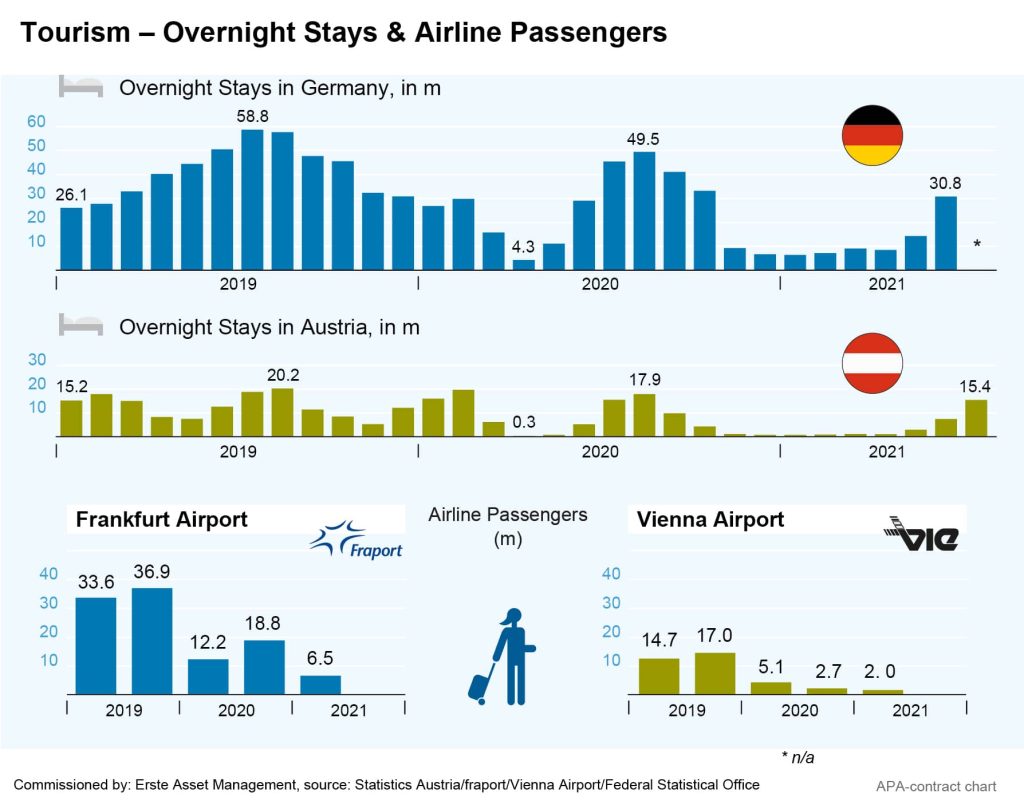

The travel and tourism industry is continuing its recovery. The number of overnight stays increased noticeably in what is now the second Corona pandemic summer, and travel figures paint a similar picture. However, pre-Corona pandemic levels are still a long way off, and the recent strong spread of the delta variant of the virus is also an uncertainty factor.

“Between May and July 2021, overnight stays in Austrian hospitality establishments were 19.5 per cent higher than during the same period last year, but still 33.6 per cent below the corresponding pre-crisis period of May to July 2019,” Statistics Austria director general Tobias Thomas reported on Friday. In July 2021, Austrian hospitality establishments reported 15.44 million overnight stays, a 17.7 per cent decrease from before the Corona crisis in July 2019, but also 0.8 per cent less than July 2020, the first “Corona summer”.

Summer Overnight Stays Promising, but Still Below Pre-Corona Levels

The situation in other countries is comparable: The German Federal Statistical Office reported a 6.1 per cent year-on-year increase in tourist overnight stays in June to 30.9 million. However, according to the data, German hotels and B&Bs are still far from the pre-crisis level. Compared to June 2019, German hotels, B&Bs and other accommodation establishments recorded a sharp decline of 39 per cent. In the first half of 2021, the number of overnight stays in Germany dropped by 34.7 per cent to 76.4 million in a YoY comparison. This is mainly due to the fact that in early 2020, before the outbreak of the pandemic, accommodation establishments were still open without restrictions for nearly three months.

Strong Tourism Figures in Italy and Greece

Not surprisingly, the summer was also strong in the popular tourist destinations of Italy and Greece. According to the ANSA news agency, the Centro Studi Turistici (CST) institute and the Assoturismo Confesercenti business association estimate the number of overnight stays in Italy at about 35 million between June and August. While the figures are well above the roughly 28 million overnight stays recorded in the previous Corona pandemic summer of 2020, they are still far from pre-crisis levels. Experts recorded more than 100 million foreign overnight stays in Italy in the summer of 2019.

In Greece, tourism revenue in June increased almost tenfold to 791 million from 83 million in the previous year, according to data from the country’s central bank. However, the central bank expects that it will take another two to three years before pre-crisis levels are attained again.

There are also demographic shifts among the guests. The pandemic has made long-distance travel more difficult, increasing the attractiveness of domestic holidays. Thus, overnight stays by foreign guests in Austria in July remained 28.6 per cent below the level of July 2019, while those by domestic guests were 13.7 per cent higher. France also benefited from the trend towards domestic holidays. An increase in local tourists and tourists from neighbouring countries made up so well for the absence of guests from the USA and Asia during summer that hotel managers in the coastal regions were even able to report an increase in business compared to 2019.

Higher Number of Airline Passenger in Summer

The passenger numbers reported by airport operators show a similar picture, with the lifting of Corona-related restrictions already resulting in rising numbers during the summer: In July passenger numbers at Frankfurt Airport rose back to 2.8 million, an increase of 116 per cent and the highest figure since the beginning of the Corona pandemic. However, because the pandemic only had a significant impact on air traffic from March onwards in 2020, passenger numbers in the first half of the year were still 46.6 per cent below the previous year and roughly 80 per cent below 2019’s record figures. The airport management does not expect 2019 levels to be reached again until 2025 or 2026.

With the recovery in passenger numbers, but also thanks to cost reductions, airport operator Fraport recorded a profit in the first half of the year for the first time since the beginning of the Corona crisis. In the first half of the year, earnings before interest and taxes (EBIT) amounted to EUR 116m, after a loss of EUR 210m in the previous year.

Vienna International Airport recently reported good summer business; however, the crisis is not yet weathered. The bottom line is that the loss for the first half of the year increased from EUR 18.2m EUR 32.5m YoY, while turnover fell from EUR 195.8m to EUR 128.6m. By comparison, before the crisis, in the first half of 2019, revenue was EUR 401.4m, with a profit of EUR 82.9m. However, the recent increase in passenger numbers gives rise to hope: with 1.5 million travellers, July was almost three times as strong as July of 2020 and the month with the most passengers since the beginning of the pandemic.

Airlines Limit Losses in the First Half of the Year

Many airlines are also noticing a recovery, but remain in the red for the time being. German AUA parent Lufthansa halved its losses in the first half-year from EUR 3.6bn to 1.8bn. In Q2 the airline group limited its deficit to EUR 756m – around half the figure for the same quarter in the previous year. The cargo business in particular developed positively. Like other airlines, Lufthansa intends to expand its route network again. From September onwards, 150 destinations will be served from Frankfurt again – 30 more than in 2019.

According to the German Air Transport Association, what the industry now needs is staying power. This year, a third of the 2019 traffic levels could be achieved, provided the recent recovery continues, the association explained most recently. With further vaccinations, declining travel restrictions and a robust economy, 80 per cent of the pre-crisis figures are possible next year. The 2019 level, on the other hand, will probably not be reached until 2025.

Tourism Groups on the Path to Recovery From the Crisis

Large tourism companies are currently also steadily but slowly recovering from the crisis. The world’s largest travel group TUI recently reported a strong increase in bookings in recent weeks, but expects a weaker summer business overall than before due to weak bookings from the UK. In total, the German group has recorded around 4.2 million bookings for the summer so far. Travel in the key holiday months is expected to reach 60 per cent of 2019 pre-crisis levels, TUI said. Meanwhile, the company was able to limit its losses in the past quarter: At EUR 935m, the loss was around one third lower than in the first Corona-related lockdown in the previous year, in which business almost completely collapsed due to the travel restrictions.

Business is currently going surprisingly well for Airbnb. The room rental platform expects a record profit in the current third quarter, but warns of possible effects from the Delta variant of the Corona virus. In Q2, gross bookings increased more than fourfold to USD 13.4bn YoY. Revenue tripled to USD 1.3bn, even exceeding 2019 pre-Corona levels by 10 per cent.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.