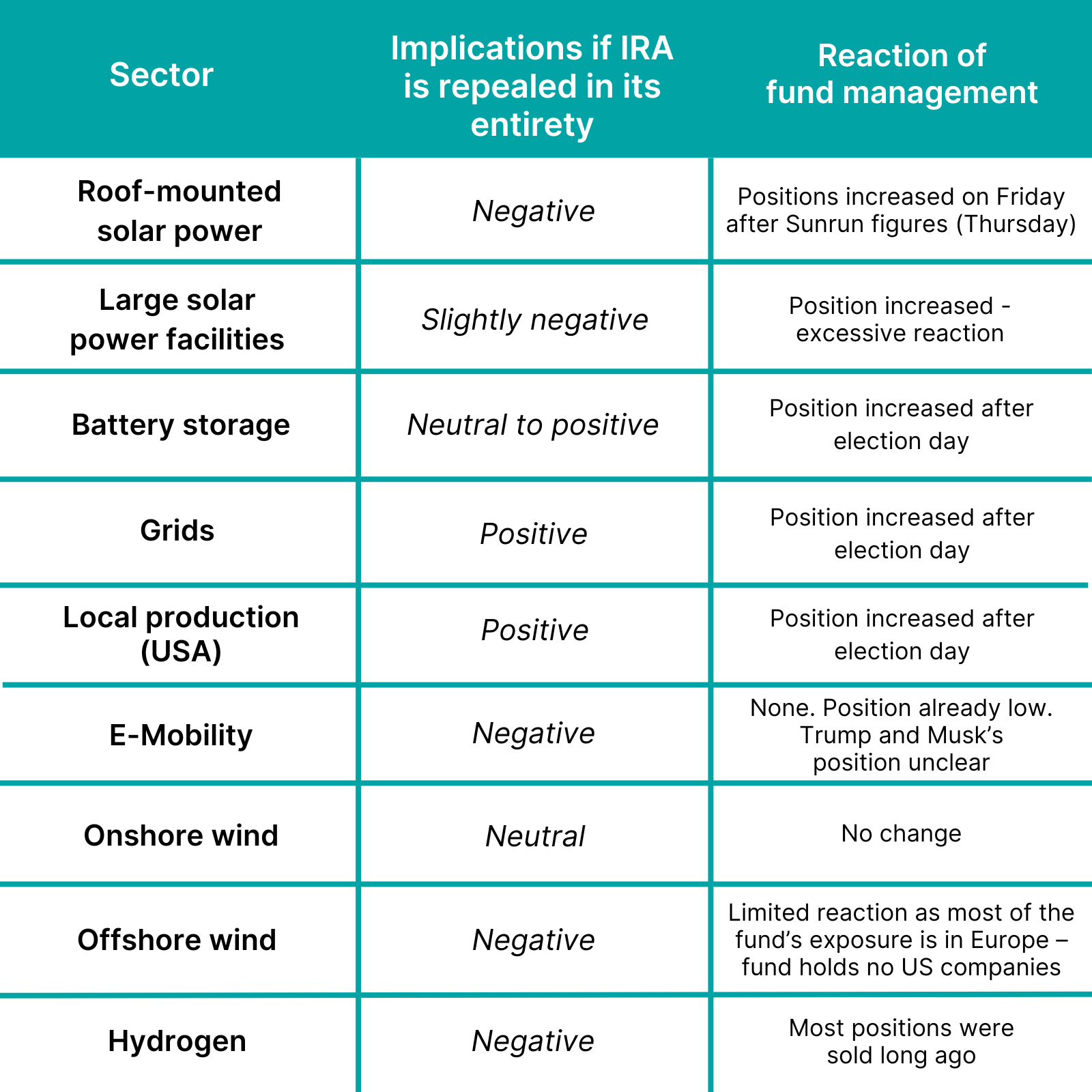

As mentioned, we had increased cash positions before the election, which, given the extreme reaction, were of little help. We will now use this cash to selectively buy companies that are either least affected by a worst-case scenario (IRA cancellation) or where this has already been most dramatically priced in (i.e. overpriced companies). Below is an overview of the various topics and how we reacted in the wake of the election.

The environment that we have been navigating since the election results has changed. Above all, there is uncertainty about what exactly Trump will do in his new, more powerful position. How this develops for the coming legislative period remains to be seen. Uncertainty means increased volatility, but this opens up opportunities for active fund management to take advantage in times of excessive losses. In the long term, the topic of environmental equities remains a growth topic worldwide, not only in the USA.

Related posts on this topic 👉

No Posts Found

Important legal note:

Prognoses are not a reliable indicator of future performance.

ERSTE GREEN INVEST

Advantages for the investor

- Broad diversification in companies of the global equity market.

- Investment into companies with above average ESG characteristics.

- Active stock selection, based on a predefined selection process with a strong environmental focus.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The net asset value of the fund can fluctuate considerably.

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

ERSTE WWF STOCK ENVIRONMENT

Advantages for the investor

- Broad diversification in companies of the environmental sector with little capital investment.

- Support for WWF’s environmental protection programs by Erste AM.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the fund can fluctuate strongly (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.