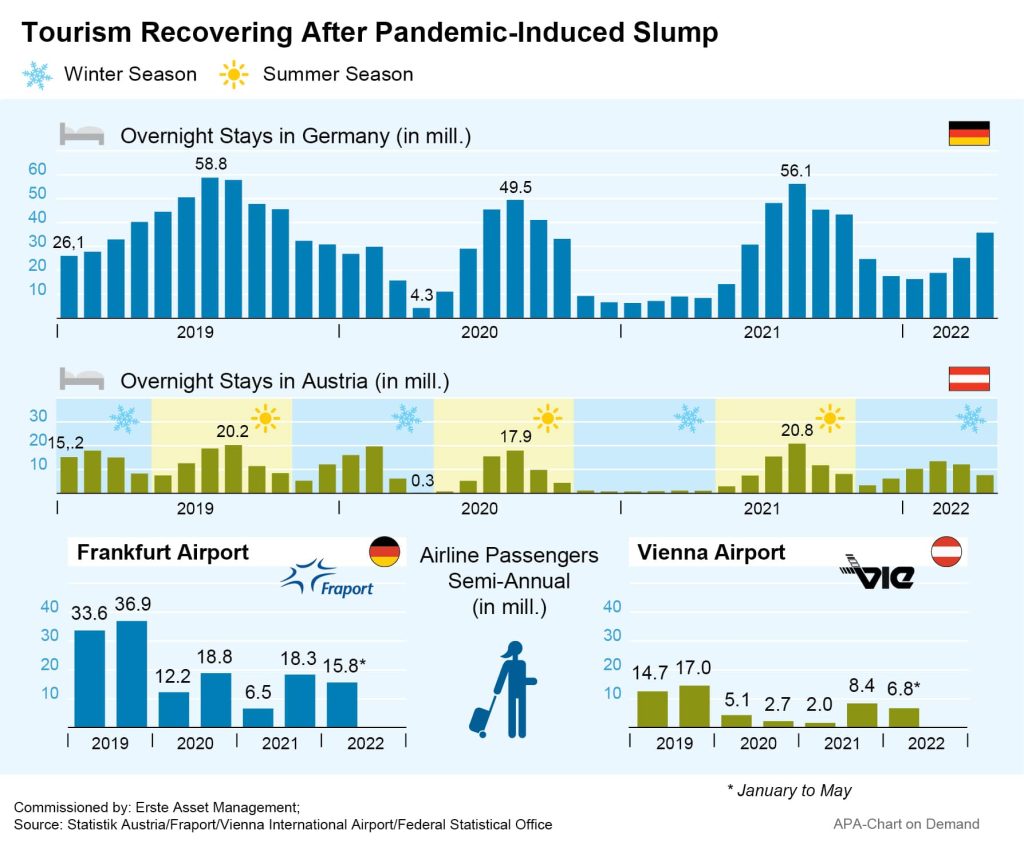

After two years of crisis, tourism and travel companies are once more looking forward to a strong summer season: many people want to travel again after living with the pandemic since 2020. Airlines are hoping for profits again after two years of losses, and tourism businesses and tour operators are equally optimistic. Companies and industry associations expect the travel industry’s recovery from the slump caused by the pandemic to continue, even if pre-pandemic levels are not likely to be attained again this year.

Experts from the Austrian research center Wifo recently expressed confidence regarding the country’s tourism. Wifo experts Oliver Fritz and Anna Burton expect demand from foreign visitors to continue to rise, but at 51 million overnight stays, demand is likely to remain significantly below the 2019 figures. Austrians themselves, on the other hand, are likely to vacation abroad, so that domestic demand is likely to decline slightly compared to the previous year and fall back to slightly below 2019 levels.

In total, Wifo expects around 75 million overnight stays in the summer of 2022. “Given the current political and economic environment, but also the uncertainty regarding further infections, these forecasts are still fraught with great uncertainty,” the authors caution.

Another increasingly critical problem for the domestic tourism industry is the current shortage of skilled workers. In April, more than three out of five tourism businesses cited a lack of labour as a major limiting factor for their business. According to Wifo, the number of vacancies in the hospitality industry has increased by more than 70 per cent compared to 2019.

Travel Company TUI Expects Return to Profitability

Travel companies, which have been hit hard by the crisis, have also recently expressed confidence. German tourism company TUI expects a return to profitability ahead of the critical summer season. So far, bookings for the summer are at around 85 per cent of the pre-pandemic levels of summer 2019, TUI announced in May. As a result, this financial year should see TUI become profitable again in its day-to-day business, Group CEO Fritz Joussen, who is set to resign from his position in September, said.

At its outset two years ago, the restrictions issued to fight the pandemic largely deprived TUI of the basis for its business. To survive the restrictions, the company received billions in national aid. With the return of tourism, however, it is now becoming apparent that TUI will emerge stronger from the crisis, said Joussen. Therefore, repayment of the loans is to continue.

From January to March alone, TUI recorded 1.9 million guests, nearly ten times the previous year’s number. Including the summer, the number of customers has reached 11 million so far. In the past six weeks, the number of additional bookings was even higher than the comparative figures for 2019, the company reported. TUI is confident that customers are currently spending significantly more money per trip than before the pandemic, with average prices for the summer up 20 per cent. This is due to a high proportion of package holidays, longer vacations, more distant destinations and higher demand for luxury hotels.

Aviation Industry Shows Optimism: Profits Expected Again in 2023

The aviation industry recently also gave an optimistic outlook. After two years of historic losses, the industry should be back in the black by 2023, said Willie Walsh, Director General of the International Air Transport Association (IATA), at the association’s recent General Assembly. After an industry loss of USD 137.7bn in the first pandemic year of 2020 and USD 42.1bn in 2021, IATA now expects a global industry loss of only USD 9.7bn this year.

According to IATA’s forecast, airlines in North America should even see a profit of USD 8.8bn this year. In Europe, the industry association expects the industry to remain in the red this year, but with a loss reduced by two-thirds and no higher than USD 3.9bn. According to IATA, airlines are struggling with the increase in fuel prices as a result of the war in Ukraine, but they are also able charge their customers higher ticket prices.

For the airlines from the Asia-Pacific region, IATA expects the loss to shrink to USD 8.9bn. Particularly in China, pandemic-related travel restrictions and strict lockdowns are slowing demand recovery. And due to flight bans over Russia, flights between Europe and Asia are becoming longer and more expensive for Western airlines.

In view of the foreseeable containment of losses and the prospect of being in the black next year, IATA chief Walsh spoke of a “time for optimism”. This year, the association expects nearly 3.8 billion passengers worldwide – 73 per cent more than last year, but still about 17 per cent less than before the pandemic in 2019.

Revenue in the passenger business is expected to more than double to USD 498bn compared to 2021 – also thanks to higher ticket prices. The air freight business, however, will probably not quite reach its record revenue from last year. Overall, IATA expects the industry to generate around USD 782bn in revenue, almost 55 per cent more than in 2021 and more than 93 per cent of pre-crisis levels.

However, the aviation industry is also feeling the shortage of skilled workers in many countries after a large number of employees left the industry in the pandemic. Especially in countries with low unemployment rates, this could lead to rising wages, according to the association.

Air Passenger Numbers Rising Despite Staff Shortages and Higher Fuel Prices

German AUA parent company Lufthansa, for example, recently cancelled more flights because of the bottlenecks at airports and the prevailing staff shortage. In addition to the 900 cancellations in July, the airline will take a further 2,200 of a total of around 80,000 flights out of the system at its Frankfurt and Munich hubs this summer, Lufthansa announced recently. This will mainly affect domestic German and European flights, not the well-booked classic holiday destinations during the holiday season. The German government now wants to alleviate the tense staffing situation at German airports with the possibility of hiring foreign auxiliary staff on a temporary basis.

Despite the staff shortages and higher ticket prices, more people are flying again. The number of passengers at German airports also skyrocketed in May, the industry association ADV recently reported, totalling 15.8 million or nearly five times as many as in May of 2021, but still about 30 per cent less than in pre-pandemic May 2019. The Vienna Airport Group also recorded a five-fold increase in passenger numbers in May – with 2.1 million passengers at the Vienna location and 2.7 million travellers in the Group including its holdings in Malta and Slovakia.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note that an investment in equities also entails risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.