With the opening of many European countries’ borders, the travel industry, which has been severely affected by the response measures to the coronavirus pandemic, is also hoping for a revival of travel and tourism, which has virtually come to a standstill. Airline groups in particular, some of which are threatened by bankruptcy, are hoping for a rapid resumption of flight operations, as they may face collapse without billion-euro rescue packages. Between March and May, air traffic in Europe and many other regions was shut down almost completely in the course of the global measures taken to combat the pandemic.

After a low point in April, with a global slump of more than 90 per cent, air traffic has been slow to resume. Vienna International Airport recorded 20,202 passengers in May, 0.7 per cent of the previous year’s level. Flight movements recorded a minus of 95.6 per cent in May. German airport operator Fraport recently reported similar figures. Frankfurt, Germany’s largest airport, handled more passengers in May than in April; nevertheless, the number of passengers in Frankfurt lay 95.6 per cent lower than in April of 2019.

For June, passenger figures in Europe are still likely to remain massively below the previous year’s figures as well, despite air traffic slowly getting into gear. International airline industry trade organization IATA forecasts declines of about 60 per cent for most European countries in June. Passengers are also currently booking flights at much shorter notice. 41 per cent of tickets are currently booked only three days before the flight date, making it difficult for airlines to estimate demand and draw up their flight plans, said IATA Chief Economist Brian Pearce.

The accelerated and coordinated easing of restrictions and resumption of operations in Europe is now crucial to prevent a worst-case scenario, with more than six million jobs in the industry being at stake, according to IATA. Worldwide, IATA expects airlines to make a net loss of USD 84bn (EUR 75bn) in 2020. The industry association is therefore calling for further state aid in the form of financial injections and extended relaxations of of take-off and landing slot allocation for airlines. Normally, airlines are required to use 80 per cent of their permitted slots, otherwise they could lose their slots to competitors. This rule was relaxed at the beginning of the crisis.

Billion-euro rescue packages are under way

Government rescue packages worth billions for the airlines are already being prepared in many countries. A rescue package for Lufthansa subsidiary AUA has already been agreed, with the Republic of Austria and the owner Lufthansa each contributing EUR 150m. In addition, AUA will receive a EUR 300m state-guaranteed bank loan.

The planned Lufthansa rescue package has not yet been approved. The German state rescue fund WSF is to take a 20 per cent stake in the AUA parent company via a EUR 306m capital increase. A further EUR 5.7bn is to flow through a silent partnership, plus EUR 3bn in the form of a loan from the state bank KfW. However, Lufthansa major shareholder Heinz Hermann Thiele recently rejected state participation in Lufthansa, and therefore the deciding shareholder’s meeting on 25 June is not yet a done deal. Without state aid, the Lufthansa Executive Board estimates that the airline group will run out of funds at the end of June.

France recently launched a EUR 15bn rescue package for the aviation industry. This includes a EUR 7bn credit for Air France. The aviation industry is of great importance for France’s economy, because aerospace company Airbus alone, with its control center in Toulouse, employs about 48,000 people.

Travel firms in the red

Publicly listed travel firms and tourism groups have slid into crisis because of the corona pandemic. In the past six months from October to March, tour operator TUI posted a net loss of EUR 892m, a loss more than two and a half times higher than that of the same period last year. According to data from the Federal Statistical Office, turnover of travel agencies and tour operators in Germany fell by around 23 per cent in the first quarter.

The publicly listed US cruise company Carnival reported a net loss of USD 4.4bn for Q2, where the company had earned USD 451m in the previous year. The group’s turnover, which also includes German cruise operator Aida, dropped from USD 4.8bn 700m. International US hotel chain Marriott reported a comparatively minor decline in turnover of 7 per cent for the first quarter, but profits plummeted by 91 per cent.

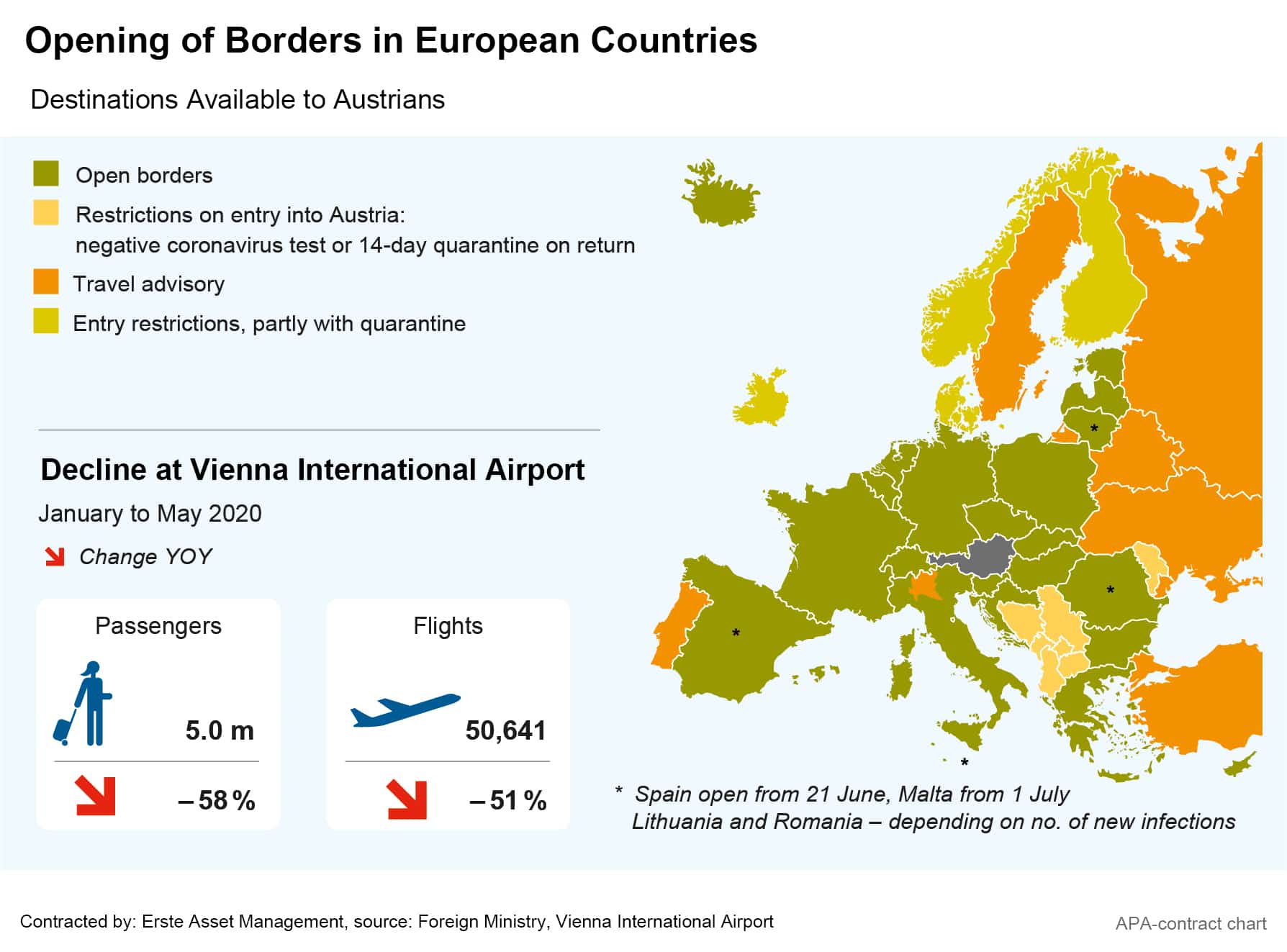

The industry is now counting on the recent opening of borders to reinvigorate travel and help effect a swift recovery. In Europe, many countries have recently opened their borders or are about to do so. Since 5 June, travel from Austria to its eastern neighbours Hungary, the Czech Republic, Slovakia and Slovenia without restrictions is possible again. Germany, Liechtenstein and Switzerland opened their borders to Austrians and other EU citizens in mid-June. On Tuesday, the Austrian entry restrictions for most other European countries were lifted. Since Sunday, the restrictions on travelling to Spain or returning to Austria have been lifted.

Air traffic and tourism are slowly picking up again

The AUA has recently resumed its flight operations. In June, five per cent of the previous year’s schedule is being offered, said AUA CEO Alexis von Hoensbroech. In July, the number of destinations will be increased to 20 per cent, after which long-haul flights are to be offered again. By the end of the year, 50 per cent of business “compared to pre-corona times” are expected. In September, AUA’s parent company, Lufthansa, plans to reinstate 90 per cent of all originally scheduled short- and medium-haul destinations and 70 per cent of long-haul destinations. Irish carrier Ryanair has also resumed scheduled flights to and from Germany. Starting July 1, 200 routes to and from Germany will be available again. The airline also plans to resume flights from Vienna come August.

The tourism industry is also gradually, if only moderately, picking up speed again. Travel company TUI reported summer business now starting after a delay and announced that more and more destinations will be gradually added in the coming weeks. About a quarter of the program for the main season is currently fully booked. According to TUI, customer interest has “noticeably” increased last week. “Germany and Belgium in particular are showing a clear recovery”, the company reported. In Germany, Austria and also Mallorca, the first TUI hotels have opened, with further Mediterranean destinations to follow in July.

Whether the relaxed travel regulations will provide the industry with an upswing now also depends strongly on the consumers’ willingness to travel: Italy’s tourism industry is preparing for a massive decline in the summer despite the relaxed measures. According to a study by tourism association Assoturismo, the number of foreigners vacationing in Italy this summer is likely to drop by half compared to last year.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.